TKO Group's 3 Big Announcements This Week

TKO Group ($TKO), the parent company of WWE/UFC, announced the approval of a $2 billion share repurchase program and the start of a $75 Million Quarterly Dividend. They also revealed a $3.25 billion all-equity acquisition of IMG, On Location and Professional Bull Riders (PBR) from Endeavor. Now although this all may seem like good news, the stock took a 8%+ hit on the day, and in this article we are going to break down why.

The Good News: $2 Billion Share Repurchase Program & $75 Million Quarterly Dividend

TKO's board of directors authorized a share repurchase program of up to $2.0 billion of its Class A common stock. A share repurchase program, also known as a stock buyback, is a strategy where a company buys back its own shares from the open market. This reduces the number of outstanding shares.

- Earnings Per Share (EPS): Lowering the number of shares outstanding can increase EPS, making the company look more profitable.

- Confidence: A buyback can signal to investors that the company's management believes the stock is undervalued.

In TKO's case, the $2 billion share repurchase program indicates that the company believes its stock is undervalued and is taking steps to increase shareholder value. TKO Group Holdings also declared a quarterly dividend of $75 million. This means that the company will distribute $75 million to its shareholders every quarter. This means that the total dividend amount ($75 million) will be divided by the total number of outstanding shares and each shareholder will receive a dividend payment proportional to the number of shares they own.

- Investor Confidence: Declaring a dividend is a positive signal to investors. It indicates that the company is financially stable and generates sufficient cash flow to reward its shareholders.

- Income for Shareholders: Dividend payments provide a regular income stream for investors, particularly those seeking stable returns.

- Potential for Increased Share Price: Dividend-paying stocks often attract investors, which can increase demand for the stock and potentially boost its price.

The "Bad" News: $3.25 billion All-Equity Acquisition Of 3 Companies

TKO Group acquired 3 companies (IMG, Professional Bull Riders and On Location) from Endeavor in an all-equity acquisition (no cash was involved). This news is very significant (as we can see by the reaction in stock price), but in order to fully understand why, we need to first dive into the history of TKO Group, WWE, UFC and Endeavor.

The History Of TKO Group | A Timeline Of Sports Entertainment

WWE 1950-1960 | The McMahon's Create "The Capitol Wrestling Corporation": The origins of WWE go as far back as 1950 when the Capitol Wrestling Corporation (CWC) was founded. Some say that CWC was founded by Roderick James "Jess" McMahon, while others say that it was Jess's son Vincent J. McMahon. The first CWC show was produced in January 1953, Jess McMahon passed away a year later in 1954.

WWE 1961-1981 | The WWWF Is Formed After Controversy: The National Wrestling Alliance (NWA) is currently known as the most legendary professional wrestling promotion, and was the biggest one in the 1950's. The NWA's main title the "NWA Undisputed World Heavyweight Championship" was defended across many different smaller promotions such as McMahon's CWC. In 1961 "Nature Boy" Buddy Rodgers (who was part of McMahon's CWC) won the title. McMahon wanted Rodgers to keep the NWA World Heavyweight Championship against the NWA's wishes, however Rodgers refused as he didn't want to lose his $25K deposit (at the time champions had to pay a deposit to ensure that they honored their commitment as champion). In 1963 Rodgers lost the Championship, which caused McMahon to leave the NWA in protest and create the "World Wide Wrestling Federation" aka WWWF. The WWWF thrived with Bruno Sammartino as the face of the company, holding the WWWF World Heavyweight Championship 2,803 days (7 years, 8 months and 1 day), which is still the longest ever consecutive world championship reign in men's wrestling history. In 1979 the WWWF was renamed to "The World Wrestling Federation" WWF for marketing purposes.

