Ladies and gentlemen it's Meta Matt here, and I hope you're ready for another dose of our Analyst Jay's financial wisdom! It's time to decipher the intricate tapestry of market moves and trade tactics in Jay's "Third Week of August Analysis". Buckle up, because we're about to dive deep into charts, targets, and trade strategies! 📈📊

Be sure to check out Jay's Week 1 Analysis of August: https://blog.pbalerts.com/stocks-to-watch-august-2023/

As well as his Week 2 Analysis:

https://blog.pbalerts.com/3-stocks-1-etf-we-are-trading-this-week/

Part One: The Mighty QQQ ETF

Let's kick off with some $QQQ drama! Remember the chat about QQQ's rendezvous with the median line of the weekly bollinger bands from Jay's Week 1 and Week 2 Analysis? Yep, it's been playing out like a well-written screenplay. Last week, QQQ took a dip from $375.29 to $364.69, gracefully landing near the middle of the weekly bollinger bands, which is currently sashaying at $349.06.

Jay's QQQ Play of the Week:

- Short-term Bearish Target: We can expect continuation to $350 over the next couple weeks.

- 🛑 Stay Alert: Keep an eye on the weekly candle closing above $375, 'cause that could change the game, and we could see moves to the upside.

Post-350 Swing to the Moon:

- The starry-eyed plan is to flip bullish and hit those new highs. What this means is to wait until $QQQ moves below $350, and then take an entry upon the first 4H candle close above $350 (we aren't just blindly buying at $350).

- 🚀 Targets: New Yearly and ATH, with a Stop Loss below $350.

Part Two: Elon vs Zuck – $TSLA & $META 🚗💎

Onto the real showstoppers: TSLA and META. Now although everyone else might be talking about their possible upcoming combat sports match, we are talking about their stocks!!! First up, Tesla's in the spotlight! Jay's seeing a retracement to the $215-$220 area. Currently playing in the low $240s, a weekly candle close above $275 might save TSLA from the journey to $215-$220.

Jay's Tesla Play:

- Strategic Swing Long Entry: First 4H candle close above $217.65 (so wait for it to drop below, and then have a 4H close above)

- 🛑 Safety Net: Stop loss below $217.65's low.

- 🚀 Dream Big: Targets at $275 and $315.

Great Risk:Reward trade that can be held for multiple days/weeks!!!

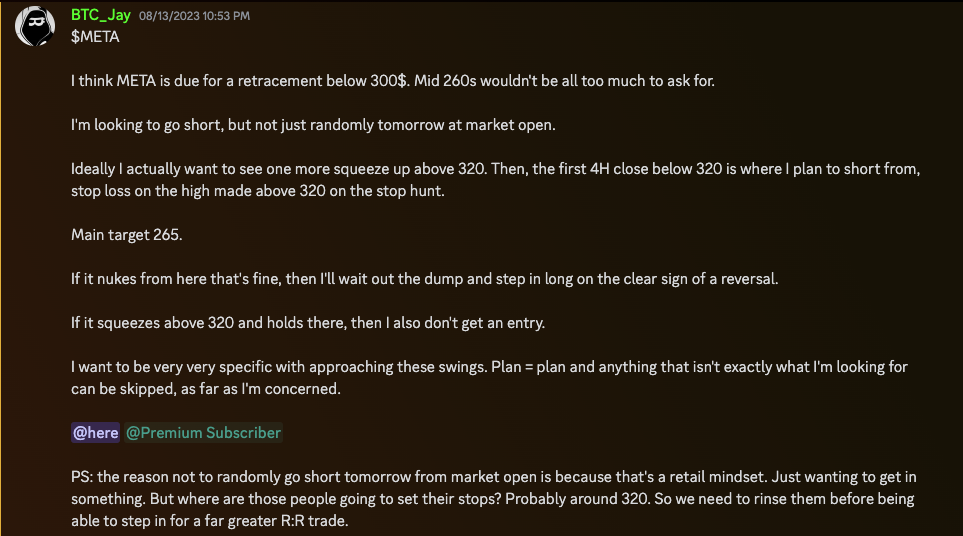

$META – Where Tech Magic Happens 🌟🔮

Hold your horses, because it's META's time to shine! Trading at the fancy end of the weekly bollinger bands, META's also waltzing towards with the median level of bollinger bands. It's like a tech dance party, and META's set to groove to the $265.15 level while currently trading above $300 (for now).

Jay's META Play:

- Get Ready to Short (but not willy-nilly) 🐻

- Entry: First 4H close below $320 (wait for a move above $320, then wait for entry).

- 🛑 Break Point: Stop Loss at the high that was made once the price crossed above $320

- Main Target: Land at a cozy $265.

Overall we are bullish on META, but we are playing a retracement down in the overall uptrend, so take your entry carefully!!

Jay's Pearls of Wisdom:

- Be specific and strategic with your swings – no random shots!

- Jay's all about plans; if it ain't the plan, skip it!

- Hunt those stops, rinse those retailers – trade like a pro!

And There You Have It! 🎉📈

Congratulations, dear traders, you've survived Jay's journey through charts, levels, and trade ideas. Remember, trading isn't a sprint; it's a high-stakes dance with the market's rhythm. Do your due diligence, follow the plan, and, as Jay would say, trade like a boss!

Until next time, stay sharp and trade on! 💼📊

Check out our FREE Trading Discord: https://discord.gg/pennybois