Series 9 And Ultra 2 Apple Watches Ban

Apple ($AAPL) stated on Monday that they will stop selling the Series 9 and Ultra 2 versions of its Apple Watch. This is following a recent ruling by the International Trade Commission that found Apple was in violation of Masimo's ($MASI) pulse oximeter patent. Masimo's patented technology uses light to read blood-oxygen levels. In 2020 Apple introduced a pulse oximeter feature for its Apple Watches Series 6 lineup. There is a ruling review period that ends December 25th, if the ruling stands Apple will have to make substantial changes to the way these Apple Watches work or have the models banned.

What Other Products Will This Affect?

Earlier this year the US International Trade Commission ruled that Apple infringed on Masimo's patents and would impose an import ban on the Apple Watch Series 9 and Ultra 2 starting December 26th. At the time no one thought it would go through seeing as Apple gets sued all the time, however here we are. If the import ban gets approved, it might be hard to find other versions of the Apple Watch such as the Apple Watch Series 6 and later, as well as all models of Apple Watch Ultra. Apple stated that the ban will not affect Apple Watch SE, and that they plan on taking all measures to make all their Apple Watches available for everyone "as soon as possible."

Apple's Defense

Masimo's CEO stated that Apple has yet to approach them about a licensing agreement or settlement, but that he is open to both. Apple however has stated that they believe the findings are inaccurate and submitted evidence demonstrating how the ban could negatively affect healthcare, scientific and medical research. They also mentioned the Apple Watch users whom currently rely on the ECG, blood oxygen and other health related features in their defense. The pulse oximeter in the Apple Watch can be useful for people with asthma, lung cancer, health failure and other health conditions.

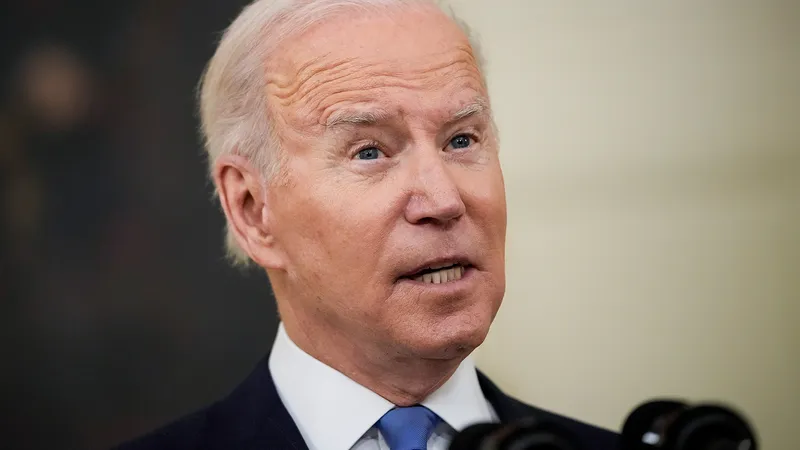

Why Is President Biden Involved?

President Biden had 60 days to review the ruling before the ban could go into effect. This is because the US International Trade Commission, which advises the White House and Congress on matters involving intellectual property disputes, is overseen by the president. Apple asked the Biden administration to reverse the ban, and The White House has until Christmas Day to decide what to do. This could be why Apple hasn't struck a deal with Masimo. "Apple is the gold standard when it comes to U.S. innovation, and I think they're hoping the Biden administration recognizes that and agrees with them to get this overturned," one expert said said. "Apple likes to play hardball with other companies, and sometimes it helps them reach more favorable deals over things like licensing."

Masimo Vs. Apple: The History

According to court documents, Masimo had a meeting with Apple back in 2013 about using their technology in Apple's products, but nothing came of it. Apple then went on to reportedly poach two Masimo executives and key engineers. Masimo claimed Apple did this in order to illegally duplicate its technology. Apple denies this, stating that they consulted several medical technology companies before deciding to come up with its own version of a pulse oximeter.

How Will This Affect Apple?

