The Next "Amazon Before It Was Amazon"

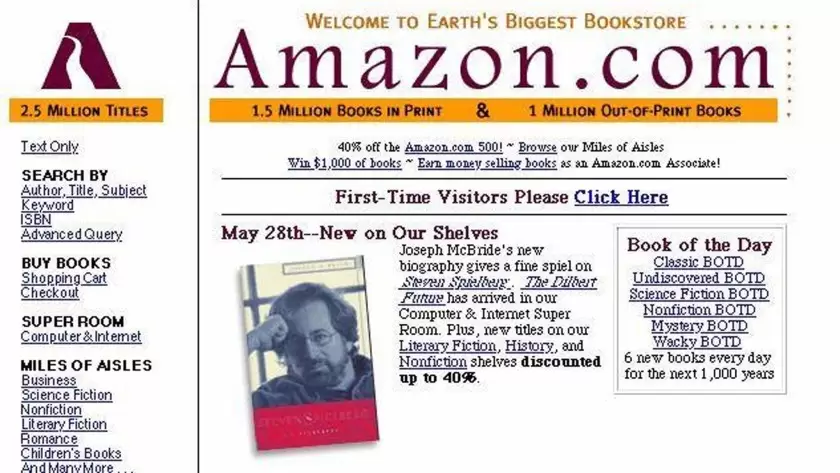

In 1997 Amazon was just a young, technology-driven company with both a ton of potential as well as risk factors for investors. Amazon had already gained traction as an online bookstore, and showed strong sales growth and potential to disrupt that traditional bookselling industry. Little did we know that they would end up doing so much more than just revolutionize how books are sold.

Turning $1K Into $2M With Amazon's IPO

In May of 1997 investors started buying Amazon shares at the IPO (Initial Public Offering). The IPO price was $18 per share. However, Amazon has undergone several stock splits since then, which means we would need to adjust the price to properly compare the IPO price to the current price.

- June 2, 1998: 2-for-1 split

- January 5, 1999: 3-for-1 split

- September 1, 1999: 2-for-1 split

- June 3, 2022: 20-for-1 split

With the splits factored in the adjusted IPO price as of today is approximately $0.075 per share. The current stock price of Amazon as of this writing is $154. So someone who bought Amazon's IPO and held the stock would be up 205,233%. That is the equivalent of a $100 investment turning into over $205,233. Or a $1,000 investment resulting in over $2 million in profit.

The Earliest Amazon Investors

Those who bought the $18 per share IPO weren't the first official investors in Amazon. Amazon, just like most companies, had pre-IPO investors who played a crucial role in providing the initial funding and support that helped propel the company towards its public debut. This included venture capitalists (VCs) who believed in Jeff Bezo's vision for the future and provided millions of dollars in funding between 1995 and 1997. There were also angel investors like Jeff Bezo's parents. Other early employees and advisors of Amazon such as their first ever employee Shel Kaphan (who now has a net worth over $1B) were also given the opportunity to invest in the company before the IPO.

The exact pre-IPO price for Amazon isn't public knowledge, however it's estimated to have been around $5 per share, which would equate to around $0.018 after all the splits. With the current price at $154, that's a 855,455% profit!!

Why People Invest In Pre-IPOs

With Amazon in particular, investors were drawn to their pre-IPO due to many factors:

- Growth potential: They recognized the disruptive potential of Amazon's online model and saw a clear path to future growth and market dominance. The rise of the internet offered a glimpse of the vast e-commerce landscape waiting to be explored, and Amazon was positioned as a pioneer in this field.

- Founder and team: They believed in Jeff Bezos's vision and leadership, and had confidence in the capabilities of the early team.

- Technological innovation: The internet was still relatively new, but its rapid adoption and growing popularity promised significant opportunities for online businesses. Investors recognized Amazon's innovative approach to online retail and its focus on technology for efficiency and customer satisfaction.