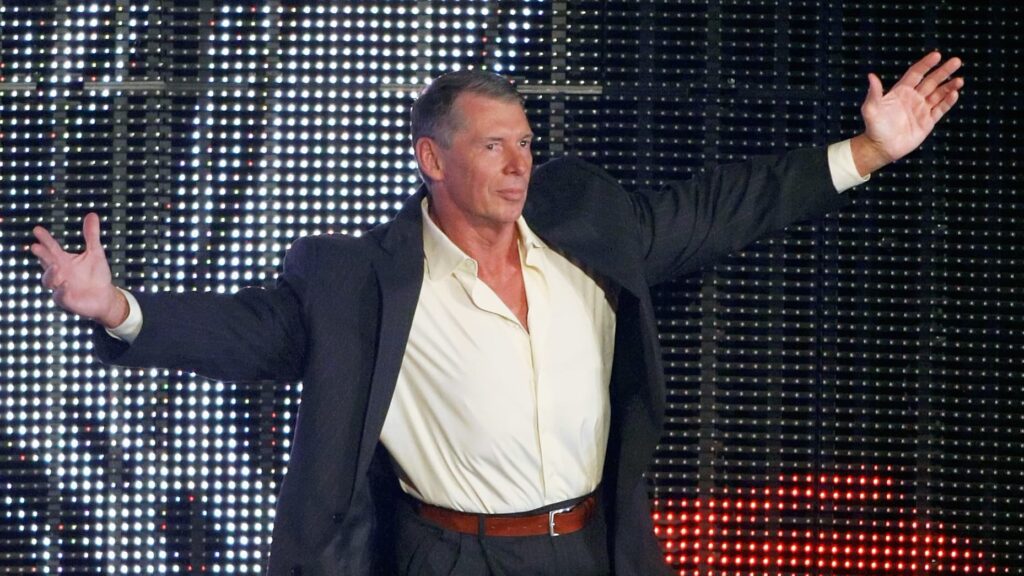

WWE 1982-1985 | Vincent K. McMahon Plans To Take Over The World: In 1982 Vincent K. McMahon (the son of Vincent J. McMahon) purchased Capitol Sports (the parent company of WWF) from his father for $1 Million. He then went on to disrupt the entire professional wrestling industry as part of his goal to create an entertainment juggernaut. In a Sports Illustrated interview Vince said; "In the old days, there were wrestling fiefdoms all over the country, each with its own little lord in charge. Each little lord respected the rights of his neighboring little lord. No takeovers or raids were allowed. There were maybe 30 of these tiny kingdoms in the U.S. and if I hadn't bought out my dad, there would still be 30 of them, fragmented and struggling. I, of course, had no allegiance to those little lords"

McMahon broke all of the unwritten rules that the other major wrestling promoters had agreed on, and were put in place in order to "keep the peace" as well as to avoid competition. The WWF had control of the Northeast, but he wanted to turn WWF into a national promotion, which would mean becoming bigger than the NWA. He signed deals to get the WWF on televisions across the United States, sold videotapes of WWF events outside of the Northeast and started advertising outside of his promotions "boundaries". He used the income from these ventures to sign wrestlers away from other promotions, such as Hulk Hogan. Vince needed more revenue in order for the WWF to tour the United States and officially become a national wrestling promotion. He threw money into an "all or nothing gamble" in the form of a concept he called "Wrestlemania".

WWE 1986-2001 | WWF vs WCW: As we all know Wrestlemania was a huge success and caused the other smaller promotions that were still alive to join together and create "Jim Crockett Promotions" (JCP), which later turned into "World Championship Wrestling" (WCW). In 1993 WWF created their prime time cable TV program "Monday Night Raw" on the USA Network, and a year later WCW signed Hulk Hogan as well as a bunch of other former WWF stars before creating "Monday Night Nitro" on TNT to compete with Raw. This was known as the "Monday Night Wars" which eventually ended with WWF winning and purchasing WCW. This was thanks to WWF's "Attitude Era" and wrestlers such as Dwayne "The Rock" Johnson, "Stone Cold" Steve Austin, and Mick Foley.

