Last week we put out trade ideas for $SAVE, $SOL, and $NEAR!! In this post we will break down all the trades, provide links on where to find them, and show which prices we are setting alerts at on our trading broker so that we can be ready to take these trades!!

Check out our prior trade ideas…

We find and play these trades using a Technical Analysis Strategy that we teach as part of our 8 Class Charting 101 Course. Every Thursday at 5PM EST we go over all these trades live in our discord!! We also update when these trades hit entry, targets and stop losses in an exclusive channel in the discord!! This channel, stream and educational course is all included with our premium membership. However, we also post all the trades right here on our Free Trading Blog and Twitter.

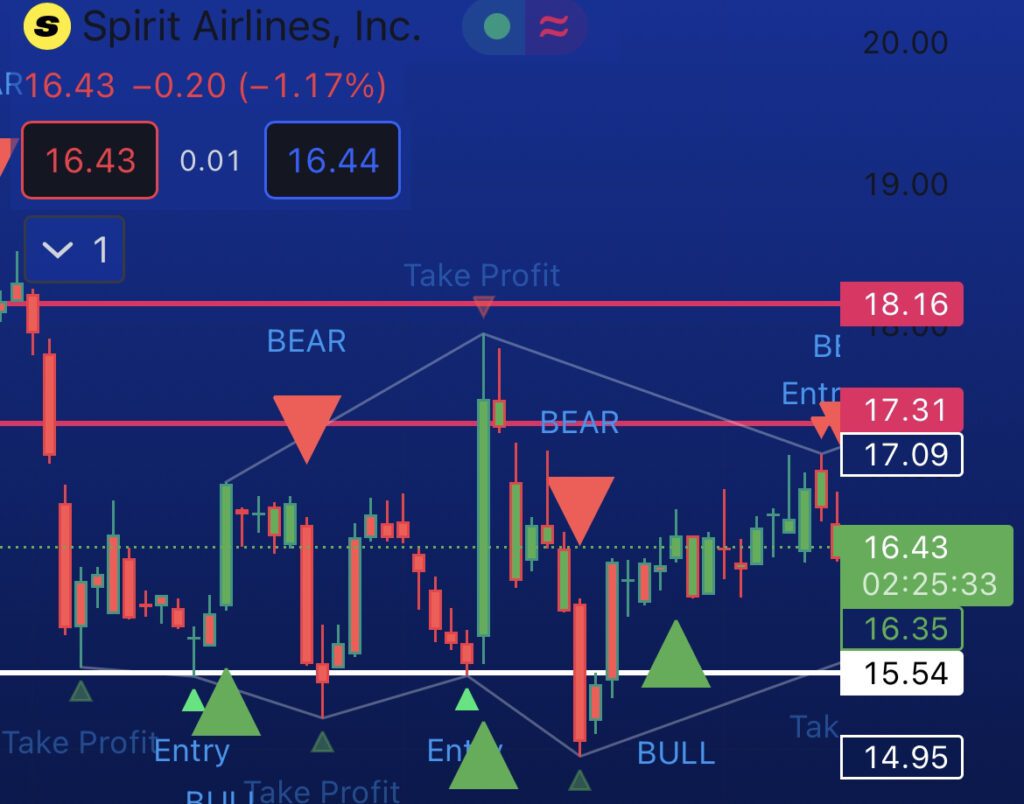

$SAVE: SPIRT AIRLINES

Click Here For Full $SAVE Trade Idea

With $SAVE we have a Fair Value Gap between $17.31 and $18.16, as well as a support level at $15.46 that we are watching. We are using the 4H TA Strategy we teach in the discord to play this one. Right now the price is around $1.00 away from both our bullish and bearish entries, and the stock moves on average around $0.56 per day according to the ATR on the daily chart.

Option 1: Short/Bearish

Entry: Wait for price to break $17.31 (and stay below $18.16). Wait for a 4H candle close back below $17.31 for entry. (safer entry is waiting for retest as resistance)

Targets: $18.16, $19.19+

Stop Loss: $16.27

Option 2: Bullish

Entry: Strong push above $17.31, enter then or wait for 4H close above $18.16 (or retest as support).. Dependent on risk levels.

Targets: $19.19, $23+

Stop Loss: Below $17.31

Option 3: Bullish #2

Entry: Break below $15.46 followed by a 4H close above that price (or retest as support)

Targets: $16.25, $17.31

Stop Loss: Below $14.34

Option 4: Bearish #2

Entry: Strong break below $15.46 (or retest as resistance)

