950%+ Equity, $15 Leap 7900%

Palantir Technologies offers three main products: Gotham, Foundry, and Ontology. Government agencies, corporations, and institutions rely upon their products to integrate, analyze, and act on data in ways that drive efficiency, security, and strategic advantage. They are unrivaled in their ability to generate depth of sight, optimize operations, and maintain a competitive edge in an increasingly data-driven world.

Gotham

Gotham (Government & Defense) is used for secure data integration, analytics, and operational planning. From a defense point-of-view, Gotham will scrape through massive amounts of data, including social media, and not only identify threats, but use powerful predictive analytics to simulate scenarios to neutralize the threat. This provides a major edge in counterterrorism, defense operations, and strategic diplomatic positioning.

Foundry

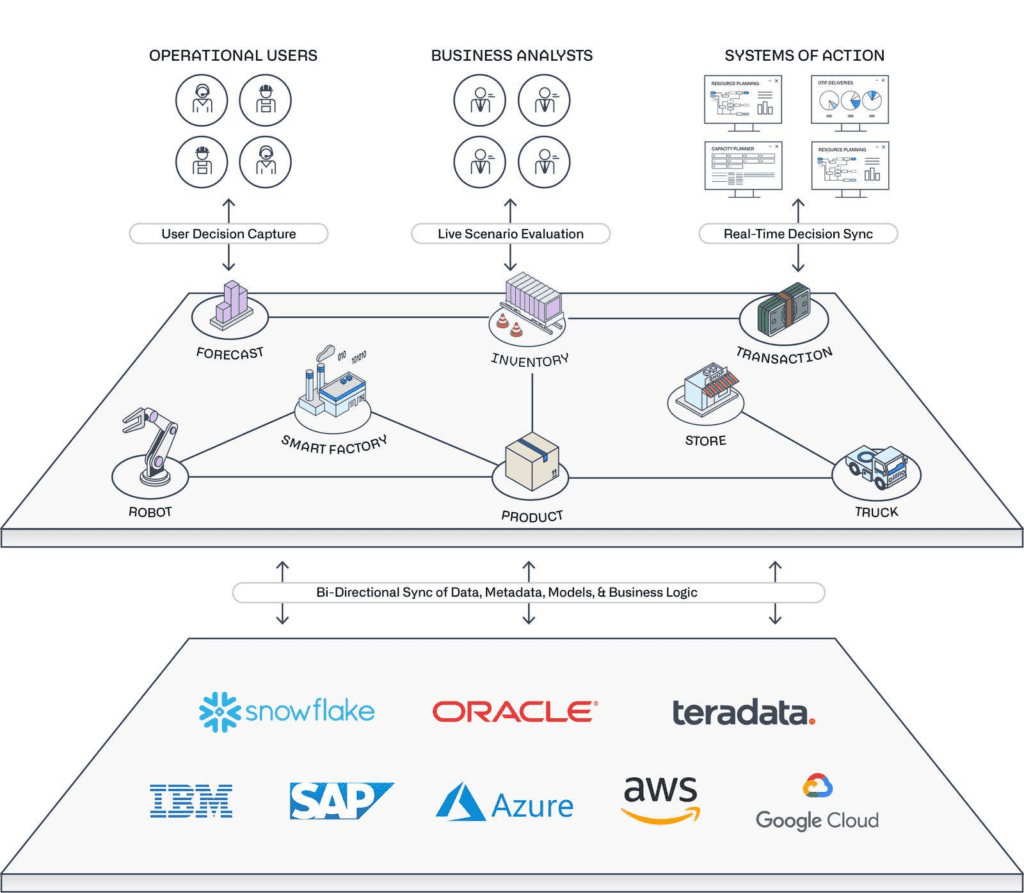

Foundry (Commercial) integrates data from different parts of a company into a single platform and provides insights to improve efficiency. Foundry’s ability to create “digital twins” of real-world assets allows companies to visualize and optimize their operations in real-time. In manufacturing, Foundry can combine supply chain data, production equipment sensors, and financial forecasts to optimize inventory levels and reduce downtime.

Healthcare: Optimized hospital operations during COVID by analyzing bed availability, staffing, and medical supply chains to enhance a hospital’s ability to respond to surges in demand.

Automotives: Helped Ferrari optimize its Formula 1 performance by analyzing build telemetry, weather conditions, and track data with real-time racing strategies.

