Jumia, often referred to as the "Amazon of Africa," stands as a trailblazer in e-commerce across a continent with immense untapped potential. From its diversified platform offerings to its deep focus on supporting small and medium-sized enterprises (SMEs), Jumia represents a transformative opportunity for both investors and consumers. However, the company’s journey has been fraught with challenges—from currency devaluations to operational missteps—making it a high-risk, high-reward investment.

Shay Boloor (@StockSavvyShay) has followed Jumia from its nascent stages to its current pivotal moment, where the groundwork for profitability and expansion is being laid. Jumia ($JMIA) was first alerted in May of 2024 at $4.50 before it ran for over 230% within just three months. However, after recent earnings, investors have been spooked and price has made a full retracement back to entry. Let’s break down the key elements of this fascinating company.

The Jumia Ecosystem: More Than Online Shopping

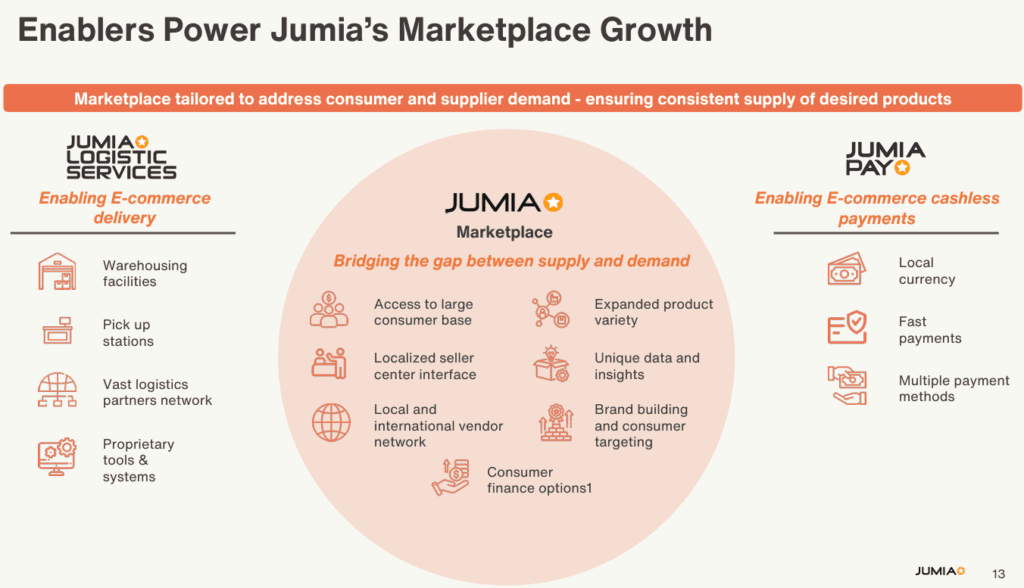

Jumia’s platform extends far beyond e-commerce, offering a suite of services that mirror Amazon’s ecosystem:

- E-Commerce: A marketplace for diverse products, including electronics, fashion, and groceries.

- JumiaPay: A digital payments platform with the potential to become a pan-African financial tool.

- Jumia Logistics: A logistics network supporting its platform and third-party sellers.

- Jumia Prime: A subscription service similar to Amazon Prime.

- Advertising: Monetizing its platform through targeted advertising for sellers.

This diversified approach not only enhances revenue streams but also creates a self-reinforcing ecosystem, making Jumia indispensable to its users.

