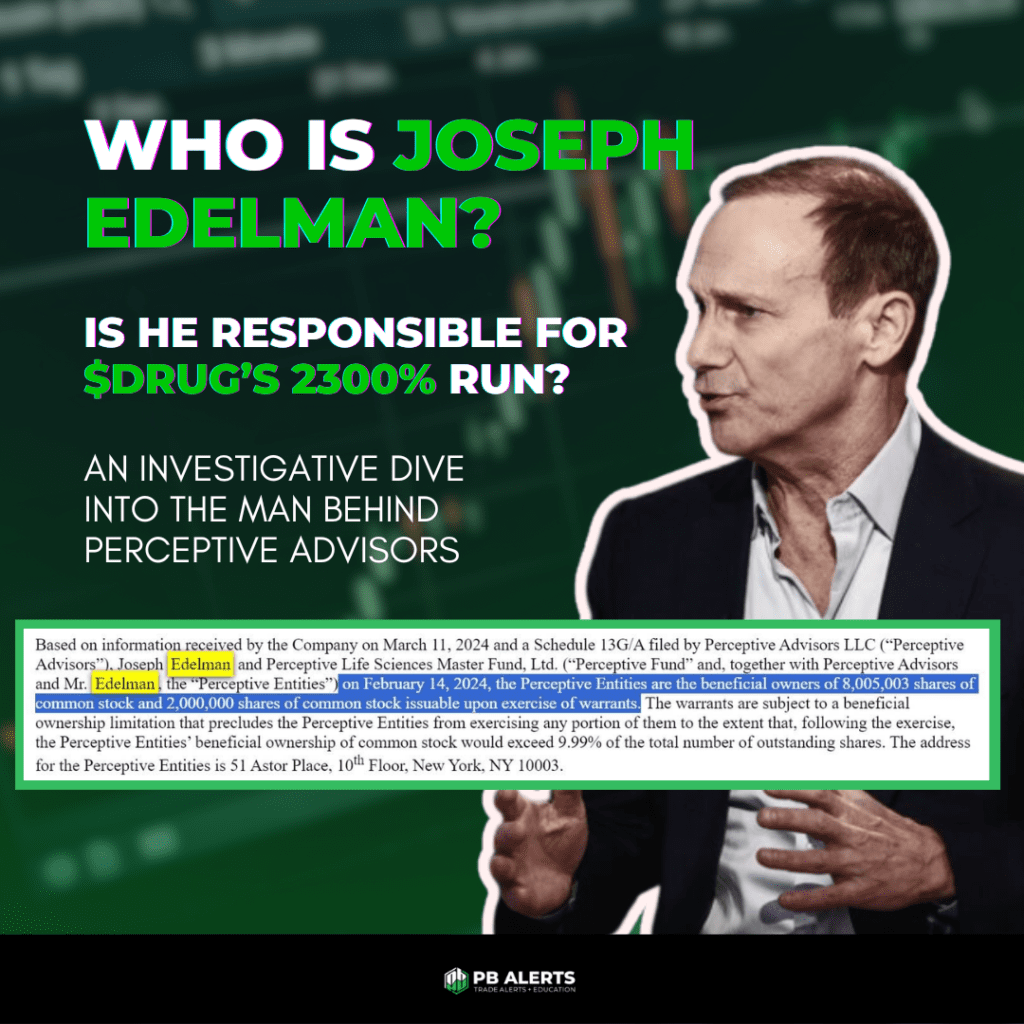

An Investigative Dive into the Man Behind Perceptive Advisors

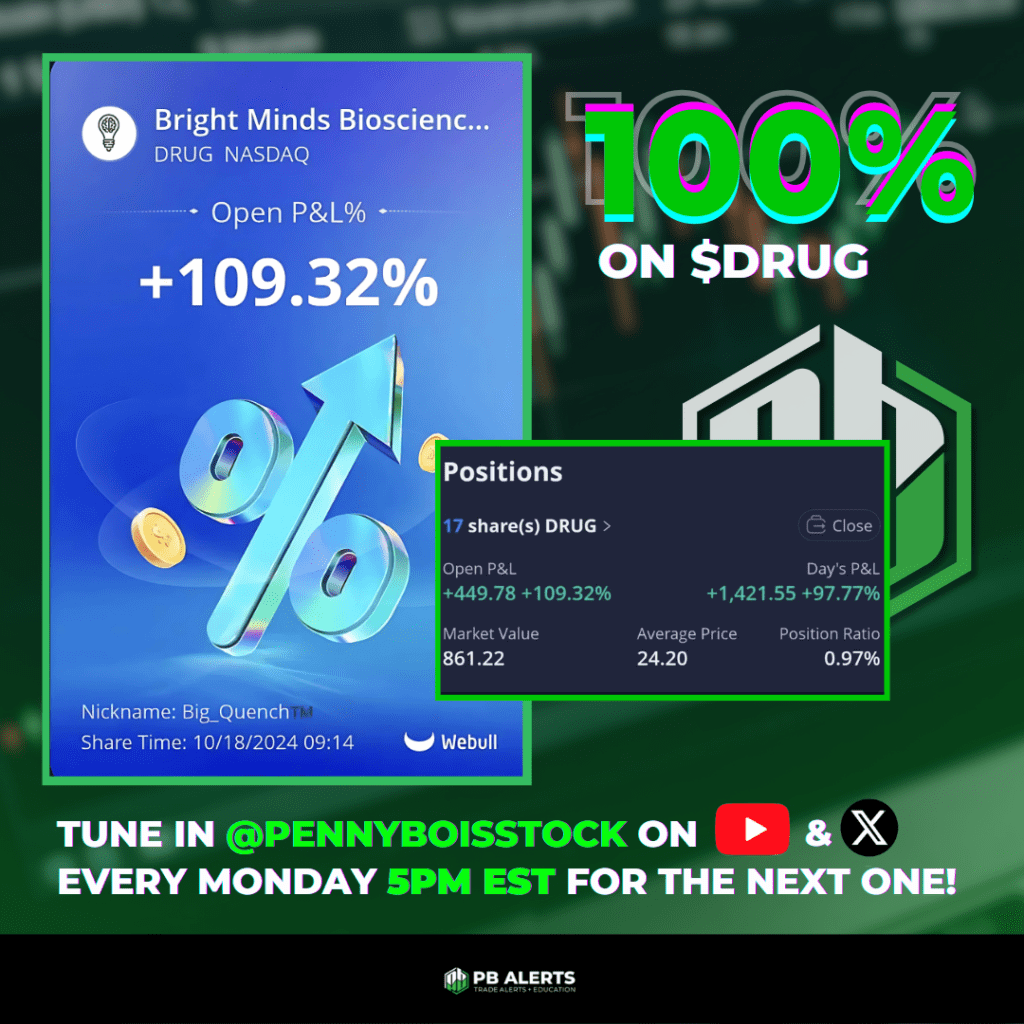

On Tuesday, October 15, 2024, Bright Minds Biosciences (ticker: $DRUG) experienced an unprecedented 2300% increase in share price over just six and a half hours of trading. This blog article is written by "The Porterhouse" from the Pennybois Discord, enjoy!!

If you’ve traded biotech stocks before, you’ll know it’s a wild sector. Many companies operate with high risks and no profits, often surviving on speculative hope and investor sentiment rather than solid fundamentals. The world of biotech can often resemble a game of chance, where fortunes rise and fall in line with trial results, partnerships, and breakthroughs in drug development. More often than not, these movements signal yet another pump-and-dump situation..... But this wasn’t any ordinary pump.

Over 160%%!!! Don't Miss The Next One!!

We’re talking about a 2300% surge in a single day. That’s beyond normal volatility, even for biotech. Had I not consumed an entire pot of coffee that morning, I might’ve just moved on with my day. But something didn’t sit right. I began digging.

The Search for Answers: A Rabbit Hole with No End in Sight

After combing through social media and news reports, I found… absolutely nothing. No one seemed to know what was happening. Social media discussions were scattered, with most retail traders equally baffled. A few small news pieces surfaced about BMB-101 and BMB-201, two compounds developed by Bright Minds, showing positive preclinical data. But preclinical data doesn’t justify this type of astronomical surge.

Curiosity got the better of me. So, I went deeper, researching Bright Minds Biosciences and its leadership team. That research led me down a two-hour rabbit hole on the wrong Ian McDonald (CEO & co-founder)—turns out the guy who ran the White House Drug Abuse Office under Reagan wasn’t the one at the helm of Bright Minds. An unfortunate diversion, but a learning experience nonetheless. Still, no concrete answers. The lack of information was puzzling. So, I pivoted.

