Pipeline, Infrastructure, & Alternate Routes

Maritime Insurance & Infrastructure

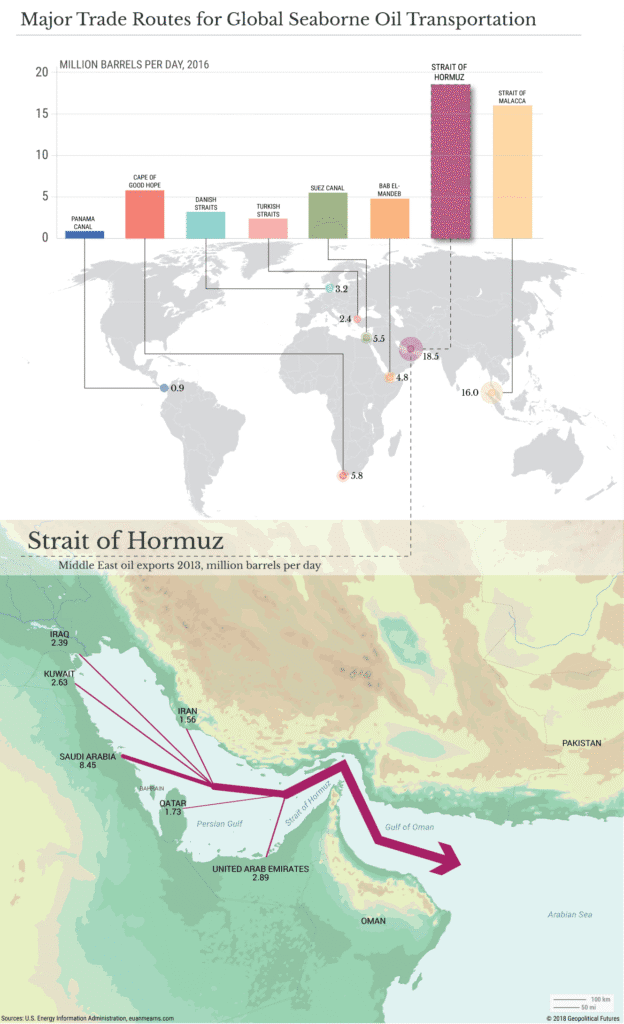

The Strait That Fuels the World

20% of the world’s oil , over 17 million barrels per day, flows through the Strait of Hormuz. One narrow maritime artery, just 21 miles wide at its tightest, and now one misstep from becoming a global trigger point.

It’s not just a chokepoint. It’s the world’s most critical oil vein.

Here’s who bleeds if it’s cut:

- Asia-Pacific (esp. China, Japan, South Korea): Over 70% of crude through Hormuz goes to Asia.

- China alone imports over 40% of its oil via Hormuz.

- Japan & South Korea are even more exposed, with up to 80–90% of their oil imports at risk.

- Europe: Less direct, but still hit. The EU imports ~12% of its oil from the Gulf. LNG from Qatar (world’s #2 exporter) also tightens.

- India: Imports ~60% of its crude through Hormuz. Energy inflation hits instantly.

- United States: Only about 3–5% of U.S. oil imports flow through Hormuz — but U.S. allies are deeply dependent, and oil is globally priced.

If Hormuz closes, Brent spikes. WTI chases. Energy trades rerate.

Markets don’t wait for the dust to settle. They reroute capital the moment a war headline hits.

At Pennybois, we don’t trade panic. We position with precision.

The Strategy: Mastery in Motion

We’re using the Market Mastery method:

- Mark key monthly levels (support/resistance)

- Wait for catalyst (war headline, gap-up, strike confirmation)

- Confirm with candle: weekly/monthly close above resistance (no wick fakes)

- Enter on retest with stop below wick lows or trendline

- Target next resistance or measured move

- Size with intent: We never wing it. Know your risk, stop, and plan before entry.

Smart money waits for alignment. We don’t trade headlines. We trade reaction.

Swing trades. Oil theme. No fluff.

