JPMorgan Names $AMZN, $GOOGL, $UBER and $NFLX As Top Stocks Of 2024

Here's how our Exclusive In-House Analyst are playing Google, Netflix, Amazon and UBER! These are 4 of the stocks JPMorgan Analyst Doug Anmuth just named as the "Top Stocks of 2024".

JPMorgan Analysts: Super Bullish On Internet Sector Stocks

JPMorgan analyst Doug Anmuth and his team of experts named Amazon and Google as their top picks for 2024!!! “We generally prefer companies with solid growth, proven profitability profiles, and reasonable valuation given the current interest rate environment,” Anmuth added. Google and Amazon check all the boxes.

Amazon To $190 Means 28% Upside Potential

Amazon ($AMZN) is trading at $148.29 as of this writing. Anmuth not only maintained his Buy rating on Amazon this week, but also set a price target at $190 (28% upside). Keep in mind, Anmuth has an average return rate of 17.3% per year according to TipRanks. Amazon has a $177.32 average target amongst Wall Street Analysts, which would be around a 20% profit from these levels on equity trades. Towards the bottom of this blog you can find our trade idea, with a target of $177.61. TD Cowen went as high as a $200.00 price target along with their Buy rating on Amazon a week ago.

Check Out Our Free Trading Discord

Why Amazon?

Amazon has the most upside potential compared to the other mega-cap companies, according to JPMorgan. Anmuth and other analysts are hot on Amazon due to its accelerating revenue growth in Amazon Web Services (AWS), which is its cloud computing unit. CEO Andy Jassy said their push into generative AI represents "tens of billions" of dollars in potential revenue for Amazon. "For cloud, we model AWS growth of +17% (vs +13% in 2023) supported by strong secular growth, new workload deployment, easier year-over-year comparisons, and growing Gen AI contribution," JPMorgan said. They also expect Amazon's retail revenue growth to rise by 11% in 2024 (compared to growth of 9% in 2023), and the total revenue to grow by 13% in 2024. Amazon is up 70% in 2023 compared to the Nasdaq-100's gain of 50%.

Google Gets $160 Price Target And 23% Upside Potential

“We believe Google has weaker sentiment and is less owned than other mega-caps,” Anmuth said implying that Google's antitrust trial that Google lost to Epic Games could have an impact "less onerous than feared." Google's improving ad growth and new AI push are two of the main reasons JPMorgan is bullish on the stock. Increasing margins after cost cuts is just icing on the cake.

Google's AI: "Gemini Ultra"

“While still early, Gemini Ultra represents significant innovation and should start to close the Gen AI gap as it rolls out in early 2024,” according to Anmuth. Google unveiled Gemini this month, which is its generative AI model and competitor to OpenAI’s GPT-4. Google $GOOGL is up 46.61% year to date.

UBER The Surprising Top Pick

Increased grocery delivery demand, overall strength and profit focus put $UBER as one of JPMorgan's top picks for 2024 as well. Even though consumers have been pulling back on spending, Anmuth thinks that mobility and delivery demand will remain high. Uber's PE ratio is 120, nearly double Nvidia's even after the year $NVDA had. Uber is up almost 150% in 2023, outperforming their rival $LYFT by over 100%.

Bullish On Streaming And E-Commerce

JPMorgan said they are expecting growth in the streaming industry due to a shift towards ad-supported models, mentioning Netflix $NFLX in particular which is up 58% this year. They also mentioned e-commerce and online travel as two areas to look at for 2024.

How Our Exclusive In-House Analysts Are Playing Amazon $AMZN

"So first we have $AMZN, on the weekly timeframe. I'm using a 50 EMA (blue line) to grasp overarching trend direction. It's up, and we have tested this blue line into support just a few weeks ago before taking off. From here, I personally need to see a retracement back into the fair value gap that we have left behind, otherwise I'm not interested to trade/chase it."

Option 1: Wait for the price to drop below $138.36 support level. Then enter once we get a 4H candlestick close back above $138.36

Option 2: The next support level we are watching is $130.02. If the price drops down past $138.36 and then keeps going down, our next option is to wait for the price to drop below $130.02 then enter once we get a 4H candlestick close back above $130.02

Target: We are watching the $177.61 resistance as a target area, making that a 28%-36% profit potential. Depending on your Risk:Reward strategy, it could be advised to take profits along the way and set a trailing stop loss to ensure profits.

Stop Loss: "If Amazon closes back below this weekly 50 EMA, that could spell trouble and I would be OUT!"