Following the Money: A Closer Look into Bright Mind’s SEC Filings

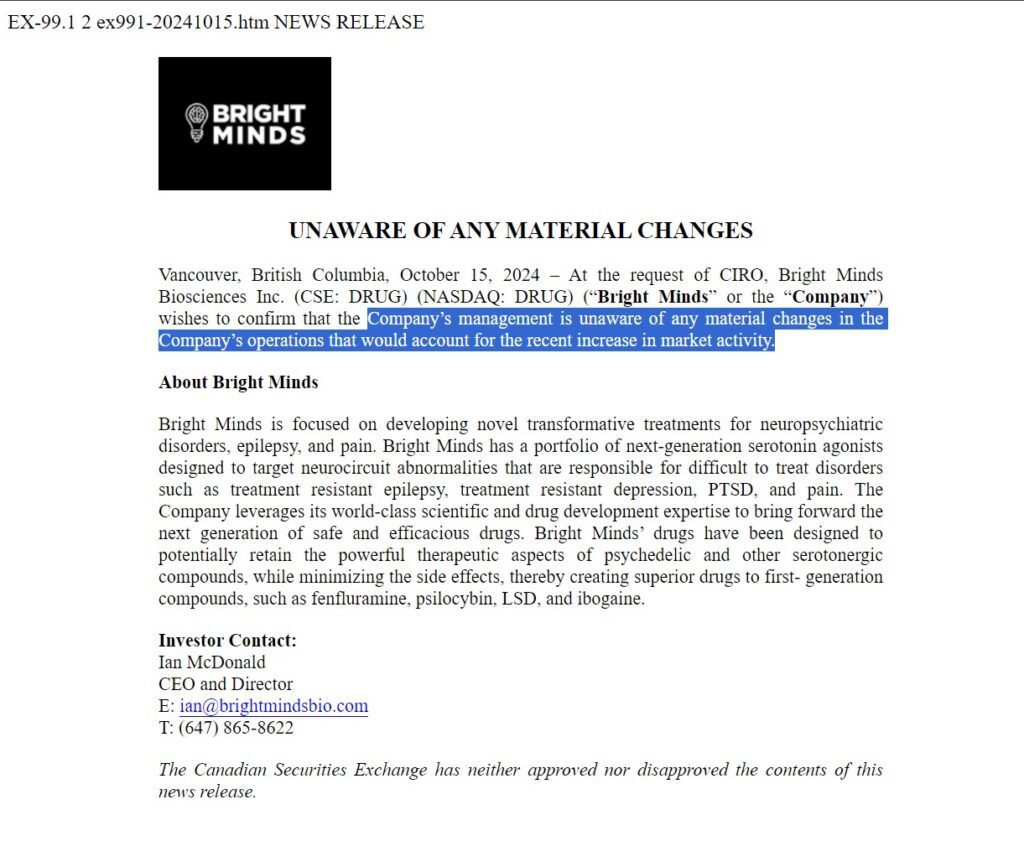

When in doubt, always follow the money... I checked the SEC filings, and there it was. A 6-K report filed by the company itself stating they too were “unaware of any material changes in the company’s operations that would account for the recent increase in market activity.”

