How Costco's Dividend Works

Costco $COST announced Thursday that the company will be paying out a special dividend of $15 per share. The record date will be 12/28/23 and the ex-dividend date (the one investors need to worry about) will be 12/27/23. In order to be eligible for this special dividend investors must purchase $COST before 12/27/23, so basically any time before 12/26/23 market close. Typically speaking you must hold the share through the ex-dividend date to receive the dividend. So, in this case, you would need to hold the share at least until the end of the trading day on December 27, 2023. For every share you own of Costco you own, you will receive a dividend payout of $15 per share. The dividend has a yield close to 2.3% (meaning for every share you own you get 2.3% return via dividend payout), however $COST's stock price is currently up 45% in 2023 so longtime shareholders technically are looking at a higher yield based off of what they paid for the stock. To fund this dividend Costco is paying an aggregated amount of $6.7 billion to shareholders.

Why This Special Dividend Is Significant

In the past, Costco has paid out $7, $5, $7, and $10 in 2012, 2015, 2017, and 2020 respectively. Seeing as Costco has paid out a special dividend every 2-3 years, their management has been asked about the next one for several quarters. Everyone was expecting one, they just didn't know when or how much it would be. Now we do, and it's 50% larger than the previous four special dividends. Unlike it's competitors, Costco has a significant net cash position. This allows them to keep borrowing expenses extremely low, which helps the company pass those savings onto members and investors. At the end of the most recently reported quarter, Costco had nearly $18 billion of cash, cash equivalents, and short term investments. There's plenty of cash to go around. Costco also pays a regular quarterly dividend of $1.02 for a .62% annual dividend yield.

What Is A Special Dividend?

A special dividend is a one-time payment made by a company to its shareholders, often outside of the regular dividend schedule. It is usually issued when a company has excess cash and doesn't see consistent future cash flow to justify raising the regular dividend. Special dividends can be a way for a company to distribute profits to shareholders or to adjust its capital structure without committing to an ongoing increase in dividend payouts. The amount of a special dividend is determined by the company's board of directors and is separate from the regular dividend.

Costco Releases Better-Than-Expected Fiscal First-Quarter Results

Net Sales: $57.8 billion vs. $57.71 billion expected

Adjusted Earnings Per Share: $3.58 vs. $341 expected

E-commerce Sales Growth: 6.3% vs. 6.1% expected

Total Revenue was up from $54.4 billion to $57.8 billion compared to the same quarter one year ago. Their earnings per share of $3.58 is up 17% year over year even during this challenging macro-environment.

Check Out Our Free Trading Discord!

Sales And App Growth

Overall sales in the quarter were up due to growing demand for Costco's groceries and essentials. CFO Richard Galanti said that consumers have started returning to buying discretionary items again, after a rough year with high interest rates and the return of student loan payments post-pandemic. He added that increased foot traffic in the stores were an "added surprise." Their app growth was also a huge factor for Costco's success. Costco's app was downloaded 2.75 million times during the quarter, totaling 20.5 million users, which is a 10% increase year over year. Galanti said Costco's e-commerce has a "lot of strength" and they are in the middle of a 2 year plan to ramp up their online presence. He said the company sold "e-gift cards on everything from restaurants to golf to airlines. For you last-minute shoppers out there, there is a Mickey Mantle autographed 1951 rookie card in nearly perfect condition and it's on sale online for $250,000".

Membership Fees Going Up?

Strong membership sales also helped Costco's financial standing. Membership fee revenue rose more than 8% to $1.08 billion. They also hinted that we could see increases in membership fees by 2024. A Costco Gold Star Membership currently costs $60 per year, and Executive Memberships go for $120. At least their hotdog and soda $1.50 deal won't change.

Costco's Global Expansion

Costco said they will open roughly 24 new locations in the US, as well as 7 international warehouses. This includes their 6th location in China. Costco currently has 871 locations in 14 countries worldwide. 600 of those 871 locations are in the US. In 2023 they opened 23 new locations. As we remember from Macy's, real estate is important!

Costco Selling Gold Bars

During the quarter, Costco sold over $100 million worth of 1 oz. gold bars. These bars went for nearly $2,000 online for members who were looking to invest in precious metals. The bars typically sell within a few hours on their website and have a 4.9 star rating with over 700 5-star reviews. The only complaint members have had it seems is the sales tax. These bars are non-refundable.

Here's What Wall Street Says About Costco

UBS: $640 to $725 BUY

Jefferies: $680 to $725 BUY

Truist: $619 to $693 BUY

TD Cowen: Analyst Oliver Chen stated that Costco is one of their top picks, and called its private label Kirkland "pretty legendary".

