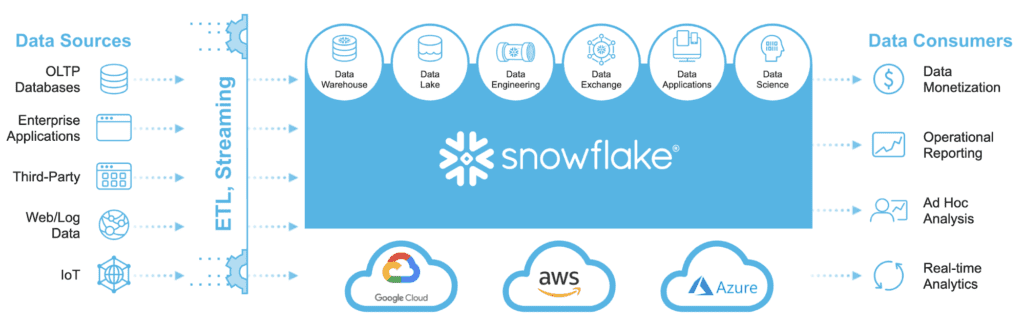

When Snowflake first entered the scene, it revolutionized how enterprises manage, analyze, and share data, creating a platform that became indispensable for businesses with significant data processing needs. Its cloud-based architecture enables organizations to store, process, and analyze vast amounts of data across multiple clouds—AWS, Azure, and Google Cloud—without the complexity of traditional data migration or integration. Snowflake isn’t just a data warehousing solution; it is a glimpse into the future of enterprise AI, data collaboration, and real-time insights.

A Seamless Data Ecosystem

Snowflake's platform operates across three distinct layers:

- Data Cloud & Warehousing | No Hardware - No Software: Snowflake optimizes every aspect of data storage, from organization to compression, creating an ecosystem designed for diverse and vast workloads. This provides a unified environment for data lakes, warehousing, engineering, and real-time sharing—all without the need for physical hardware or software installations. The design is built for vast and diverse data workloads. When data is uploaded, Snowflake optimizes all aspects of how this data is stored.

- Query Processing: With independent clusters called “virtual warehouses,” Snowflake maximizes performance by ensuring queries don’t compete for compute.

- Cloud Services: These services coordinate every operation, from data queries to collaboration, providing users with a seamless experience across multiple cloud platforms.

This trifecta allows Snowflake to redefine how businesses approach data management, making it a cornerstone for those aiming to leverage data-driven decision-making.

Why Snowflake Stands Out

Data Sharing & Internal Economy of Collaboration

One of Snowflake's defining features is its ability to enable seamless data sharing across organizations. With its internal marketplace, businesses can monetize their data by offering it to other users, creating an internal economy of collaboration that is both secure and efficient.

