What Is The United States Dollar Index?

You might have heard of the term "USDX", "DXY", or "Dixie" and might be wondering what they all mean. Well, long story short, they are all the same thing, the United States Dollar Index:

- USDX: This is the most common and formal term for the index. It stands for "United States Dollar Index."

- DXY: This is a ticker symbol used on financial exchanges to represent the USDX.

- Dixie: This is an informal nickname for the USDX.

So, regardless of which term you use, you are referring to the same index.

How Does It Work?

The index is designed to reflect the overall strength or weakness of the U.S. dollar in the global foreign exchange market, also known as forex or fx (not the TV channel). The six currencies included in the United States Dollar Index are often looked upon as America's most significant trading partners. The U.S. Dollar Index is calculated using a weighted geometric mean formula, where each currency in the basket is assigned a weight based on its importance in U.S. trade.

- Euro (EUR) - 57.6% weight

- Japanese yen (JPY) - 13.6%

- Pound sterling (GBP) - 11.9%

- Canadian dollar (CAD) - 9.1%

- Swedish krona (SEK) - 4.2%

- Swiss franc (CHF) - 3.6%

The USDX was established in 1973, and was only changed once, in 1999 when the euro replaced the German mark, French franc, Italian lira, Dutch guilder, and Belgian franc. Due to this, the index does not accurately reflect present-day U.S. trade, when it comes to the currencies in the basket. Some believe that it will be changed again in the future, to add currencies such as the Chinese yuan (CNY) and Mexican peso (MXN) in the index seeing as China and Mexico are now major trading partners with the United States. China has the third largest share in U.S.–World Trade following Mexico and Canada

How To Read The Chart

The Index was established in 1973, shortly after the Bretton Woods Agreement was dissolved. It started with a base of 100. To this day, the value of the United States Dollar Index is relative to that base of 100. What this means is if the current United States Dollar Index value is 110, that means the U.S. dollar is 10% stronger than its value in 1973 (against the basket of foreign currencies listed above). A value of 90 would be a 10% weakening, relative to the base of 100.

Fun Fact: The mathematical equation for finding the United States Dollar Index is: USDX = 50.14348112 × EURUSD^-0.576 × USDJPY^0.136 × GBPUSD^-0.119 × USDCAD^0.091 × USDSEK^0.042 × USDCHF^0.036

