CrowdStrike has become a staple in the cybersecurity space. This company not only innovates but defines what it means to thrive in an ever-evolving digital battleground. From its Falcon platform to its cutting-edge AI-driven advancements, CrowdStrike has positioned itself as a leader in enterprise cybersecurity—a space with soaring demand as digital threats grow more sophisticated. One area companies will not cheap-out on is cybersecurity.

However, the road has been far from smooth. A global outage earlier this year tested the company’s resilience and shook investor confidence, prompting comparisons to SentinelOne ($S) and even whispers of an Enron-like downfall. But CrowdStrike proved the doubters wrong, staging an incredible recovery that highlights its strong fundamentals and robust competitive positioning. StockSavvyShay and Big Quench, however, remained unshakable in their conviction that $CRWD is the tier one winner in the AI-driven cybersecurity thematic, combining technical superiority with a proven ability to adapt and grow.

The Falcon Platform: The Backbone of Enterprise Cybersecurity

At the core of CrowdStrike’s dominance is its Falcon platform, a comprehensive solution designed to protect enterprises from cyber threats. Unlike many competitors, Falcon isn’t just a tool, but a complete ecosystem:

- Flexibility: The Falcon Flex licensing model allows customers to select the modules they need, ensuring cost efficiency and driving deeper adoption.

- Adoption Metrics: A staggering 66% of customers now use five or more modules, with 20% adopting eight or more.

- Customer Retention: With a 97% gross retention rate, CrowdStrike's platform is indispensable to its clients.

The platform has also expanded into next-gen solutions like Charlotte AI and Next-Gen SIEM (Security Information and Event Management), which are driving triple-digit and 150% ARR growth, respectively. These innovations not only secure CrowdStrike’s leadership but deepen its moat, making it a critical partner for enterprises across the globe.

2024: A Year of Challenges and Comebacks

2024 was a tumultuous year for CrowdStrike. A major outage that caused significant reputational damage coupled with the August 5th "market tantrum", plummeted the stock to $200 with doubts looming over its ability to recover. However, the company’s response was nothing short of remarkable:

- Recovery Narrative: Within five months, $CRWD rebounded to $389, nearing its pre-outage high of $398. Deals delayed by the outage began closing, reigniting ARR momentum.

- Q3 Earnings Masterclass: Revenue surged 29% YoY to $1.01B, subscription revenue grew 31%, and ARR surpassed $4B for the first time. The company posted a Rule of 40 score of 51, showcasing its balance of growth and profitability.

This comeback underscores CrowdStrike’s ability to thrive under pressure, turning setbacks into opportunities, reinforcing its long-term value proposition, and fortifying it's moat as the tier one leader in cybersecurity.

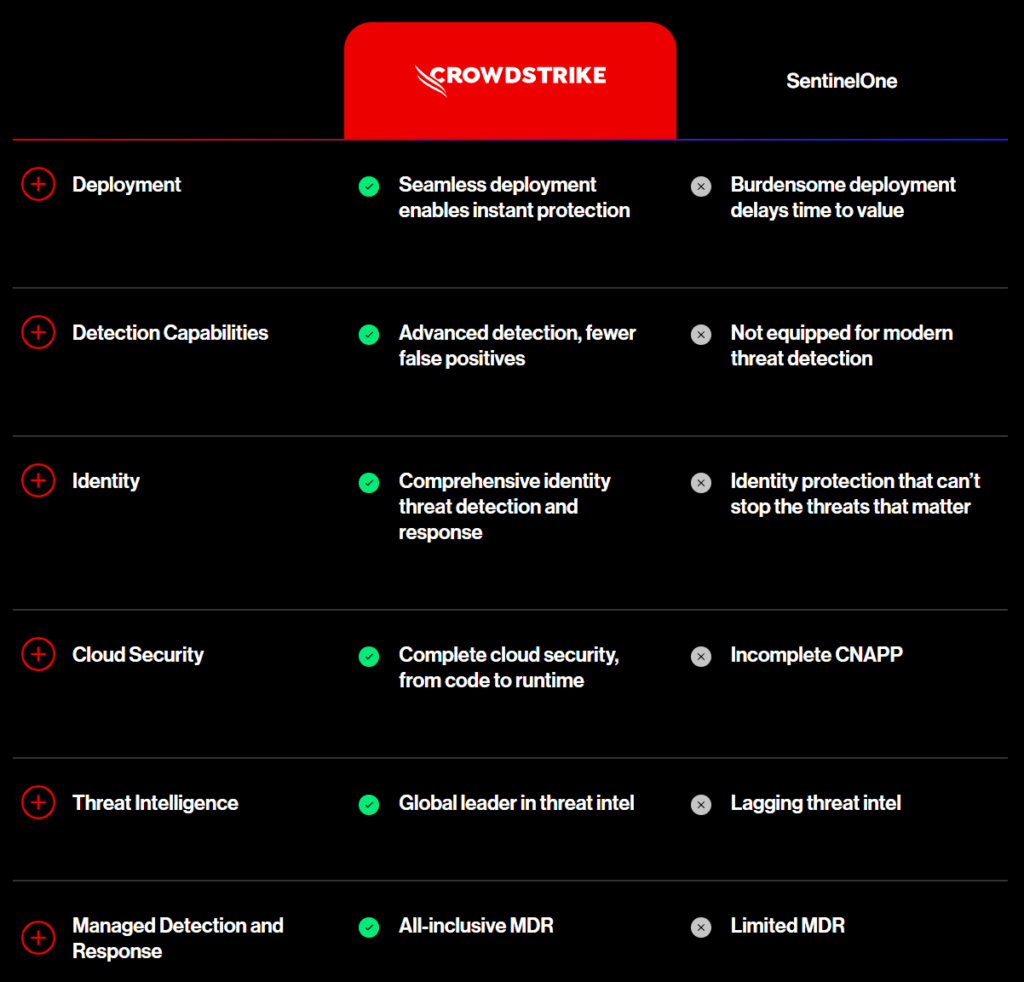

Competitive Landscape: Why $CRWD Stands Out

CrowdStrike operates in a fiercely competitive space, facing challengers like SentinelOne ($S) and tech giants such as Microsoft ($MSFT) and Google ($GOOGL). Here’s why CrowdStrike continues to lead:

- Technological Edge: SentinelOne has been unable to match CrowdStrike’s advanced platform capabilities, particularly its integration of AI for real-time threat detection and response.

