Last week we put out trade ideas for $PLNT, $FIL, $DIS and $SHOP!! In this post we will break down all the trades, provide links on where to find them, and show which prices we are setting alerts at on our trading broker so that we can be ready to take these trades!!

This post goes over our trade ideas posted between 1/01/24-1/07/24. Check out our prior trade ideas…

Also Make Sure To Check Out Our Blog Trade Idea Glossary!!

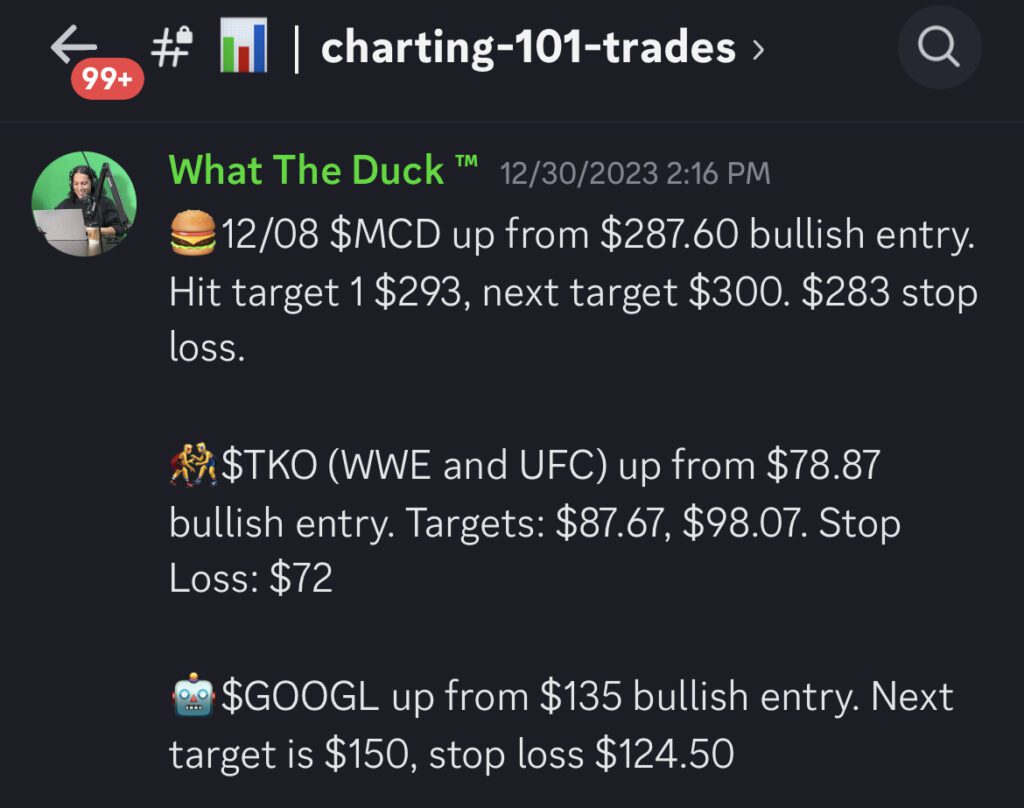

We find and play these trades using a Technical Analysis Strategy that we teach as part of our 8 Class Charting 101 Course. Every Thursday at 5PM EST we go over all these trades live in our discord!! We also update when these trades hit entry, targets and stop losses in an exclusive channel in the discord!! This channel, stream and educational course is all included with our premium membership. However, we also post all the trades right here on our Free Trading Blog and Twitter.