How To Trade $DXY

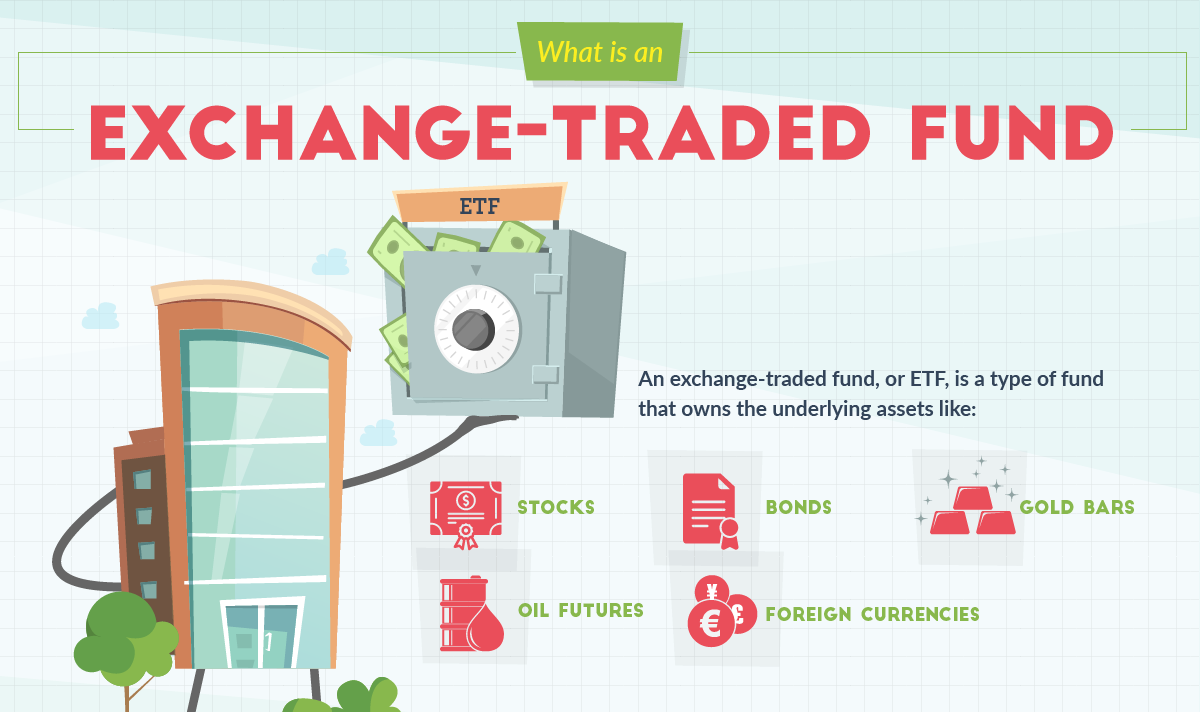

One way to get indirect exposure to the USDX is through exchange-traded funds (ETFs) or mutual funds. For example, the Invesco DB U.S. Dollar Index Bullish Fund (UUP) is an ETF that mirrors changes in the value of the US dollar using USDX futures contracts. Another option is the Wisdom Tree Bloomberg U.S. Dollar Bullish Fund (USDU), an actively-managed ETF that takes a long position on the U.S. dollar against a basket of developed and emerging market currencies. For those who are bearish, Invesco DB provides the U.S. Dollar Index Bearish Fund (UDN), designed for investors looking to profit from a weakening dollar as it takes a short position on the currency. This means it gains value when the dollar depreciates. Another way to trade the DXY is through futures or options contracts.

How Stock Traders Can Use The United States Dollar Index

You don't have to be a forex trader in order to find value in using the DXY:

- Stock Trading:

- Global Economic Indicators: Stock traders can monitor the $DXY for indications of global economic conditions. A strengthening dollar may influence multinational companies and impact international trade, potentially affecting stock prices. Make Sure To Join Our FREE Trading Discord!

- Crypto Trading:

- USD Correlation: Cryptocurrency traders often observe the $DXY to gauge the USD's correlation with digital assets. In periods of dollar strength, cryptocurrencies may experience increased volatility and inverse price movements. Check Out Our Sister Crypto Discord

- Commodity Trading:

- Currency-Commodity Relationships: Commodity traders should be attuned to the $DXY's influence on commodity prices. A stronger dollar may lead to lower commodity prices, affecting trading strategies in markets like gold, oil, and agricultural commodities.

How Forex Traders Can Use The United States Dollar Index

Another way to use the DXY in your trading is by trading correlated currency pairs. The DXY has a big influence on the currency markets, and many traders use its support and resistance levels, as well as patterns and other technical indicators to determine forex trades.

Correlated pairs are forex pairs that move in the same direction as the DXY. Some examples are USDEUR, USDCAD, and USDGBP. Some traders will find patterns, support/resistance, trend-lines, or other technical analysis factors on DXY, and then trade a correlated pair (such as USDCAD) when DXY breaks through a resistance/support or shows a bullish/bearish technical signal.

There are also currency pairs with inverse correlation to the DXY. This includes EURUSD, NZDUSD, and other pairs that do well when DXY does poorly. Traders can use the DXY to help determine trades for these pairs as well. We will be discussing currency pairs in detail, as well as a trade idea, on the next blog article.