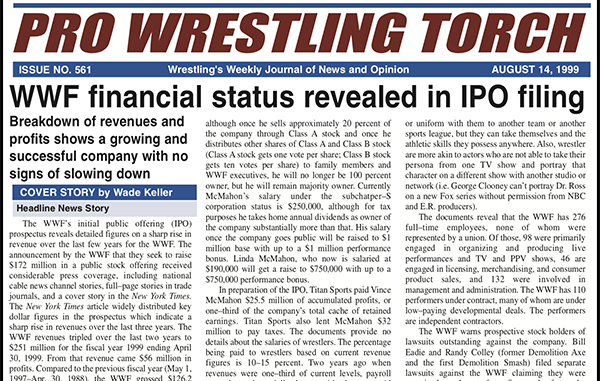

In 199 WWF went public, having an Initial Public Offer valued at $172.5 million. They began trading on the New York Stock Exchange.

UFC 1990-2000 | The Controversial Origin Of UFC: During WWF and WCWs "Monday Night Wars' another phenomenon was being formed. "Gracies in Action" was a video series produced by the famous Gracie family of Brazil, where Gracie jiu-jitsu students were showcased defeating martial artists of various backgrounds including karate, kickboxing, and kung fu. Art Davie was inspired by these and pitched the idea of a televised tournament featuring martial artists from different backgrounds facing each other in no holds-barred style combat to determine the "best style of martial art". Davie pitched this to Rorion Gracie of the Gracie family, and one of Gracie's student's John Milius who was a film director/screenwriter. Gracie and Milius accepted, so Davie wrote a business plan and found 28 investors to start up "WOW Promotions".

Originally the idea was to have the fights look like real-life "Street Fighter" or "Mortal Combat" when it came to the arena. They didn't want it to be similar to boxing or professional wrestling with ring ropes, nor did they want their fighters to be able to easily escape the ring. Some other ideas that were pitched consisted of a moat with alligators, electrified fencing, and a platform surrounded by a razor wire fence. Eventually they decided on an Octagon surrounded by a chain link fence.

See Which Of Our 4 Veteran Trading Coaches Is The Best Fit For YOU!

They named the show "The Ultimate Fighting Championship." Their first event, which is now known as "UFC 1" was shot in 1993 with Art Davie as the booker and matchmaker. It featured a kickboxer, taekwondo practitioner, savate fighter, karate expert, sumo wrestler, and a boxer. It also featured Brazilian jiu-jitsu black belt Royce Gracie, who was also the younger brother of co-founder Rorion Gracie. Ken Shamrock was also featured at UFC 1. Both Ken Shamrock and Royce Gracie are now in the UFC Hall of Fame. Their fight at UFC 5 was the reason that time limits and referees were implemented to determine draws, after their fight exceeded the 30 minute time slot the PPV had appointed for the fight.

When talking about UFC 1 (which was supposed to be a one-off event) Dana White said; "It did so well on pay-per-view they decided to do another, and another. Never in a million years did these guys think they were creating a sport". The UFC at that time famously used the tagline "there are no rules", and that was true. Unlike today with weight classes, back then they had Keith "The Giant Killer" Hackney face off against Emmanuel Yarbrough at UFC 3 where Yarbrough had a 9 inch height advantage and 400 pound weight advantage.

Due to the lack of rules the UFC events were known as super brutal spectacles. 36 states put through bans on UFC style fights in response, and in 1996 Senator John McCain led a campaign to ban the UFC. This led to the UFC implementing new rules to cooperate with the state athletic commissions. At UFC 12 weight classes were introduced, at UFC 14 gloves became mandatory, UFC 15 is when strikes to the back of the head became illegal as well as head-butting.

Check out our Long Term Investment Newsletter

Endeavor 1995-2009 | Endeavor Talent Agency Launches: Two years after the debut of UFC 1, in 1995 The Endeavor Talent Agency launched. They were a Beverly Hills-based talent agency founded by Ari Emanuel (current CEO of TKO Group $TKO) and his business partners. They were all top television agents with dreams of starting their own agency. Those dreams were overheard by their boss at their current agency, which got them fired, causing them to pursue their dreams. In HBO's show "Entourage" the character Ari Gold is based on Ari Emanuel. Endeavor saw great success as they continued to build and grow, boasting a talent pool that included Christian Bale, Ben Affleck, Hugh Jackman, Matt Damon, Charlie Sheen and Kevin James.