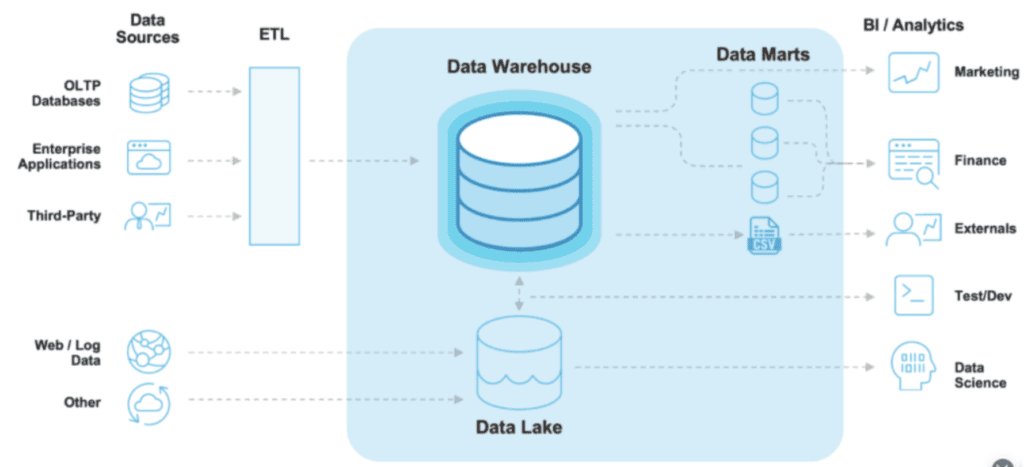

Data Warehouse & Data Lake Storage | Structured & Raw Data Unite

- Data warehousing organizes data into clean and unified sets where little to no data prep is required for users to access and analyze data. Accurate and complete data is available more quickly, turning information into insight.

- Data lakes store a vast amount of both structured and unstructured (raw) data. This data is available for use far faster and the broader range can be analyzed in new ways, often with unexpected and previously unavailable insights.

Snowflake's ability to bridge data lakes and warehouses gives organizations the flexibility to work with both raw and structured data. This dual capability allows for quicker insights and more comprehensive analytics, giving businesses an edge in innovation and strategy.

AI and Machine Learning Integration

As businesses increasingly rely on AI for decision-making, Snowflake’s platform provides the scalable infrastructure needed to support massive datasets for AI training and inference. Its architecture integrates seamlessly with AI applications, making it a critical player in the AI ecosystem.

The Risks

High Valuation & Volatility: Snowflake’s high valuation multiples have made it susceptible to sharp market corrections, particularly in uncertain macro environments.

Competition: Giants like AWS, Google Cloud, and Microsoft Azure are formidable players, offering data solutions with deep pockets and vast customer bases.

Dependence on Cloud Providers: While Snowflake’s multi-cloud strategy is an asset, its reliance on cloud providers for infrastructure leaves it vulnerable to changes in partnerships or pricing structures.

Economic Downturns: In challenging economic conditions, data warehousing may fall victim to budget cuts, particularly for organizations looking to trim operational expenses.

The Narrative

From Bottom-Feeder to Future Megacap

Snowflake has faced its share of challenges, from macroeconomic headwinds to sector-wide volatility. However, its ability to bounce back and adapt has set it apart. Despite temporary setbacks, including controversies such as the data breach, Snowflake's fundamentals remain rock solid. This company is best in class with a moat that protects its position as a leader in enterprise data utilization.

The AI Advantage

In the AI era, Snowflake has transformed from a laggard to a leader. Its ability to process and integrate data for enterprise AI applications gives it an edge over competitors. Snowflake has demonstrated it can not only keep pace with the AI revolution but lead it, creating solutions at a fraction of the cost of its peers.

Customer Stickiness

Snowflake's marketplace and collaboration tools create an ecosystem that customers find difficult to leave, much like Amazon’s AWS or Starbucks’ loyalty programs. This internal economy ensures long-term customer retention.

The Verdict: A Firesale on the Future

For StockSavvyShay and Big Quench, Snowflake represents a generational opportunity. With only 30% of businesses currently using the cloud, the runway for growth is massive. The world’s data is Snowflake’s ecosystem, and its innovations in AI, data sharing, and enterprise solutions position it as a future megacap.

With a Rule of 40 score of 54 and 30% growth projected over the next few years, Snowflake isn’t just a story stock—it’s a company writing the future of enterprise AI. Quench and Shay remain steadfast in their conviction: Snowflake is a name to buy and hold as it transitions from underdog to titan. For them, the recent volatility represents a firesale, and they’re sharks circling the opportunity. This is the time to scale in, secure positions, and hold for the long term.

Snowflake had a heavy selloff after wrestling back-to-back heavyweights of the user-end data "breach," sector volatility, and macro FUD catalysts. However, the data breach was settled with no significant financial consequences and this thesis is one of dominance over the next decade.

People fail to understand just how valuable the data they process is for some of the largest businesses in the world. Similar to how car companies will likely move towards EVs, businesses will move towards data storage and utilization companies.