Other Factors Investors Should Look Out For

When the U.S. Dollar Index (DXY) goes up, it generally indicates that the U.S. dollar is strengthening relative to the basket of currencies included in the index. This movement can convey several implications to overall investors:

- Global Economic Conditions: A rising DXY might signal concerns or uncertainties in the global economy. Investors may view the U.S. dollar as a safe-haven asset during times of economic instability, leading to an increase in demand for the currency.

- Interest Rates and Monetary Policy: Currency values are influenced by interest rates and monetary policy decisions. A higher DXY could reflect expectations of higher interest rates or a more hawkish monetary policy in the United States compared to other economies. This can attract foreign capital seeking better returns.

- Trade Competitiveness: A stronger U.S. dollar can make U.S. exports more expensive for foreign buyers, potentially impacting the competitiveness of U.S. goods in the international market. Conversely, it may make imports relatively cheaper for U.S. consumers.

- Inflation Expectations: Currency values are also influenced by inflation expectations. A rising DXY may indicate that investors expect lower inflation in the United States compared to other countries, as a stronger currency can potentially reduce import costs and contribute to lower domestic prices.

- Investment Flows: Investors may adjust their portfolios based on expectations of currency movements. A stronger U.S. dollar can influence capital flows, with investors reallocating assets to take advantage of potential currency appreciation.

"Risk-on" and "risk-off" are terms used in financial markets to describe investors' attitudes towards risk and their preferences for certain assets. The U.S. Dollar Index ($DXY) plays a role in these sentiments. Understanding the relationship between risk sentiment and the $DXY can provide insights into broader market dynamics:

Risk-On:

Definition: "Risk-on" sentiment prevails when investors are more willing to take on risk and invest in higher-yielding or riskier assets.

DXY Impact: During risk-on periods, investors may reduce their holdings of safe-haven assets, including the U.S. dollar. As a result, the $DXY may weaken when risk appetite is high.

Risk-Off:

Definition: "Risk-off" sentiment occurs when investors become more risk-averse and seek safety in less volatile or traditional safe-haven assets.

DXY Impact: In risk-off scenarios, there is often an increased demand for safe-haven assets like the U.S. dollar. Investors may move funds into dollar-denominated assets, causing the $DXY to strengthen.

Morgan Stanley's "The Dollar Smile Theory" Using The United States Dollar Index

This theory was invented around 20 years by Stephen Jen and Morgan Stanley, after they noticed a correlation between the strength of the US dollar and the state of the global economy. Their theory is that the USD constantly cycles through three states:

Stage 1. The global economy is in recession, yet the USD is remains strong: The USD is seen as a "safe haven" during this stage, and investors choose to move their money into safer assets, increasing the value of the USD.

Stage 2. The global economy starts to recover from recession, and the USD starts to weaken: Once the US economy gets affected by the recession, investors start to move their money once again, putting it into outperforming currencies.

Stage 3. The US economy recovers, and the USD strengthens: Once the US economy also starts to rebound, investors take advantage of the GDP growth and expect higher interest rates in the future, which makes the USD an attractive asset once again, giving it strength.

How Our Exclusive In-House Analysts Are Trading $DXY

"So it's just a chart like any other chart. For DXY we are watching for a break above 103.983, more specifically we want to see a 4H candle close above that level. That would make me bullish on the DXY, and looking for it to go as high as 107.348 then 110.426 as a main "price target". 100.196 would be the level that if it went below I would change my bullish stance.

Due to this I will be watching to short EUR/USD or GBP/USD, we can update on those specifics once/if in later blogs as well as during our Thursday 5PM EST stream in our discord where we go over all these blog trade ideas.

For now its just consolidating, if it breaks below 100 I can see it pushing lower, as that's such a huge psychology level, being the base. If we drop below 100, we are looking at support at 96.111. If we drop below 96.111 and then get a 4H candle close back above that level, that would be my personal trigger to once again short EUR/USD or GBP/USD. Meta Matt said we will get into currency pairs next blog, with a trade idea too!" -BTC_JAY