This comes at the end of the holiday season, and experts say that this shouldn't effect Apple's holiday sales too much, as those who wanted to buy the Apple Watch as a gift already have. That being said, according to one research expert this isn't a good look for Apple and "there may be an impact on sales in the first quarter of next year, but at the end of the day, no one wants to be caught infringing on patents." Apple sold 49 million smartwatches in 2022 and around 27 million in the first 3 quarters of 2023. That all being said Dan Ives said the ban could cost Apple $300-$400 million in lost sales.

Is Apple Growing "Too Cautious"?

The Apple iPad didn't get a new model this year, marking this the first time that has happened since its launch in 2010. Rumor had it that Apple was planning on launching a foldable iPad, however those rumors were dispelled last week when Apple said they don't plan on releasing a foldable tablet anytime soon. Instead they plan on focusing on OLED screens. This leads investors to believe that Apple has become more cautious recently. This could be in part due to social media, as they might fear a video going viral breaking down a defect or flaw in the product. A foldable iPad could be looked upon as a potential disaster due to this, instead of a game-changing idea. Keep in mind, this is the same company that in 2016 removed the headphone jack from the iPhone.

Apple Loses Goldman Sachs Partnership

Apple and Goldman Sachs are looking at the end of their Apple Card partnership as soon as early 2024. The "break-up" has been described as "rocky", and now Goldman is in search for a buyer for its share of the partnership. Apple might have to make changes to the partnership details in order to attract a new buyer. For example, they currently don't share Apple Card user data with anyone, including Goldman Sachs. This was one of the reasons Goldman struggled to turn the Apple Card partnership into a lucrative one. This could change for Apple with a new partner. Citigroup and Capital One are two of the companies that have been rumored as potential new partners, JPMorgan Chase was offered a deal but passed because "their potential cut of profits was too small".

How YOU Can Claim Part Of Apple's $25 Million Settlement

If you are subscribed to Apple Music you could be eligible to claim part of a $25 million settlement. This lawsuit is over Apple's Family Sharing perk, a free service that allows up to 6 users to access (all under one shared subscription) pay-per-month apps such as Apple News+, Music TV+ and Apple Card. According to the settlement in Walters Peters v Apple Inc, Apple advertisements for Family Sharing included apps that were not included with the service. Apple has denied any wrongdoing that it misled customers. U.S. customers who had a Family Sharing plan and bought a subscription to a third-party app due between 06/21/15-01/30/19 can file a claim under the settlement here. Eligible class members can expect to receive up to $30 via ACH transfer or a check.