There is a tremendous amount of growth potential with only 30% of companies currently using the cloud. The world's data is their ecosystem and Snowflake is best positioned to benefit from the AI thematic. They have transitioned from being behind in the AI race to at the forefront creating an LLM in just 3 months at 1/8th the cost of their competitors. Their internal economy of data sharing will keep customers.

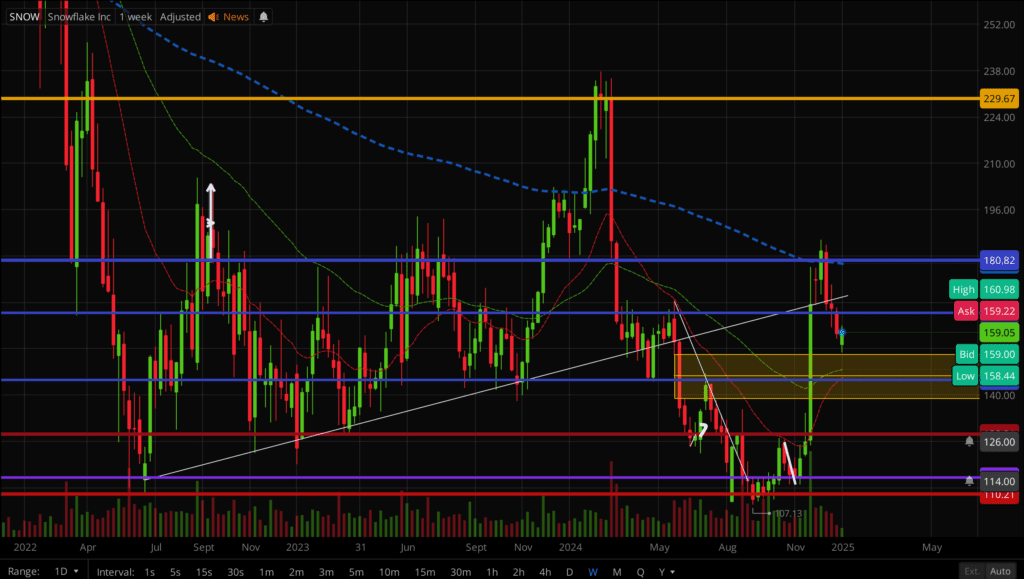

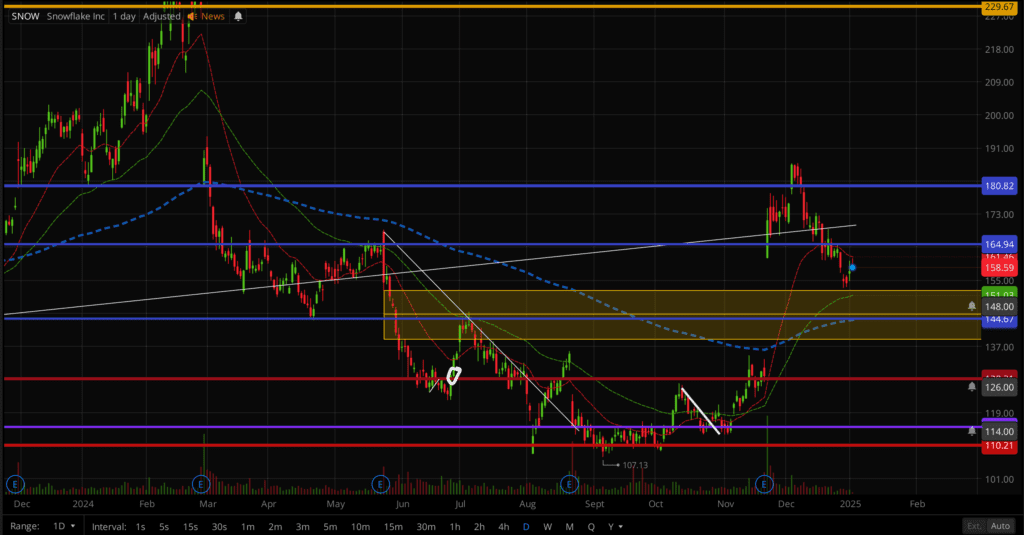

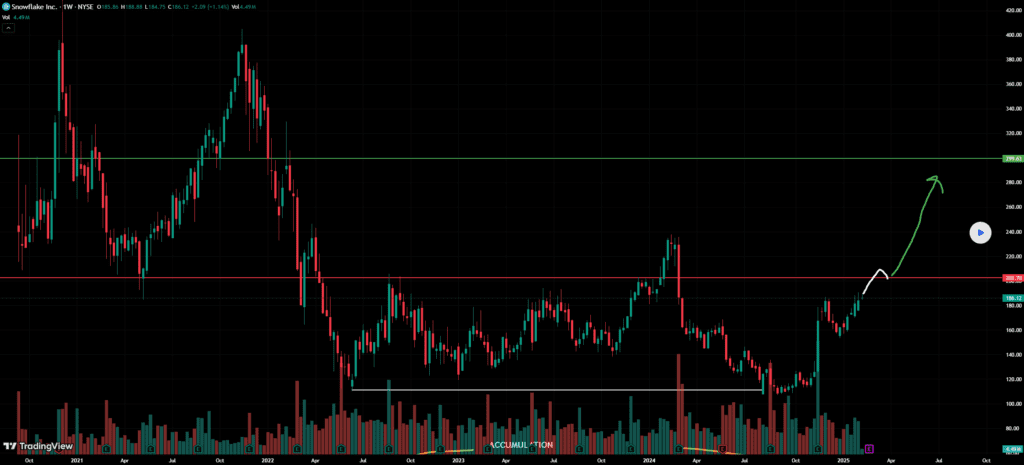

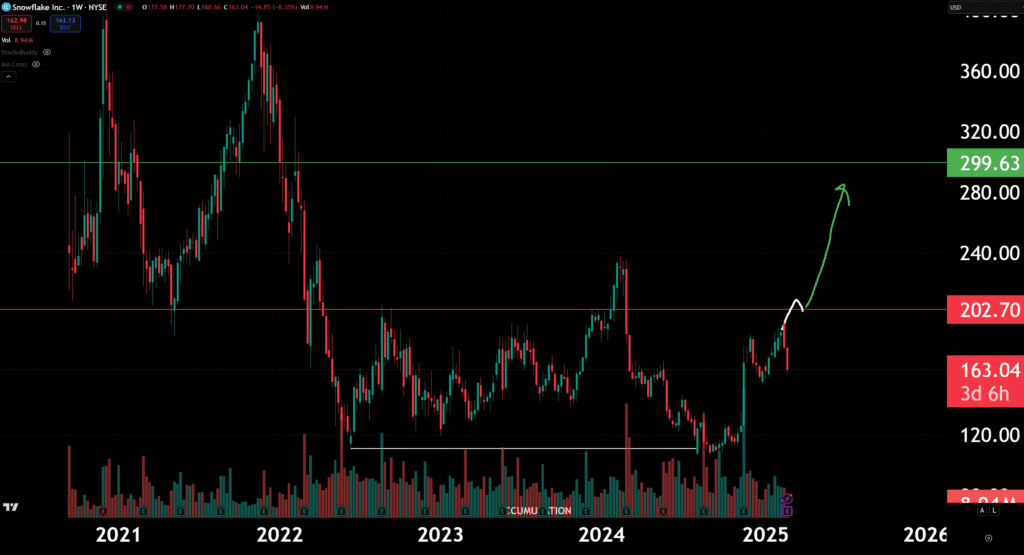

The Trade

Quench, well-known for his bottom-feeder setups, did not disappoint with $SNOW. We have been scaling in from $125 down to $109 awaiting the break of $145 to target $180 short-term and $230, $300, and $400 long-term.