UFC 2001-2005 | Dana White & The Ferititta's Buy UFC: Due to the public scrutiny and bans on UFC style fights, in 2001 the company was close to bankruptcy. Station Casinos executives Frank and Lorenzo Ferititta as well as their business partner Dana White bought UFC for $2 million. Lorenzo once said; "I had my attorneys tell me that I was crazy because I wasn't buying anything. I was paying $2 million and they were saying 'What are you getting?' People thought that Dana White and the Ferititta's were crazy for buying UFC as there were not a lot of assets other than a dozen fighters contracts, the octagon ring, and the name "UFC".

The UFC started to recover and raise in popularity due in part to great advertising, strategic sponsorships, and the return to cable pay-per-view events. However they were averaging just 45,000 buys per pay-per view event, and there were speculations that they were facing bankruptcy once again. Ken Shamrock had left UFC to wrestle in the then super-popular WWF. He returned to UFC and brought with him a whole new audience. At UFC 40 he took on the then-current UFC Light Heavyweight Champion Tito Ortiz, which sold over 150,000 pay-per view buys. Despite the success of UFC 40, by 2004 UFC had incurred $34 million in losses since it was bought by Dana White and his business partners in 2001.

WWE 2002-2018 | "WWE" Is Born, Due To Lawsuits: In 2002 the WWF lost a lawsuit from the World Wildlife Fund (also the WWF) and had to change it's name. They decided to go with World Wrestling Entertainment (WWE). The company saw a lot of success due to young wrestlers who ended up becoming household names such as John Cena, Randy Orton, Brock Lesnar and Batista. In 2009 WWE changed to TV-PG programming to try to be more family friendly. In 2011 the company stopped using the name "World Wrestling Entertainment" and started just going by "WWE".

UFC 2005-2015 | The Ultimate Fighter Saves UFC: In 2004 the UFC was thinking about folding as they were not making money and in massive debt. The Fertitta brothers (co-owners of UFC at the time alongside Dana White) were coming off of being featured on the reality TV series "American Casino" for their work with their Casino business. After seeing how well the series worked to promote their Casinos, they decided to create a UFC based reality TV show. They pitched their idea to several networks, but got rejected every time. Spike TV finally gave them an outlet for their show, but not until UFC agreed to pay the $10 million production cost themselves.

Get Access To Custom Indicators

In 2005 on Spike TV, UFC launched "The Ultimate Fighter 1" (TUF 1) in the time-slot following WWE's flagship show "Monday Night Raw." The Ultimate Fighter featured up-and-coming MMA fighters who were all competing for a six-figured UFC contract. The first season was a booming success, so much so that Dana White credits TUF 1 for saving the UFC. Stars such as Brock Lesnar, Connor McGregor and Nate Diaz have all been on TUF since. The success of "The Ultimate Fighter" led to Spike TV launching "UFC Unleashed" and "UFC Fight Night". UFC and Spike shared a very successful partnership for 6 years until UFC inked a deal with Fox in 2011.

The Fox Partnership was due to the major success of UFC. Former WWE Champion Brock Lesnar brought a lot of new fans to UFC (just like former WWF/WWE star Ken Shamrock did prior). Lesnar took on Frank Mir at UFC 100 which got 1.6 million pay-per-view buys and drew interest from ESPN. In 2012 Dana White announced that the UFC would feature women's MMA when they signed Ronda Rousey. She went on to become the first ever female UFC Champion.

Endeavor 2009-2013 | Endeavor Talent Agency Merges With William Morris Agency To Form "Williams Morris Endeavor": During the middle of both the UFC and WWE's rise in popularity, in 2009 Endeavor Talent Agency and Willam Morris Agency announced that they were forming William Morris Endeavor (WME). The Williams Morris Agency was known as the "first great talent agency in show business" and added a new Agent Training Program to Endeavor's arsenal. Ari Emanuel was CEO of this new company, as he was seen as one of the brains behind the merger. He once said about the new company; "We built a culture where people are rewarded for taking risks."

