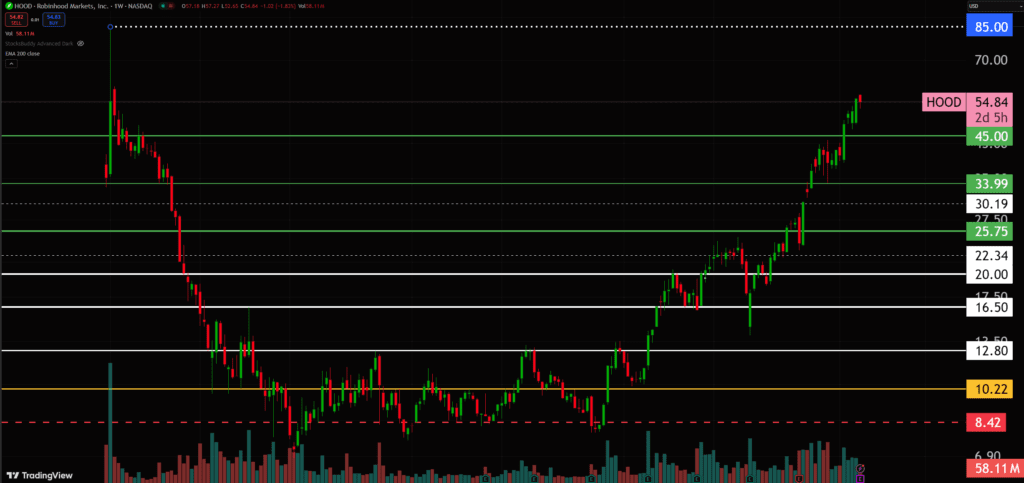

When Robinhood first entered the scene, it was hailed as a game-changer, democratizing trading by making it accessible to the masses with its sleek, user-friendly interface. For the first time, retail traders could participate in the market without barriers, commissions, or complex platforms. As more retail investors flock to the markets, Robinhood is well-positioned to be the first platform at entry compared to the more advanced and intimidating platforms. This accessibility fueled a cultural shift that culminated in the meme stock phenomenon, with names like GameStop ($GME) and AMC Entertainment ($AMC) becoming symbols of retail trader power. However, the platform's legacy became more complicated during the COVID era. The controversy surrounding Robinhood’s decision to remove the buy button on certain meme stocks sparked outrage, raising questions about its commitment to retail traders. Despite the turbulence and a post-IPO rise to $85 followed by a steep fall to single digits, we saw more than just volatility—we saw opportunity in the noise.

IPO and the Early Days: Finding the Bottom

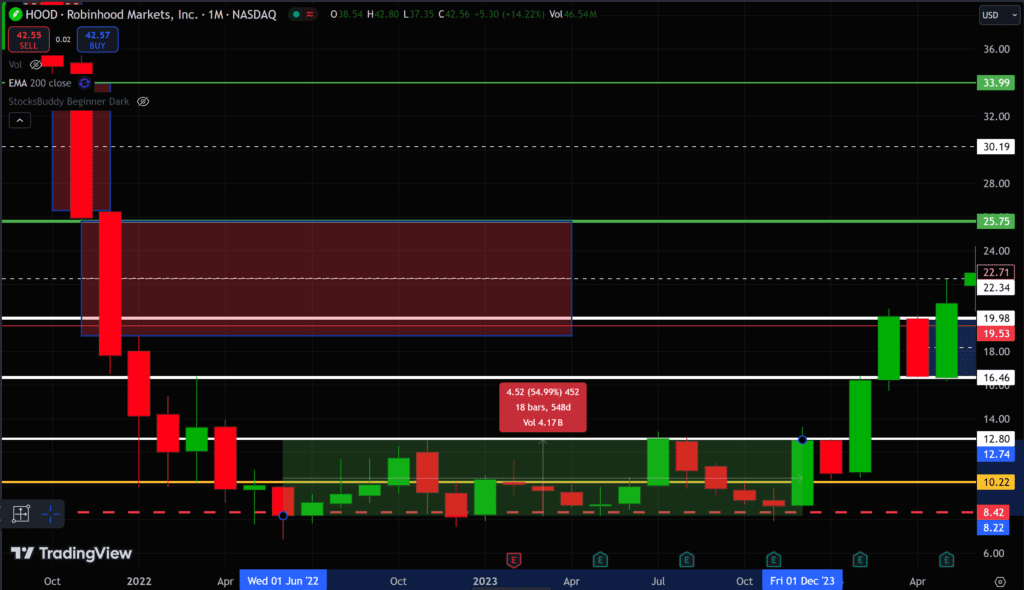

Robinhood's IPO in 2021 came during a euphoric time for growth stocks. However, by mid-2023, the stock had tumbled below $8, drawing parallels to companies like Palantir and Square during their consolidation phases. At that point, Big Quench saw a diamond in the rough. The narrative for Robinhood wasn't about its current state but its untapped potential to expand far beyond a brokerage into broader retail and fintech markets.

