Netflix Releases New Master Plan

First up is the streaming giant Netflix. They've become so successful that they're running out of room to grow. But fear not, Netflix has a master plan: charging those sneaky password-sharers! They realized that around 100 millions customers have been letting people who live in other addresses to use their accounts, so Netflix decided to squeeze some extra dollars out of them. Don't worry, this isn't "Orange is the New Black", there won't be any jail time involved.

Free Trading Discord: https://discord.gg/pennybois

However they introduced a $7.99 fee for US Password-sharing, which is more expensive than one month of Netflix's basic package. Talk about turning freeloading into a profitable business model! Sure, there's been a bit of a backlash, with people threatening to cancel their subscriptions, Netflix co-CEO stated that they have seen an "initial cancel reaction", but Netflix sees it as an opportunity for those moochers to eventually become legit paying customers. I wonder if those unsubscribers will be able to stay unsubscribed once Jake Paul's episode of "UNTOLD" Volume 3 comes out (kidding)!!

Disney Cutting Streaming Services?

Next in line is Walt Disney ($DIS), the magical kingdom of content. They've been splurging on creating shows and movies for their streaming platforms, Disney+ and Hulu. But, uh-oh, their accounting department suddenly realized they've been bleeding money faster than the Millennium Falcon! So what's their solution? They're cutting back on content. Yes, you heard that right. They're taking the "less is more" approach to a whole new level. Who needs a vast library of shows and movies when you can just binge watch Marvel and Star Wars all day, right? For those sports lovers out there don't worry, they plan on only cutting out non-sports content. Maybe Mickey Mouse is going to have to learn how to throw a Football to stay on Disney+!! Although subscribers might not love the news, investors are probably happy that Disney will be taking a more conservative approach to spending on content.

Is Warner Bros Discovery A Hidden Gem?

Last but not least, we have Warner Bros Discovery ($WBD), the underdog of the streaming world. They might not have as many subscribers as Netflix or the deep pockets of Walt Disney, but they've discovered their secret weapon: free ad-supported television (FAST), which is comprised mostly of previously aired movies and TV shows. It's like finding a hidden treasure chest full of nostalgic movies and TV shows, all for free. They've even partnered with platforms like Roku and Tubi to spread the joy of free streaming. Warner Bros Discovery is all about giving the people what they want, even if it means risking the success of their other streaming services. Who needs profits when you can bask in the glory of being the hero of free streaming? That being said they do have plan on launching their own version of Tubi or Pluto, without buying content from anybody. Their CEO stated they have the "largest TV and motion picture library in the world."

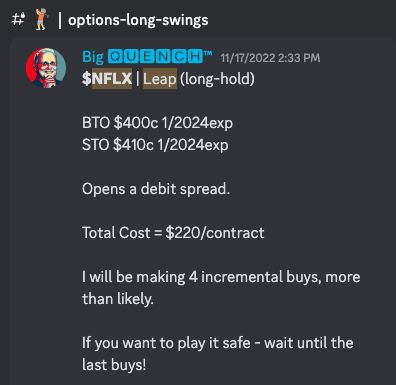

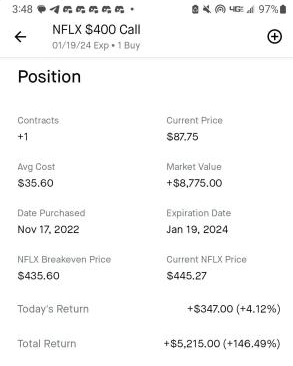

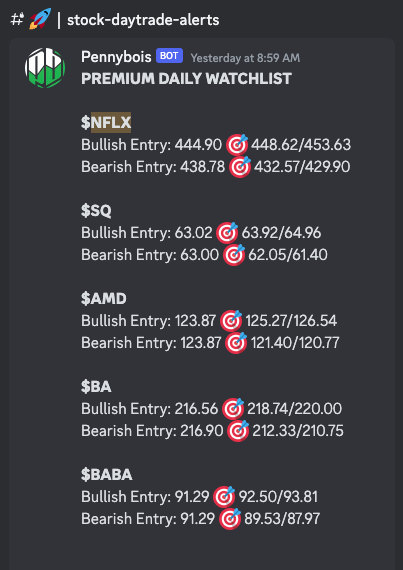

Is $NFLX a BUY here?

"Key support levels to watch with a short-term outlook are $431.50 -> $427 -> $424 -> $416... Bottom dollar support for bullish continuation looks to be near $416. If we do see that bullish continuation our long-term price target is still $507. But some sell-side volume has come in recently and we're expecting some healthy pullback on the stock, after such an extensive run. We've seen absolutely explosive price action over the past couple of weeks.. We originally talked about the breakout over $200 months ago being our bullish signal and the stock has gained over 125% since the alert." -Austin (BigQuench on our Discord)