Endeavor 2013-2014 | "Williams Morris Endeavor" Acquires "IMG" To Form "WME-IMG": In 2013 Williams Morris Endeavor announced that they acquired "IMG" (a global fashion, sports, events and media company HQed in NYC) for $2.4 billion. Ari Emanuel was also CEO of this new company as well. The company went by "WME-IMG". This acquisition showed that Ari Emanuel and Endeavor wanted to make a mark in the sports and media industry.

Endeavor 2015-2016 | WME-IMG Buys "Professional Bull Riders (PBR): WME-IMG acquired the "Miss Universe Organization" from Donald Trump. They also bought "Professional Bull Riders (PBR) for $100 Million. These purchases solidified WME-IMG's spot in the sports/media industries.

Endeavor/UFC 2016-2019 | WME-IMG Changes Name To "Endeavor" And BUYS UFC!! A New Era Begins: In 2016 UFC was acquired for $4.025 billion by "WME-IMG", which was at the time the biggest ever acquisition in sports. A year later WME-IMG changed their name to "Endeavor". The Fertittas brothers stepped down from their roles in UFC, however Dana White stayed on as President and was given stake in the new business. It was revealed that another company had bid almost $1 billion more than Endeavor, but UFC went with Endeavor due to the Fertittas brothers relationship with Ari Emanuel.

Get a Technical Analysis Coach

WWE 2019-2022 | AEW Brings Competition And The End Of The "Vince McMahon Era" Begins: In 2019 Jacksonville Jaguars owner Tony Khan alongside Professional Wrestler Cody Rhodes (son of Dusty Rhodes) formed a new Professional Wrestling Promotion called "All Elite Wrestling" (AEW) to rival WWE. At the time WWE (under Vince McMahon) was getting a bad reputation in the wrestling world due to the way they treated their wrestlers, sexual-harassment allegations against Vince, and the fact that the storytelling was becoming too "family friendly". AEW offered an alternative where the focus was on a much older audience. Fans flocked to AEW due to the bloody, hardcore, adult-friendly product they were putting out. Billionaire Tony Khan was also able to rival Vince McMahon when it came to net worth, up until that point WWE was floating by without any real rivals that could match their monetary spending on advertisements and wrestlers contracts. AEW offered lighter schedules and bigger contracts to snag WWE's top talents such as Chris Jericho, Dean Ambrose and Daniel Bryan. It was not looking good for Vince McMahon or WWE.

In 2022 Vince McMahon stepped down from CEO and chairman of WWE after he was accused of sexual misconduct which prompted an internal investigation. His daughter Stephanie McMahon was named the interim CEO and his son-in-law Paul Levesque (WWE Former World Champion "Triple H") took a much larger role as Head of Creative. This was known as the beginning of the end of the "Vince McMahon Era", and the start of the "Triple H Era". This also marked the first time that a "Vincent McMahon" wasn't the CEO of the juggernaut promotion dating back to the 1950's.

Endeavor/UFC 2020-2022 | Endeavor's Initial Public Offering: In 2o20 Endeavor bought "On Location" for $660 million, a company that provides premium hospitality at events such as The Super Bowl. On April 28, 2021, Endeavor IPOed at a $24 per share ($10.31 Billion valuation). They originally planned to IPO in September of 2019, but changed it last minute due to the performance of the Peloton IPO. Elon Musk joined the board of directors of Endeavor during the IPO in a rare board appointment outside of a company he already owned (he resigned from the board in 2022 stating it “was not the result of any disagreement with the company on any matter relating to its operations, policies or practices”)