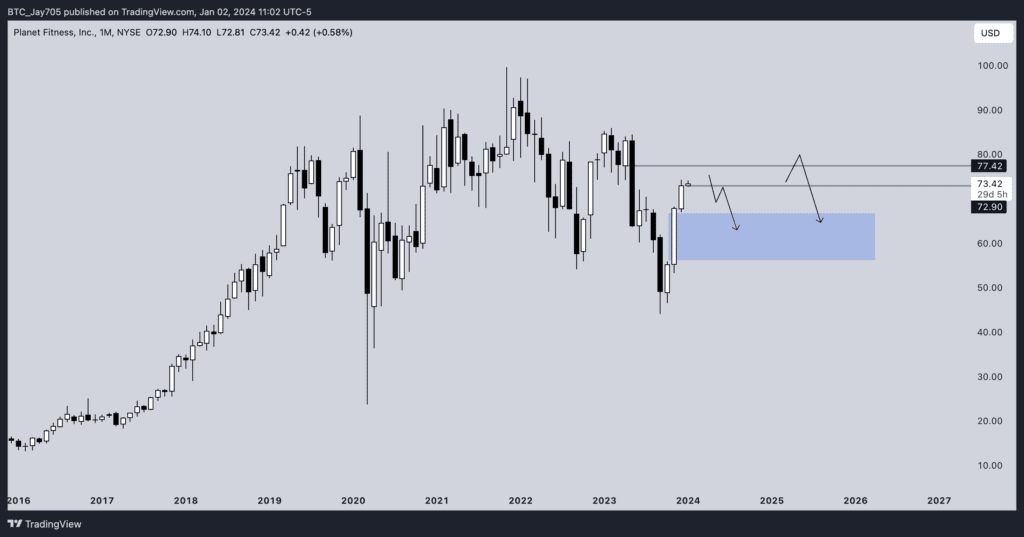

$PLNT Planet Fitness: Full Blog

Revenue in the U.S. fitness, health and gym club industry was $30.6 billion 2022 and numbers are expected to increase to $30.8 billion for 2023. They have 18.5 million members and nearly 2,500 locations operating in all 50 states, the District of Columbia, Puerto Rico, Canada, Panama, Mexico and Australia. More than 90% of Planet Fitness locations are independently owned and operated.

“We are not immediately looking to go long on PLNT just from here, but are rather carefully planning out short positions. A first option is that we run above $77.42, this would mean we run in a monthly timeframe bearish order-block. We want to see a 4H candle close back below $77.42 after first going above to take short entry, stop loss can be above $80, targeting $67 and $56 for a swing play. Alternatively if we don't reach that high, we can look for the $72.9 level to turn from support into resistance. We want to see a clean break below, then take an entry (short) on the retest of $72.9. We also target $67 and $56 for a swing short play here, our stop loss can go above $77.42. If we get stopped out that’s fine, we will then look for a 4H close back below $77.42 to short it once again if it sets up.

In terms of longs I'm not interested here after 3 months of only up. I think this will pullback at some point this year and at least hit $67. $67 and $56 are the main levels to long from. A move below either of these levels followed by a 4H candle close back above is the trigger too long.” -BTC_Jay

Option 1: Short

Entry: Price breaks above $77.42. Watching for a 4H candle close back below $77.42

Targets: $67, $56

Stop Loss: Above $80

Option 2: Short

Entry: Waiting for price to test $72.90. Watching for it breaks below this price and $72.90 flip to a confirmed resistance.

Targets: $67, $56

Stop Loss: Above $80

Option 3: Long

Entry: Waiting for price to break below $67 then watching for a 4H candle close back above $67

Targets: $72.90, $80

Stop Loss: Below $56

Option 4: Long

Entry: Waiting for price to break below $56 then watching for a 4H candle close back above $56

Targets: $67, $72.90, $80

Stop Loss: Below $54.05

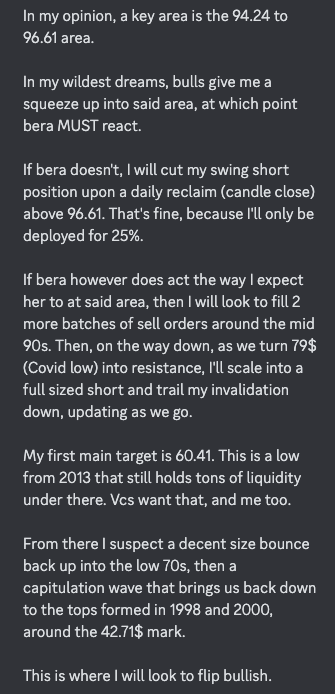

$DIS Disney: Full Blog

We love Mickey Mouse, The Avengers, Star Wars, Maui, and the rest of the Disney Universe, however our analyst BTC_Jay is not bullish on $DIS currently.

Observation 1: $DIS has never closed two consecutive yearly candlesticks below the 12 EMA. This year, we are doing exactly that after running into it and rejecting from it. That could be a bearish signal.

Observation 2: 2009 up until 2021 has been only up, with little to no consolidation at all on the way up, which leaves support on the way down.

Option 1: Bearish

Entry: Watching for the price to break above $94.24. Then watching for a 4H close below $94.24 (or strong showing that $94.24 is resistance).

Targets: $85.55, $78.50

Stop Loss: Daily close above $96.61

Option 2: Bearish

Entry: If price breaks above $94.24 and keeps going we can be watching for the price to break above $96.61. Then watching for a 4H close below $96.61 (or strong showing that $96.61 is resistance).