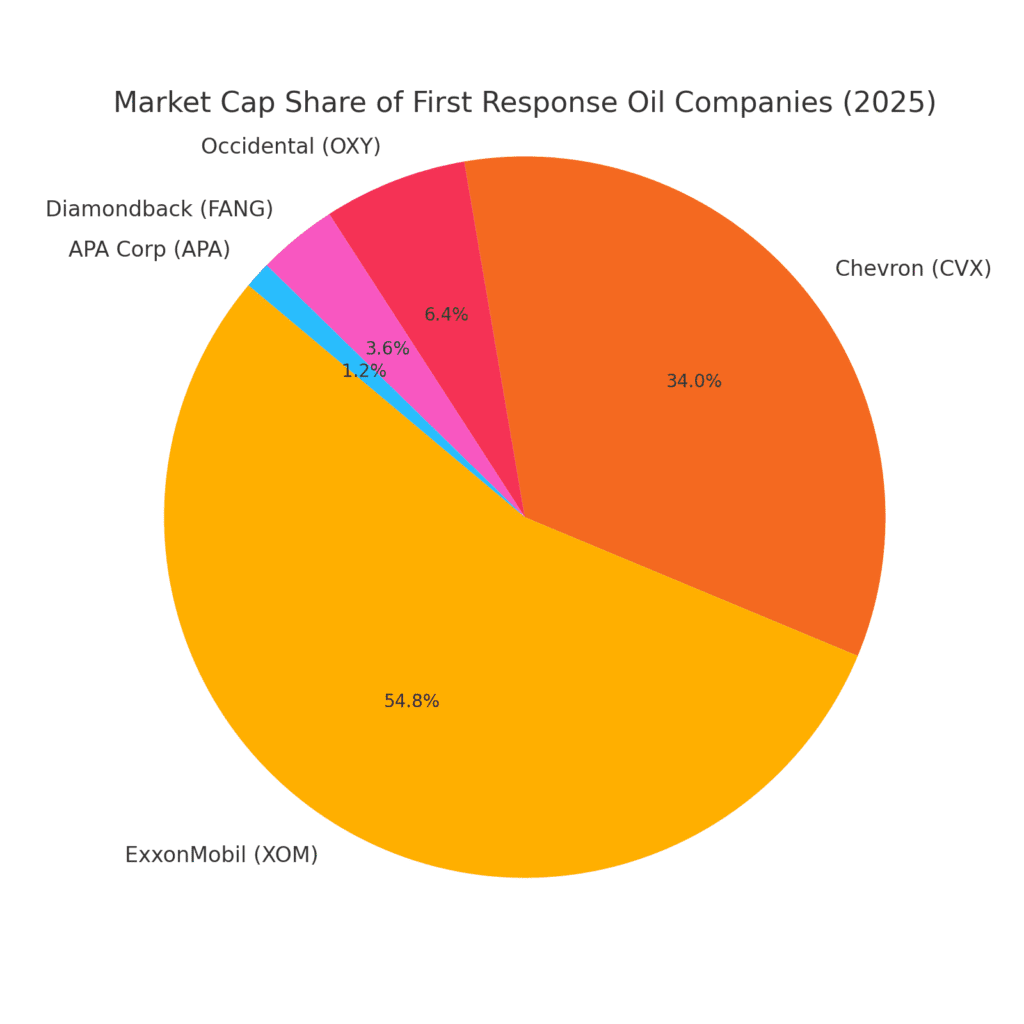

First Response Swing Team

If the Strait of Hormuz is compromised, global oil tightens fast. Who steps up? U.S. producers. This is the homeland oil cavalry, the majors, the shale kings, and the high-beta names that institutions chase when crude runs.

Together, they form your first-response swing team — primed to rerate on any Middle East supply shock.

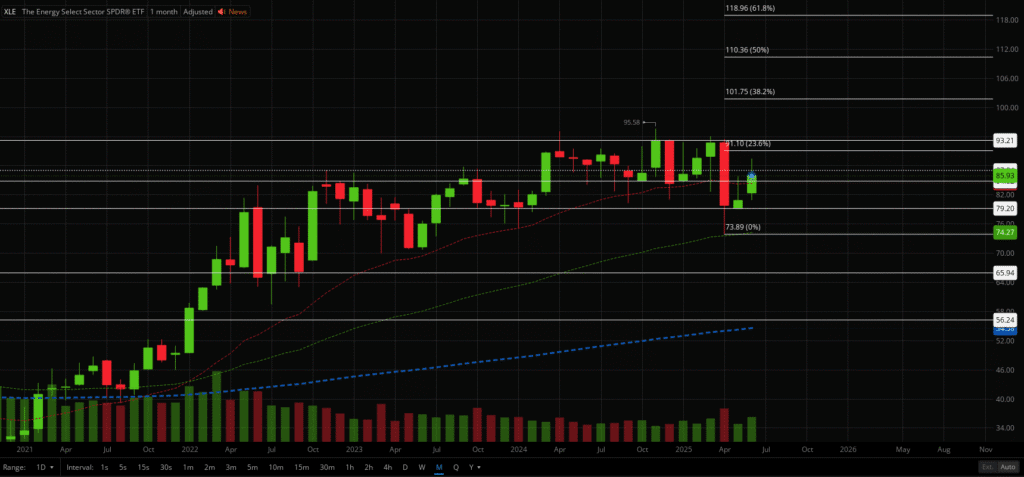

$XLE | The Energy Backbone ETF

$XLE is the cleanest way to bet on large-cap U.S. energy plays ($CVX, $XOM, $SLB) benefiting from any Hormuz disruption without picking names. While crude rises, these cash-flow machines print. The breakout structure on the monthly aligns with cyclical uptrend timing. If war breaks out and oil spikes, they print money.

BREAKOUT TRADE:

- Entry: Monthly close above $93.20

- Targets: $101.75, $110

RANGE TRADE:

- Entry: $84.80 to $87

- Targets: $93.20, $95.50, Continuation: $110

Occidental Petroleum ($OXY) | Buffett's Warlord

Warren keeps buying for a reason. $OXY’s cash flow is a levered bet on crude. This is a high-momentum name on breakout. Buffett’s favorite. If war premiums hit oil, $OXY will outperform. High beta to crude with solid debt cleanup and free cash flow.