Key Strengths: Jumia's Moat

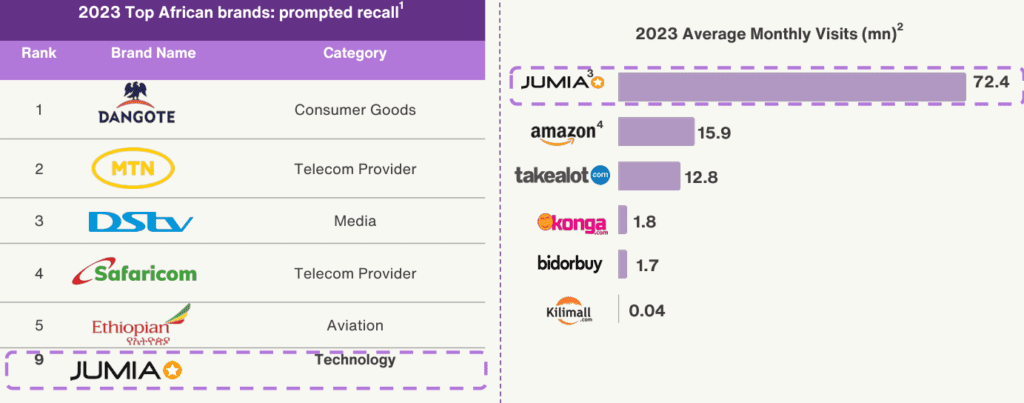

First-Mover Advantage

Jumia has carved out its position as the leading e-commerce platform in Africa. Its early entry has allowed it to build unparalleled brand recognition, customer loyalty, and an extensive logistics network. This is a critical moat in a fragmented market.

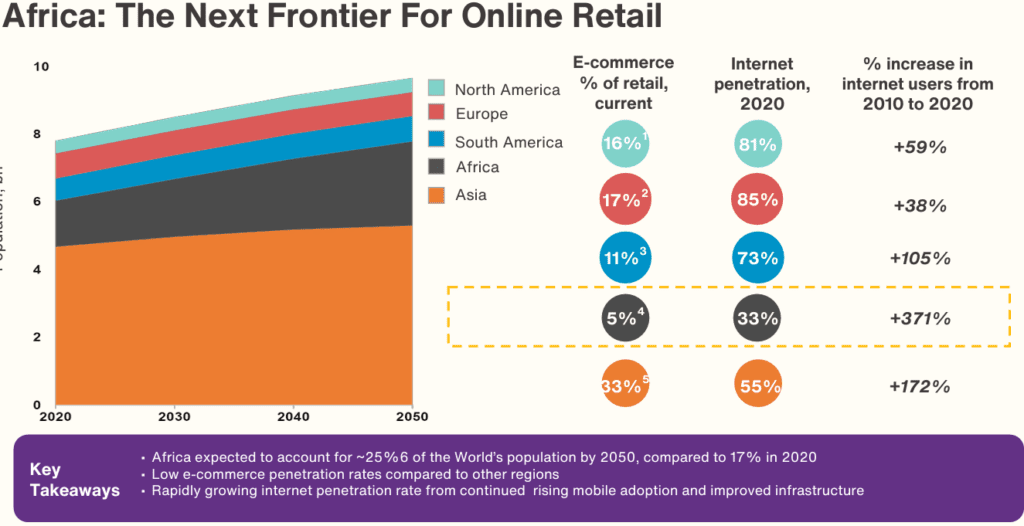

Rapid E-Commerce Growth

Africa’s e-commerce sector is in its infancy, with internet accessibility and the middle class expanding simultaneously. This dual growth trajectory provides a fertile environment for Jumia’s continued expansion.

Strategic Local and International Partnerships

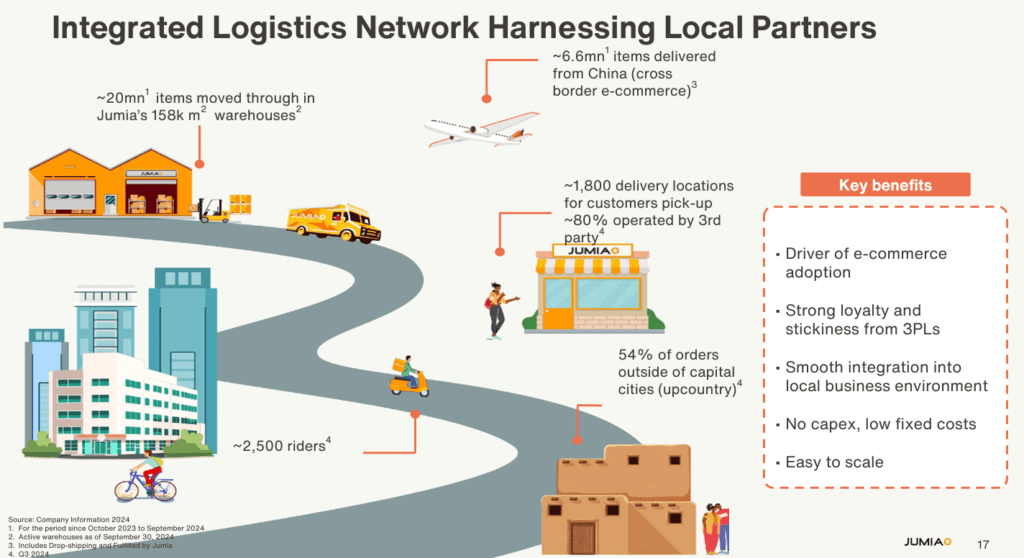

Furthermore, collaborations with global giants like Mastercard and UPS further bolster Jumia’s ability to scale while improving logistics and payments infrastructure.