- High-risk, high-reward gamble: Investing in a pre-IPO startup inherently carries significant risk, but it also offers the potential for substantial returns if the company succeeds. For early investors in Amazon, this gamble ultimately paid off handsomely.

The IPO price of $18 per share might have seemed ambitious compared to established brick-and-mortar retailers at the time. However, for some investors, this was justified by the potential for exponential growth and disruption in the online space. They were willing to accept the higher risk associated with a young, technology-driven company for the chance of substantial returns. Their gamble, as history shows, paid off handsomely, with Amazon's stock price soaring over the years and generating immense wealth for those who held on.

What Is Boxabl?

Boxabl builds compact, foldable homes. These portable units come pre-finished and can be set up quickly (some within an hour), making them ideal for affordable housing, disaster relief, and flexible building projects. Think tiny homes meets Legos for buildings! These foldable units arrive ready to unfold (like an accordion), offering instant living space with minimal fuss. Perfect for eco-conscious living, off-grid adventures, or adding extra space to your property. They also build modular room systems as well as large scale developments such as apartment buildings.

Prefabricated Modular Homes

Boxabl builds compact, portable, and stackable units made of durable materials like steel, concrete, and EPS foam. These units come in various configurations, including studio apartments, one-bedroom homes, and even larger, three-bedroom options. Get this, they come are pre-finished with kitchens, bathrooms, plumbing, and electrical systems already installed. They can unfold and be set-up within hours.

Modular Room System For Real Estate Development

Boxabl offers a room module system for large-scale building projects. These modules allow developers to quickly and efficiently construct buildings like hotels, student housing, and apartment complexes. They also come prefabricated with interior finishes, plumbing, and electrical systems. It's important to note that while Boxabl's homes are often referred to as "foldable", they don't literally fold like origami. Instead, they unfold like an accordion, expanding out from a compact package into a fully functional living space.

The Boxabl Casita

The Boxabl Casita is the flagship product of the Boxabl company that over 170,000 people have indicated interest in by reserving one on their website. The Casita arrives as a compact package and expands into a 361 square foot studio apartment with a full kitchen, bathroom, and modern finishes. Its durable steel and concrete construction ensures longevity, while its sleek design and high-quality materials make it feel anything but cramped. It is also eco-friendly and sustainable, the Casita minimizes building waste and can be easily relocated if needed. Plus, its energy-efficient design makes it cost-effective to maintain. The Casita arrives pre-finished and requires minimal setup, saving you time and hassle compared to traditional builds. It had a starting price of $49,500 however due to inflation and their long wait-list, the price is not guaranteed.

How To Invest In Pre-IPO Boxabl

Boxabl does not have a stock that trades on a public exchange like the NYSE or NASDAQ, so you won't be able to find it under a stock ticker symbol. This is because Boxabl is still a private company, meaning it hasn't gone through the process of an initial public offering (IPO) to become publicly traded. However, there are a couple of ways for interested investors to get involved with Boxabl:

- Accredited investors can purchase private shares in the company directly. The current price per share is $0.80, with a minimum investment of $25,000. Each share also comes with two warrants, which give the holder the right to purchase additional shares at a future date.

- Boxabl is considering a Regulation A+ offering, which would allow non-accredited investors to purchase shares for as little as $500. However, this offering has not yet been qualified by the SEC, so it's not yet available for investment.

Keep in mind, in order to qualify to be an accredited investor via the SEC website, you must have a net worth over $1 million, excluding your primary residence. You must also have an income of over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and expect the same for the current year. Other investors who don't meet that criteria can join the Boxabl waitlist by clicking here. Canadian Investors of Boxabl can click here to invest using Front.fundr.com.

It's important to note that investing in private companies is riskier than investing in publicly traded companies. There is no guarantee that Boxabl will ever go public, and even if it does, the value of your shares could go up or down significantly. If you're considering investing in Boxabl, it's important to do your own research and make sure you understand the risks involved. If you have any questions please feel free to ask in our discord!!

