I decided to start this challenge after having a good amount of our discord members asking if it is possible to trade with a sub $1,000 account. I typically tell them that it’s possible to trade with any size account, however for brand new traders the best investment is in themselves, meaning spending what you are able to on Trading Education. When I say “spending what you are able to” I mean either money on courses/coaches, or time on free education and resources.

Once you feel confident enough to brave the markets, paper trading is a great way to get exposure to how trading works without risking your own money. Think of it like batting practice. When you learn to ride a bike for the first time, there’s a good chance you will fall a few times before you get the hang of it. The same goes for trading, which is why a lot of new traders start off paper trading so that those “falls” don’t happen while their hard earned money is on the line.

It might be daunting seeing other traders posting about their $100,000 accounts and thousand dollar profits per trade, but even they started somewhere. If you’re trading with a smaller account, for example $250, the trades you make are just as important as those traders with $100,000. Because you’re at a stage where you are (hopefully) building good trading habits and mindsets that will not only help you down the road when you do have a $100,000 account, but also help you get there.

4/19/24: My goal with this $250 account challenge is to practice good trading mindset techniques while taking trades from the trade ideas that we post on this blog. Since I have a $250 account, I will only be looking at sub-$35 stocks. Currently the stocks on our watchlist from these blog trade ideas under $35 is $CCL, $AAL, and $SNAP. $CCL happened to hit our entry level, so I entered that one today.

My plan is to post some more blog trade ideas of sub-$35 stocks this upcoming week to put on the watchlist, but for now all we have is $SNAP and $AAL, neither of which are near our price levels of interest for entry, so it looks like I am sitting on my hands for the rest of the day.

Today was a win for me. Down $0.12, but resisted the urge to YOLO 50% of the portfolio on options day trades.

I notice that with this small account it’s easier for me to try to justify bigger risks, however we all know how bigger risks lead to bigger rewards, but also potential big losses. I noticed myself trying to trying to do this a few times, but resisted the urge.

Times when I got the urge today…

-Looking at some of our Alert Channels that contain high risk plays hitting 100%+

-Going on X and seeing my friends posting profits

-Right before market close

So going forward I need to be aware of this, so I can use these observations to make sure I’m allowing myself to be in the best trading mindset and environment possible.

Remember what we said in our trading psychology weekly live session it’s all about finding the symptoms of emotional trading so we can learn how to manage them

Resisting Impulsive Decisions: Even small losses like $0.12 can trigger the urge to take excessive risks in pursuit of quick profits.

Awareness of Emotional Triggers: Recognizing the times I felt the urge to take bigger risks, such as when seeing high-risk plays or friends posting profits, is crucial for managing emotions during trading. By identifying these triggers (or ones like them) we can better understand our emotional responses and implement strategies to stay grounded and rational.

Importance of Emotional Management: As we've discussed in our trading psychology streams, it's essential to identify the symptoms of emotional trading, such as the urge to justify bigger risks, and learn how to manage them effectively. By staying emotionally balanced and disciplined, we can make more rational and strategic trading decisions. It might not be the reason behind the big wins, but it keeps us from the big losses.

Starting Small and Growing: Starting with a $250 account reminds us that every trader begins somewhere, and it's essential to manage risk carefully, regardless of account size. Even small losses can have a psychological impact, so it's crucial to prioritize capital preservation and risk management, especially in the early stages of trading.

Focus on Long-Term Goals: While it's tempting to chase quick profits, remember that successful trading is a marathon, not a sprint. Just like in the Rags to Riches series, let’s focus on our long-term goals and objectives, and avoid falling victim to short-term impulses that can derail our progress.

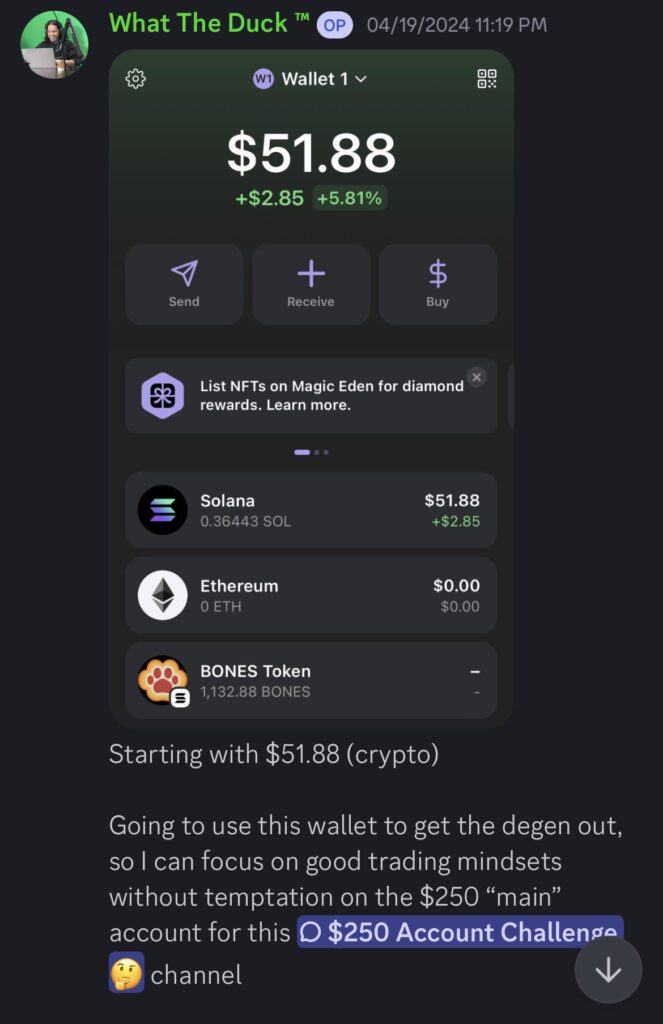

I decided to start a Phantom wallet with $51.88 (crypto) as part of the overall Trading Mindset goals in mind. I’m going to use this wallet to get the “degen” out of my system when I need to, so I can focus on good trading mindsets without temptation on the $250 “main” account for this challenge.