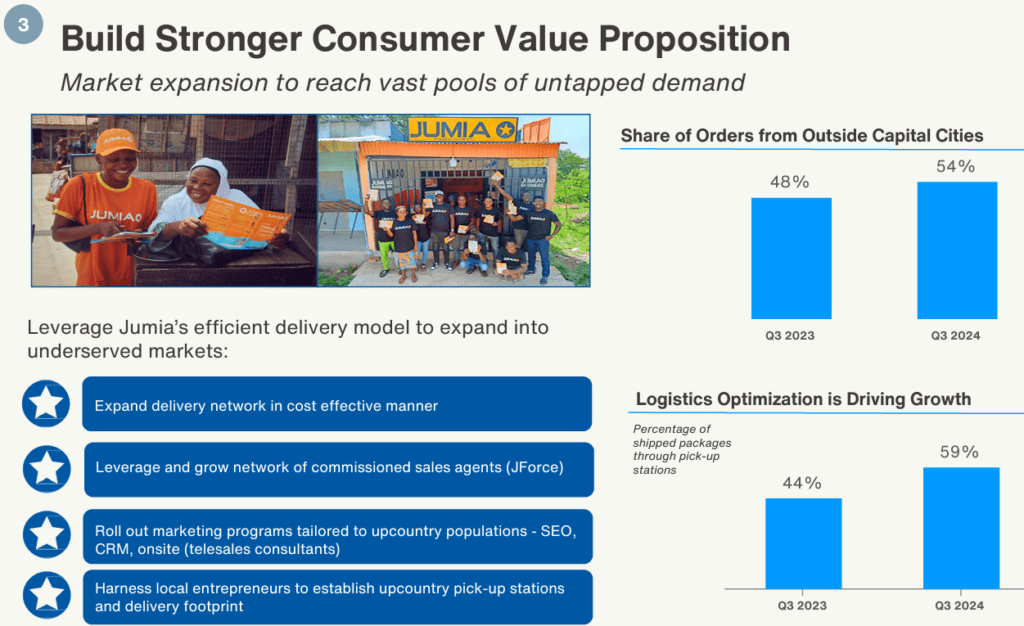

Rural Market Expansion

More than half of Jumia’s orders now come from rural areas, a largely underserved segment. These low-cost expansions into rural markets offer significant growth potential with minimal capital investment.

Operational Efficiency

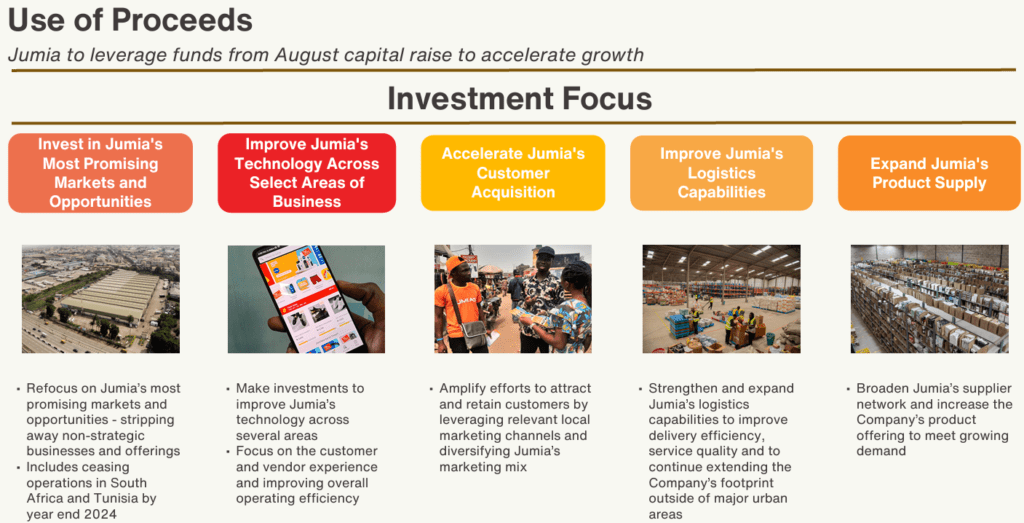

Recent efforts to consolidate warehouses and exit unprofitable markets have streamlined operations, paving the way for more sustainable growth.