Finance: Helps hedge funds and investment firms monitor market risk by integrating real-time market and financial data, news feeds, and proprietary tools and research.

Retail: Unifies point-of-sale data, supply chain logistics, and consumer trends optimizing pricing, inventory, and improving customer experience in relation to seasonal demands, trends, and supply chain disruptions.

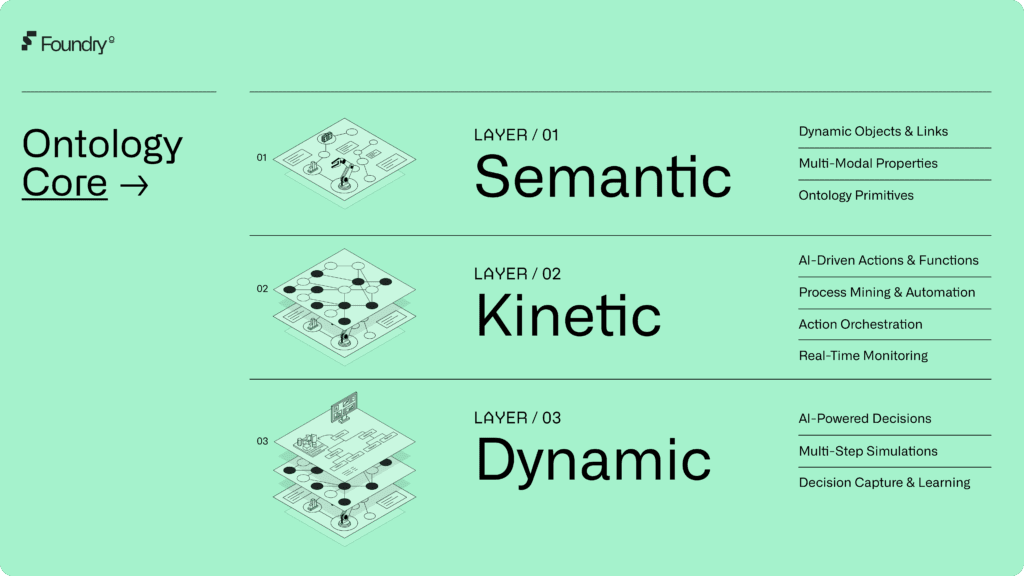

Ontology

While Foundry brings the data together, Ontology adds a semantic layer that makes sense of the data by showing how it is connected. As new data flows into Foundry, Ontology updates its relationships automatically. It allows users to ask complex, cross-domain questions. It is the brain that doesn’t just manage data; it helps you understand why and the probabilities of what will happen next.

Key Advantages

Government Trust: Palantir is trusted by top government agencies for defense and intelligence operations.

Virtually No Competition: Palantir is unique in its market, with no direct competitors matching its comprehensive capabilities.

AI Integration: With the rise of AI, Palantir’s Ontology platform is positioned to become indispensable for managing and understanding complex data environments.

Scalability: Palantir’s solutions are built to scale across industries, from defense to healthcare, making it a key player in multiple sectors. The company is on track to become a megacap, with its products increasingly adopted across various industries.

The Palantir Playbook: From IPO to AI Titan

When Palantir ($PLTR) went public on September 30, 2020, at $10 per share, most of Wall Street brushed it off as just another tech company vying for attention. Analysts doubted its ability to scale and misunderstood its role in the market. It was a blackbox company dependent on government contracts, but for those paying attention, the story was clear. This was not just another name. It was a revolution waiting to happen.