This $50 is money I am OK losing. This is why it’s my “degen” account, so I can get my YOLO out. Some people go to the bar or pay for a yoga class to keep them sane for their job. This YOLO account is my beer after work or hot yoga session… Keep in mind people don’t (ideally) go to the bar if they can’t afford it. Remember, this is money I’m OKAY with losing. I wouldn’t do this with an account that wasn’t the case.

In this challenge we will treat the $250 account (stock one) as money we can’t afford to lose. So we will be practicing good trading mindsets and risk management techniques.

This YOLO account is in place to help me with the overall trading mindset when it comes to my “main” account. Just like that beer or walk after work.

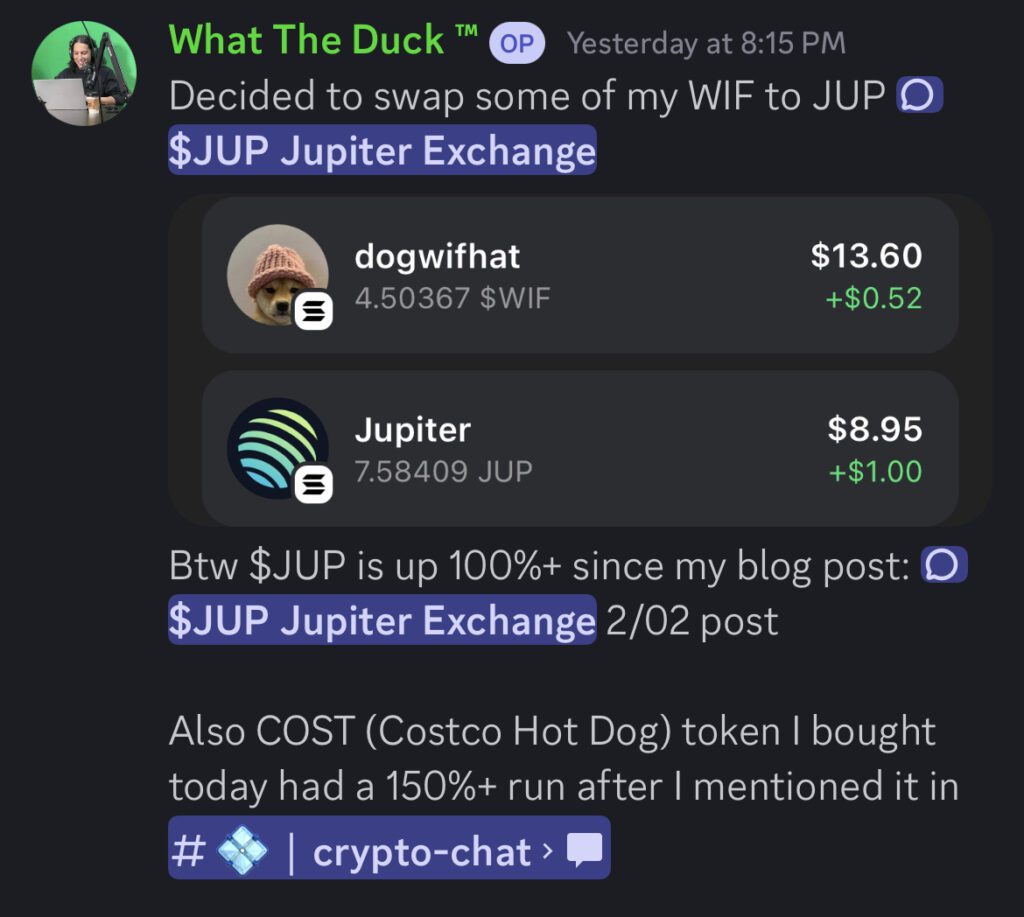

Got some $MOG because I keep seeing it all over X accounts of people I’ve met “IRL” at events. Also, for the culture… $WIF (DOGWIFHAT) is because why not?.. It’s a good meme, and has good memers on X as holders.

4/20/24: Happy 4/20! I decided to get some Costco Hot Dog, no real reason other than I think it’s a funny meme coin. I called it out in our crypto chat in the discord a while back, and it had a potential 150%+ profit from that call out.

I also decided to swap some of my WIF for JUP. You can check out my blog post on Jupiter Coin here.

4/21/24: No updates really today. So far down $.12 on my $250 stock account, and around even on the $50 one (was up nicely until Solana and crypto decided to take a mini snooze). Tomorrow I plan on adding some more stocks to the watchlist for the $250 account!! I also plan on maybe scaling out of Solana and diversifying into NEAR and/or some other crypto ecosystems. I will update every buy and sell in the discord, as well as my thoughts on each trade and just in general!! Hope to see you there!!