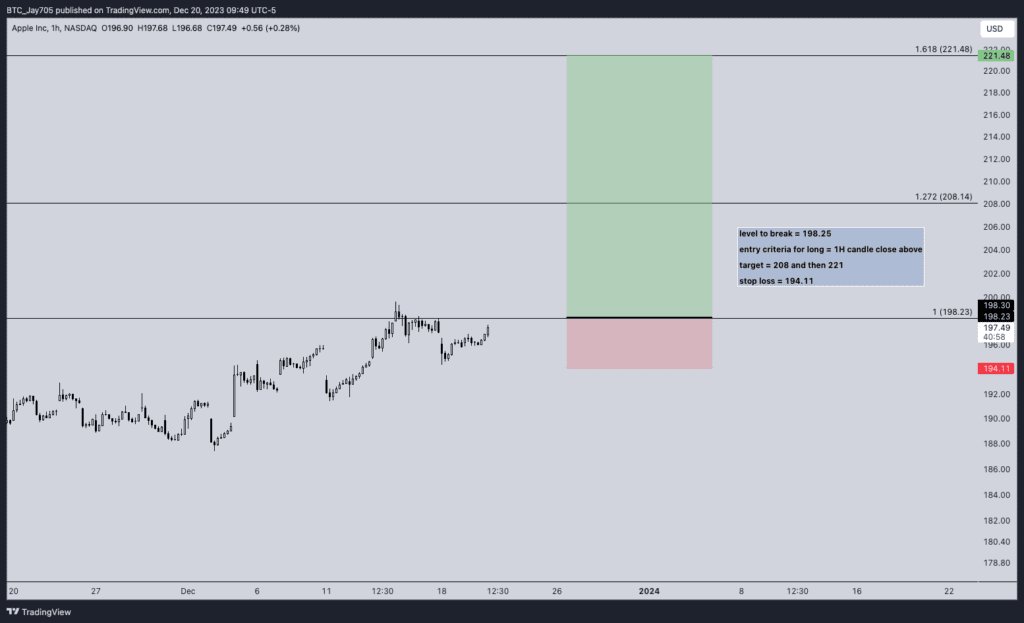

How Our Exclusive In-House Analysts Are Trading $AAPL

Check out our Free Trading Discord!!

"$AAPL is reaching all-time-highs. Once it breaks that it typically flys, so I don't want to short here. I am looking for a bullish entry, with a 1H close (4H close is safer, but this one might go fast so 1H is good too here) as my confirmation to enter." -BTC_Jay

Entry: 1H Candle Close Above $198.25

Targets: $208, $211

Stop Loss: $194.11

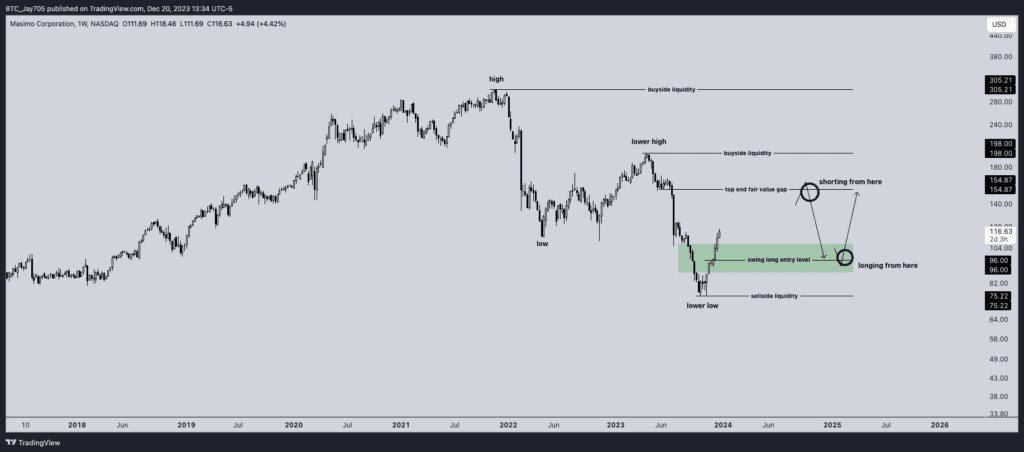

How We Are Trading Masimo Corp $MASI

"First of all this is trading in a weekly downtrend ever since we have put in a top at $305.21 back in November 2021. Currently we are trading at $116.49, which is no-man's land to me. I would either want to long from support on a higher low, or I would like to short from a higher resistance." -BTC_Jay

Option 1: Bullish/Long Entry

Entry: Wait for the price to go below $96, then enter upon a 4H candle close back above $96

Targets: $107, $124

Stop Loss: $88

Be Sure To Check Out StocksBuddy

Option 2: Bearish/Short Entry

Entry: Wait for the price to go above $154, then short upon a 4H candle close back below $154

Targets: $139, $129

Stop Loss: $164

We have an 8 week "Options 101 Course" starting the first week of January available to our Premium Members in the discord!! We will go over how to take this analysis to help determine options contracts to buy/sell. In the meantime check out our Free Options Trading Explained Series, you can find them as Classes #11-#20 of our 50 Class Trading 101 Series.

We go track all of our blog-related trades in our Discord and on Twitter! Every Thursday 5PM EST we also go over these trades and more LIVE in the premium section of our discord!! Be sure to ask about our Premium 8 Lesson Charting Strategy Series where we go over how to find trades just like these two!! Check out our prior blog articles for more trade ideas!!