TransMedics Group, Inc. (TMDX) is not just another healthcare company. It is a pioneer in the field of organ transplantation, fundamentally changing how donor organs are preserved, transported, and utilized. By leveraging cutting-edge technology, TransMedics' Organ Care System (OCS) addresses critical limitations of traditional cold storage methods. This innovation has placed the company at the forefront of medical advancements, with a total addressable market (TAM) that is both massive and largely untapped.

As of early 2025, TransMedics has become a high-conviction play for Market Mastery members, with a clear trajectory to mid-cap status and beyond. Shay and Quench have been aggressively adding to this position, believing it to be a rare gem in a crowded market. Here's why this small-cap stock has earned its place in our bonsai portfolio alongside giants like $PLTR and $AMZN.

The Innovation: Organ Care System (OCS)

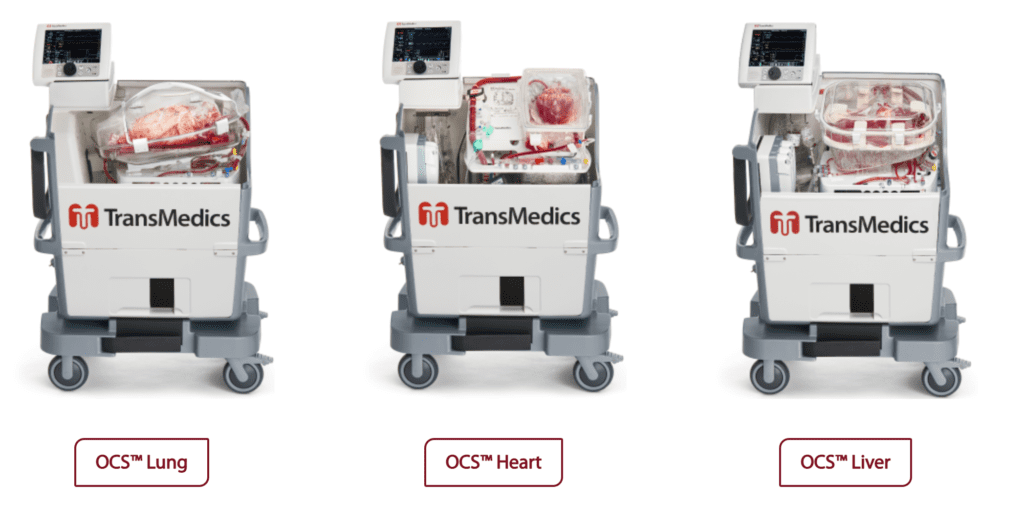

At the heart of TransMedics’ value proposition is the Organ Care System (OCS). They have the only FDA approved technology for heart, lung, and liver transplantation indication in the United States. Unlike traditional cold storage, which involves placing donor organs in ice, the OCS preserves organs in a warm, functioning state. This revolutionary approach:

- Enhances Organ Quality: Keeps organs alive and functioning until transplantation.

- Increases Organ Utilization: Reduces the number of organs discarded due to damage or poor quality.

- Expands the Donor Pool: Allows for longer preservation times and safer transport across greater distances.

This end-to-end solution is a game changer for a healthcare system where organ shortages are a perennial problem.