- Key Entry Points:

- Initial accumulation began below $8, with $8.83-$10.22 as the primary range of focus for support and accumulation.

- Secondary entries at $12, $16.50, $20

- Long-term Targets:

- $33 (Reversion to the Golden Mean)

- $45

2023: A Period of Patience and Precision

Throughout 2023, Robinhood remained a bottom-feeder stock. This period was marked by consolidation, testing trendlines, and holding critical levels at $10-$12. For range traders, that was a 25% to 54% range that could have been traded 3-4 times before the final breakout.

Quench frequently highlighted the importance of RSI coiling, volume surges, and institutional ownership (~60%) as indicators of a brewing reversal. This strategy emphasized structure and accumulation zones, focusing on where "big money" was entering the stock.

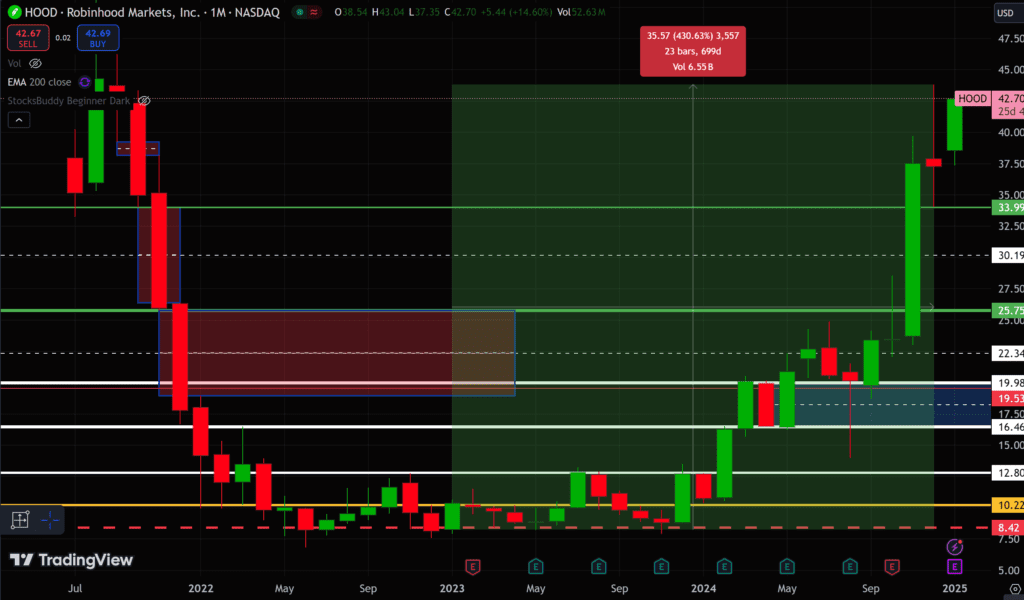

2024: The Breakout Year

2024 was the year of validation. Robinhood began to fulfill its potential with strategic moves that expanded its Total Addressable Market (TAM) without heavy spending on R&D or CapEx. By the summer, the stock had already tripled, breaking critical resistance levels at $16 and $21. Big Quench aptly described this breakout as moving through a "liquidity zone" where price action was swift and relentless.

- Key Milestones:

- $16-$18 liquidity zone was cleared rapidly, paving the way for $30-$33, and now up to $45.

- Equities gained over 430% from initial entries, while long-term options soared over 1,000%.

Fundamentals: TAM Expansion with Discipline

One of the most compelling aspects of Robinhood’s story is its ability to expand its TAM strategically. Unlike competitors that overextend through aggressive spending, Robinhood has diversified into multiple retail industries while maintaining discipline in its cost structure. This efficiency allowed it to grow without the pitfalls that have plagued other fintech names.

Quench often compared Robinhood to "the Google of investment platforms," positioning it as a foundational tool for the next generation of investors. The company's focus on simplicity and accessibility resonates deeply with retail investors, particularly younger demographics entering the market.

A Masterclass in Patience

Robinhood’s journey is a testament to the power of patience and conviction. From buying in the lows of 2023 to holding through tight consolidations and finally riding the breakout of 2024, this stock exemplifies the principles of disciplined investing. Quench and Shay didn’t just pick a winner; they nurtured it, guided by technical precision and an unwavering belief in the fundamentals.

The takeaway for traders and investors alike is clear: focus on structure, respect the range, and trust the process. As we look ahead, Robinhood’s story is far from over, but its transformation from a bottom-feeder to a market force will remain one of the defining narratives of this market cycle.

Current State: A Stock at a Crossroads

As of late 2024, Robinhood has achieved many of the targets we set over the past two years. Its move from $8 to $44 represents a journey of resilience, patience, and strategic execution. However, as Quench frequently reminds us, the game doesn’t end here.

- Current Targets:

- Near-term resistance at $45-$50.

- Long-term potential to revisit $50, a level it hasn’t seen since its IPO mania.

- Watch Levels:

- Supports at $33 and critical support at $20.