Oppenheimer: Analyst Rupesh Parikh removed Costco from its top pick rating "due to valuation following significant outperformance lately."

How Our Exclusive In-House Analysts Are Playing $COST

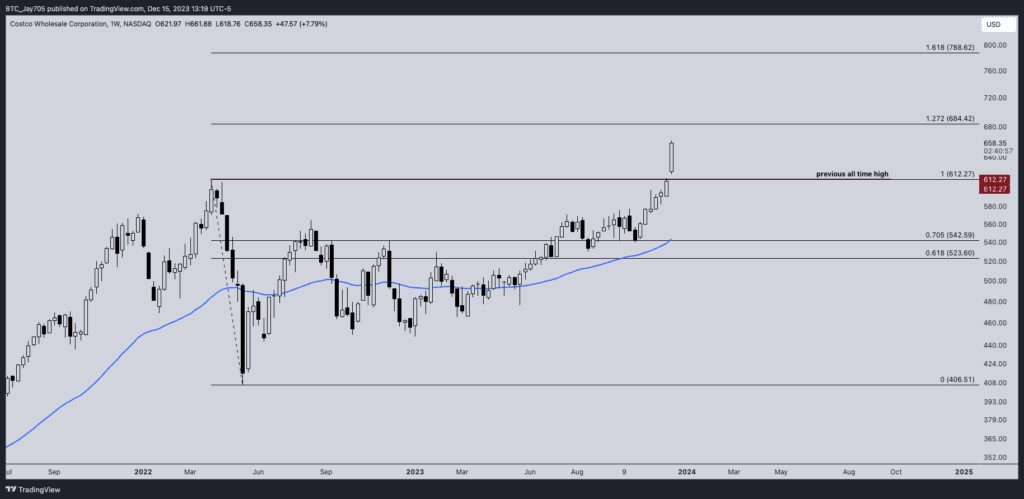

"This is breaking out and making new all time highs, therefore going into price discovery mode. Luckily using Fibonacci we already know in advance where the resistance will be, even though we have no prior price action at higher levels. The retracement from the previous all time high ($612.27) all the way to the bottom of 2022 ($406.51) now determines how far up we are looking to go. Minimal target from here is $684.42, but if that level breaks and flips into support, this could go all the way to $788.62 (next year somewhere) If we come down and fail to hold the previous all time high as support ($612.27), we are potentially looking at a bigger correction back down" -BTC_Jay

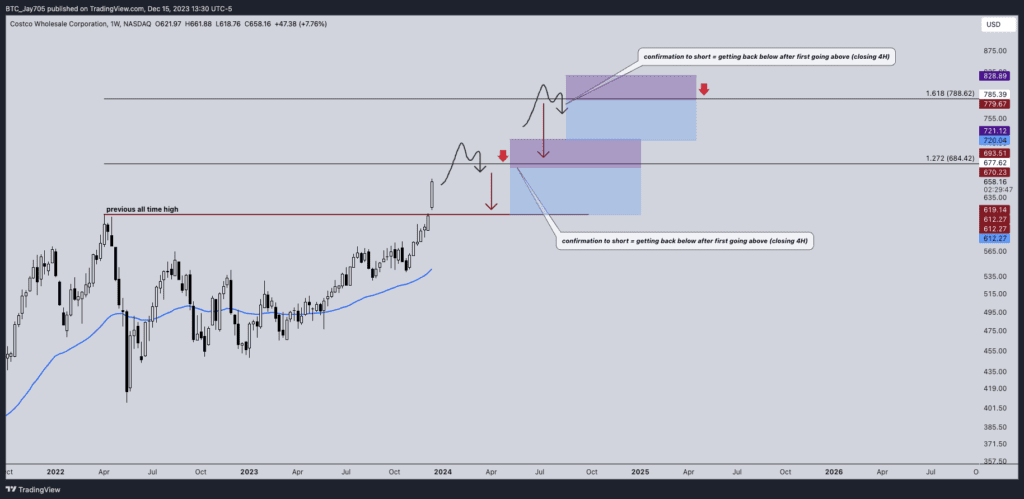

Option 1: Enter a short/bearish position once it hits a fibonacci resistance level and shows bearish confirmation ($684.42 or $788.62). What this means is waiting until the price breaks above one of these levels, and then has a close on the 4H chart below that level for entry.

Option 2: Enter a short/bearish position once the previous all time high ($612.27) gets flipped from support back into a strong resistance. What this means is waiting until we see a confirmation that $612.27 is a resistance level again.

Option 3: "I personally wouldn't buy this currently up here at $660 while the first main target is only about $25 higher. Lots of people are going to get torched on this ticker not waiting for confirmation." One could wait until the price breaks and holds above $684.42 for a continuation play to $788.62.