Endeavor/WWE/UFC 2023 | TKO Group Holdings Is Formed: In January of 2023 it was announced that WWE was looking for a potential buyer, this was in part due to Vince McMahon having stepped down the year prior as chairman and CEO due to the sexual harassment investigation. Vince ended up rejoining the WWE's board after the investigation was closed. In April of 2023 it was announced that Endeavor and WWE had struck a deal, which would see WWE merge with Endeavor's private company UFC and form a new publicly traded company ("TKO Group Holdings" $TKO). WWE was valued at $9.3 billion and UFC at $12.1 billion, turning TKO Group Holdings into a $21.4 billion company. The agreement had Endeavor holding a 51% controlling interest in TKO Group, and WWE existing shareholders owning the remaining 49% (WWE was a publicly traded company at the time so was owned by shareholders, whereas UFC was private so was owned by Endeavor). Ari Emanuel took the CEO role of the new company, Vince McMahon became the Executive Chairman of TKO Group Holdings and Dana White continued as President of UFC.

TKO Group Holdings 2024 | Vince McMahon Steps Down, Endeavor Goes Private, & The Rock Joins TKO's Board: 2024 was a busy year for TKO Group Holdings. In January of 2024 Vince McMahon resigned from TKO Group and the TKO Board of Directors following sexual assault, trafficking and physical abuse allegations against him from a former WWE employee. The allegations also included former UFC and WWE World Champion Brock Lesnar. Vince McMahon made $1.5 billion from selling his shares of TKO Group Holdings upon stepping down. In April 2024 Triple H stated that WWE was entering "another era", which has now been coined the "Triple H era". Dwayne "The Rock" Johnson also famously joined the TKO board of directors, adding more WWE star-power to TKO Group Holdings. WWE has been thriving ever since the "Triple H era" began. UFC has also been seeing growing popularity and ticket sales, in part due to the Social Media attention their fighters have been getting.

In the spring of 2024 private equity firm Silver Lake agreed to acquire 100% of the outstanding shares of Endeavor that it didn't already own, taking Endeavor off of the publicly traded market and making it private. Ari Emanuel remained CEO of Endeavor and TKO Group Holdings. Silver Lake agreed to pay $27.50 per share in cash to Endeavor shareholders at the time (the stock price was $17.72) to buy out the shares. This valued Endeavor at $13 billion. That valuation did not include TKO Group Holdings, as it is a separate public entity.

"Follow The Money" | History Of TKO Group By The Numbers

1950: Vincent J. McMahon founded WWE

1982: Vincent K McMahon buys WWE from his father for $1 Million

1999: WWE goes public at $172.5 million valuation

1993: Art Davie, Rorion Gracie and John Milius founded UFC

1995: Ari Emanuel founded Endeavor

2001: Dana White buys UFC for $2 million

2016: Endeavor buys UFC for $4.025 billion

2021: Endeavor goes public at $10.31 billion valuation

2023: UFC ($12.1 billion valuation) and WWE ($9.3 billion valuation) merge to form TKO Group Holdings. Endeavor owns 51%. Ari Emanuel becomes CEO of TKO, Vince McMahon becomes Executive Chairman of TKO, Dana White continues as President of UFC

2024: Vince steps down from role due to sexual assault allegations. Sells TKO shares for $1.5 billion.

- Vince McMahon Jr bought WWE for $1 million from his father, and recently sold his shares for $1.5 billion!!!!

- Dana White and his partners bought UFC for $2 million, it's now valued at over $12 billion!!!

- Ari Emanuel is CEO of both Endeavor and TKO Group. His estimated net worth is $1.3 billion. His base salary in 2023 was $4.91 million, with $36.65 million in cash bonuses, $43.47 million in stock awards, and was given $608K for work related travel expenses on Endeavor's Private Jet

