"Brace yourselves, because when those quarterly earnings reports hit the market, things can get wilder than a Game of Thrones finale."

Options Strategies Based on the Directional Expectation

So, you've done your research and have a gut feeling about which way a stock's going to swing after the earnings report. If you're feeling bullish and expect those numbers to skyrocket, why not buy some CALL options and go on a speculative adventure?.. Well, the rising implied volatility before the announcement can squeeze your long option position harder than The U.S. Healthcare System squeezes our wallets. Ouch!

On the other hand, if you're predicting a nosedive in stock prices, it's time to bring out the PUT options. Right?.. Well if you do that, the IV crush can be as brutal as “The Super Mario Bros Movie” Rotten Tomatoes Score.

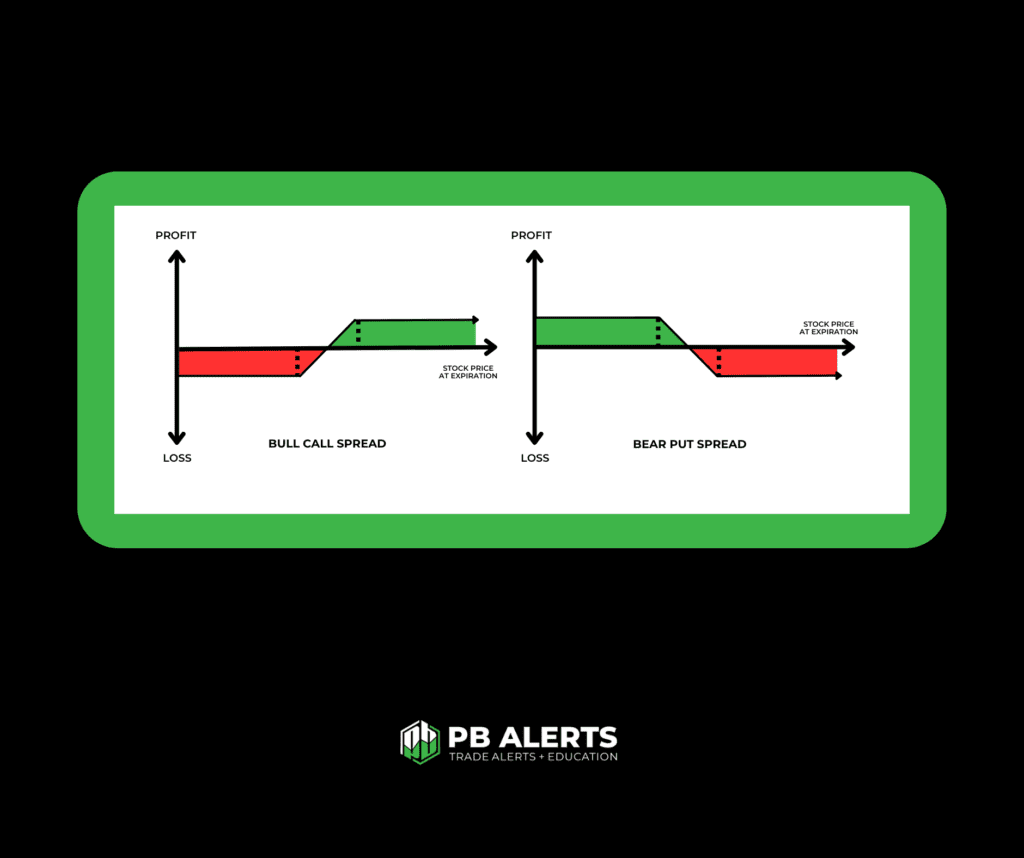

For those who want to reduce volatility risk, multi-leg strategies like vertical spreads could be your go-to move. It's like playing chess with the stock market. By simultaneously buying and selling different strike prices of calls or puts with the same expiration, you can trade directionally while keeping theta and vega risk in check. Just remember, profits may be capped.

How To Use The Spread Trading Strategy: https://www.youtube.com/watch?v=jmt6k36HgeA

Anticipating a Big Move, But are Unsure of the Direction?