BREAKOUT TRADE:

- Entry: Monthly close over $47 (entry off retest)

- Targets: $54, $59, $70

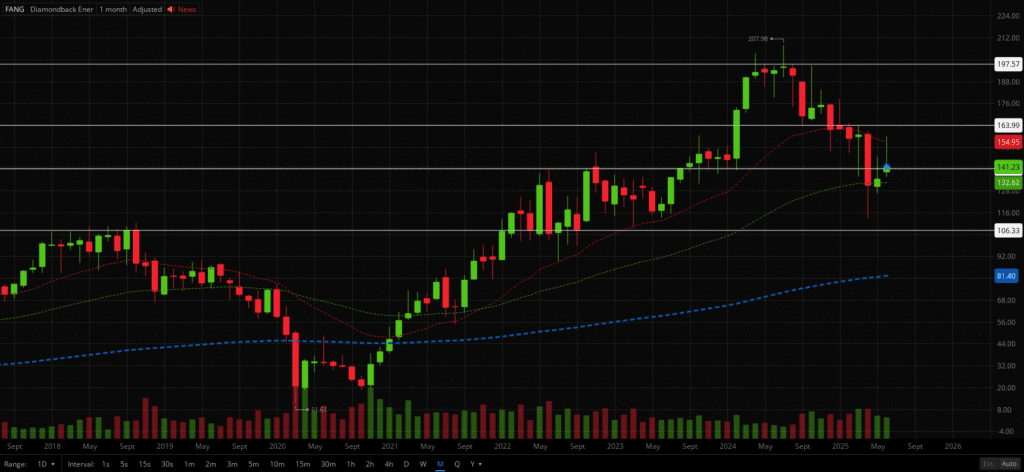

Diamondback Energy ($FANG) | U.S. Shale Upside

If foreign oil is compromised, U.S. shale becomes king. $FANG is the prince of Permian. $FANG is one of the best run shale firms, with excellent cost structure and Permian basin strength. If Hormuz restricts Middle East exports, U.S. shale is next man up.

SWING SETUP

- Entry: $133-$140 (monthly 55 EMA & horizontal key price point, respectively)

- Targets: $160, $164, $178, $197.50

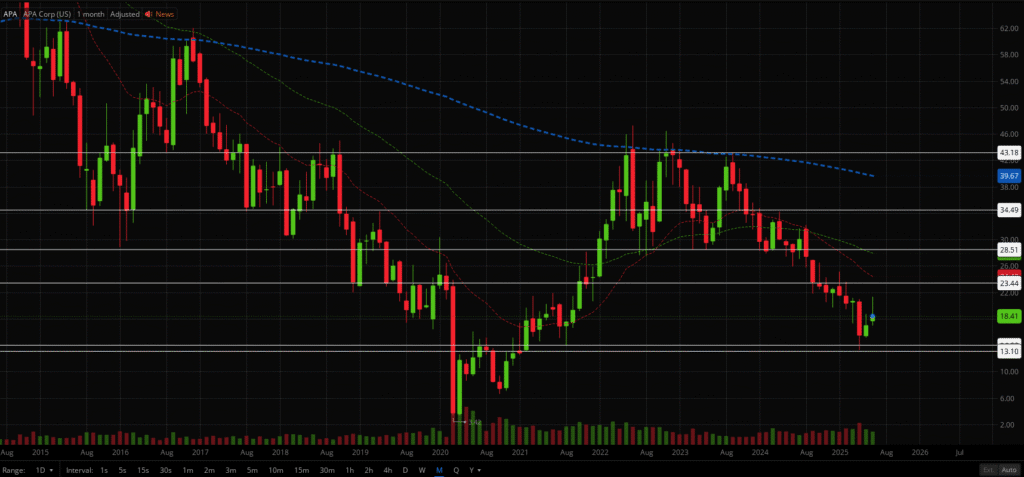

APA Corp. ($APA) | Beta Play Oil Producers

Less stable, more explosive. $APA moves fast on crude spikes and gets bought up by momentum algos.

STRUCTURE: Long-term downtrend, but clean ranges with significant upside

RANGE TRADES:

- Entries: Retest and monthly close above $14 (higher risk), Monthly close over $23.50, Monthly close over $28.50 (safest)

- Targets: $23.50, $28.51, $34.50, $40, $43

The Tanker Trifecta

The Hormuz trade's mission is diversified within the war-trade itself, capturing different parts of the oil flow chan. If Hormuz closes, shipping routes elongate, insurance premiums rise, and freight rates spike. Tankers will likely spike next. For this section, $STNG, $INSW, and $FRO form a complete war-shipping hedge for refined products, hybrid exposure, and crude oil.

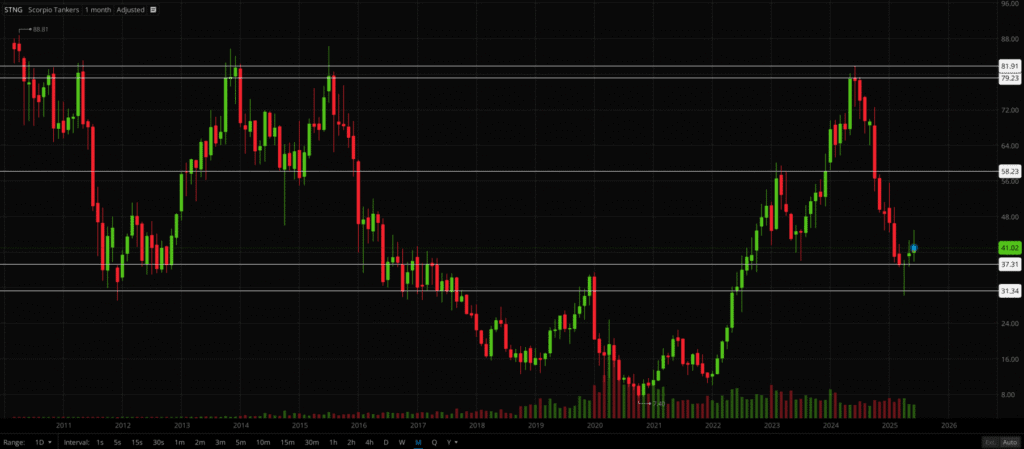

Scorpio Tankers ($STNG)

Scorpio transports refined oil (gasoline, diesel, jet fuel) rather than crude. If Hormuz closes, refiners outside the Middle East will be relied on heavily to export refined fuel globally.