Recent Earnings: Progress Amidst Challenges

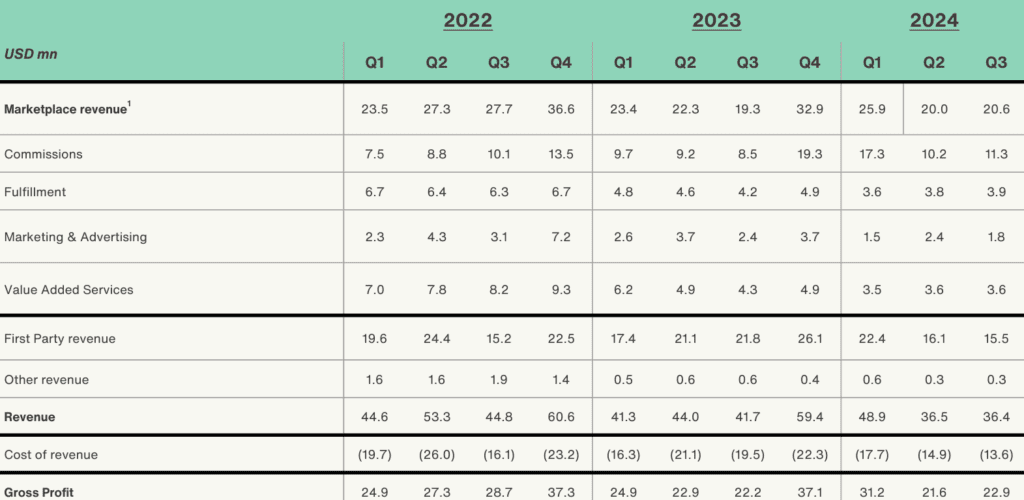

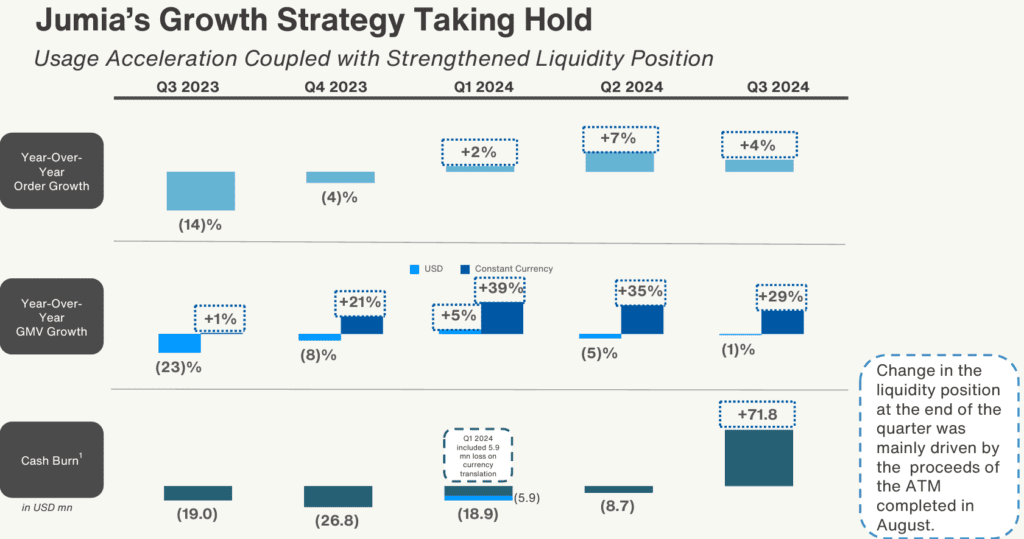

Jumia’s Q3 2024 earnings painted a mixed picture:

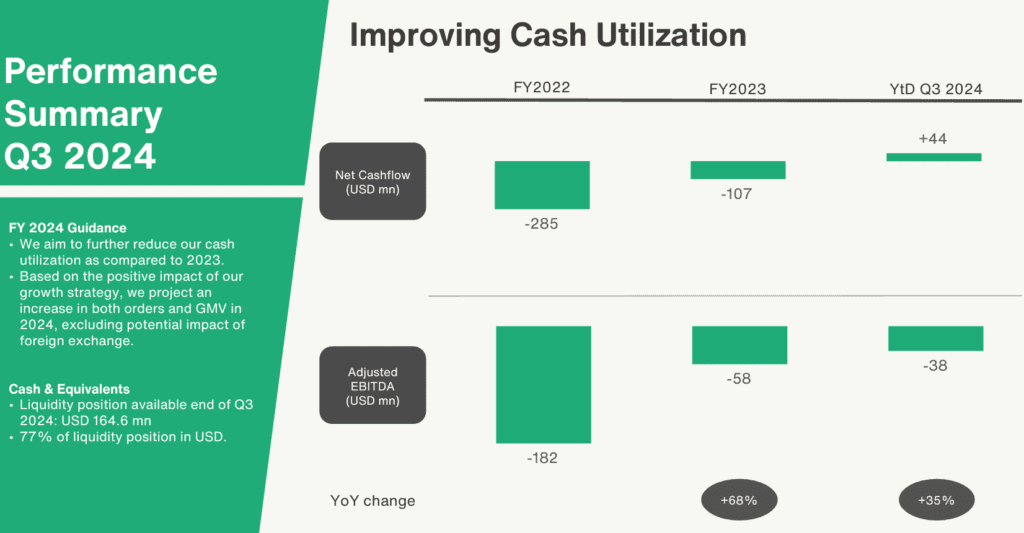

- Cash Burn: Reduced to an all-time low of $8.7 million, reflecting disciplined cost management.

- Orders Growth: Total orders returned to growth for the second consecutive quarter.

- Operational Upgrades: New, technology-enhanced warehouses in key markets like Nigeria and Egypt.

- Repurchase Rates: Improved to 39% without heavy promotions, showcasing the platform’s growing appeal.

However, currency devaluations in markets like Nigeria weighed heavily on reported revenue, which declined 13% YoY. Investor concerns also spiked after Jumia issued over 20 million shares, diluting existing shareholders and highlighting its need for cash. This has spooked investors giving similar vibes to February 2021, where $JMIA sold off by more than 95% in just under three years.

Challenges on the Horizon

Jumia’s path is not without significant hurdles:

- Currency Volatility: Operating in multiple African countries exposes Jumia to unstable local currencies, which can erode revenue when converted to U.S. dollars.

- Infrastructure Deficiencies: Africa’s infrastructure remains inconsistent, complicating logistics and raising costs.

- Investor Confidence: Recent share dilution and lack of clarity on capital allocation have led to skepticism about Jumia’s long-term financial stability.

- Profitability: Jumia’s profitability hinges on achieving scale, cutting costs, and maintaining consistent growth—all while navigating external headwinds.

Market Mastery’s Perspective: The Bonsai Approach

Jumia is classified as a “bonsai” position by Shay—high-risk, high-reward, small allocation investments cultivated carefully over time. While short-term sentiment may be negative, the long-term thesis remains intact:

- Massive Market Potential: Jumia is uniquely positioned to capitalize on Africa’s growing middle class and increasing internet access.

- Improved Fundamentals: Cost reductions and operational upgrades signal a company moving toward profitability.

- Strategic Timing: With $200 million in cash reserves and a burn rate of $8.7 million, solvency risk is minimal, allowing Jumia time to invest in and execute its vision.

Technical Analysis and Targets

From a technical perspective, Jumia is a picture perfect double-bottom setup. It offers clear entry and exit points:

- Support Levels: $3.90, $2.90

- Resistance Levels: $4.75, $5.67, $7, $10, $12.50, $15, $18, $20

- Ranges to Watch: $2.9–$4.75, $4–$10, $10–$18

Big Quench and Shay have been scaling in from $3-$4.50. Based on fundamentals, Shay is targeting $20 in 2025. Based on technicals, Quench is targeting $14.50 (reversion to the golden mean) and $30. With Shay and Quench targeting $20 by 2025, the key lies in scaling positions wisely and adhering to a disciplined plan.

The Verdict: High-Risk, High-Reward, Small Allocation

Jumia’s story is one of transformation and resilience. Once seen as a speculative play with little substance, the company has evolved into a leaner, more focused operation with a clear path to profitability. While risks remain, the potential for outsized returns makes Jumia a compelling long-term investment for those willing to weather volatility.

As Shay succinctly puts it, “This is just the beginning for this mini-monster.” Whether you’re looking to build a position or revisit this name, Jumia represents a unique opportunity to tap into Africa’s e-commerce revolution. Stay tuned, stay disciplined, and let the plan guide the trade.