Hey traders, it's Meta Matt here, and it's time for another weekly trade analysis with Ben! Today, we dive deep into the AAPL stock chart and make our predictions on QQQ's future moves. So, grab your notepads and let's dissect these potential trading moves that Ben wrote out in his Market Thesis.

AAPL - Apple Inc.: The Tech Giant

Key Stats:

- Dividend Yield: 0.54%

- Current Stock Price: $174.49

- Support Levels: $170, $165

- Resistance Levels: $176.50, $180

- Institutional Ownership: 60.10%

Now, let's unpack the key insights on AAPL stock chart:

- This tech behemoth is in a current downtrend, breaking out of an ascending channel to the downside. Ouch!

- The high analyst price target is a juicy $240, with an average target of $198. That spells a potential upside of 13% to 37% from the current price.

- Mark your calendars for October 25th, 2023, because that's when Apple's earnings report drops – a potential game-changer.

- AAPL has been on a revenue-winning streak for the last four years, and its net income is singing a similar tune.

- Positive P/E ratio and positive EPS? Check!

Trading Strategies for AAPL:

- For the optimists out there, here's a swing long play. Wait for AAPL stock chart to break above $176.50, ensuring that buying pressure is strong. If that's the case, consider entering above $176.50, with a savvy stop loss below $175 for risk management. Target prices? Aim for $180 and then $186.50+.

- But what if you're leaning towards the bearish side? If AAPL stock chart doesn't hold above $170, it might be time to enter a short position. Set your stop loss above $171.50, stay vigilant, and target $165 and beyond.

Remember, always have a max stop loss in mind before entering the play.

QQQ - Invesco QQQ Trust: Riding the Market Waves

Key Stats:

- Dividend Yield: 0.58%

- Current Stock Price: $358.13

- Support Levels: $350, $340

- Resistance Levels: $363, $371

Time to shine the spotlight on the QQQ:

- Analysts are eyeing a promising average price target of $422, which hints at a possible 17% upside from the current price.

- Over the past year, QQQ has delivered a respectable 9.54% return.

- With a 9 out of 10 Quant rating for Quality and Momentum, QQQ seems to be the belle of the ball.

Trading Strategies for QQQ:

- Bullish spirits, this one's for you. If QQQ manages to break above $363 and the buying pressure holds strong, consider joining the party above $363. Safeguard your trade with a stop loss below $360, and set your sights on price targets at $371 and then $380+.

- But, if QQQ falters and doesn't hold that $350 support level, there might be a short play in the cards. Enter cautiously and set your stop loss above $353. Target prices? $340 and beyond.

As always, keep your max stop loss handy to manage risks effectively.

Hidden Potential: The IT Sector

The Information Technology sector is a treasure trove of investment opportunities. Here's why savvy investors often flock to IT:

- Innovation and Growth: IT is the hub of innovation, with technologies like AI, blockchain, and IoT promising hefty returns.

- Global Demand: IT solutions transcend borders, catering to a global audience.

- Resilience: IT tends to weather economic storms better than most sectors.

- Scalability: Many IT companies can scale rapidly without soaring costs.

- Dividends and Appreciation: Some IT companies offer dividends, and tech stocks have historically appreciated over time.

- Diversification: The IT sector spans various sub-industries, allowing for portfolio diversity.

- Evolving Consumer Behavior: Changing preferences drive the growth of IT-related industries.

- Long-Term Potential: With tech becoming an integral part of daily life, IT is primed for long-term growth.

So, whether you're eyeing AAPL stock chart or the QQQ ETF, remember, knowledge is power in the world of trading. Stay sharp, set your targets, and may your trades be ever in your favor! 🚀📊

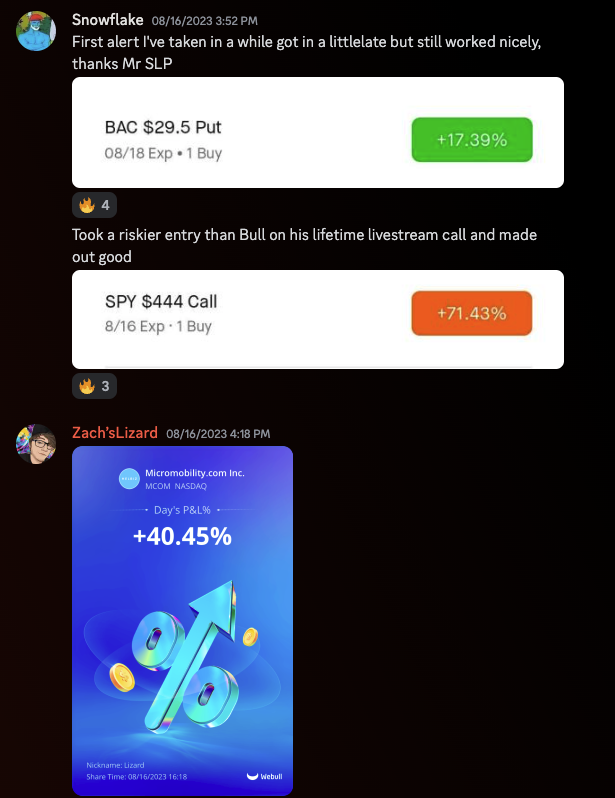

Check out our FREE Trading Discord for more: https://discord.gg/pennybois