Scorpio tends to move fastest on shipping rate spikes and Middle East reroutes. In 2022, as product tanker rates exploded, so did $STNG from $36 → $60+.

RANGE TRADE:

- Entry: $37-$40

- Targets: $48, $58, $80

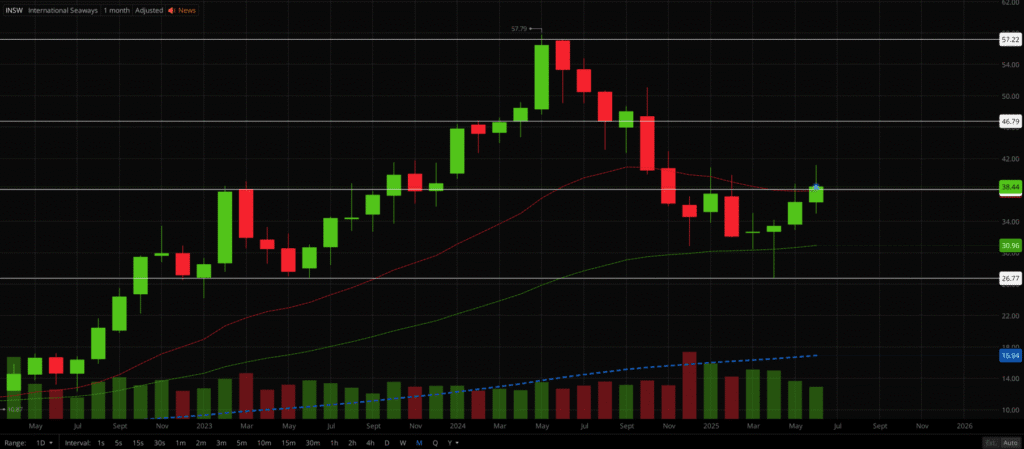

International Seaways ($INSW)

This company owns both crude and product tankers. Having a diversified fleet means it catches upside regardless of what’s disrupted.

Fundamental and technical beast with low debt, high yield, clean bases before explosive moves and favored by institutions during inflation and war premiums.

BREAKOUT RANGE TRADE:

- Entry: Monthly close over $38.10 (entry off retest)

- Targets: $46, $51, $57

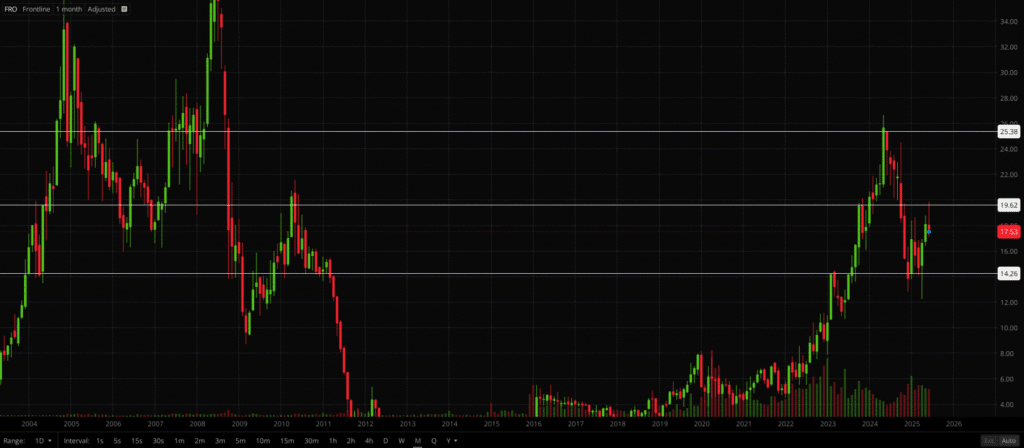

Frontline Ltd. ($FRO)

Frontline specializes in large crude carriers (VLCCs). Hormuz closure directly hits crude oil shipping hardest. $FRO’s entire fleet benefits from day-rate surges.

There is a speculative edge due to low float, headline sensitivity which captures the attention of a growing mass of retail investors.

RANGE TRADE:

- Entries: Retest and monthly close over $14.30 or $17 (higher risk)

- Target: ($17), $19.60, $22.50, $25.40

BREAKOUT TRADE:

- Entry: Monthly close over $19.60 (entry off retest)

- Targets: $22.50, $25.40

The Refiners

Refiners also benefit from war volatility. They can operate independently of Middle Eastern supply and can benefit substantially from crack spread expansion. $MPC and $PSX will be the focus. You will notice both charts look very similar in price action.