Our Trade Idea For Google $GOOGL

"Same idea as for $AMZN, but looks slightly less bullish for now. We are also trading above the weekly 50 EMA (blue line), so looking for bullish positions, not bearish. It's only when we get and close back below the weekly 50 EMA that more downside continuation becomes likely. Personally I'm attaching a lot of value to the $135 level, which is the open price of the weekly big red candle from back in October. This candle could be a bullish order-block, but in order to confirm that, we need to get above $135. I'd be looking to play a bullish continuation play if GOOGL manages to break $135, stopping out below $124.5, and aiming for at least $150."

Entry: Break Above $135

Target: $150+

Stop Loss: Below $124.50 Support

Our 50 EMA Trade For $NFLX

"Same thing as the other two in the sense that we are trading above the weekly 50 EMA, so becoming bearish here is not optimal. I prefer to look for a higher low and then continuation."

Entry: "For that higher low, simply look at either $440 or $410 as important levels. Again, no blind orders:"

Option 1: Wait for the price to get below $440, then enter upon a 4H close above $440.

Option 2: Wait for the price to get below $410, then enter upon a 4H close above $410.

Target: $485+

Stop Loss: You can either set a percentage based stop loss that fits your plan, or use the 50 EMA as a guide.

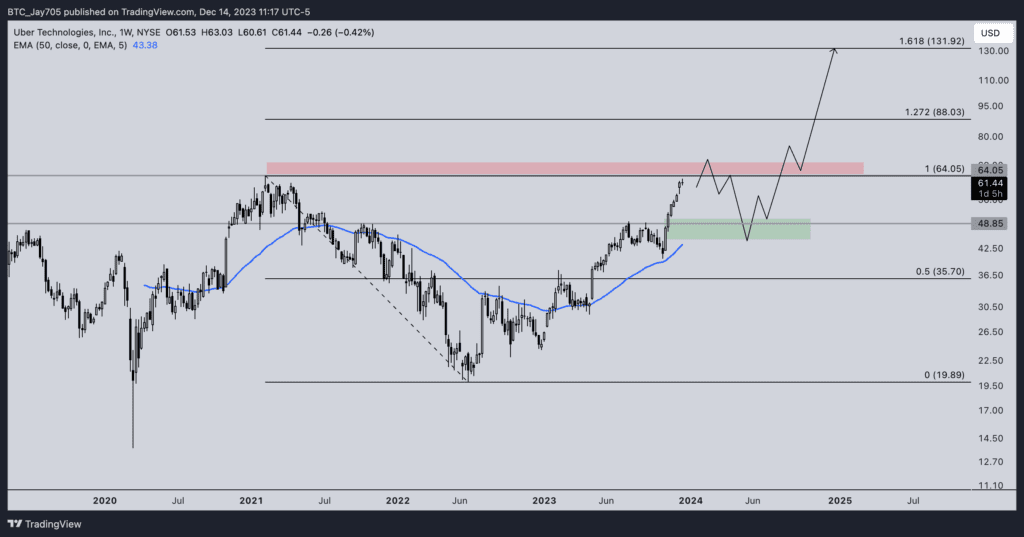

How We Plan To Ride $UBER To The Bank

"Lastly we have $UBER, which just like our three previous tickers, is trading well above the weekly 50 EMA. So once again - it's an uptrend, so shorting/bearish is very risky. However, UBER is closing on the previous all time high at $64.05. Chances are that if we get above this all time high, but close a 4H candle back below $64.05, that we start to come back down. In the bigger picture I'm most of all interested in longing UBER from a higher low. My idea is that at some point, long positions with a stop loss below $50 are going to get hunted and bought up. Ideally I want to see UBER get back below $50, then to long once we close a 4H candle back above $50 (this would ensure that everyone that needs to get stopped out is stopped out and we can take it higher)... IF we break the all time high at $64.05 and successfully flip this level of resistance into support, then UBER is going into price discovery mode, which is likely to pull the price up to at least $88 over the course of the coming months."

Option 1: If UBER breaks above the all time high at $64.05 and then gets a 4H candlestick close below $64.05 we could enter a bearish position looking for $48.85 as a target.

Option 2: Wait for UBER to get below $50, then enter a bullish position once we see a 4H candlestick close back above $50. Targets could be $64.05 and $80+

Option 3: If we break and hold above the high of $64.05 we could enter and look for targets at $88+ over the coming month.

Get Our Trade Alerts In Real Time

Get crypto education, live streams, real time trade alerts, exclusive NFT deals, and more.

Get Our Weekly Watchlist

Get the latest market news, stocks to watch, earning reports, exclusive discounts and more!

PennyBois

PennyBois is a group of experienced traders dedicated to providing hedge fund quality trade alerts without the cost.