Top Economic Announcements

- S&P Global Manufacturing PMI (January) Reported Monday @9:45 AM ET

- ISM Manufacturing Prices (January) Reported Monday @10:00 AM ET

- ISM Manufacturing PMI (January) Reported Monday @10:00 AM ET

- JOLTS Job Openings (December) Reported Tuesday @10:00 AM ET

- ADP Nonfarm Employment Change (January) Reported Wednesday @8:15 AM ET

- S&P Global Services PMI (January) Reported Wednesday @9:45 AM ET

- ISM Non-Manufacturing Prices (January) Reported Wednesday @10:00 AM ET

- ISM Non-Manufacturing PMI (January) Reported Wednesday @10:00 AM ET

- Crude Oil Inventories Reported Wednesday @10:30 AM ET

- Initial Jobless Claims Reported Thursday @8:30 AM ET

- Average Hourly Earnings (MoM) (January) Reported Friday @8:30 AM ET

- Nonfarm Payrolls (January) Reported Friday @8:30 AM ET

- Unemployment Rate (January) Reported Friday @8:30 AM ET

Other Market Notes

Market volatility is heightened by ongoing global issues, including the many global conflicts like Gaza and Ukraine, rising inflation, and U.S. political dynamics under President Trump's tariff policies. Effective risk management strategies are crucial in this environment. Future downside risks are always a factor, but it’s especially dangerous when we’re in times of extreme volatility

Events & Livestream Schedule

Upcoming Earnings Releases

Economic Calendar

Broad Market Analysis

/SPX500USD: SP500

- The SP500 is still sitting right above key support of $6900, which is the line in the sand going forward for the SP500.

- If $6900 can be held as support this week, look for a move higher to $7000. Anything above $7000 and targets would be $7025/$7050/$7100 in the future.

- If $6900 cannot hold as support, look for a move down to $6800/$6700/$6600 in the future.

$S5FI: SP500 Stocks Above 50-Day Average

- Short term breadth remained unchanged from last week, so the same setup applies.

- If 65% can be held as support, look for a move higher to retest 72.50% and potentially higher in the future.

- If 65% cannot hold as support, look for a move down to 55%/45%/40% in the future.

$S5TH: SP500 Stocks Above 200-Day Average

- Long term breadth is still sitting right below support of 65%, which will be the key level for long term breadth going forward.

- For this week, if 65% can be broken and held as support, look for a move higher to 70%/75% in the future.

- If 65% remains as resistance in the future, look for a move down to 60%. Anything below 60% and targets would be 55%/50% in the future.

$US30: Dow Jones Industrial Average

- The Dow literally did not move last week at all, with it still sitting right below $49000.

- If $49000 remains as resistance this week, look for a move to $48000. Anything below $48000 and targets would be $47000/$46000 in the future.

- If $49000 can be broken and held as support, look for a move higher up to $49500/$50000/$50250 in the future.

$IXIC: Nasdaq Composite

- The Nasdaq attempted to break over $23750 last week, but failed to move higher.

- For this week, if $23750 can be broken and held as support, look for a move higher to $24000/$24500/$25000 and potentially higher in the future.

- If $23750 holds as resistance, look for a move to $23000. Anything below $23000 and expect a move to $22500/$22000 in the future.

$US2000: Russell 2000

- The Russell moved lower last week after it failed to hold $2700 support.

- For this week, if $2600 cannot hold as support, look for a move to $2550/$2500/$2475/$2450 in the future.

- If $2600 can hold as support, look for a move higher to $2650/$2700. Anything over $2700 and expect a move to $2730 and potentially higher in the future.