- Strategic Partnerships: Collaborations with AWS, NVIDIA, and Fortinet amplify the Falcon platform’s reach, embedding it deeper into enterprise ecosystems.

- Organic Growth: Unlike competitors that rely heavily on acquisitions, CrowdStrike’s growth is primarily organic, further solidifying its competitive moat.

Google’s acquisition of cybersecurity startup WIZ for $23 billion (60x valuation based on ARR) in 2024 set a high valuation benchmark for the industry, further validating CrowdStrike’s premium position. If we apply that same principle to Crowdstrike $CRWD, their $500 million ARR would put them at $30 billion, just 15% of their total business.

The Financials: A Solid Foundation for Growth

CrowdStrike’s financial metrics are as robust as its platform:

- ARR Growth: Exceeded $4B, up 27% YoY, reflecting strong adoption across its customer base.

- Free Cash Flow Margins: A stellar 30%, highlighting operational efficiency.

- Revenue Growth: Consistently growing at 29%-30% YoY, maintaining a rare combination of high growth and profitability.

Shay and Quench both emphasize that while $CRWD trades at a premium, its valuation is justified by its market leadership, unmatched technology, and ability to execute in a volatile industry.

The Path Forward: Technicals and Long-Term Targets

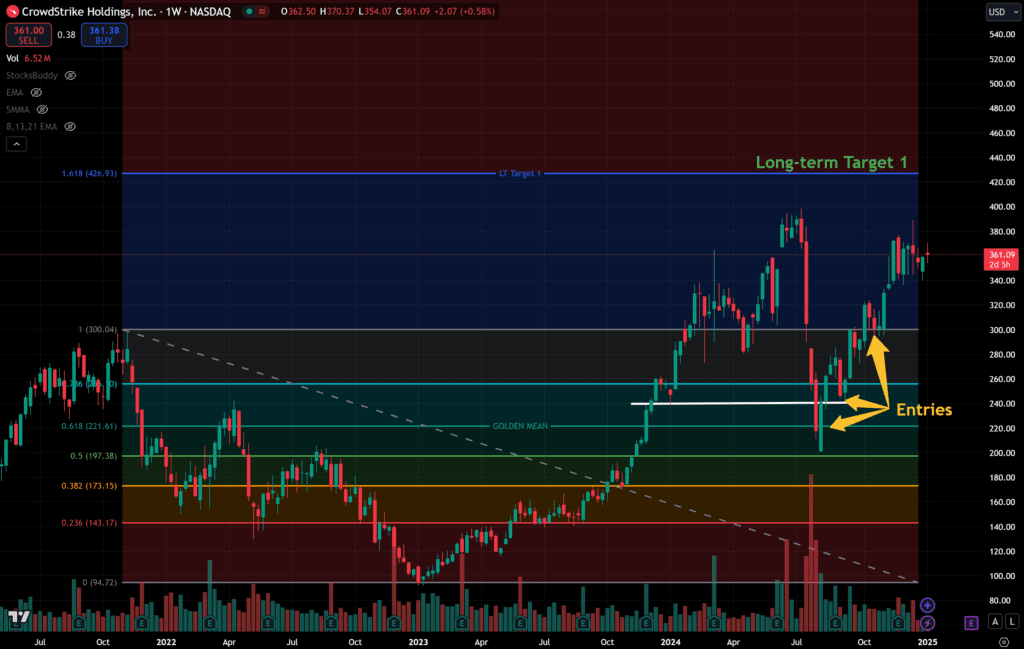

From a technical perspective, $CRWD’s recovery has positioned it for significant upside:

- Entry Levels: $220 and $240 have served as strong accumulation zones. Secondary entry at $300.

- Targets: Shay and Quench are eyeing $426 and $450 as long-term targets, with potential for even higher moves if cybersecurity consolidation intensifies.

The stock’s recent trajectory mirrors other high-conviction plays like Tesla ($TSLA) and Rocket Lab ($RKLB), where patience during consolidation phases rewarded investors with exponential gains.

Another bottom-dollar entry on this high conviction name has our entries sitting at 58%-77% gains. We are looking for consolidation over $300 for the next leg up to $426-$450.

The Verdict: A Beach Stock for the AI Era

Shay has called $CRWD a “beach stock”—a company you buy, hold, and forget about because of its unparalleled potential. With its Falcon platform, innovative licensing model, and relentless focus on growth, CrowdStrike is well-positioned to dominate the cybersecurity space in the AI era. The company’s rebound from adversity showcases its resilience, while its strong financials and strategic vision highlight its capacity for long-term success.

For Market Mastery, CrowdStrike isn’t just another ticker; it’s a cornerstone of the enterprise AI thematic. Whether you’re looking for a short-term trade or a long-term investment, $CRWD offers a compelling blend of innovation, growth, and rock solid ranges in an increasingly uncertain world.