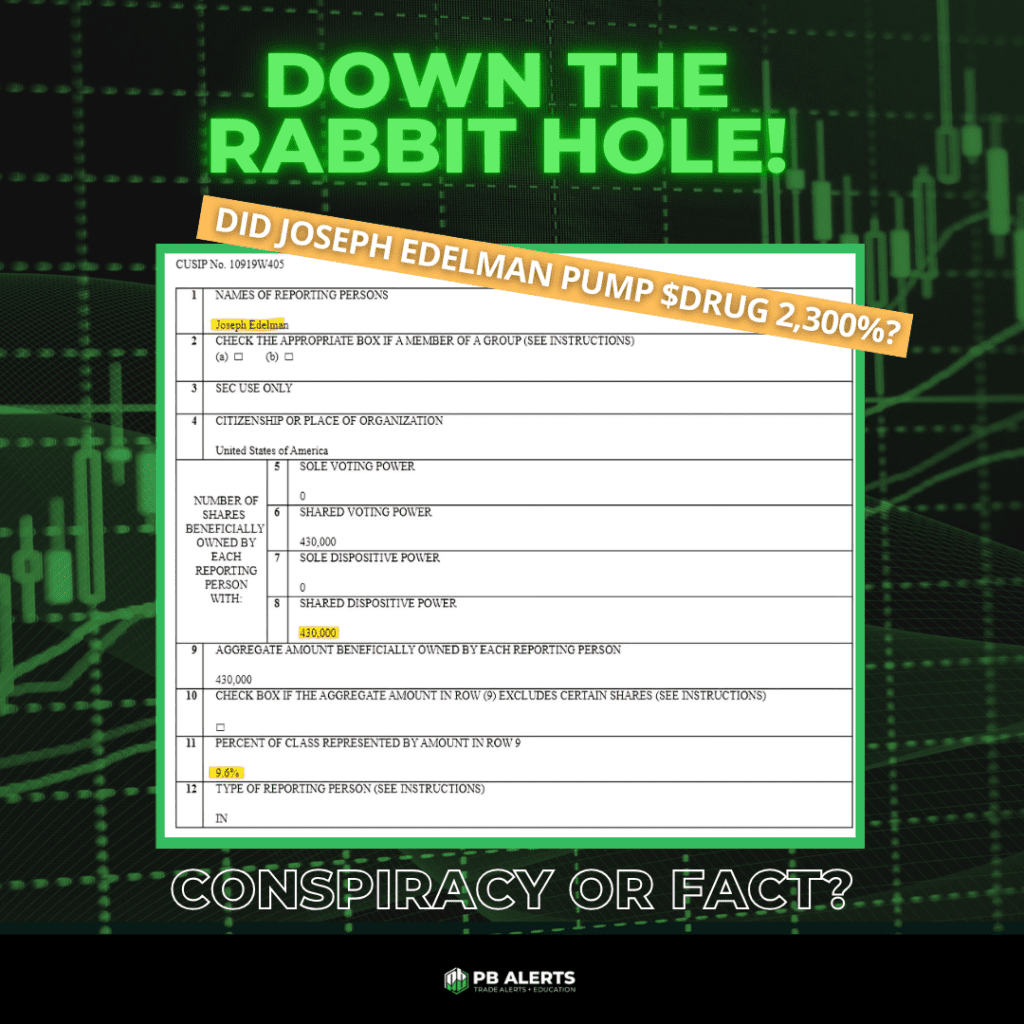

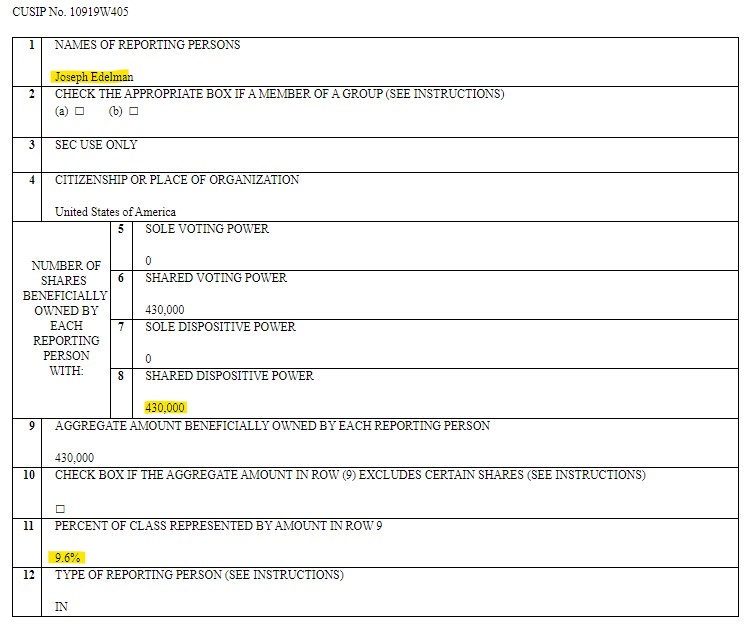

Excellent. No news, no one on social media, not even the company has any idea (publicly) what is going on... Now things were getting strange... Then, I found it. A Schedule 13G filing dated October 14th, 2024—a day before the stock made its explosive move. This form is used to disclose when an entity or individual acquires more than 5% of a company’s shares. The filing?

This Plays Is Over 160% Now!! Don't Miss The Next One!!

Perceptive Advisors LLC, a hedge fund founded by Joseph Edelman, had purchased 430,000 shares, giving them 9.6% ownership in the company. No other filings, just this... That got me asking the most important question of all: Who is Joseph Edelman?

The 41% Man: Joseph Edelman’s Rise to Hedge Fund Domination

Joseph Edelman is not your typical hedge fund manager. In 1999, he founded Perceptive Advisors, a biotech hedge fund. What started as a small $6 million operation had ballooned into a biotech behemoth managing over $4.1 billion in assets by 2022. His hedge fund, the Perceptive Life Sciences Fund, has posted annualized returns of 30% since its inception.

But what really put Edelman on the map was 2017. That year, his hedge fund delivered a 41% gain, earning him the No. 13 spot on Institutional Investor’s Rich List and netting him a cool $525 million. According to those in the know, Edelman’s returns are “so spectacular that nobody was in his league.”

