Donald Trump Stocks Soar

Donald Trump is currently in the lead in the Republican Primary with 20 delegates. Ron DeSantis is in second with 9 and Nikki Haley is in third with 8. Vivek Ramaswamy dropped out of the race this week to endorse Former President Trump, who won the Iowa caucuses in a landslide victory yesterday. This gave Trump a huge win in a state that rejected him 8 years ago.

Ron DeSantis and Nikki Haley are neck and neck. The two have been spending just as much time and money attacking each other as they have Trump. Those who are "anti-Trump" were hoping for a two-person race, as they fear a crowded field with many candidates will split the anti-Trump voters, giving Trump the advantage. DeSantis and Haley are only one vote apart, and neither seem like they are ready to drop out yet.

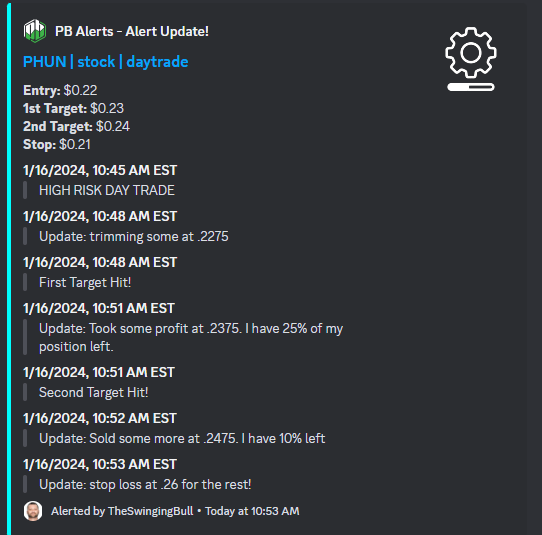

$DWAC and $PHUN are known for being "Donald Trump Stocks". There's a reason Benziga Pro flagged $PHUN as a Trump-sensitive stock. Phunware has worked with Trump in the past, to design the official app for his 2020 presidential campaign. DWAC (Digital World Acquisition Corp.) is a Special Purpose Acquisition Company (SPAC) that was formed in 2021 with the intent of merging with a business in the technology or media sector. In October 2021, DWAC announced plans to merge with Trump Media & Technology Group (TMTG), the company behind TruthSocial, a social media platform launched by former US President Donald Trump. However, the proposed merger between DWAC and TMTG has faced several challenges. Therefore, the current affiliation between DWAC and Trump is uncertain. That all being said $DWAC is one of the top stocks that tends to move up when there is positive news regarding Donald Trump. Many investors still link $DWAC to Trump.

Our $DWAC And $PHUN Trades

We put out a trade idea for $DWAC here. Our $17.50 bullish entry level was hit. We currently are up 25% (way above target, which is where trailing stop losses or regular stop losses come in handy to secure profits).

Completed Trade 1: Bullish

Entry: $17.50

Profit: 25%+

JetBlue & Spirit Airlines Merger Blocked By Judge

A federal judge blocked JetBlue's $JBLU proposed $3.8 billion acquisition of Spirit Airlines $SAVE. The Department of Justice sees this as a victory, as they argued that the acquisition would negatively effect travelers by reducing competition, which would increase prices. If this had gone through it would have created the nation's fifth-largest airline. The top four largest U.S. airlines are American Airlines, Delta, Southwest and United Airlines and they all control around 2/3 of the market. The Justice Department argued that smaller airlines like Spirit help reduce fares, and allowing them to be acquired by JetBlue (which charges higher prices) would hurt customers. JetBlue argued that the acquisition would help them better compete with larger airlines.

Why JetBlue Went Up And Spirit Went Down

JetBlue shares went up 5%, due to the rejected merger saving the company $3 billion. Spirit shares fell around 50% after the news dropped, as this merger would have greatly helped the struggling smaller company. Spirit is not only struggling with operational issues, buy they have also not turned a profit since before the pandemic.

JetBlue To Pay Out $400 Million To Spirit Shareholders

As part of the agreement, JetBlue agreed to pay Spirit Airlines $70 million and its shareholders $400 million. The $400 million payout from JetBlue to Spirit shareholders involves two key aspects:

Trigger: This payout is contingent on the merger between JetBlue and Spirit being blocked, presumably by regulatory authorities. If the merger goes through, Spirit shareholders wouldn't receive this specific payment. In a joint statement, both Spirit and JetBlue do not agree with the decision by the judge.

Distribution:

- Pro-rata basis: The most likely scenario is that the $400 million would be distributed to Spirit shareholders proportionally to their existing ownership stakes. This means each shareholder would receive a payment based on their percentage ownership of Spirit's outstanding shares. For example, if a shareholder owns 1% of Spirit's shares, they would receive 1% of the $400 million payout.

- Specific terms: However, the exact details of how the $400 million would be distributed to shareholders might be outlined in the specific merger agreement and could potentially involve different mechanisms depending on the reason for the blocked merger. It's possible, for instance, that a portion could be directed towards certain shareholder categories or classes if specified in the agreement.

Purpose: This payout serves as a financial incentive for Spirit shareholders to support the merger, as it compensates them for the potential lost value if the deal falls through. It also provides some security and reassurance to shareholders who might be hesitant about the merger's uncertainty.

This Is Not The Only Airline Merger Request

Alaska Airlines recently announced plans to acquire Hawaiian Airlines for $1.9 billion, if approved this would give Alaska Airlines around 8% of the airlines market. Currently United, the fourth-largest U.S. airline, has 16%. The merger between Spirit and JetBlue would have given them 10%. In May, a partnership between JetBlue and American in Boston and New York was blocked by judges.

Our Spirit Airlines Stock Trade

We posted a trade idea on Spirit Airlines $SAVE on 12/27. In our discord we updated when entries and exit levels were hit. We played a bullish play at first from $15.46 to $16.25 for a 5% gain.

We then got a bearish entry level hit at 1/12 at $15.46. That was on Friday before the long weekend. Then today we got a 50%+ drop in price, which was great for our bearish/short position.

Completed Trade 1: Bullish

Entry: $15.46

Profit: 5%

Completed Trade 2: Bearish

Entry: $15.46

Profit: 50%+

Check Out Our Other Trade Ideas