In the fast-paced world of technology stocks, Nvidia (NVDA) has been making waves with its impressive earnings report and stellar performance in the market. As a finance-savvy investor, you might be wondering whether now is the right time to dive into Nvidia's stock, or if you should consider other options after the buybacks (which we will breakdown as well in this blog). I’m Meta Matt, and together we will dive into the recent developments and the future outlook for Nvidia.

Nvidia's Q2 Earnings Showcased Its AI Dominance

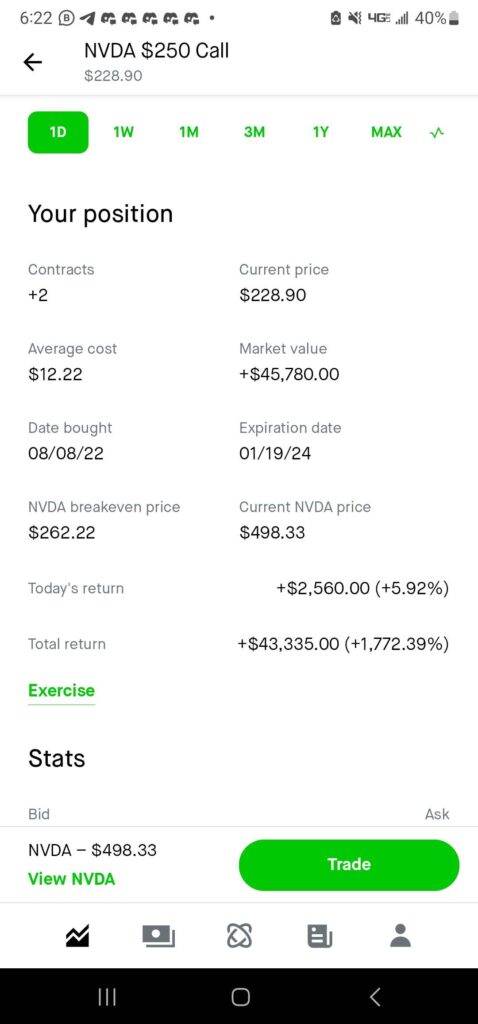

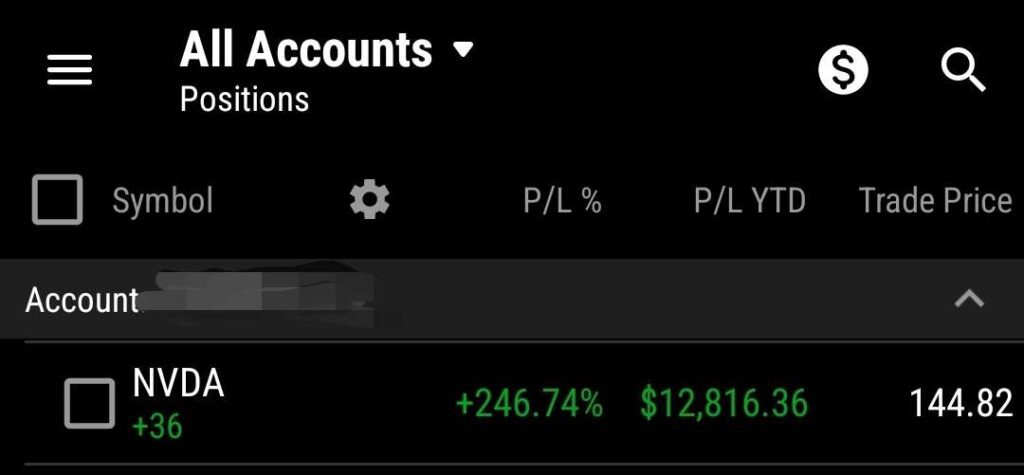

Nvidia's second-quarter earnings report, released on August 23, 2023, sent shockwaves through the market. The company reported record-breaking revenue of $13.5 billion, a staggering 101% increase compared to the previous year. This surge was primarily driven by the booming demand for Nvidia's processors used in artificial intelligence (AI). The data center segment, especially AI-related processors, raked in an impressive $10.3 billion in revenue, marking a remarkable 171% year-over-year growth. (Don’t forget to check out our Trading Discord, where we called out $NVDA CALLS early! See below)

The Earnings Impact: Stunning Profitability

Beyond just revenue, Nvidia's profitability saw jaw-dropping growth. Adjusted earnings per share (EPS) soared by a whopping 429%, while GAAP EPS increased by an incredible 854%. These results didn't merely meet Nvidia's own expectations; they blew past analysts' consensus estimates.

Now, you might be thinking, "Can this growth be sustained, or is it just a flash in the pan?" Let's dive into what's driving this remarkable performance.

The Catalyst: The AI Boom

The catalyst behind Nvidia's stellar earnings is the relentless expansion of artificial intelligence (AI). Businesses across the board are racing to integrate AI systems into their operations, driven by the promise of improved productivity. This demand has created a surge in the adoption of Nvidia's AI-related products and solutions.

Nvidia's Stock Buyback: A Surprise Move

In a somewhat surprising move, Nvidia announced a $25 billion stock buyback. While this might sound like a standard financial maneuver, it raised eyebrows because of the company's red-hot stock performance. Nvidia's shares have skyrocketed by approximately 220% in 2023.

Typically, companies repurchase their shares to bolster their stock price, which can be beneficial when a stock is undervalued. However, Nvidia's shares were trading at a premium, with a forward price-to-earnings ratio nearly double that of the S&P 500.

The Rational Behind the Buyback

So, why did Nvidia opt for a buyback when its stock was flying high? The answer might lie in Nvidia's unique situation. Following the collapse of its deal to acquire semiconductor designer Arm Holdings Ltd due to regulatory concerns, Nvidia finds itself generating substantial cash reserves with limited avenues for deploying them. The company allocated about 27% of its revenue to research and development last year, consistent with its industry peers.

Nvidia's Confident Move

Despite the hefty dollar amount of the buyback, it represents only about 2.1% of Nvidia's massive market value, a relatively modest percentage. In essence, Nvidia's buyback can be seen as a show of confidence in its future growth potential. It's a strategic move to utilize excess cash while maintaining the flexibility to seize future opportunities.

A Unique Perspective on Buybacks

Tech companies often favor buybacks over dividends because it allows them to remain agile and pursue growth opportunities. Investors may interpret Nvidia's buyback as a signal that the company views its stock as undervalued and a promising long-term investment.

Nvidia's Future Outlook

Nvidia's impressive earnings report and strategic buyback have certainly caught the attention of investors, especially young finance enthusiasts like you. While some might question the buyback's timing, it underscores Nvidia's confidence in its continued growth. As the AI revolution charges forward, Nvidia appears poised to maintain its dominant position.

As a finance-savvy individual, it's essential to stay informed about market trends and company strategies. While past performance is no guarantee of future results, Nvidia's recent moves indicate a high degree of confidence in its future prospects. Whether you choose to invest in Nvidia or explore other opportunities, remember to research thoroughly and make informed decisions to build a prosperous financial future. 🚀📈

Our In House Analyst Outlook On Nvidia

“I simply expect higher prices. the more we retrace, the more bullish I can become, and the more violent the next move up will be. bears suck and will continue to get rekt.” -BTC Jay

Check out our FREE Trading Discord to stay up to date with the Market! We also have over 100 FREE Trading Classes, and Stock Alerts: https://discord.gg/pennybois