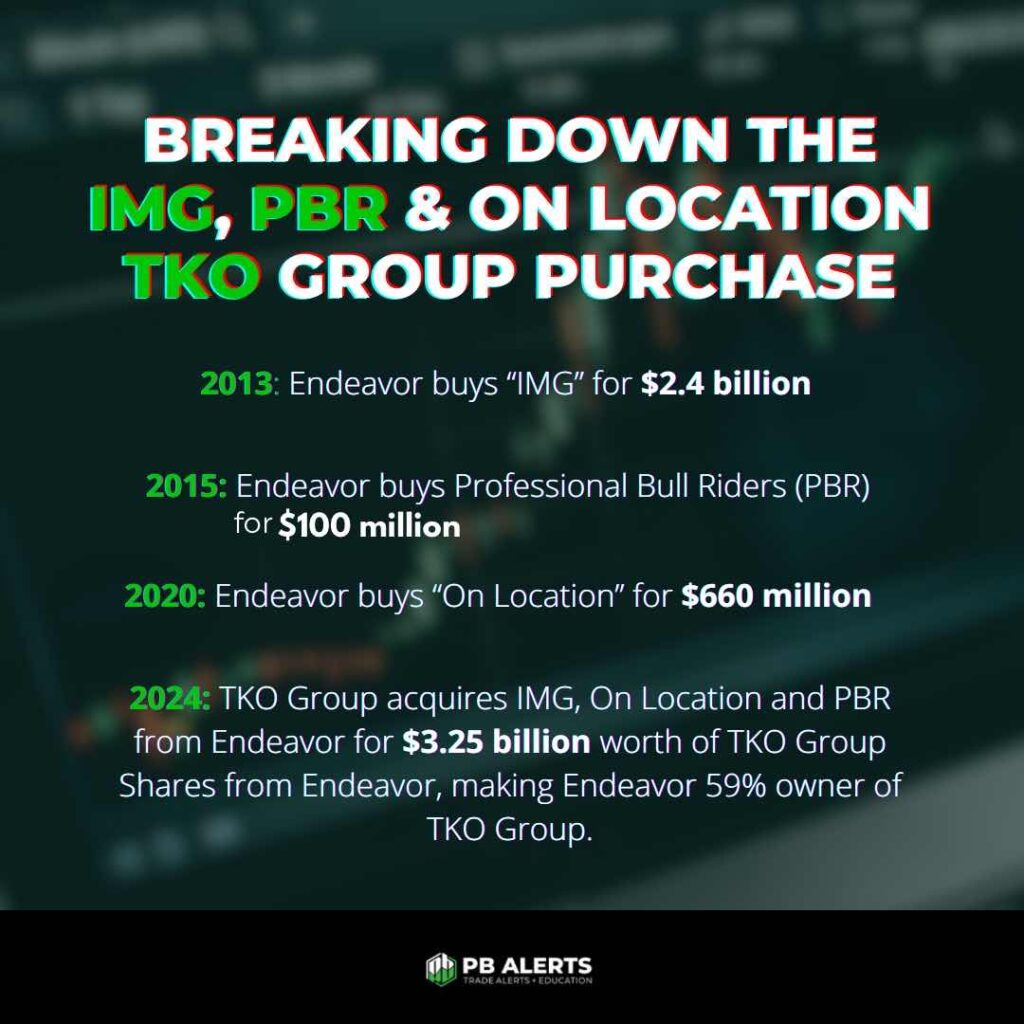

2013: Endeavor buys “IMG” for $2.4 billion

2015: Endeavor buys Professional Bull Riders (PBR) for $100 million

2020: Endeavor buys “On Location” for $660 million

2024: TKO Group acquires IMG, On Location and PBR for $3.25 billion worth of TKO Group Shares from Endeavor, making Endeavor 59% owner of TKO Group.

- Endeavor bought IMG, PBR and On Location for a total of $3.1 Billion

- TKO Group bought IMG, PBR and On Location this week from Endeavor for $3.25 Billion.

Here's Why TKO Group $TKO's Stock Price Dropped This Week

TKO Group's $3.25 billion acquisition of IMG, On Location, and Professional Bull Riders (PBR) from Endeavor's portfolio was structured as an all-equity transaction, meaning no cash exchanged hands. Instead, TKO Group Holdings (the newly formed entity from the WWE-UFC merger) issued new shares to Endeavor to acquire these assets. Here's how this kind of transaction works:

- Ownership Implications: With the additional shares given to Endeavor in exchange for these assets, Endeavor’s control over TKO could increases from 51% to 59%, with remaining TKO Shareholders owning the other 41%.