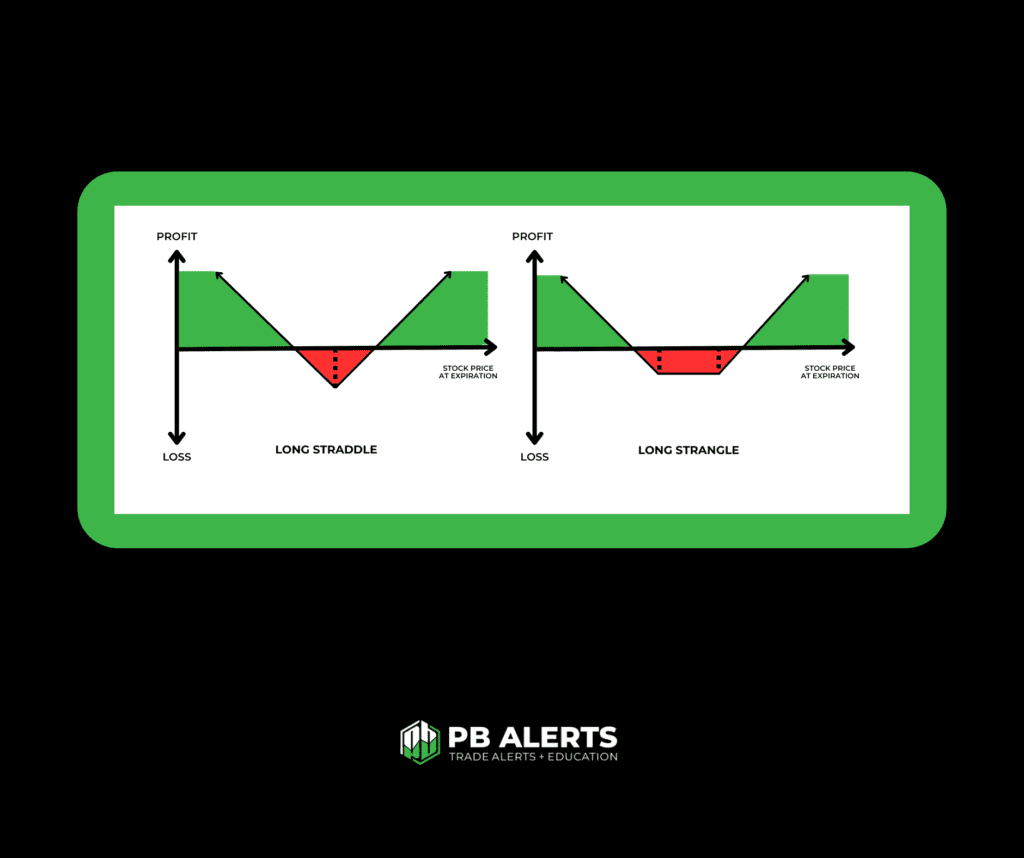

Picture this: you sense a storm brewing in the stock market, but you can't quite predict if it'll be a rainstorm or a snowstorm. This is where the long straddle/strangle strategy comes into play. It’s like packing an umbrella and snow pants, just in case there is rain or snow.

A long straddle involves buying a call and a put option with the same expiration date and strike price. Your'e taking both the red pill and the blue pill, just to see where the rabbit hole leads. If the stock price goes bonkers outside the set price range before the options expire, you'll be laughing all the way to the bank. But be warned, this strategy requires the stock to make a significant move, it just doesn't matter if it's up or down.

How To Trade Long Straddles And Strangles: https://www.youtube.com/watch?v=J82Me2Nc9gE

Embrace the Chaos, but Proceed with Caution

So there you have it, a few options strategies to consider during the crazy rollercoaster ride of earnings season. But remember, this is no walk in the park. So make sure to do your due diligence, research, and understand the risks before diving headfirst into these strategies.

Make sure to follow us on Twitter to stay up to date with all the Earnings Plays coming up!! https://twitter.com/PennyboisStock

Remember, the stock market can be as unpredictable as Pete Davidson’s dating life, but with the proper risk management strategies, community, and mindset, it is possible to #MakeSomeBread!!!

Free Trading Discord:https://pennybo.is/DISCORD

Options Trading Playlist: https://pennybo.is/OptionsTradingPlaylist!

-Options 101

-The Greeks

-Covered CALLS

-Spread Trading

-Brokers For Options Trading

-Implied Volatility

-Protective PUTS

-Iron Condors

-Options Spread Trading