Fundamental Strengths: Why $TMDX Is a High-Conviction Stock

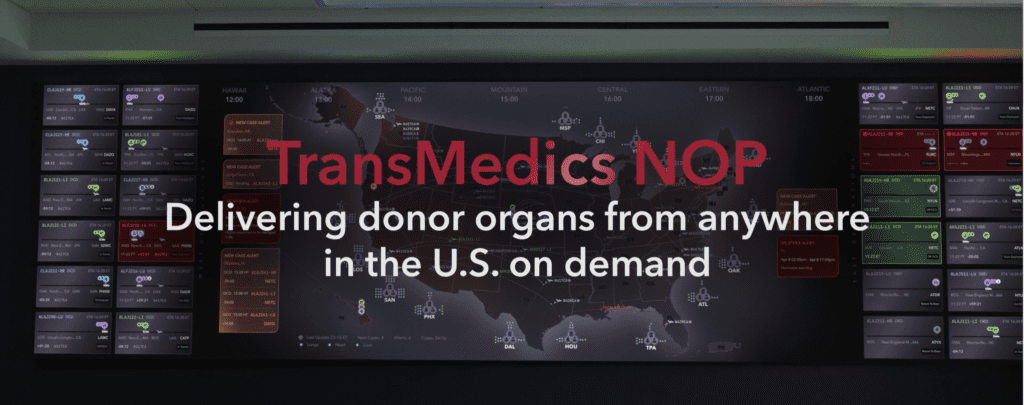

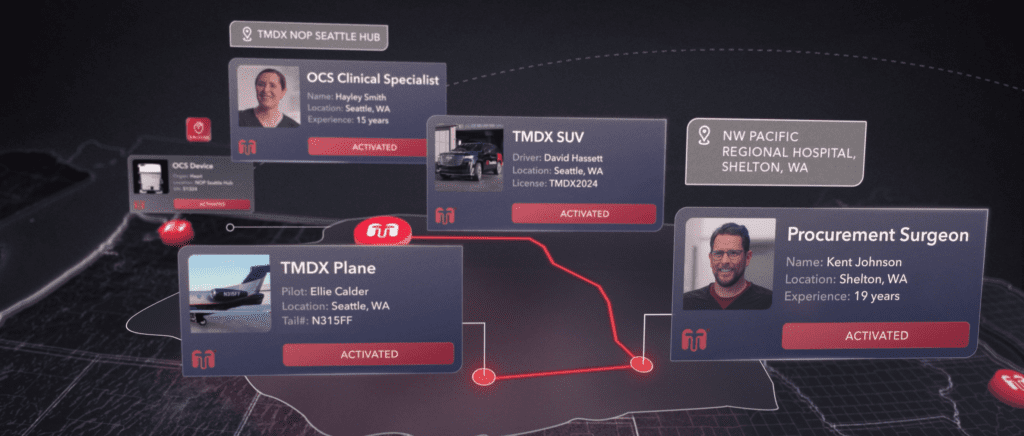

- Defensible Moat: TransMedics is not just a product company; it provides a comprehensive, white-glove service that includes organ transportation and monitoring. Competitors like NRP lack the scalability to handle more than 25% of cases, while TransMedics dominates with an end-to-end solution.

- Growth Potential: The TAM for organ transplants is enormous, and TransMedics is one of the first movers in this space. The company is aggressively scaling operations, adding fleets and expanding its geographic reach.

- Expanding Narrative: While the stock price has faced volatility, the business fundamentals continue to improve. The addition of daily flights alone demonstrates the growing demand for their services. Shay and Quench believe 2025 will be a pivotal year for TransMedics, marked by substantial growth and a narrative shift.

- Mergers and Acquisitions (M&A) Potential: With Stryker acquiring NARI at 126x revenue, TransMedics is positioned as an attractive target or could follow a similar growth trajectory independently. Based on that valuation, $TMDX could be worth $290, significantly above its current price of $75 at the time of writing this.

- Short Squeeze Opportunity: With 24% short interest, TransMedics is also a prime candidate for a significant squeeze, adding fuel to the potential upside.

Recent Developments: Challenges and Opportunities

TransMedics has faced its share of challenges, including updated guidance for 2024, CFO transitions, and tax loss harvesting pressures. However, these headwinds are overshadowed by its long-term growth story:

- CFO Transition: While the resignation of CFO Stephen Gordon caused temporary uncertainty, the appointment of Gerardo Hernandez signals fresh leadership as the company enters a critical growth phase.

- Earnings Guidance: Revised guidance initially raised concerns, but Shay expects topline growth closer to 45-55%, far exceeding the updated 35% estimate.

- Narrative Reset: Investor confidence will hinge on upcoming earnings. Shay and Quench anticipate earnings to "fix the narrative" and reignite bullish momentum.