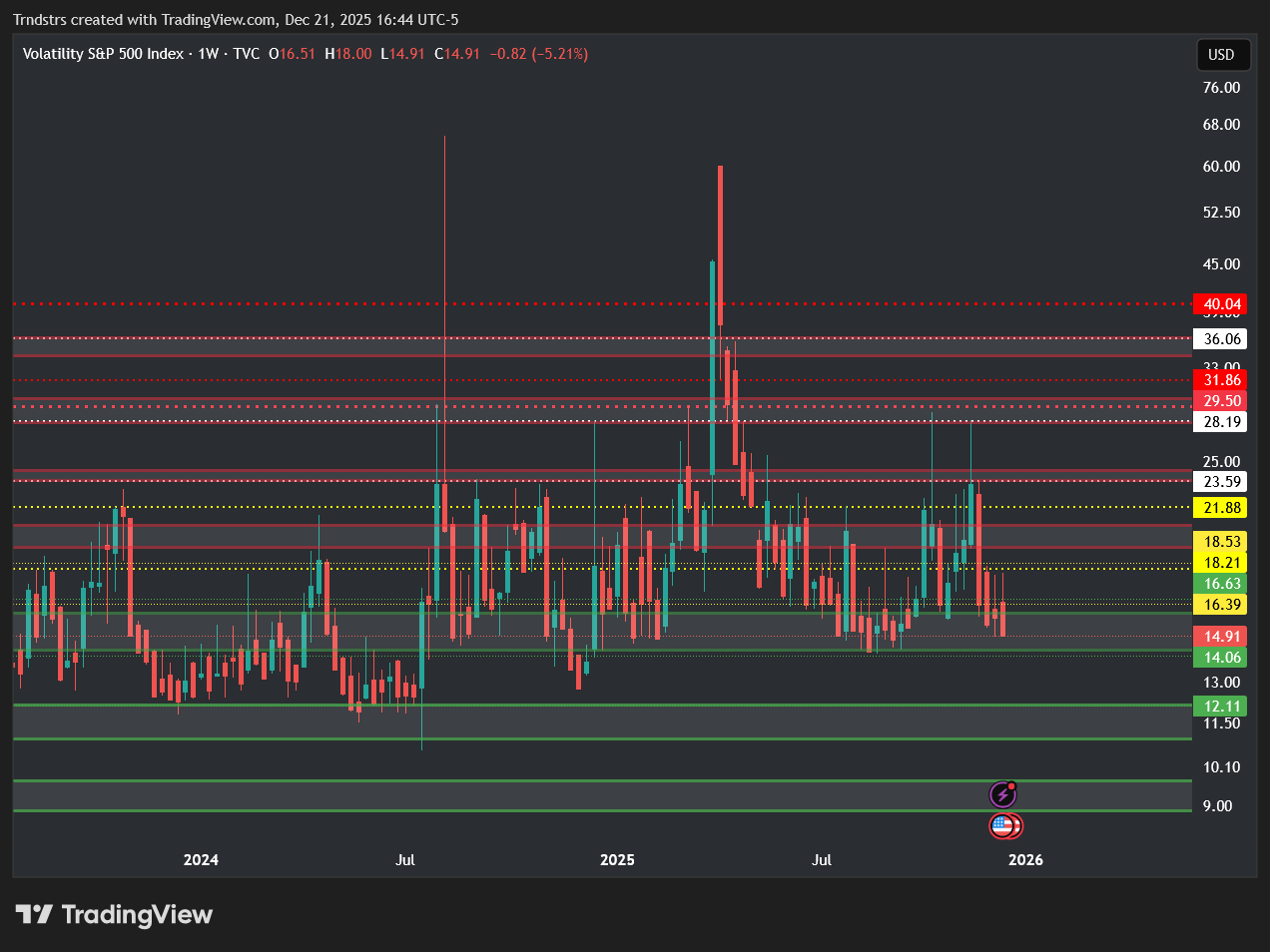

$VIX: Volatility Index

- The VIX managed to hold onto $16 support last week and close right under $18 resistance.

- For this week, if $18 can be broken and held as support, look for a move higher to $20/$23.50 in the future.

- If $18 cannot be broken and remains as resistance, look for a move to $16/$14/$12 in the future.

$XAUUSD: Spot Gold

- Gold finally pulled back last week after nonstop candles higher for literally months on end. With that, $5000 is officially resistance going forward and a major level to watch.

- If $5000 can be reclaimed this week, look for a move higher to $5250/$5500/$5750 in the future.

- If $5000 remains as resistance, look for a move lower down to $4500/$4400/$4250/$4000 in the future.

$XAGUSD: Spot Silver

- Silver also had a terrible week, with one of the sharpest corrections I have ever seen in my entire life.