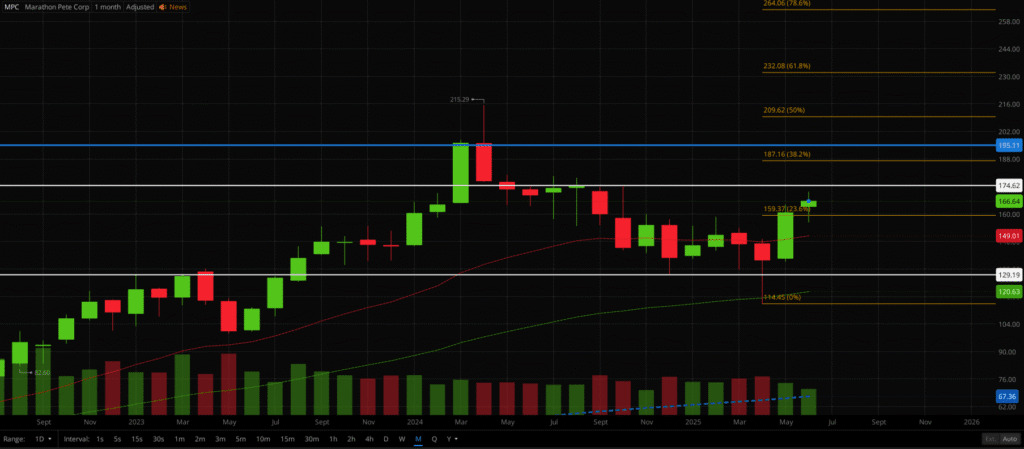

Marathon Petroleum ($MPC)

Marathon has a strong geographic advantage should Middle Eastern refined supply is disrupted. Located along the U.S. Gulf Coast, $MPC is an export muscle being one of the largest exporters of refined fuels to Latin America and Europe. If Europe can’t get refined product from the Middle East, MPC fills that gap.

They crushed it during the Russia-Ukraine energy panic surging from $60 to $130+. War-driven volatility tends to widen crack spreads (profit margin between crude input and refined output), which directly boosts refiner profits.

RANGE TRADE:

- Entry: Monthly close over $174.60 (entry off retest)

- Targets: $187, $195, Continuation: $200, $210, $232

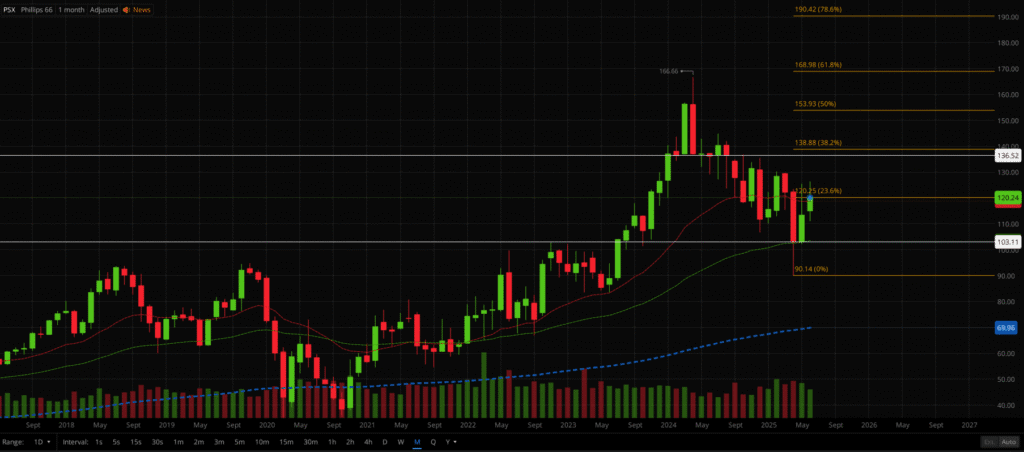

Phillips 66 ($PSX)

Phillips 66 has a diverse revenue stream: refining, midstream, and chemicals, which gives it extra resilience in volatile macro environments. They have a large U.S. presence and pipelines linked to key crude basins, staying supplied even when international flows break down. With European ties, there is downstream exposure that could benefit if Europe scrambles for refined product due to Middle East chokepoints.

This stock is an institutional favorite. It sees strong buying during chaos and a staple in defensive, dividend, and inflation-hedged portfolios.

RANGE TRADE:

- Entries: Wait for retest and monthly close over $103 or weekly close over $120 (higher risk off downtrend since April 2024)

- Targets: $136, $139, $153, $167

LNG Liquidity

LNG plays are crucial in the Strait of Hormuz thesis because they represent the Plan B for Europe and parts of Asia if Middle Eastern oil and gas flows are disrupted.

If Strait of Hormuz shuts:

- Europe turns to U.S. LNG immediately

- Tanker spot prices for LNG cargoes spike

- Speculative LNG names rerate overnight

- Big money floods into already-operational exporters

This is the new wartime gas flow map.

NextDecade ($NEXT)

NextDecade is building Rio Grande LNG, one of the next big U.S. LNG terminals. Not yet fully operational, but has massive speculative upside when LNG demand surges.

This is a speculative play that moves fast on headlines, rumors, or funding deals. If Hormuz closes and Europe scrambles, this name can rerate hard.

