Stock Market

Historically, Trump’s market approach involves reducing regulations and taxes to spur growth. Investors can anticipate similar trends, with likely boosts to energy, defense, and manufacturing stocks. Potential trade restrictions may create short-term volatility in global stocks and supply-dependent sectors.

Taxes

Trump's tax policies lean toward benefitting corporations and high earners, with potential reductions in corporate tax rates to 15% and repeals of Biden-era taxes. At the same time, Trump proposes relief for middle-class earners, such as exemptions on tips, overtime, and Social Security wages. If implemented, these measures could be favorable for corporate earnings and, by extension, stock performance, though the potential benefits for working-class Americans remain unclear.

- Apple Inc. (AAPL) – Tax cuts could boost profits for this cash-rich tech giant.

- Microsoft Corp. (MSFT) – Lower tax rates could further increase profitability for this powerhouse.

- Berkshire Hathaway (BRK.B) – A diversified company that may see gains if corporate taxes decrease.

Tariffs and Trade

Trump’s trade policies emphasize American production, with plans to impose tariffs of 10-20% on foreign goods and reduce dependency on imported essential goods. This stance could have mixed effects on U.S. businesses: some domestic manufacturers might gain, but companies dependent on international supply chains could face increased costs.

- Caterpillar Inc. (CAT) – Global operations make it highly sensitive to trade policies.

- Nucor Corporation (NUE) – Domestic steel producer likely to benefit from tariffs on imports.

- Ford Motor Co. (F) – U.S.-based automaker that could gain from a focus on American manufacturing.

Social Security, Medicare, and Medicaid

Trump aims to protect these programs, though his tax proposals (such as exempting tip income) may impact funding. Any shifts could affect healthcare providers, insurance companies, and related industries.

- UnitedHealth Group (UNH) – Major health insurer impacted by Medicare and Medicaid policy shifts.

- CVS Health Corp. (CVS) – A leading provider in healthcare and pharmacy services, sensitive to entitlement program changes.

- Humana Inc. (HUM) – Large Medicare provider that would be affected by policy adjustments.

Affordable Care Act and Health Care

Trump continues to push for ACA repeal without offering a concrete replacement, aligning with his skepticism of federal health mandates. This uncertainty may contribute to volatility in health insurance and hospital stocks, especially if federal subsidies for health coverage decrease.

- Centene Corp. (CNC) – Heavy involvement in government-backed health insurance programs.

- Cigna Group (CI) – Major player in health insurance, reliant on federal health policies.

- Anthem Inc. (ANTM) – A key ACA market insurer, vulnerable to any repeal efforts.

Clean Energy and Fossil Fuels

Trump favors traditional energy sources, advocating for “drill, baby, drill!” while opposing green energy investments. EV development incentives and Biden-era climate-focused spending may be rolled back. This change could benefit traditional energy stocks and reduce support for renewable energy firms.

- Exxon Mobil Corp. (XOM) – Set to benefit from a pro-fossil-fuel stance.

- NextEra Energy Inc. (NEE) – A major renewable energy provider that may face policy headwinds.

- Chevron Corp. (CVX) – Oil and gas company that could gain from relaxed regulations.

Electric Vehicles (EV)

While not opposing EVs directly, Trump would likely end federal incentives for EV adoption, which could slow the sector’s growth. For investors, this could mean increased support for fossil-fuel-dependent industries and pressure on renewable energy and EV companies, especially those reliant on subsidies.

- Tesla Inc. (TSLA) – Leader in EVs that could be impacted by changes to federal subsidies.

- Ford Motor Co. (F) – Increasing EV presence but may feel the pinch without incentives.

- General Motors Co. (GM) – Investing heavily in EVs; affected by shifts in government support.