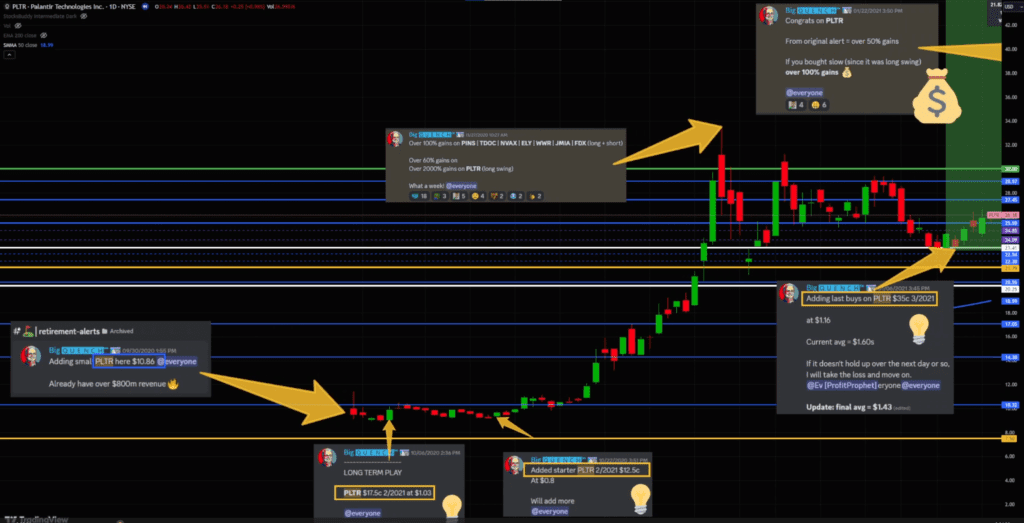

Quench sensed from the beginning this was the stock to keep on radar long-term. On day one after Palantir’s IPO, he alerted entry at $10.86 after seeing them post $800 million in revenue.

In 2024, when Shay Boloor (StockSavvyShay) joined forces for the Market Mastery stream, he added depth into the fundamentals surrounding the AI thematic. First comes hardware. Software comes second.. Software can scale substantially faster with increased margins as the cost of production and distribution is significantly lower compared to hardware. Once software is developed, it can be replicated and delivered at a scale with minimal additional expense. Palantir’s products, once proven scalable, were a certain homerun with unmatched capabilities in data utilization, deep government ties, and the building blocks for enterprise AI dominance.

“If the US government trusts you for its defense using your AI, what’s a bigger stamp of approval than that? The scalability is unheard of. During an environment where costs are high, inflation is rising, companies will try every avenue to minimize costs and keep up with earnings estimates. This is what PLTR can do. Big players, governments, billions of citizens.”

This is not just the story of Palantir’s meteoric rise to $82. It is also the story of conviction, technical precision, and the long game of seeing what others could not and knowing when to act.

The Early Years: Conviction Meets Technical Precision

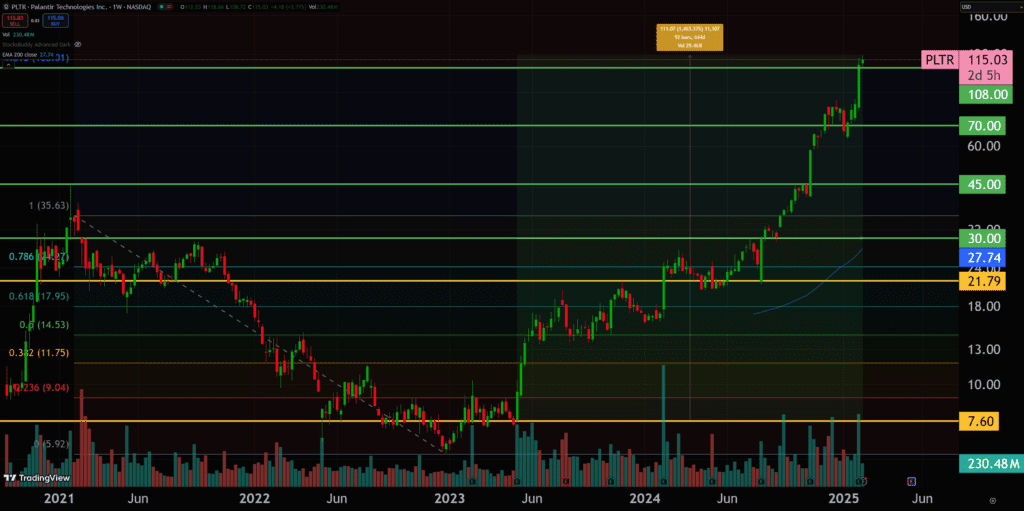

Palantir’s IPO was unassuming, opening at $10. Within weeks, the first trading range was established between $9 and $10.30. Quench mapped it early, adding shares while others hesitated.

The options market provided even greater opportunities. By October 6, 2020, Quench alerted $17.5 and $12.5 Calls for February 2021. Those positions, bought at bargain prices, were executed perfectly. On January 6, 2021, he entered $35 Calls for March at an average cost of $143. In just 21 days, Palantir reached $45.

These trades were not guesses. They were based on understanding Palantir’s ranges and timing entries with precision. The $35 Calls ran for a 570% gain, and the profits set the tone for the years to come.

