The $CAVA IPO opened with a sizzling start as the stock seared-err I mean soared over the expectations, opening at $42 per share. Cava Group priced their IPO at $22 per share, the stock hit a high of $45.42 today (106% up from IPO price) before settling back down into $41 range where it currently is trading at (still a 90% gain from IPO).

Investors were eager to dig into a slice of the Mediterranean pie, pushing the company's market value to a mouthwatering $4.68 billion. It's like finding a hidden gem in a baklava!

What Is Cava?

Cava, founded in 2006, made its mark on the fast-casual dining scene in 2011. Inspired by the success of Chipotle, they decided to bring the build-your-own concept to Mediterranean cuisine. It was a match made in heaven, as customers flocked to create their personalized bowls filled with ingredients like harissa and tahini. Who knew that pita and hummus could create such a frenzy?

But Cava didn't stop there. They spread their flavors beyond their restaurant walls and into grocery stores, selling their signature dips, spreads, and salad dressings. It's like taking a piece of Cava home with you—a taste of the Mediterranean at your fingertips.

In 2018, Cava made a bold move by acquiring Zoes Kitchen, a rival Mediterranean chain, for $300 million. They've spent the last five years converting Zoes Kitchen locations into Cava restaurants, expanding their empire to a total of 263 locations as of April 16.

Cava's Financial Successes And Woes

While Cava's net sales climbed to a savory $564.1 million last year, their losses widened from $37.4 million in 2021 to $59 million in 2022. But hey, who said cooking up success was easy? Despite the losses, industry experts believe that Cava has shown it can "tweak it's recipe" and find a clear path to profitability, making it an attractive option for investors seeking growth stocks. In the first quarter, they even managed to narrow their net loss to a mere $2.1 million.

So, what's next for Cava?

With the proceeds from their IPO, they plan to add new locations and tackle general corporate matters. Remaining proceeds from their IPO will go to "general corporate purposes".

Are IPO's Back?

Cava's IPO also signals a potential revival in the IPO market, which had been in a drought for some time. Perhaps other restaurant chains will take a bite out of Cava's success and follow suit. Salad chain "Sweetgreen" went public in November 2021 and now has a market value of over $1.2 billion. Brazilian steakhouse "Fogo De Chao" (if you haven't gone, you HAVE to, it's so good) and Korean barbecue chain Gen Restaurant Group both have filed regulatory paperwork. Meanwhile Panera and Fat Brands' Twin Peaks have expressed interest in an IPO in the near future.

The IPO world is hungry for new flavors, and Cava has set the table.

Is $CAVA A BUY At These Levels?

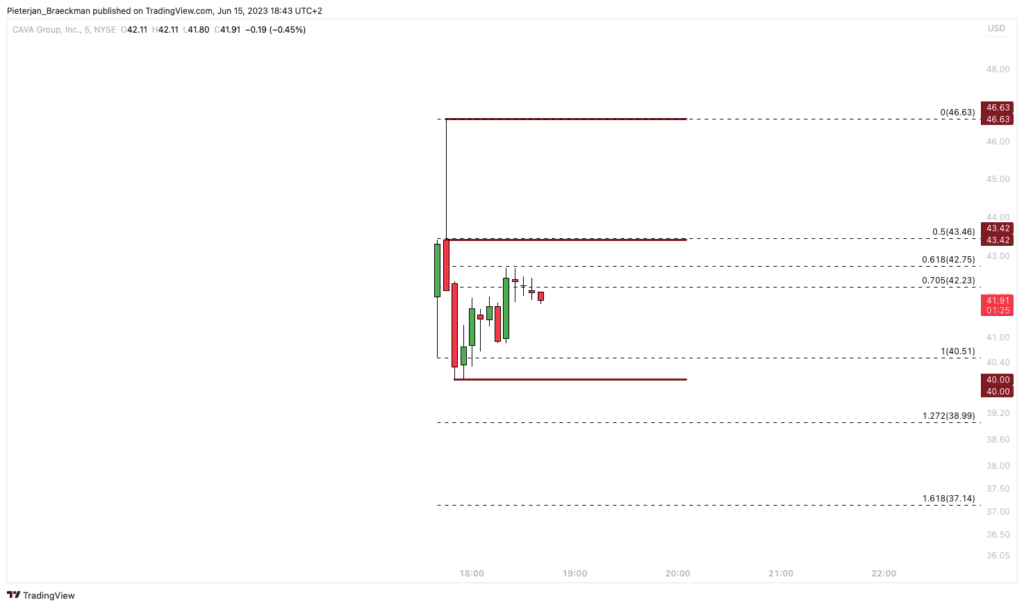

When asked about $CAVA, our Stock and Crypto Analysts Pieterjan Braeckman (BTC_JAY on Discord) said; "Way too little price action to make a definitive statement. If support gets broken we could be looking at $37.14 then $28.99. If it breaks above $43.46 we can see some new highs. However there's really not much to be said about this chart."

When asked about Mediterreanean fast food he said; "Amazing!! It's the Bitcoin of food!!" For more from BTC_Jay or our other Analysts be sure to check out our Free Trading Discord: https://discord.gg/pennybois