Why Boxabl Is Seeking Investors

In 2020, Boxabl successfully raised funds from investors to construct factories to build their products. They have since launched 3 Factory buildings in record time and have shipped hundreds of houses. Now that they have demonstrated their ability to execute with their initial investors money, they are seeking to take on more investors to build the "Boxzilla Factor", the world's largest and most advanced housing factory. They are currently seeking to raise $1 billion dollars to make upscale housing affordable for all.

Boxabl plans on going public in the future via an IPO, SPAC, or direct listing. Investors interested in buying private share of Boxabl pre-IPO must invest a minimum of $25,000. They will receive shares at $0.80 per share, and receive two warrants. A warrant grants the holder the right to purchase additional shares at $0.80 at a future date. The warrants can be exercised within a three-year period, or can be called in by the company with a 30-day notice. If you hold Boxabl shares you are also eligible for a percentage of the bonus shares. Early investors also got a bonus share % based off of how early they invested.

What are "OTC Stocks"?

For an Initial Public Offering (IPO) the company sells its shares on a public exchange for the first time, raising capital and increasing liquidity for investors. This is Boxabl's long-term goal, but it hasn't announced a timeline yet. These exchanges would include the New York Stock Exchange (NYSE), Nasdaq, Toronto Stock Exchange (TSX) and other major public exchanges.

The OTC market is a decentralized network where unlisted or delisted securities trade directly between buyers and sellers, without a central exchange. There are no formal listing requirements, making it an alternative for companies that may not meet the standards of major exchanges. This is why smaller companies that aren't big enough to meet major exchange requirements are typically found on the OTC Markets, however there are still some larger ones like Nintendo who trade on the OTC Markets possibly due to the lack of regulations.

Some companies, particularly smaller ones or those considered high-risk, might choose to raise initial capital by selling shares on the OTC before attempting an IPO on a major exchange. This allows them to access some funding while avoiding the stricter requirements and costs of an official IPO. If a company on the OTC performs well and meets the listing requirements of a major exchange, it may choose to uplist its shares. This involves moving to a regulated exchange with increased visibility and liquidity, potentially attracting more investors and boosting the company's value. Due to this, the main ways to invest in a company super-early is either via Pre-IPOs or on the OTC Markets.

Why Are Exclusive In-House Analysts Are Watching OTC Stock VetComm $CEOS

VetComm helps American veterans get their full financial benefits monthly for the rest of their lives. In March 2023 CECORS Inc. $CEOS acquired VetComm, which was beneficial for both companies. VetComm offers a range of services and resources including:

- Free VA Disability Claim Filing Courses: VetComm provides comprehensive online courses through their "Freedom Vault" platform, guiding veterans through the entire process of filing a claim, from gathering evidence to understanding VA terminology.

- Paid Gold Services: For additional support, veterans can access personalized guidance from experienced VetComm specialists. These services include claim review, appeal assistance, and representation during VA hearings.

- Veteran Membership: VetComm offers a paid membership program that provides access to exclusive resources, discounts on services, and a supportive community of veterans facing similar challenges.

- Veteran Groups and Partnerships: VetComm actively connects veterans with other organizations and support groups focused on specific needs or issues.

- Public Engagement: VetComm raises awareness about the challenges veterans face in accessing their benefits and advocates for policy changes to improve the VA system.

- Resource Library: Their website offers a wealth of free information and resources related to VA disability claims, legal rights, and other veteran-related topics.

VetComm's mission is to help every veteran get the disability compensation they deserve. They emphasize integrity, respect, and a commitment to serving the veteran community.

How Our Exclusive In-House Analysts Are Trading $CEOS

We have a key resistance at .052. We are watching for a breakout play from this level.

Entry: Watching for a breakout above $.052, ideally a successful retest as confirmed new support.

Targets: $0.06, $0.0651, $0.0872+

Stop Loss: $.0464

This is an OTC Stock and Pennystock so has high risk.