The Data "Breach"

After the data breach and drawdown after the previous earnings in May and August of 2024, a formidable base was formed at $109-$111. November earnings came and reinforced the tagline, "narrative follows price action." Eleven days later, Snowflake surged 46%.

From here, $145 and $165 are key levels to hold. Our main long-term bullish pivot is $180 where price has moved very quickly up to $230.

Christmas came early this year. Bottom dollar entry, high conviction, against a mass of haters. Stock price was completely disconnected by business execution. This is not just a data warehousing company that will be cannibalized by AI. This is a company that stores 40% of Global 2000 data into their ecosystem that the previous CEO didn’t believe in and thus didn’t invest in the architecture to support it.

Sridhar Ramaswamy is an AI genius who is launching Snowflake towards becoming the data platform for enterprise AI. This is the first time in ten quarters net retention rate improved, revenue re-acceleration towards 29%, and 25% free cash flow. Their margins are expanding. They are still lower than previously but that is because they are investing in compute to build their AI vision. Their Rule of 40 score is an incredible 54 in an investment year. Shay sees 30% growth for the next 3-4 years. There is a ton of room for this rally to continue.

New Position Trade | 2-3x Potential

2/10/25 Update

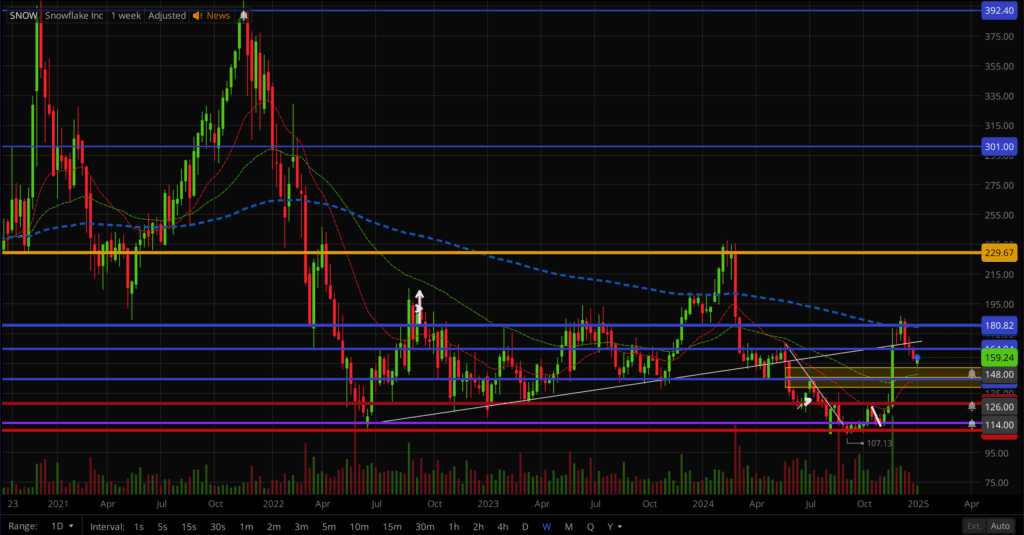

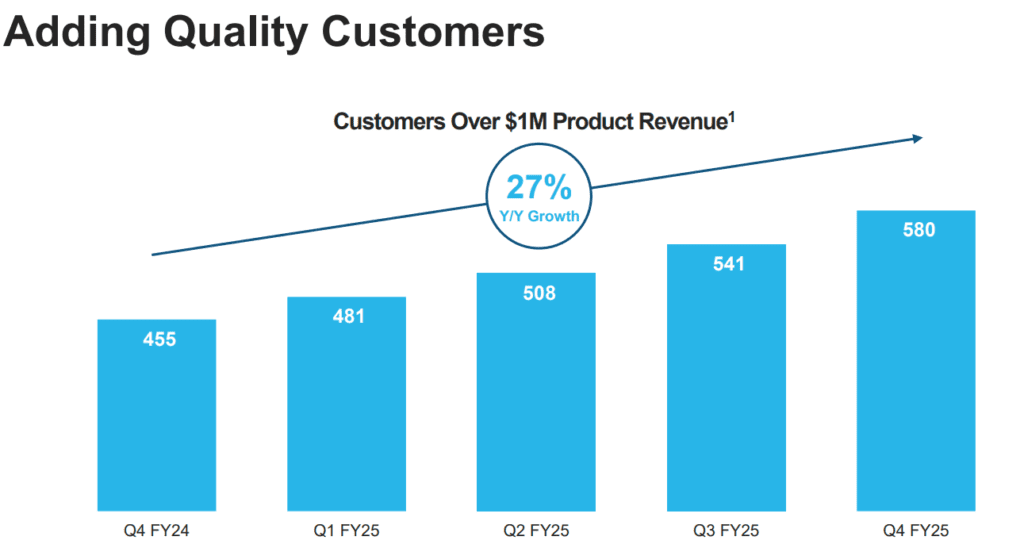

Our top analyst Shay Boloor (StockSavvyShay) is adamant that Snowflake will be rerated in 2025 with a price target of $300 (called out live on Fox Business). Their NRR is at 127%, meaning existing customers will spend 27% more YoY. For Snowflake to grow 27% within the next year, all they need to do is nothing. They can afford to sit.

Data consumption models make money out of thin air. 40% of the Fortune 2000 data is stored in Snowflake’s ecosystem ALREADY. They are trading at 25% of Palantir’s valuation and 20% of Cloudflare’s. This could be a 3-4x trade. There is still no floor on AI and its applications.

On the technical side, over $205 and we have a liquidity zone up to $300. Our entries are at $109 and $125, but this would be a secondary entry for a position trade to capitalize on one of the top names in stage two AI (software/applications).