BREAKOUT TRADE:

- Entry: Monthly close over $9.75

- Targets: $10.80, $15

RANGE TRADE:

- Entry: Retest and monthly close over $6.90

- Targets: $7.35, $8.15, $9.75

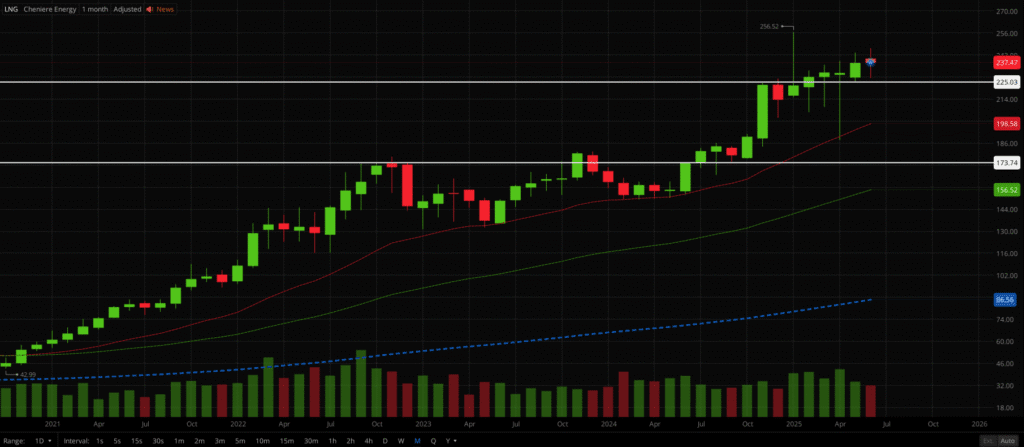

Cheniere Energy Inc. ($LNG)

This is the king of U.S. LNG exports. Period.

It owns the largest LNG infrastructure in the U.S., with exports globally, especially to Europe and Asia. If Hormuz shuts and Qatar gas is rerouted or delayed, Europe turns to U.S. LNG. Cheniere wins that flow.

This is an institutional-grade swing, a hedge fund favorite, where big money will chase this on any supply crunch.

INVESTMENT / LONG SWING:

- Entries: $225, Monthly 21 EMA (currently at $198.57)

- Stop: Monthly close under monthly 21 EMA

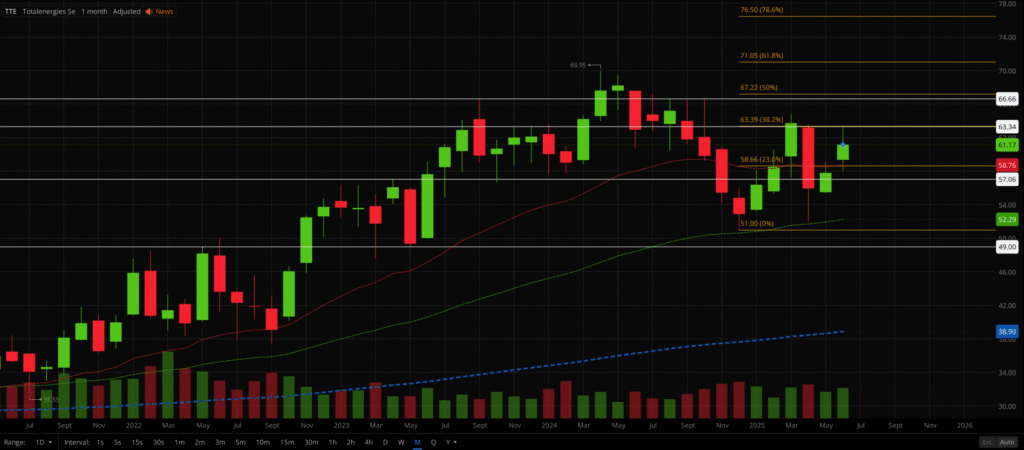

TotalEnergies SE ($TTE)

This is the European (France based) LNG pivot. $TTE is heavily exposed to LNG through Africa, U.S., and Qatar, and has deals across the globe. This is a geopolitical hedge against regional risk. Europe can't count on Russian gas. If Hormuz supply falters, and LNG demand explodes, $TTE becomes a beneficiary both as seller and operator.

INVESTMENT / LONG SWING:

- Entry: $58-$60

- Targets: $63.40, $66.60, $69, $71, $76.50

- Stop: Monthly close under $57

Pipeline, Infrastructure, & Alternate Routes

These are midstream monsters. They don’t drill oil or refine. They move it, store it, and get paid whether oil is at $40 or $140. $ET has higher yield, more upside, and oil exposure. $KMI has a smoother chart, is more conservative, and gas-focused.

Together, they give:

- Yield income while you wait

- Low volatility entry into the energy war trade

- Exposure to pipelines, terminals, and infrastructure critical if Gulf disruptions shift more burden to the U.S. network

If Hormuz closes:

- Tanker routes jam up

- Global flows shift

- U.S. becomes energy logistics backbone

- Pipelines like $ET and $KMI see surging volume and investor flow

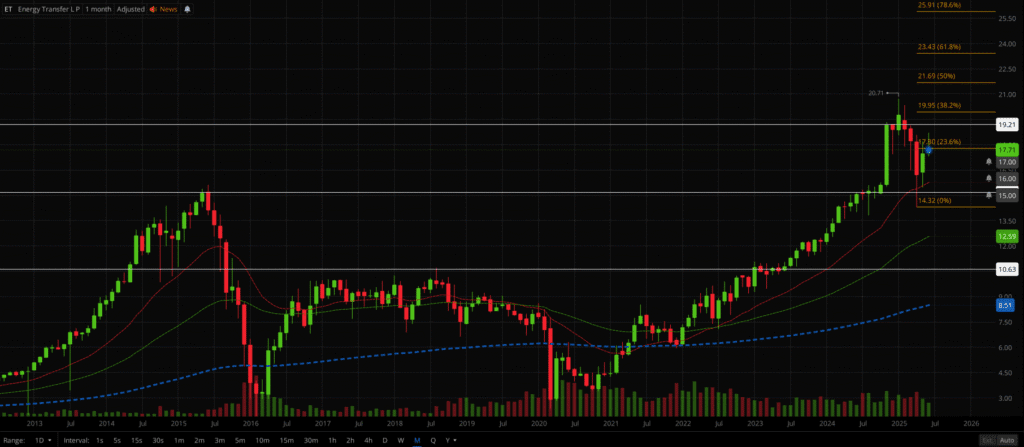

Energy Transfer ($ET)