The lesson was clear: conviction allowed us to hold through the noise, but technicals showed when to enter and exit. If you look at the chart with the updates, Quench consistently nailed both the bottoms and the tops.

2022-2023: Doubt and Reloading

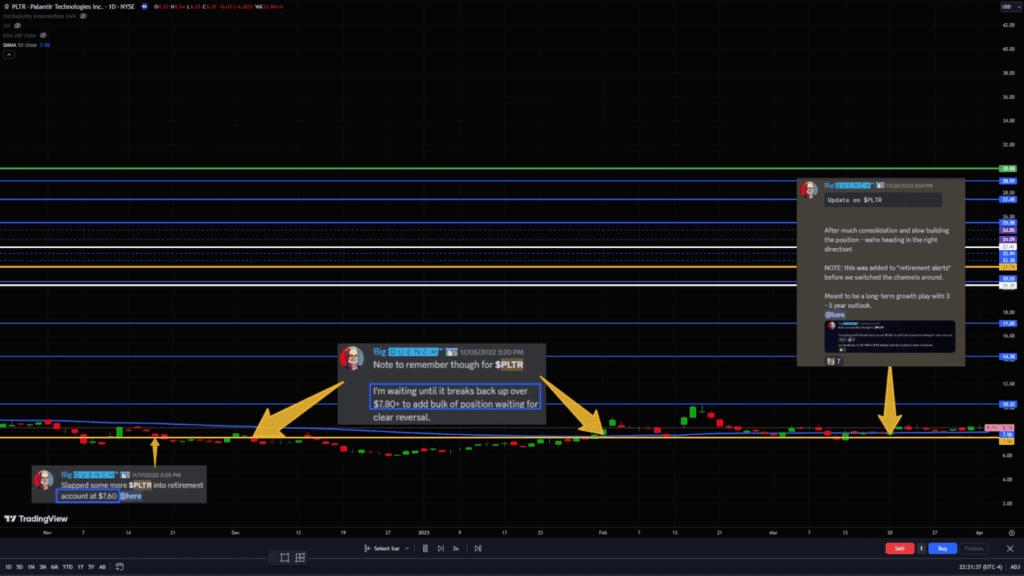

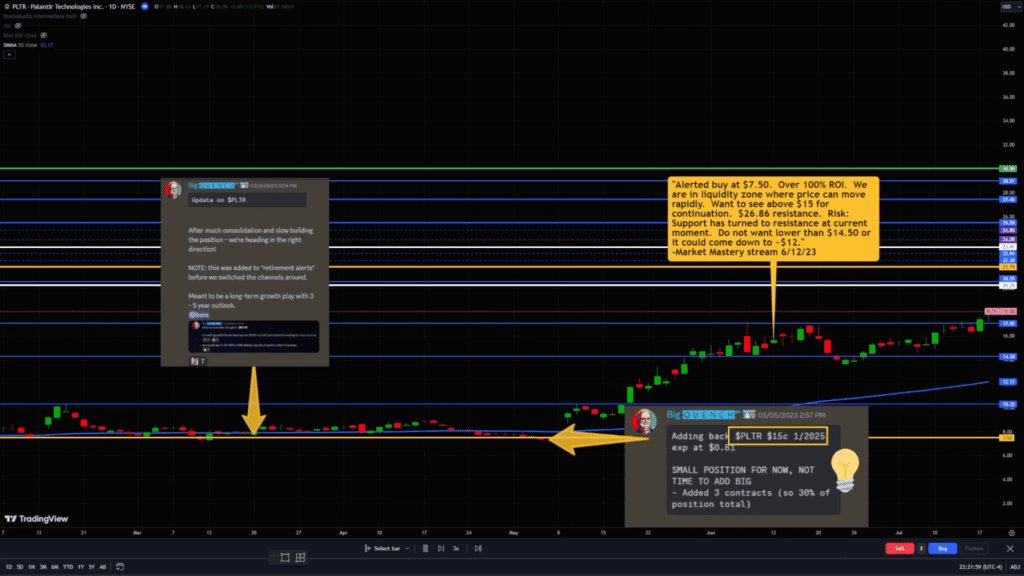

Palantir’s price action tested even the strongest hands. By November 2022, $PLTR had fallen to $7. Sentiment had soured, and the media narrative labeled it a broken stock. For Quench, however, this was the opportunity to reload.