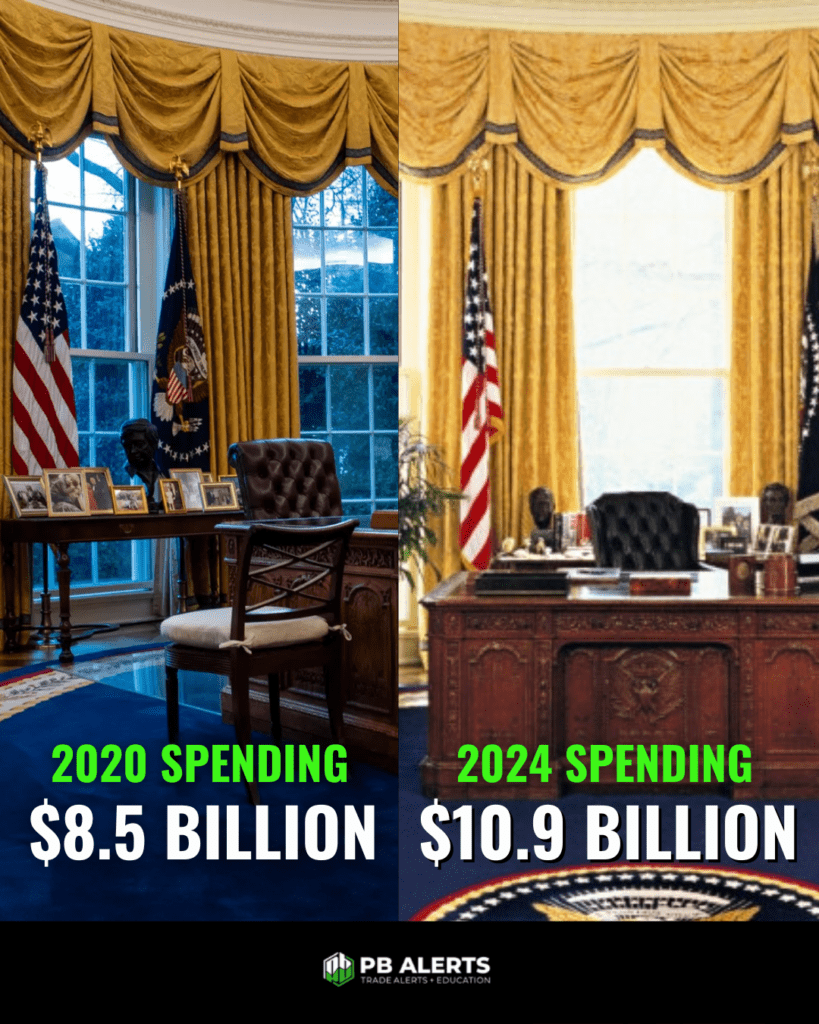

Cryptocurrency

Crypto investors see this as a big win for Crypto. Bitcoin hit $75K after the news of Trump winning hit the markets.

- Coinbase Global Inc. (COIN) – Major U.S. crypto exchange, sensitive to regulation changes.

- MicroStrategy Inc. (MSTR) – Holds large bitcoin assets; impacted by crypto market trends.

- Marathon Digital Holdings Inc. (MARA) – A key player in crypto mining, vulnerable to regulation.

Social Media

As an advocate for free speech and a user of his own platform, Trump is likely to focus on reducing regulation on social media, potentially overturning restrictions on platforms like Truth Social. This could benefit social media firms, particularly those catering to conservative voices.

- Meta Platforms Inc. (META) – Possible benefactor of fewer content regulations.

- Twitter (X) – Could gain freedom under a reduced regulation approach.

- Rumble Inc. (RUM) – Alternative social media platform that may benefit from free speech policies.

Artificial Intelligence (AI)

While Trump has not outlined specific AI policies, a deregulatory stance could support faster AI development across sectors. Investors should watch for AI-driven gains in tech and automation, although ethical concerns may emerge as a key issue.

- NVIDIA Corporation (NVDA) – Dominates in AI computing hardware and is positioned to grow with less regulation.

- Alphabet Inc. (GOOGL) – Heavily invested in AI development, sensitive to changes in tech policy.

- Microsoft Corp. (MSFT) – A leader in AI with OpenAI partnership, potentially benefits from a deregulatory environment.

Immigration

Expect a hardline approach with a focus on border security, resembling Trump's previous tenure. His plan includes potential mass deportations, expanded law enforcement involvement, and stricter entry screenings, with proposed reforms like ending birthright citizenship. Immigration policy may become more stringent overall, potentially impacting industries reliant on immigrant labor, such as agriculture and construction.

- Tyson Foods Inc. (TSN) – Reliant on immigrant labor for production; may face challenges with stricter policies.

- Laboratory Corporation of America (LH) – Healthcare company dependent on diverse workforce access.

- Aramark (ARMK) – Foodservice provider that might be affected by immigrant labor shifts.

Abortion

Although Trump takes credit for overturning Roe v. Wade, he aims to keep the issue in state hands rather than pursuing a federal abortion ban. While less aggressive federally, conservative legal pathways may still aim for broader protections for fetuses. Investors should watch sectors tied to healthcare and reproductive services, which could see volatility depending on state actions.

- HCA Healthcare Inc. (HCA) – Could see impacts based on state-by-state abortion regulation.

- Pfizer Inc. (PFE) – Pharma company that produces women’s health drugs, possibly affected by access regulations.

- Bayer AG (BAYRY) – Produces contraceptive and women’s health products, vulnerable to policy changes.

DEI, LGBTQ, and Civil Rights

Expect a push against federal diversity programs and transgender rights in schools. Trump's policies may shift toward more traditional definitions of civil rights, particularly in education and public services. Investors in sectors connected to government contracts or public services may want to monitor these policy shifts for potential changes.

- Target Corp. (TGT) – Retailer with a DEI focus; could experience consumer and regulatory shifts.

- Salesforce Inc. (CRM) – Known for inclusive workplace policies, potentially influenced by new DEI guidelines.

- Disney (DIS) – Entertainment giant that could be affected by social policy shifts.

Regulation, Bureaucracy, and Presidential Power

Trump’s approach could reduce regulatory oversight across various sectors, with promises to open federal lands for fossil fuel production, ease housing restrictions, and cut environmental regulations. For investors, these moves may signal an advantageous period for energy and construction industries, though environmental and socially conscious sectors could face challenges.

- Lockheed Martin (LMT) – Defense contractor likely to benefit from increased military spending.

- Boeing Co. (BA) – Aerospace company that could gain from deregulation and defense budget increases.

- Raytheon Technologies (RTX) – Heavily dependent on defense contracts, sensitive to federal policy changes.

Education

Trump’s education policies focus on removing federal oversight and reallocating funds to private initiatives, potentially eliminating the Department of Education. He has proposed new federal funding models favoring merit-based teacher pay and limiting diversity initiatives in schools. Educational tech and private institutions could see expansion opportunities, while traditional public systems may face funding pressures.

- Chegg Inc. (CHGG) – Online education company that might benefit from privatized education support.

- 2U Inc. (TWOU) – Provider of online degree programs that could gain from new education models.

- K12 Inc. (LRN) – Online learning company that might benefit from changes to public education funding.

What This Means for Investors

Investors might find opportunities in energy, defense, and manufacturing sectors, while green energy and EV stocks may face challenges. The potential for corporate tax cuts could make U.S. equities attractive, but trade policies and reduced federal spending in specific areas could introduce volatility. Trump’s presidency could be favorable for traditional industries, but a selective approach will be key for navigating the shifting policy landscape.