$ET controls crucial U.S. pipeline networks for oil, natural gas, and NGLs, mostly in Texas and Louisiana.

If the Strait of Hormuz shuts and global flows get disrupted, U.S. internal energy logistics become more valuable. ET moves that energy.

Historically, $ET outperforms $XLE during oil spikes due to defensive cash flows and leveraged upside.

INVESTMENT / LONG SWING:

- Entry: Wait for retest and close over $15-$16

- Targets: $17.80, $19.20, $21.70, $23.40, $25.90

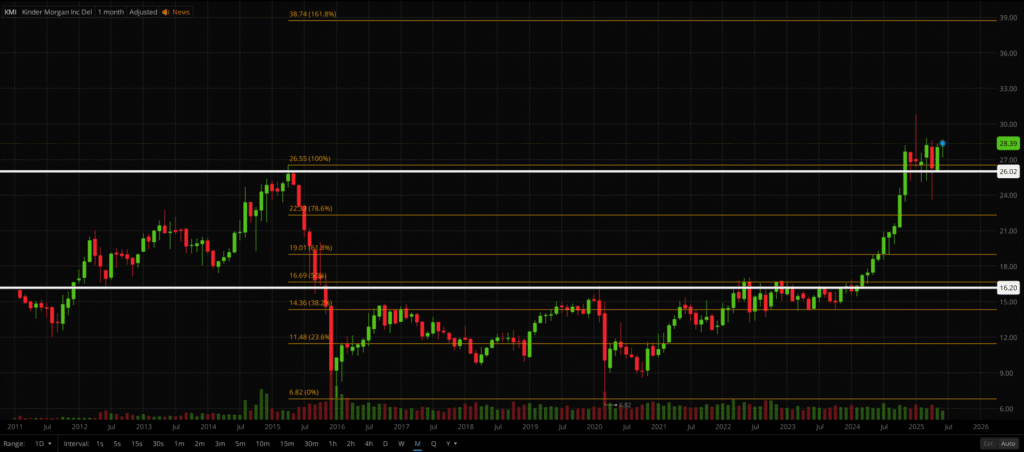

Kinder Morgan ($KMI)

Kinder Morgan owns 70,000+ miles of pipelines for gas, oil, and CO₂. It is also an industry leader in export terminals. It offers strong natural gas exposure (vs. oil-heavy ET), which gives balance in an LNG demand surge.

It is also a stability play as an institutional favorite in energy for its predictable cash flow and lower beta making it attractive in volatile markets. Also as a defensive war hedge, it pays a 4.4% dividend.

BREAKOUT TRADE:

- Entry: $26-$28

- Targets: $31, $38

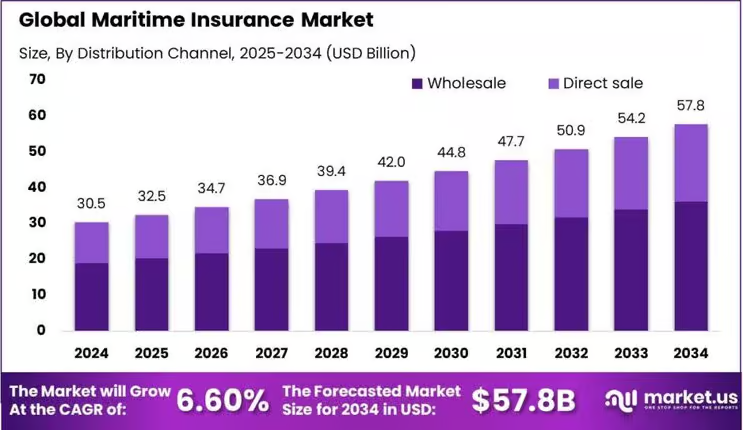

Maritime Insurance & Infrastructure Hedge Shipping

These companies are non-obvious but powerful chess pieces in a war-disruption trade. These aren’t direct oil or gas trades. They are second-order beneficiaries when the world destabilizes. Think of them as “chaos derivatives.”