- Asset Transfer via Equity: Instead of paying cash, TKO Group Holdings issued $3.25 billion worth of its own shares to Endeavor. In effect, Endeavor received additional ownership in TKO as compensation for these valuable sports and entertainment assets.

- Strategic Reshuffling: By moving assets like IMG, On Location, and PBR to TKO, Endeavor could consolidate its combat sports and entertainment assets under one entity, simplifying its portfolio while giving TKO more diverse revenue streams and event-based assets.

Keep in mind Ari Emanuel is the CEO of both TKO Group and Endeavor. The price of $TKO dropped by almost $10 per share after this news was announced, as a lot of analysts said this wasn't a smart business move on TKO's part, some calling it a "favor to Endeavor".

- Perceived Overvaluation: Analysts may have viewed the $3.25 billion price tag as excessive for the assets being acquired, especially given that TKO was already dealing with the complexities of merging WWE and UFC. Concerns about overpaying can lead to negative sentiment in the market.

- Concerns About Strategic Fit: Some analysts might feel that the acquisition doesn't align well with TKO's core focus on combat sports and entertainment. If they perceive that the acquired entities don't significantly enhance TKO's value or strategic direction, this could lead to skepticism.

- Impact on Financial Health: An all-equity acquisition increases the share count and could dilute existing shareholders' value. If analysts believe that this acquisition won't generate enough revenue or synergy to justify the dilution, they may view it unfavorably.

- Favoritism towards Endeavor: The notion that this acquisition was a "favor to Endeavor" implies that it may have been more beneficial for Endeavor than for TKO. If market participants perceive that TKO is prioritizing Endeavor’s interests over its own growth and profitability, it could lead to distrust and a sell-off.

$TKO Trade Idea | Why I Am Still Bullish On $TKO Long Term

Our Technical Analysis Coach Jay has a trade idea for $TKO!! He is watching $100,76, $92.51 and $72.33. He is waiting for a move below one of these levels followed by a 1H Candle close back above the level for an entry!! Make sure to check out the discord to see where his stop losses and targets are!!

I personally (Meta Matt) am still bullish long term on $TKO, and am still holding my position with a $104 average. WWE's Monday Night Raw is moving to Netflix in 2025, TKO just announced a dividend program, and UFC is becoming more and more mainstream!! I'm still personally holding at these levels long and strong!!!

Here are 10 reasons I am still remaining bullish on TKO Group Holdings, Inc. ($TKO) despite the recent market reaction to the acquisition:

- Strong Underlying Business: TKO's core businesses, WWE and UFC, continues to demonstrate strong performance with sold-out shows and increasing popularity, especially among younger demographics.

- Diversification: The acquisition of IMG, On Location, and PBR diversifies TKO's revenue streams, reducing reliance on a single business segment.

- Enhanced Content Library: The acquisition significantly expands TKO's content library, providing more opportunities for licensing, merchandising, and content distribution.

- Increased Global Reach: IMG's global presence and expertise in sports and entertainment will help TKO expand its reach into new markets and fan bases.

- Synergies and Cost Savings: The combined entity can achieve significant cost savings through operational efficiencies and economies of scale.

- Strong Leadership: TKO is led by experienced executives with a proven track record of success in the sports and entertainment industry.

- Investor Confidence: The $75 million quarterly dividend demonstrates TKO's commitment to returning value to shareholders.

- Positive Industry Trends: The sports and entertainment industry is experiencing significant growth, driven by increased consumer spending and technological advancements.

- Strategic Partnerships: TKO has formed strategic partnerships with major players in the industry, such as Netflix, which can drive growth and innovation.

- Long-Term Growth Potential: TKO's focus on content creation, distribution, and live events positions the company for long-term growth and success.