Entry: Over $205

Targets: $230, $300, $400

Follow the trade on Big Quench's Chart!

Q4 2024 Earnings

2/24/24

We are still awaiting that rerating narrative to come to fruition. Shay is specifically watching net retention rate, Gen AI revenue becoming heavier percentage, and gross margins to stabilize and expand. Snowflake is still lagging in price. Snowflake is well-positioned to dominate the agent AI world and the data marketplace, similar to how Salesforce became a dominant player in the cloud market. Their data consumption-based business model is a key advantage, as it allows the company to generate revenue on "thin air" as data usage grows. Best case scenario is Nvidia drops on earnings and Snowflake dominates the quarter. Then, Shay will be adding. Shay is still firm in his $300 year-end target. For Quench, he wants to see price break through $205 with conviction.

3/3/25 Update

Snowflake is holding up surprisingly well relative to the market. For Shay, the earnings were quite revealing that the market has not priced in future growth. They are pricing in 24% growth over the next four years. All metrics that Shay focuses on are showing 27-28%. Existing customers that spend over $1 million expanded 27% YoY.

AI agents are still in the experimental phase. Once they become scalable, it will be an explosion of data that Snowflake is well positioned to capitalize on. Data queries will incrementally add value over time. Data liquidity (sharing data between customers) grew 33% YoY. This is a goldmine for both profitability and customer stickiness.

LLMs will become a massive commodity where companies will cannibalize others to differentiate and compete. Companies like Palantir and Snowflake are “LLM and cloud agnostic” players. The Gen AI side of their business is taking off. Their partnership with OpenAI that directly integrates OpenAI’s models into a cortex AI suite, Snowflake’s inflection point.

Snowflake's biggest win for Shay was their RPO (Remaining Performance Obligations) rising 33% YoY. This is what customers are going to eventually spend in their ecosystem. This suggests that Snowflake has a significant amount of future contracted revenue that has not been recognized.