- With that, $85 is the new line in the sand for Silver, so keep a close eye on the level going forward.

- If $85 can be broken and held as support, look for a move to $90/$95/$100/etc.

- If $85 remains as resistance going forward, look for a move lower down to $70/$65/$60/$55 in the future as there is no support below at all.

$DXY: US Dollar Index

- The US Dollar closed right below $98 last week after it managed to recover off of $96 support to close the week.

- With that, if $98 remains as resistance this week, look for a move to $96/$94 in the future.

- If $98 can be broken and held as support, look for a retest of $100. Anything over $100 and targets would be $101/$102/$103 in the future.

$USOIL: Crude Oil

- Crude Oil managed to have a nice move last week after it broke over $62.50 resistance, with a close right near $65 to end the week.

- With that, it is currently getting rejected off of the long-term downtrending trendline, which has been a line in the sand for Crude Oil.

- For this week, if $65 can be broken and held as support, look for a move to $67.50. Anything over $67.50 and targets would be $70/$72.50/$75 and potentially higher in the future.

- If $65 remains as resistance, look for a move to $62.50/$60 in the future. Anything under $60 and expect a move to $57.50/$55/$52.50 in the future.

$US02Y: US Government Bonds - 2-Year Yield

- The 2-Year got rejected off of 3.60% resistance last week, which is a key level for the 2-Year to watch going forward.

- If 3.50% cannot hold as support this week, look for a move to 3.40%. Anything under 3.40% and targets would be 3.25%/3%/2.75% in the future.

- If 3.50% can hold as support this week, look for a retest of 3.60%. Anything over 3.60% and targets would be 3.80%/4%/4.15% in the future.

$US10Y: US Government Bonds - 10-Year Yield

- The 10-Year remained unchanged last week after it broke over 4.20% resistance last week.

- Going forward, if 4.20% can hold as support, look for a move to 4.30% resistance. Anything above 4.30% and targets would be 4.50%/4.60% in the future.

- If 4.20% cannot hold as support this week, look for a move lower down to 4.10%/4%/3.90% in the future.

Get Three In-Depth Research Reports Every Month

Rest & Retire provides busy investors with three in-depth research reports directly to your inbox every month.

YOU MAY ALSO LIKE

Technical Analysis

$HD: The Home Depot

- Home Depot has my attention here! Without a doubt, the $370 area has been trying to hold, and if we do candle analysis - I really like the way Friday's candle closed.

- The weekly got a sweep of last week’s low, and if it can hold $370, I like the potential of going and sweeping last week high’s and higher.

- Acceptance over $374.9, we have room to $380.41, $388.52, and $393.11 with the potential of testing $400’s.

$NVDA: Nvidia

- Nvidia has been struggling to get over $192.84, but anytime it gets lower around the $185-$187 area, buyers wake up and push it higher. Anytime an area gets tested, the weaker it becomes - so if it continues to test $192.84, I believe buyers can break resistance and break out.

- Looking at the monthly close, it has the potential of setting a potential higher low, and breaking over last month’s high.

- Acceptance over $192.84, we have long targets at $196, $199.03, and $202.34.

- If bears take over and $NVDA fails to hold $185.73, we have room to $184 and $179.

