BRICS Expands: A New Era of Global Geopolitics

The recent Brics summit in Russia marked a pivotal moment in the global geopolitical landscape. With the addition of six new members – Egypt, Ethiopia, Iran, Saudi Arabia, the UAE, and a host of other potential entrants – the bloc is poised to reshape the world order.

What is BRICS?

BRICS is an acronym for a group of five major emerging national economies: Brazil, Russia, India, China, and South Africa. These countries, collectively, represent a significant portion of the world's land mass, population, and economic activity. The grouping was formed in 2006 and has since grown into a powerful force in global affairs. The member countries share common interests, including economic development, political cooperation, and a desire to challenge the traditional Western-dominated global order.

BRICS Expansion: The Quest for a New Global Power Dynamic in an Evolving Economic Landscape

In a world increasingly marked by geopolitical divides, the recent summit of emerging nations in Russia underscores a turning point in global politics. At this gathering, the BRICS bloc, which recently expanded to include nine countries, positioned itself as a formidable counterweight to the traditionally Western-dominated world order. This expansion signals an era of evolving influence in global governance, trade, and economics, one in which developing nations are asserting a larger role in shaping international policies.

Originally composed of Brazil, Russia, India, China, and South Africa, BRICS welcomed four new members at this summit: Egypt, Ethiopia, Iran, and the United Arab Emirates. Additionally, Saudi Arabia, though not yet a full member, is highly engaged with the bloc, and numerous countries, including Indonesia, Malaysia, Sri Lanka, and Myanmar, are either formally applying or strongly considering membership. The bloc’s expansion highlights a shared aspiration among developing nations for an international framework that better aligns with their economic priorities and goals for social development.

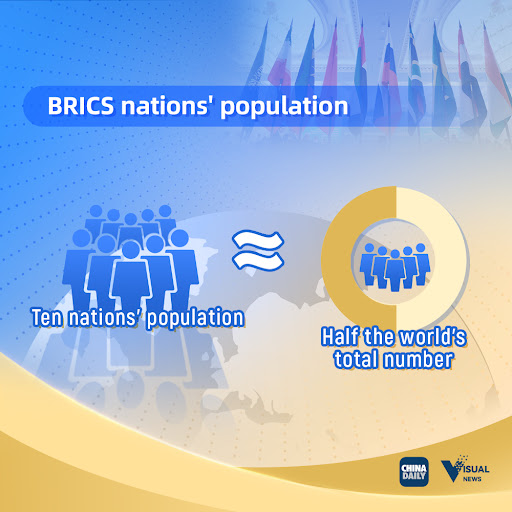

The growth of BRICS extends beyond simple economic potential. It reflects a rising challenge to the Western-led international order and signals the bloc’s intention to reshape the current rules of global engagement. Developing countries, particularly from the Global South, are increasingly looking to BRICS as an alternative avenue to the U.S.-led institutions that have traditionally held sway, such as the United Nations and the World Trade Organization. BRICS now accounts for approximately 45% of the global population and represents over a third of the world’s economy, making its influence hard to ignore.

For the United States and its Western allies, this expansion of BRICS presents a strategic crossroads. Attempting to discourage nations from joining the bloc risks alienating these countries further. Instead, Western powers should focus on addressing the underlying grievances that are motivating nations to explore new alliances. Analysts, like Sarang Shidore of the Quincy Institute, argue that Western nations must recognize the reality of these nations’ strategic maneuvering. “Hedging behavior” – where countries diversify their alliances rather than relying solely on the West – is a natural response to the limitations and biases of existing institutions.

Don't trade this election season on your own!

As these developing nations seek a fairer place within the global system, some experts, including Shidore, advocate for a rejuvenation of Western-backed institutions by refocusing on mutual interests rather than attempting to influence or change the aspirations of other states. This involves addressing the failures of policies that have often left the Global South with limited agency in international decision-making. BRICS’ expansion is both an opportunity and a challenge. It may usher in a more balanced global landscape, providing developing nations with a stronger voice and reshaping financial and political alliances. However, it also complicates BRICS’ identity, as its rapidly growing membership now includes countries with diverse political and economic backgrounds. The bloc’s unity could face pressures from its internal dynamics as it works to define its broader goals.

Get a technical analysis coach today!

In the coming years, as BRICS strengthens its position on the world stage, the implications for global markets and investors could be significant. An expanded BRICS with enhanced economic influence and strategic vision could reshape the flow of trade and investment, especially for emerging market economies. For those in the trading world, monitoring these developments will be essential, as the balance of power continues to shift.

BRICS Trade Idea $VALE

$VALE Vale S.A., is a Brazilian multinational mining company. It's a major player in the global mining industry, particularly known for being the world's largest producer of iron ore and pellets. Brazil is the "B" in "BRICS", so BRICS expansion could help this Brazilian company.

- Headquarters: Rio de Janeiro, Brazil

- Major Products: Iron ore, pellets, nickel, copper, fertilizers, and coal

- Market Cap: Approximately $49.6 billion USD (as of October 26, 2024)

- Stock Exchange: NYSE (New York Stock Exchange)

- Current Stock Price: $10.88 USD (as of October 26, 2024)

- Global Supply Chain: Vale's iron ore is a crucial ingredient in steel production, making it a significant player in the global supply chain for various industries.

- Economic Impact: As a major exporter, Vale contributes to Brazil's economy and has a global impact on commodity markets.

- Investment Opportunity: VALE stock can be an investment option for those interested in the mining sector, particularly iron ore.

Our Technical Analysis Coach Jay is looking for the price to drop to $8.80 before considering an entry. Once the price does break below $8.80 he is looking for a 1H candle close back above $8.80 to enter. Check out his coaching program to see how he sets his targets and stop losses! Keep in mind this is a Swing Trade, so takes patience!!