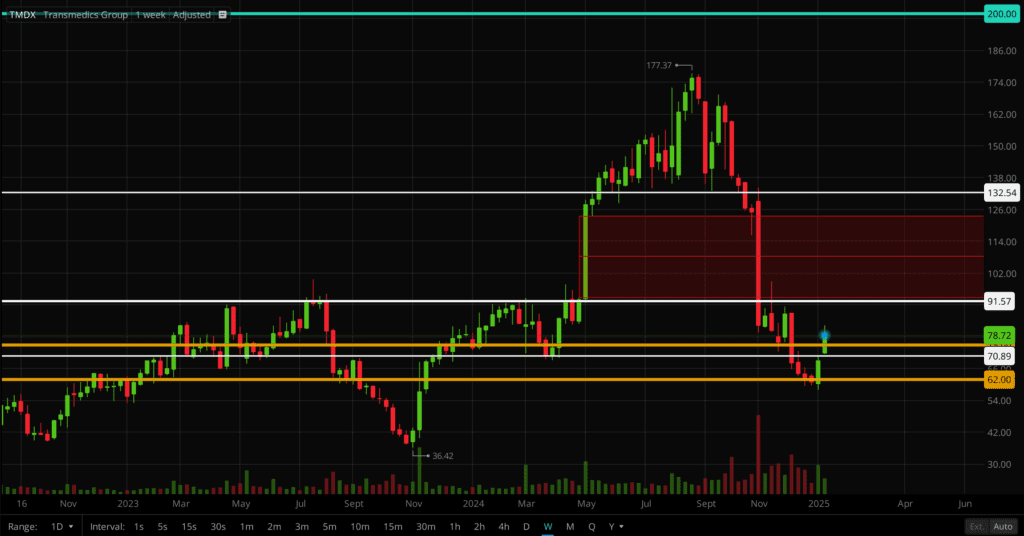

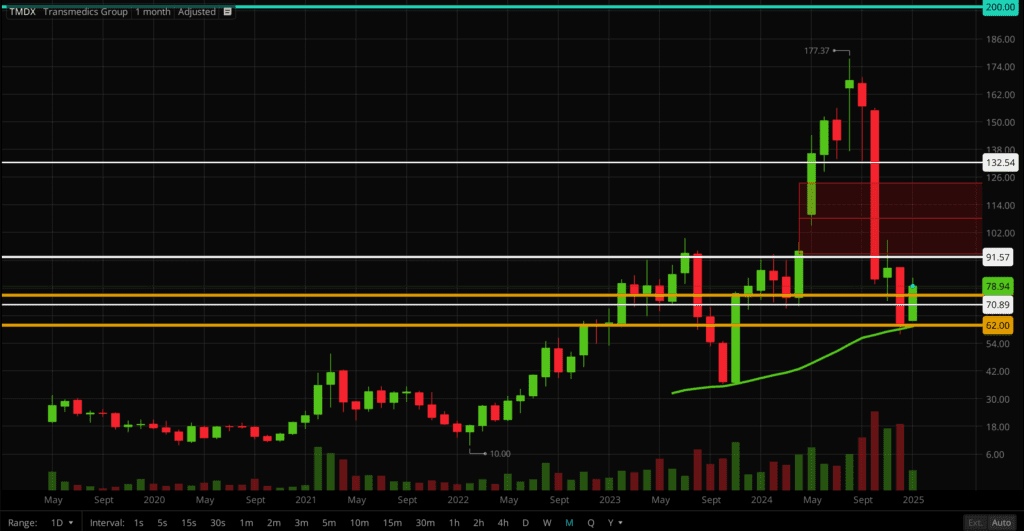

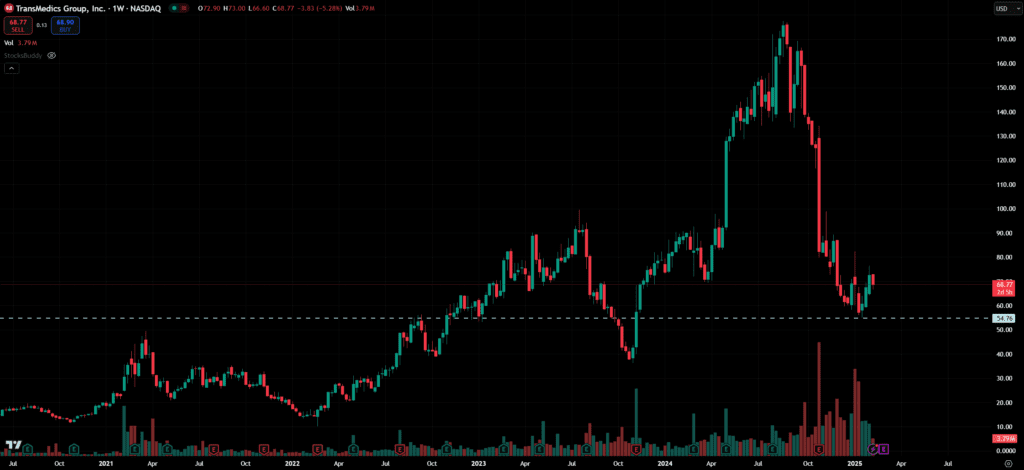

The Technicals: Key Levels and Targets

TransMedics’ technical setup mirrors its fundamental strength:

- Support Levels: $62 has been a key support zone for months. Shay and Quench have emphasized the importance of holding this level, with a worst-case scenario gap down to $40.

- Upside Targets: Over $75, the stock could see significant momentum, targeting $200-$250 in the long term.

- Short-Term Risks: Price action under $62 warrants caution. However, the 50SMA (green line below) on the monthly chart remains a guiding trendline. We also have top of range resistance at $91.

The Verdict: A Future Mid-Cap in the Making

TransMedics is not just a small-cap healthcare stock. It is a pioneer with a defensible moat, an expanding TAM, and a strong narrative aligning with long-term growth themes. From its groundbreaking OCS technology to its aggressive scaling and potential for M&A, $TMDX offers a compelling investment thesis.

For Shay and Quench, this is a firesale opportunity. While market volatility may persist, the fundamentals point to a bright future. Whether it’s a short squeeze, narrative shift, or earnings beat, TransMedics is poised to reward patient investors. As Quench aptly puts it: “This is a time to be a shark in the water and scale into position.”

Critical Price to Hold

2/3/25 Update

Above $55 and we are golden. Volume is beautiful for a reversal. We will be more confident over $80. Shay decreased his position to 4% due to the disconnect between what management is saying and the short-side. 2025 is the year for software. Shay needs more clarity and proof that his thesis is correct before adding to his position. Quench and Shay emphasize the importance of staying agile and willing to adjust positions based on new information, even if it meant going against their initial long-term convictions.