- Consolidation zones between $30-$33 for a healthy base before the next leg up.

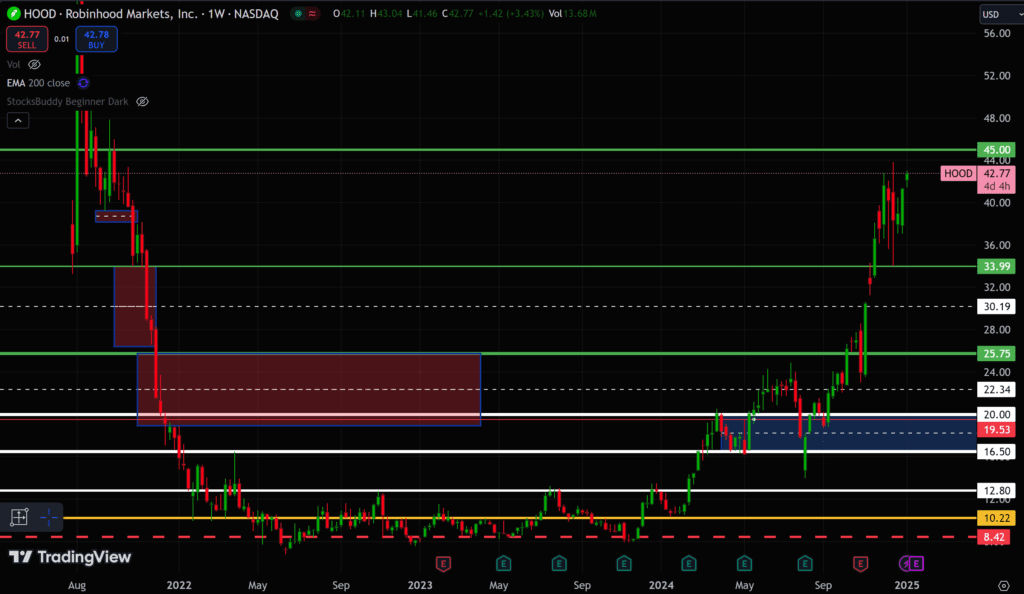

2/3/25 Update

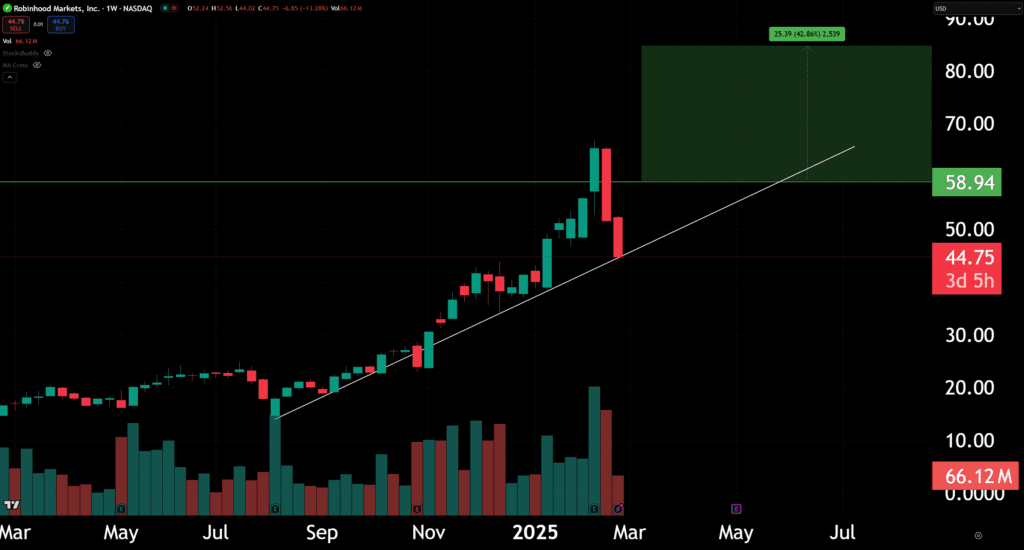

Robinhood, like Palantir, IonQ, and Snowflake, is also experiencing a rerating, where the company’s perceived value changes in the eyes of investors. Quench mentions that from here there is "insane liquidity" up to $84.

2/24/25 Update

Shay is a bear on Fintech, except Robinhood. Robinhood has successfully transformed its business model from a transaction-based revenue model to a more diversified, subscription-driven engine allowing less exposure to market volatility. Robinhood is evolving into a "Bank of our generation," with the potential to accelerate the velocity of funds into its platform. Robinhood has created a flywheel system, converting casual traders into long-term, engaged participants through its subscription-based Gold Membership and other ecosystem offerings. Shay describes Robinhood’s UI as the “chef’s kiss” that noone else has been able to replicate successfully. Robinhood is not just a brokerage platform, but also a data company that generates revenue from selling data on the back-end. This is their moat: UI/Brand, Flywheel/Stickiness, Data Monetization. $58 is the key level to hold. Above, and our target remains $85.