Stock Market Regulatory Rules

I’m Meta Matt, Director of Education and welcome to PB University LITE! This is a 50 Class Trading 101 Series geared towards both new and veteran traders alike! We go over everything from Trading Psychology, Technical Analysis, and Options Trading to Commodity Trading, Forex, and more!! This 50 Class series is not designed be taken in order, it is instead designed for traders to browse and pick which classes interest them. I will include the list of classes at the bottom of this page.

Start Trading With Webull: Free Stock Shares

Custom Trading Indicator DISCOUNT: Try StocksBuddy Today

Get A Trading Coach, Premium Alerts, Education, and Community:

1 Month Membership

90 Days (Save 10% Per Month)

1 Year (Save $279)

What is the Regulatory Environment?

- The regulatory environment refers to the framework of rules and regulations established by governing bodies to oversee financial markets.

- Its primary aim is to ensure fair, transparent, and stable trading practices.

Key Regulatory Bodies:

- Securities and Exchange Commission (SEC): In the United States, the SEC is the primary regulatory body responsible for protecting investors, maintaining fair markets, and facilitating capital formation.

- Financial Conduct Authority (FCA): In the United Kingdom, the FCA oversees financial markets and firms, ensuring their compliance with regulatory standards.

Regulatory Tools and Measures:

- Regulatory bodies employ various tools such as examinations, audits, and investigations to monitor market activities and enforce compliance.

- They have the authority to impose penalties and sanctions for non-compliance.

Important Regulations:

- Securities Act of 1933 and Securities Exchange Act of 1934: These acts lay the foundation for securities trading in the U.S., requiring companies to register their securities and regulating transactions on the secondary market.

- Dodd-Frank Act: Enacted post the 2008 financial crisis, the Dodd-Frank Act aims to promote financial stability and protect consumers through significant reforms.

Compliance Requirements:

- Market participants, including brokers, dealers, and investment advisors, have distinct roles and responsibilities with specific compliance requirements.

- Traders should familiarize themselves with regulations such as Pattern Day Trader Rules, Cash vs Margin Account Rules, and others.

Critical Issues and Procedures:

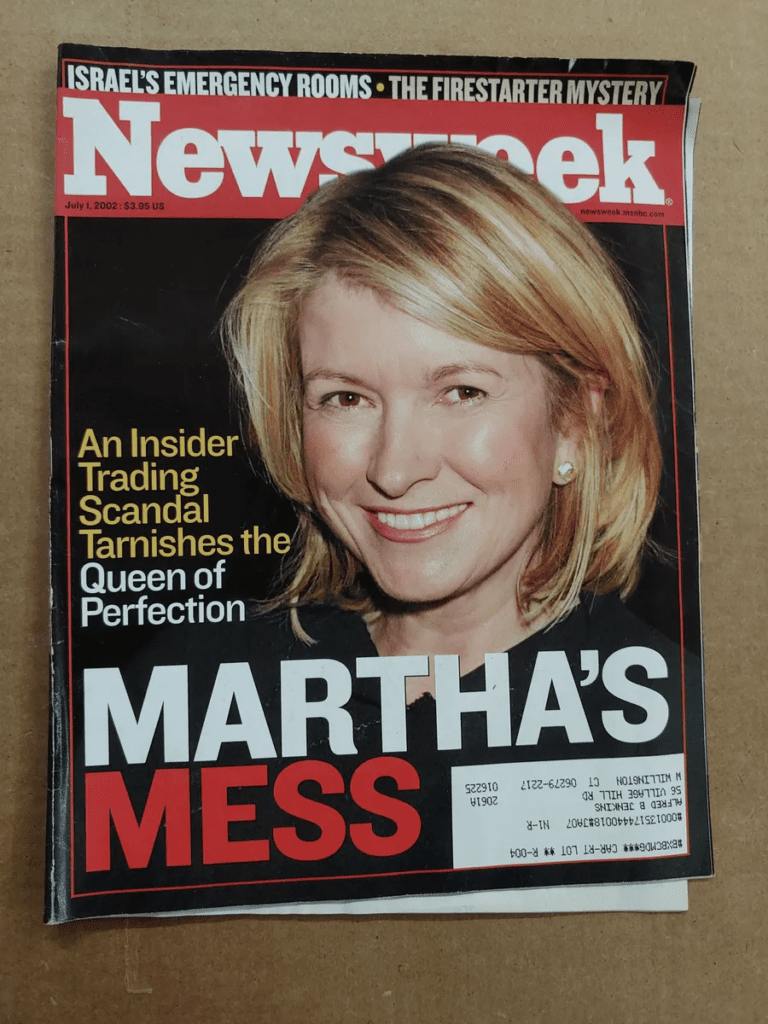

- Insider trading, market manipulation, Know Your Customer (KYC), and Anti-Money Laundering (AML) procedures are essential aspects of regulatory compliance.

- KYC procedures verify customer identities to prevent fraud, while AML measures detect and report suspicious activities related to money laundering.

Real-time Monitoring and Reporting:

- Regulatory oversight includes real-time monitoring of trading activities and reporting requirements to identify and investigate suspicious activities.

- This monitoring enables traders to access Bid and Ask Prices, Level 2 Data, Trading Volume, and other vital information.

Clearing and Settlement:

- Clearinghouses play a crucial role in ensuring secure transactions, acting as intermediaries between buyers and sellers to facilitate clearing and settlement processes.

Cybersecurity Measures:

- Regulatory requirements are in place to safeguard against cyber threats, emphasizing the implementation of best practices for cybersecurity to maintain trust and security within the industry.

Adapting to Regulatory Changes:

- Regulations are not static and evolve to adapt to changing market conditions.

- Staying informed about regulatory changes and adjusting trading strategies accordingly is imperative for trading professionals.

PB University LITE Class List

1) Trading Terminology

2) Stock Market Indices

3) Common, Preferred, and Penny Stocks

4) Diversification of Assets

5) Fundamental Analysis Made Easy

6) Technical Analysis Made Easy

7) Risk Management In The Market

8) Portfolio Management

9) How To Follow Market News

10) Trading Psychology

11) Options Explained

12) The Greeks In Options Trading

13) How To Short Sell Options

14) Covered CALLS

15) Spread Trading

16) Online Brokers for Options Trading

17) Implied Volatility Calculators & Tools

18) Protective PUTS

19) Iron Condors

20) Straddles

21) Reading Level 2

22) Taxes

23) Trading Psychology Techniques

24) The Art Of Trading

25) Becoming A Jedi In The Stock Market

26) Futures Trading Explained

27) Commodity Trading 101

28) Regulatory Environments

29) How To Become A Millionaire

30) $100K In 100 Days

31) Wash Sale Rule

32) Behavioral Finance Part 1

33) Behavioral Finance Part 2

34) 5 Charting Indicators

35) Fair Value Gap

36) Insider Trading and Market Manipulation

37) Stock Chart Types

38) Moving Averages 101

39) Base vs Precious Metals

40) Electricity Trading 101

41) Trading Brokers 101

42) 5 Trading Strategies

43) 85% Trading Rule

44) Are Win Rates A Scam?

45) Futures Trading 101

46) ATR Indicator Strategy With The Greeks

47) MACD Indicator 101

48) Bollinger Bands Indicator 101

49) Wedges, Triangles, Flags and Pennants

50) RSI Divergence 101