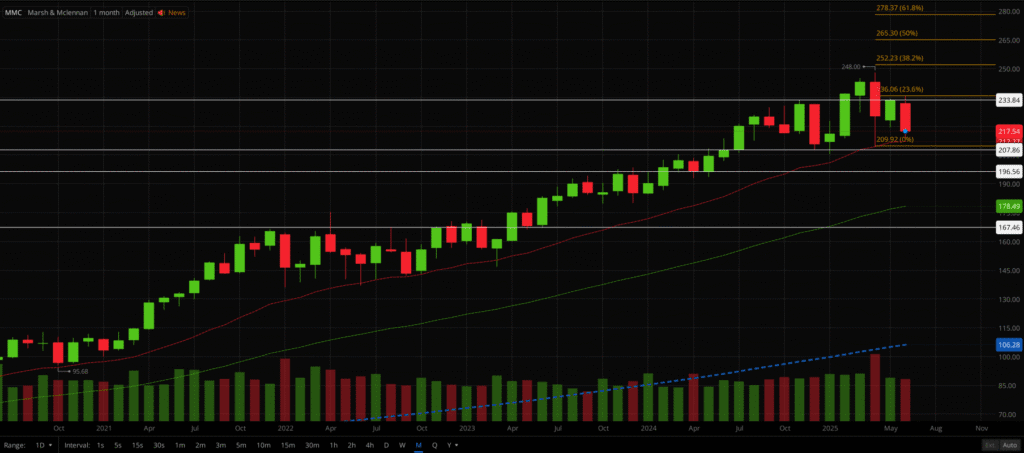

Marsh & McLennan ($MMC)

$MMC is the largest insurance broker in the world. It insures energy infrastructure, tankers, cargo, ports. If tankers are getting bombed, or Hormuz is under threat, insurance premiums skyrocket. $MMC brokers those policies.

Goverments, oil majors, and global logistics firms are the exact players affected by the Hormuz risk. During the 2022 shipping chaos and Gulf tensions, $MMC was a safe-haven.

$MMC sells fear at a markup — and fear is profitable when war headlines hit.

RANGE TRADE / INVESTMENT:

- Entry: $208-$210

- Targets: $233, $248, $252, $265, $278

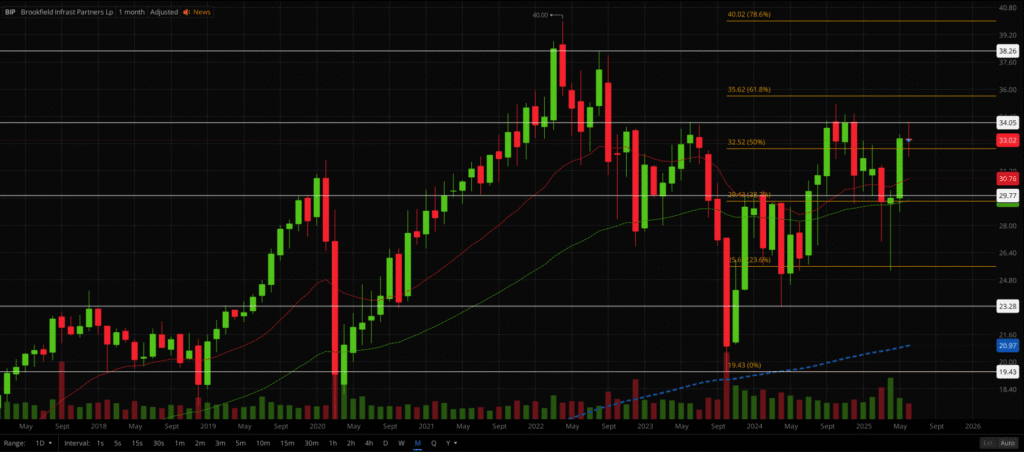

Brookfield Infrastructure Partners L.P. ($BIP)

$BIP owns critical global infrastructure, including ports, pipelines, telecom towers, freight, and data centers. When oil routes change, ports get congested, or logistics reroute, $BIP profits via higher fees and volume surcharges. If Hormuz shakes global trade, it's not just oil. $BIP's tentacles are in every transport and logistics node. Plus it pays a solid dividend around 5%, trades like a bond with upside, and surges when infrastructure get repriced due to war spending.

RANGE TRADE:

- Entry: Retest and monthly close over $30

- Targets: $32.50, $34, Continuation: $35.50, $38, $40

BREAKOUT TRADE:

- Entry: Monthly close over $34.10

- Targets: $35.50, $38, Continuation: $40, $45

The Strait Is Ticking: Positioning Across the Oil War Chessboard

A Hormuz flashpoint ricochets through the entire energy ecosystem. That’s why this playbook spans every square on the board:

- Core U.S. Producers & $XLE sit at the top of the funnel. If Gulf barrels disappear, shale and Big Oil fill the vacuum and rerate first.

- Tankers monetize the scramble to move crude and refined products along longer, risk-priced routes. Freight day-rates can triple before the market even digests the headline.

- Refiners capture widening crack spreads as unsupplied regions bid up diesel, gasoline, and jet fuel.

- LNG exporters become Plan B for Asia and Europe when pipeline and tanker flows seize up.

- Pipelines, terminals, and infrastructure MLPs ($ET, $KMI, $BIP) turn into the quiet toll-booths of rerouted energy, minting cash flow while the rest of the world scrambles.

- Insurance brokers like $MMC sell fear itself — profiting every time war risk drives premiums higher on ships, cargo, and ports.

Together, these names form a layered war-trade lattice: producers print on price, shippers on distance, refiners on margins, LNG on substitution, pipes on volume, insurers on chaos. One catalyst, six profit channels.

Hope is not a hedge. When the world’s most critical strait blinks red, capital flows to whoever is already positioned. Now you know the thesis, the tickers, and the levels.

If it blows, the market won’t send an invitation. It will send a gap.

Most will freeze. Some will chase. The prepared will already be positioned.

You’ve got the thesis. The tickers. The levels.

Preparation through panic and precision prints.