Quench alerted a retirement account entry at $7.60 and patiently waited for a reclamation of $7.80 to add in bulk, stating clearly that this was a long-term play. During Market Mastery streams in early 2023, he doubled down on his thesis providing a roadmap at each key level for entry, stop, and short-term targets.

By May 2023, Palantir was breaking out again. Quench added $15 Calls for January 2025 at $0.81. The roadmap was clear: a reversion to the golden mean (61.8% Fibonacci retracement) to $30.

The Inflection Point: Palantir Finds Its Runway

2024 marked a turning point for Palantir. Enterprise AI adoption exploded, and Palantir was at the center of it. Shay outlined on the May 6, 2024 Market Mastery stream that the days of Palantir trading under $30 were over. Governments and major corporations were adopting Palantir’s platform to optimize costs and scale operations. This was the moment the market began to realize what Quench and Shay had already known: Palantir was not a theory anymore; it was a titan in the making.

Driven with explosive earnings, then S&P 500 inclusion, price shattered $30 up to the all-time high of $45. Shay called for a $70 target. By November 2024, Palantir’s earnings shattered expectations: 30% year-over-year growth, a 38% margin, and a Rule of 40 score of 68. The fundamentals caught up with the price.

Within 35 days, Palantir nearly doubled, smashing through $45 up to $82.74 by December 9. Quench and Shay both trimmed profits while holding a core position, and Shay’s conviction remained firm that Palantir would become a $1 trillion company. From bottom dollar entry to top, we nailed this one nearly 1000%.

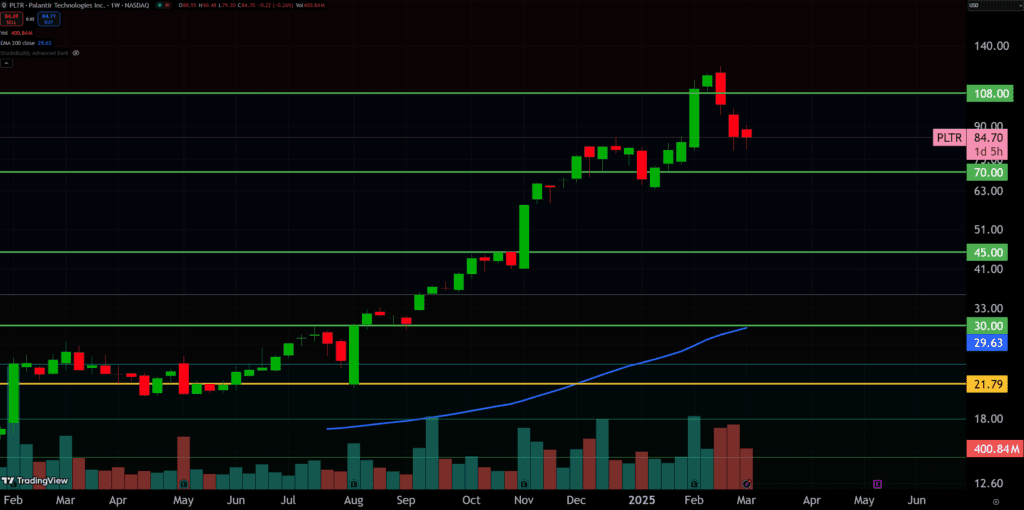

Where We Stand Today: The Near-Term Top and Beyond

Palantir is now trading at a premium, with expectations running high. Shay notes that sustaining this level requires 35% topline growth for the next quarter. If Palantir delivers, the next target of $100-$108 could become reality. If not, the stock may consolidate between $60 and $65 while fundamentals catch up.

This is where technicals meet fundamentals once again. Palantir’s enterprise AI moat, a sticky ecosystem, and first-mover advantage remain intact. However, the market’s euphoria needs to pause before the next leg higher. We are overextended and fundamentals need time to catch up.

Long-term, this is still one of the strongest AI plays in the market. Palantir will be a pillar of the AI economy that will define the technological revolution over the next decade.

Palantir’s story is far from over. It will consolidate. It will retest support levels. The hype may wear off. But for those who understand its role in enterprise AI and government defense, the roadmap remains clear. Use the levels, respect the plan, and protect your gains. As Shay said, “This stock will be one of the Magnificent 7 in the era of AI.”