Targets: $85.55, $78.50

Stop Loss: Daily close above $96.61

Option 3: Bullish

Entry: If price breaks above $96.61 we can watch to see if that level flips to a strong support level.

Targets: $103.50, $113+

Stop Loss: $89.51

Option 4: Jay opened a short/bearish position already with a $89.55 average (50% allocated). He is waiting for $79 (Covid low) to flip into a resistance to add the other 50% of his position. StocksBuddy is giving off a bearish signal on the daily chart, and is in the $91.50 range currently, so an entry here or lower would align with Jay's trade idea and StocksBuddy (NFA, always DYOR). His first target for this trade once fully allocated is $60,41. He then expects a bounce back up into the low $70's, then a capitulation wave that brings us back down to the top formed in 1998 and 2000 around the $42.71 mark.

Option 5: Watching for a bearish entry at current levels and playing this down with targets at $85.51, $78.50, $79, $42.71. Stop Loss at $96.25. This would be the most risky of the options.

This Is Not Financial Advice! It Is Important To Always Do Your Own Research When Investing Into Any Asset!!

$FIL Filecoin: Full Blog

Filecoin $FIL is currently trading at $6.541 as of this writing.

If we get a dip from here: We are personally watching for the price to break below $5.80 and then have a 4H candle close back above $5.80 for a bullish/long entry. Targets at $7.60, $9.50 and $11.40. Stop loss below the low that was made when the price originally broke below $5.80

If we go up from here: If we go up from the current price, and have a strong break above $7.60 on the 4H chart, we are watching for a bullish/long entry with targets at $9.50 and $11.40. Stop loss at $6.80.

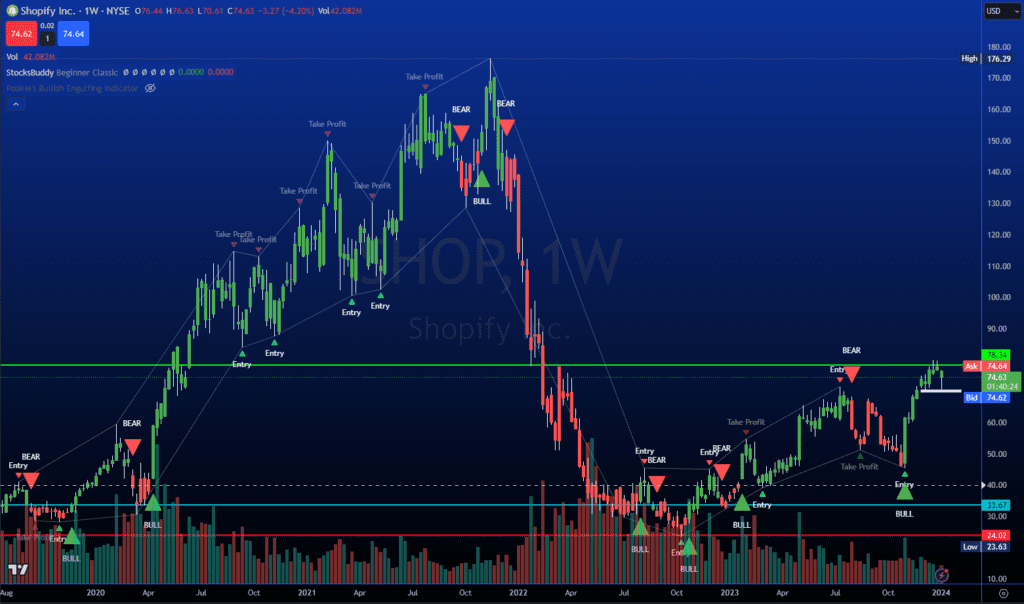

$SHOP Shopify: Full Blog

"We're slapping a resistance level here and had a nice clean entry below at $33.67 on the weekly chart after the massive selloff from late 2022. This looks like a bearish flag in my opinion. If it can break over $90 and hold, it may have bullish potential, but it is at a point of value for the bears right here and may continue selling off to new lows. $SHOP has good potential as a growth candidate, but due to it's limited post-agreement valuation, the likelihood is higher that investors lose confidence and we see another deflation over time. Those investors are looking at better opportunities with higher valuation ceilings, such as $SNOW." -Steve Toggo

This post goes over our trade ideas posted between 1/01/24-1/07/24. Check out our prior trade ideas…