Target: $14.07, $13.28

Stop Loss: Below $16.25

DISCOUNT: Check Out Our Custom Indicator: StocksBuddy

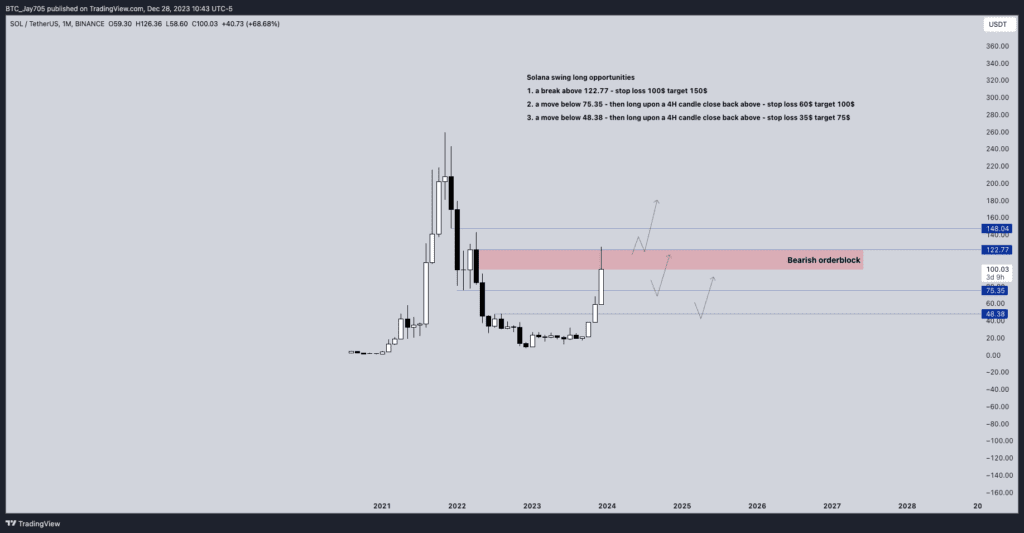

$SOL: SOLANA

Click Here For Full $SOL Trade Idea

We are basing our analysis and levels using a monthly and quarterly timeframe. High timeframe levels, with a 4H timeframe we use to take entry on. -BTC_Jay

Ways We Can Play Solana

- A move below $75.35 - then enter upon a 4H candle close back above $75.35 - stop loss $60 target $100+

- A move below $48.38 - then enter upon a 4H candle close back above $48.38 - stop loss $35 target $75

- A move below $48.38 - then enter upon a 4H candle close back above $48.38 - stop loss $35 target $75

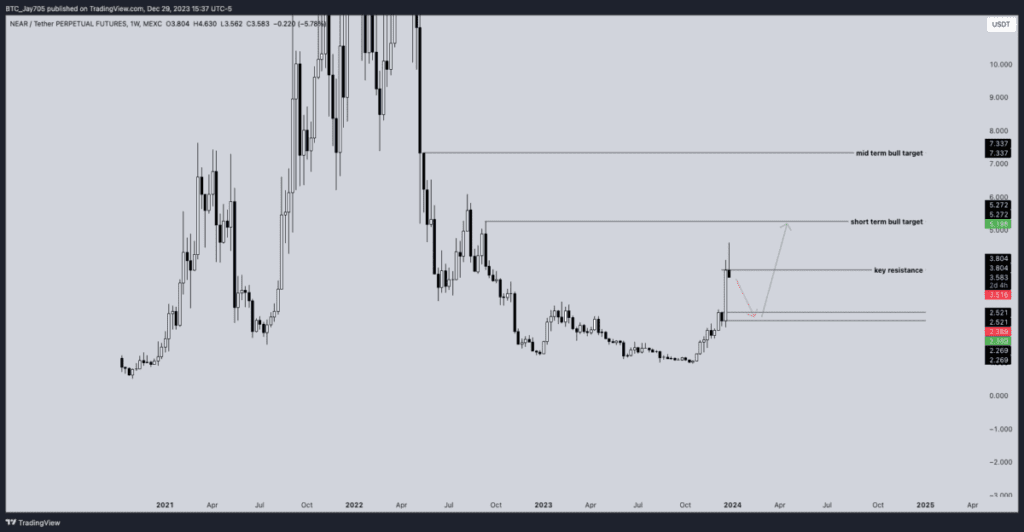

$NEAR: NEAR PROTOCOL

Click Here For Full $NEAR Trade Idea

“Option one is the main scenario and would offer us the best risk to reward long trade setup. We want to wait until $NEAR retraces back to a weekly bullish order-block that runs from $2.521 to $2.269. A move below either of those levels, then a 4H candle close back above to go long. When we go long, stop loss below $2.10. Targets $3.30, $3.80 and leaving a runner for $5.30. Other option is waiting for $NEAR to get back above $3.80 with a 4H candle close to go long if that happens. Targets $5.30 and $7.30, stop loss if price closes below $3.50 on the 4H timeframe.” -BTC_Jay

Option 1

Entry: Wait for the price to go below $2.521, then enter upon a 4H candle close above $2.521

Targets: $3.30, $3.80, $5.30+

Stop Loss: Below $2.10

Option 2

Entry: If price breaks below $2.521 and keeps dropping: wait for the price to go below $2.269, then enter upon a 4H candle close above $2.269

Targets: $2.521, $3.30, $3.80, $5.30+

Stop Loss: Below $2.10

Option 3

Entry: 4H candle close above $3.80

Targets: $5.30, $7.30

Stop Loss: Candle close below $3.50 on 4H chart

Trade Recaps

Check out our prior trade ideas…