Lessons from Palantir: Conviction, Ranges, and Fundamentals

Conviction matters: From $10 to $80, the vision never wavered. We had perspective. We had a plan. Regardless of outcome, we came prepared.

Technical precision: Every entry and re-entry, whether at $7.60-$7.80, $15, $17, or $21.79, was mapped with clarity and discipline.

The fundamentals align: Enterprise AI adoption is just beginning, and Palantir remains one of the strongest beneficiaries.

All Long-term Targets Achieved +1470%

2/4/25 Update

Shay is a thematic investor where he looks for structural shifts that will disrupt multiple industries. Moat is important in how scalable and sticky a business’s products and services are. We took this trade from mid-$7 all the way up through all of our long-term targets o $30, $45, $70, and approaching $108. AIP was Palantir’s inflection point where Shay knew it would be a $1 trillion company. Yesterday’s earnings were a blowout. They reported dominance. They are now priced at 170x their earnings valuation, with 26% topline growth for 2025 and a Rule of 40 score of 81 (double the goal)! On the consumer side, subscribers increased 64% YoY. 129 deals were over $1 million and 10 deals over $10 million. Fueled by larger deals, bigger spend, and expanding AI adoption, Palantir is unicorn status where nobody knows the ceiling of AI. Once customers and investors get a taste, they want more.

2/10/25 Update

This is the power of being an early investor. Now every $7.60 move (7% from here), our position moves 100%. Hardware was the first stage of AI, but not the biggest. The real crown jewel of AI is software. Palantir and Tesla have cemented themselves as the leaders. Shay is most excited for further government applications leveraging business and defense, especially if used by the Department of Government Efficiency (D.O.G.E.). To be an investor in AI, Palantir is the stock to own.

3/3/25 Update

We got the gap fill down to $84 under $109. We expect consolidation between $60 to $80. This pullback is healthy for a stock that ran over 1300% from our entry. We think $71 is a good entry point for building a new position. We will follow Fibonacci retracement levels for areas of support and resistance.

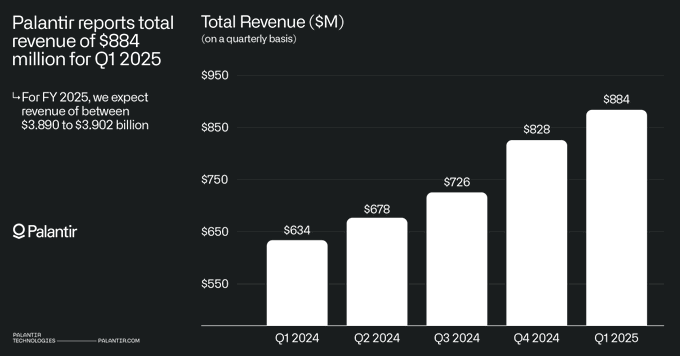

Palantir Earnings Update – May 5, 2025

Palantir just dropped another strong earnings report and the market punished it again.

Despite exceeding expectations across the board, $PLTR is trading lower post-earnings. Price and performance are not always correlated.

Q1 2025 Earnings Highlights

- Revenue: $884M vs $862M expected

- EPS: $0.13 in-line with expectations

- U.S. Commercial Revenue: $255M → up 71% YoY

- Customer Growth: +39% YoY

- Q2 Revenue Outlook: $936M vs $899M expected

- FY25 Revenue Outlook: $3.9B vs $3.75B expected

- Rule of 40 Score: 83 (beating last quarter's record)

Price Action & Positioning

Shay Boloor reminded us that when you’re trading stocks at 200x earnings, surprises are rare and execution is everything. With this level of performance, Palantir continues to stand out as the Stage 2 AI winner in a market that’s still searching for a clear ceiling. While the stock pulled back post-earnings, Quench emphasized this wasn’t a bloodbath, it was expected behavior given the double-top resistance zone.

Weeks ago, we alerted $PLTR near $72. Since then, the stock has nearly doubled, briefly touching $66 before roaring back to over $110. Quench still holds 500–600 shares long, only trimming a small amount into strength.

If you followed that alert, you saw the explosive potential in positioning early on high-growth names. This isn't a place where we are chasing. We are looking for $70 to hold as support to trade past all-time highs.

The Bottom Line

Palantir just delivered another quarter of hyper-growth, crushed expectations, raised guidance, and solidified its lead in commercial AI. Short-term price might be choppy, but our long-term trajectory and thesis are stronger than ever!