Bearish Sector Sentiment

Consumer Staples and Discretionary-

Types of Consumer Staples Stocks

Each stock market sector can be broken down into several industries and sub-sectors. The consumer staples sector is generally segmented into the following sub-sectors:

- Retail. These companies operate store chains, wholesale operations and e-commerce sites—basically any place where consumer staples products are sold.

- Food and beverage. Food staples include companies that make cereals, snacks and other dry goods. Beverages can include alcohol but are more often colas and energy drinks.

- Household products. Furniture, decor and cleaning products are all included in this category.

- Personal products. These include cosmetics and personal hygiene products, ranging from perfume and deodorant to mouthwash and toothpaste.

- Tobacco. This is a controversial member of the consumer staples family, given changing public attitudes toward smoking. But the tobacco subsector still represents big business for those companies that manufacture and sell cigarettes and related products.

Examples...

PG Procter and Gamble

KO Coca-Cola

WMT Walmart

As we are experiencing price capping on most “necessities'' that did not get cut back on in an inflation cycle, we see companies like Walmart, Coca Cola, and Procter & Gamble reap the rewards of this tightening. Price ceilings are something that should be a major catalyst on forward guidance and sentimentality of what stocks are prone to being bullish and bearish through the end of 2023. Stable prices and maximum employment is the feds ultimate goal, and we have a while to go to reach those goals.

The biggest financial pressure on consumer staples and discretionary companies are going to be on forward guidance if our consumer goods and staples companies. These companies have been able to raise prices in accordance with the inflation, which helped cushion their profit margins and their earnings statements through post covid economy.

Now, as we begin to hit capping and ease inflation, compressed margins are going to start affecting these companies, which will decrease their ability to maintain profitability while keeping the same prices for consumers. Also, 2023 is the first year that we are not getting additional income with checks handed out to middle class America.

In December 2022, retail Christmas spending was down 1% year over year, one of the first indications that tightening of consumer spending was finally transitioning into our “staples and necessities'. When it comes to companies forward guidance that starts to get reported in Q3 2023, I believe we will begin to see the effects.

Walmart, restaurants and retail, etc will have their cost of operations and goods continue to stay elevated, while at the same time price capping is happening with ease of rate hikes. These companies will report cuts in with positive forward guidance through 2023 on our gold banner performing companies of 2022.

Remember, even if inflation was 0%, and you’re selling your burger at $10 and used to sell them at $6, you are seeing your gross profits get hit as we hit the ceiling of inflation and companies' costs continue to stay high, failing to lower or at least maintain in accordance with consumer prices paid.

The companies that survive can maintain a compressed margin. Now, I am not saying that we will see deep selloff on these “Americana” stable companies, however, if we line up these companies vs our mid cap tech, small caps, biotech stocks, I believe that this is a likely lagging and underperforming, or red sector into late 2023.

People will wipe excess savings by early 2024, staple companies will start to feel the inflation ceiling and bottom line squeezes, and finally, the LEAD TIME of the 2/10 year yield curve invert could be as long as 24 months for recession to really take hold.

(keep reading for two bonus bearish setups)

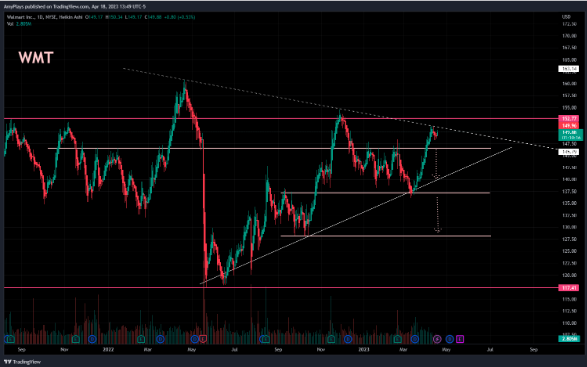

WMT (Walmart)

Sitting at a triple top trend channel currently

Watch for a loss of $145 for first leg down

Short targets:

$140/$128

Bearish Catalysts:

Walmart's operating profit margin fell to 3.4% in its most recent quarter. That was down from 3.9% in the same quarter in the prior year.

3B insider shares sold Q1

PG (Procter & Gamble)

Quad Top resistance current setup

Watch for a loss of $148 for first leg down

Short Targets: $141, $135, $122

Bearish Catalysts

Insider selling increased over 400% quarter over quarter 4 2022

Total Revenues down 1% Q4 2022