$5.8 Billion Bid To Make Macy's Private

Macy's ($M) stock rose 20% Monday, the biggest daily increase for the company in over 2 years. This was due to the $5.8 billion bid by real estate investing group Arkhouse Management and Brigade Capital Management to acquire the 165-year-old retail giant and make it private.

It's All About The Real Estate?

Macy's owns 320 of its 784 stores. Its Real Estate Portfolio alone is estimated at $8.5 billion by JPMorgan, with their flagship NYC Herald Square location estimated at $3 billion alone. That being said Department stores' values are historically overestimated.

It is rumored that Arkhouse and Brigade are interested mostly in Macy's Real Estate Portfolio and that the retail portion of the company is just "icing on the cake". This could suggest that they plan on converting many of the department stores into residential buildings, as we are in a time of housing shortage.

Macy's Triumphs And Woes

Macy's price has nearly doubled in the past couple months in part due to adopting private brands, pivoting to smaller stores, growing its digital marketplace, and building up Bloomingdale's (which is owned by Macy's) as a luxury brand. In October they announced the addition of 30 new store locations at strip malls in an attempt to pivot away from relying on traditional shopping malls. Tony Spring, who currently is successfully running Bloomingdales, is set to replace Jeff Gennette as CEO of the entire company in February.

That all being said Macy's is still experiencing the struggles that most department stores are currently going through. "Consumers don't want to shop where their parents shopped" said one expert. Shoppers today not only want to feel a connection to the brands they wear, but they also care about elements like environmental sustainability and fair labor practices. Macy's however is meant to feature a mishmash of all brands, which makes it hard for them to communicate each individual brand's values which is why this era has been deemed "the decline of department stores" in the past.

JCPenny, Lord & Taylor, Belk, Stage Stores, Bon-Ton, and Sears have closed around 1,500 department store locations since 2018 according to JPMorgan. However Macy's didn't benefit from their competitors closing as one would have thought, as they have lost 90 basis points of market share in the US Softlines Retail Industry. This is in part due to the growth of e-commerce, consumers being more cautious with their spending due to the current economy, and expansions of discount retailers like TJ Maxx. On top of all of that, brands that have partnerships that Macy's relies on have recently started to prefer to operate their own stores instead of featuring their clothes at department stores such as Macy's.

Is The Real Estate Worth It?

Even though they boast an impressive Real Estate Portfolio, the fact that the bid is so low compared to Macy’s asset value shines a spotlight on the difficulty facing retail real estate. The demand for department stores has decreased, instead buyers are converting these multi-million square foot buildings for other use. This proves difficult seeing as zoning isn’t easy, interest rates are high, and office spaces aren't in demand due to the increase of "work from home" jobs. Cost and time is also a factor. The NYC Herald Square location could cost anywhere between $200-$550 per square foot to reconstruct it and the overall conversion process could take 3-5+ years according to experts.

Is The Bid Too Low?

Even with all the recent struggles Macy’s beat earning estimates last quarter and they make a profit (unlike most other big box retailers). It is highly unlikely they will take the $5.8 billion bid at $21 per share, as they were trading at $25 last year. The bid also undervalues the company according to most valuation metrics. It is possible however that this bid by Arkhouse will cause other bidders to show interest in Macy's. This happened two years ago when Arkhouse placed a $2.4 billion bid on Columbia Property Trust, which ended up being sold for $3.9 billion. Arkhouse and Brigade also expressed a willingness to raise their bid if Macy's agrees to open its books to them.

$M Trade Ideas

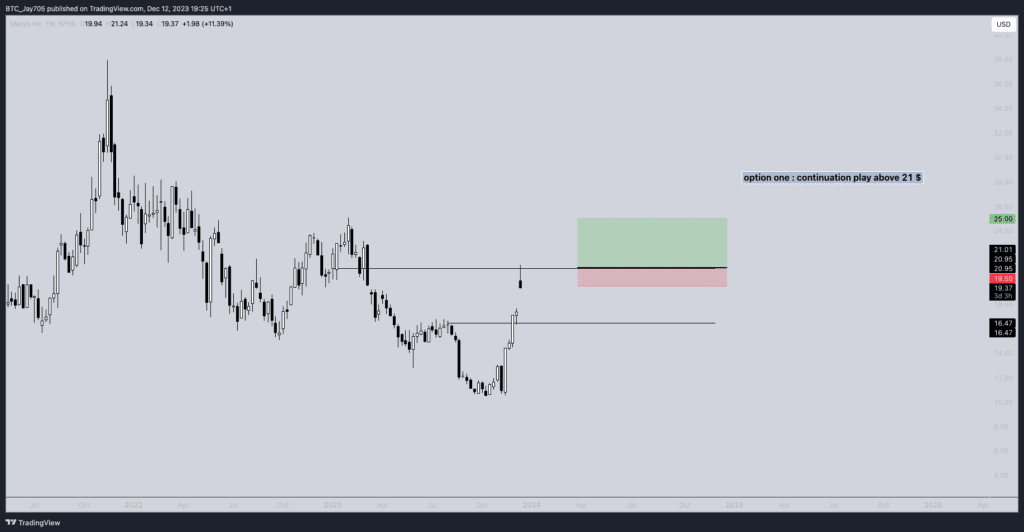

Option 1: Continuation Play

If we don’t get a dip from here, we could look for a $21 entry for a continuation play. This means entering upon a strong break above $21, or upon the confirmation that $21 turned from resistance to support. Targets would be $23 and $25 with a Stop Loss below $19.50.

Check Out Our Custom Indicator StocksBuddy

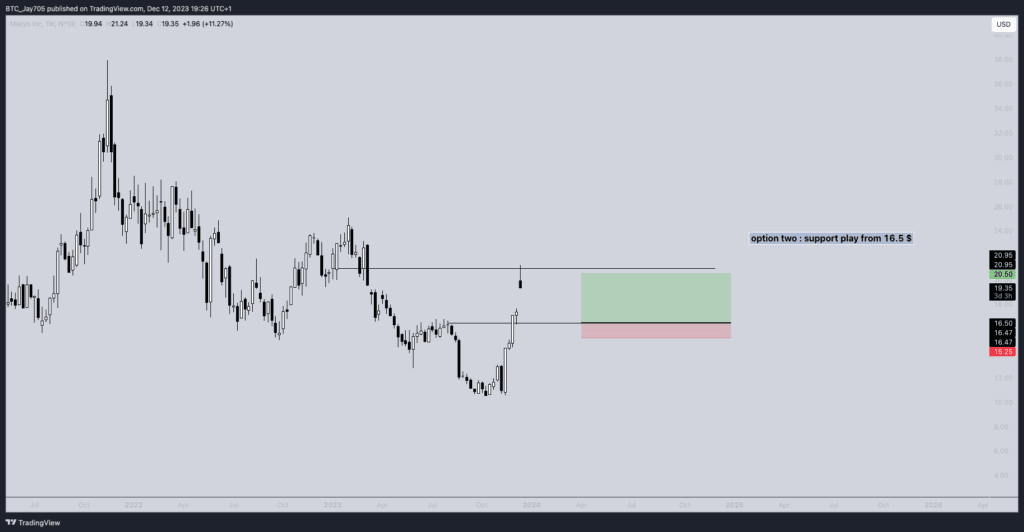

Option 2: Support Bounce Play

If we do get a dip from here, we could play off the support at $16.50 This means entering upon a bounce off of the $16.50 support level, or upon a successful retest of $16.50 as support. Targets would be $18.50 and $20.50 with a Stop Loss below $15.25.

Check Out Our Free Trading Discord For More Trade Breakdowns And Education