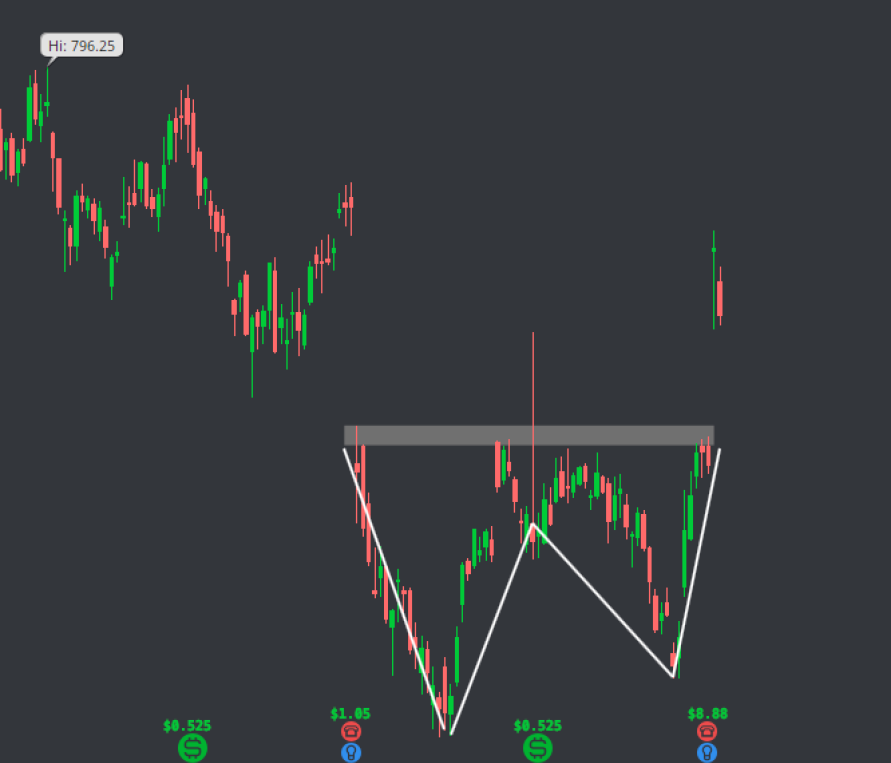

$META: Meta

- META had a beautiful earnings rally, gapping up way over the neckline for this double bottom on the daily chart. If we see a pullback to the neckline near $680 and fill the gap to the downside, then we’ll be pretty excited about a bounce off $680.

- That said, we probably will not see a massive decline like that after such a strong rally.

- We’ll be looking for continuation above $738.50 for potential retests near $571.95. $576.15, $760.72, and $768.04. If we really want to take a risk, we can use $720.65 as our confirmation trigger instead of $ 738.50 and simply add that level as PT 1.

- We have support levels around $701 / $705 that we could target if we capitulate below $715.48, but we’re extremely close to that trigger, and it’s likely to false trigger.

$TSLA: Tesla

- Tesla has been getting the better of me recently. I’ve been bullish and holding shares of it since before the election, but got scared when I noticed this trendline support paired with how slow TSLA has been after setting NATH and refusing to even test $500 territory.

- At this point, given where we are, I think it’s still pretty 50/50 on which direction TSLA is headed next, but we can all be certain that we’re near a line in the sand and should expect a large move soon.

- For the bulls, we have to break above $440 and retest levels near $450, $456.2, and $462.20 so that we can start trending higher, bouncing off this trendline, and attempt another NATH wave up. For the bears, they want to keep us under $440 with confirmation below $415.51 and downside targets near $408.5 / $391.20.

$PG: Procter & Gamble

- Expected a little more out of $PG last week, but the weekly candle still looks bullish.

- This is a long-term play similar to $JNJ from a few months ago, but a little riskier since we're in more of a downtrend on $PG than we were on $JNJ, in my opinion.

- Regardless, I have some shares near $149.50 and plan on aiming for an ATH break or cutting below these lows around $143. About a $7 loss for a $30 aimed reward. Great dividend name with $PG as well, from what I can tell, to add to that R/R favorability.

- We have support around $150 / $149.8, and $149.34 to watch for a bounce.

- Otherwise, looking for acceptance over the recent highs near $152 for level retests near $152.8, $153.6, $154.21, then we have a little breathing room up to $157.02 / $158.30.

$KO: Coca Cola

- Speaking of dividends, KO is a fan favorite dividend stock, and we came into last week calling for NATH. We certainly got it! However, now we have to be a little creative to come up with some realistic targets for the near future.

- I think we’ll likely see another 10% out of this in the coming months, and I’m basing that on the consolidation that occurred before this neckline breakout.

- We have support levels near $73.7, $73.25, and $72.83 to watch for a bounce if we pull back, but with a breakout of this nature, we want to see strong continuation. We’ll have to see how the stock reacts to psychological levels like $75 / $77.5 / $80. Definitely seems more like a set and forget shares play vs an options play given all of that info.

Get Our Weekly Watchlist

Get the latest market news, stocks to watch, earning reports, exclusive discounts and more!

PB Alerts is a group of experienced traders dedicated to providing hedge fund quality trade alerts without the cost.