Edelman’s investment strategy is bold, high-conviction, high risk, high volatility. He shuns big pharmaceutical companies, preferring to back small- and mid-cap biotech companies whose fortunes often hinge on a single drug or treatment. But biotech investing is not for the faint of heart. According to the Institutional Investor, of the roughly 500 biotech companies in the U.S., only about 20 are profitable. Even companies with promising treatments can face setbacks, whether from clinical trial failures or FDA rejections. The risks are enormous, and even the best investors can get burned.

However, Edelman has seemed to dominate this game riding the line of what seems possible. Since Perceptive’s inception (before 2018), the fund has only posted two down years. In 2002: -10.33% (Nasdaq Biotechology Index: -45%) and in 2008: -23.98%.

It has also held strong when the market was weak, such as in 2016 when biotech lost nearly 22%, whereas Edelman’s funds returned 3.81%. It has also posted insane returns in individual months such as a 69% portfolio gain on its second month in existence.

Coincidence or Pattern? Edelman’s Timing and the 13G/13D Filings

The timing of Edelman’s 13G filing before the explosive run in $DRUG could be just pure luck, although I’d be naive to attribute such a coincidence to a man that has beaten the market in brow-raising ways. Using a website that tracks hedge fund positions, I decided to dig deeper into Edelman’s previous filings and stock moves. Here’s what I found:

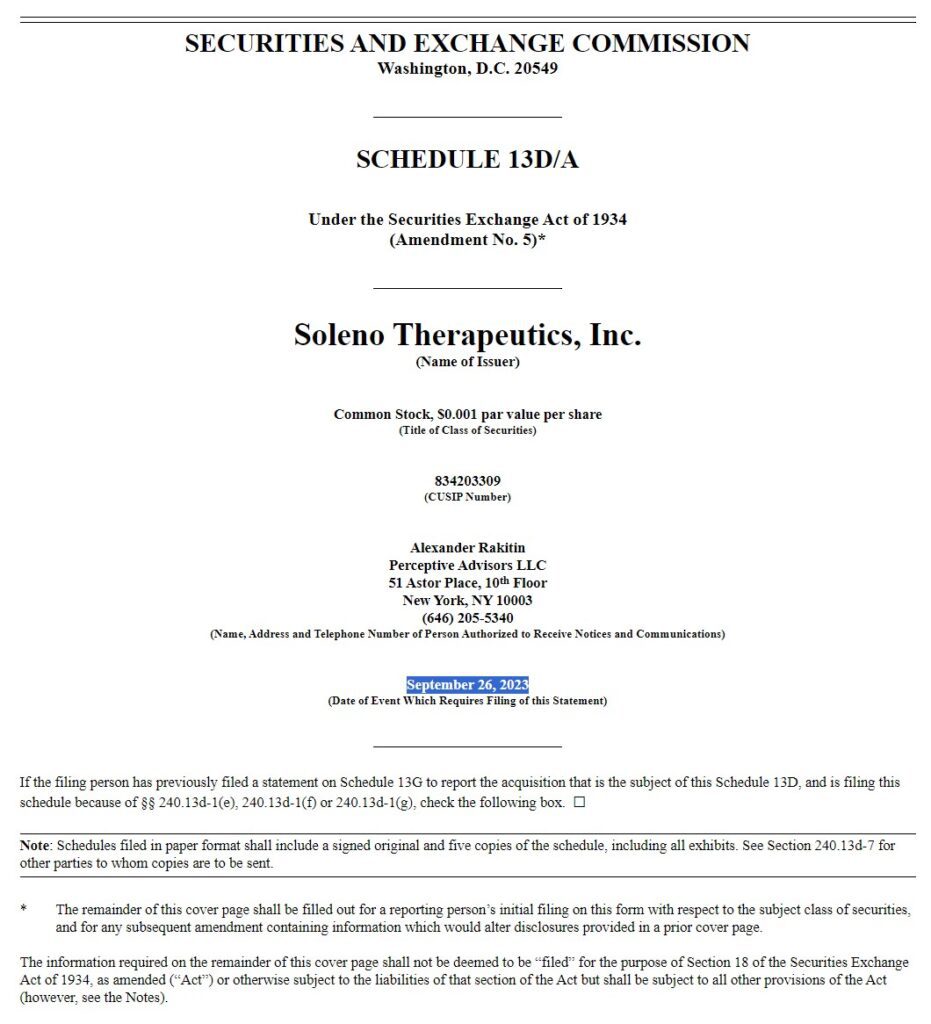

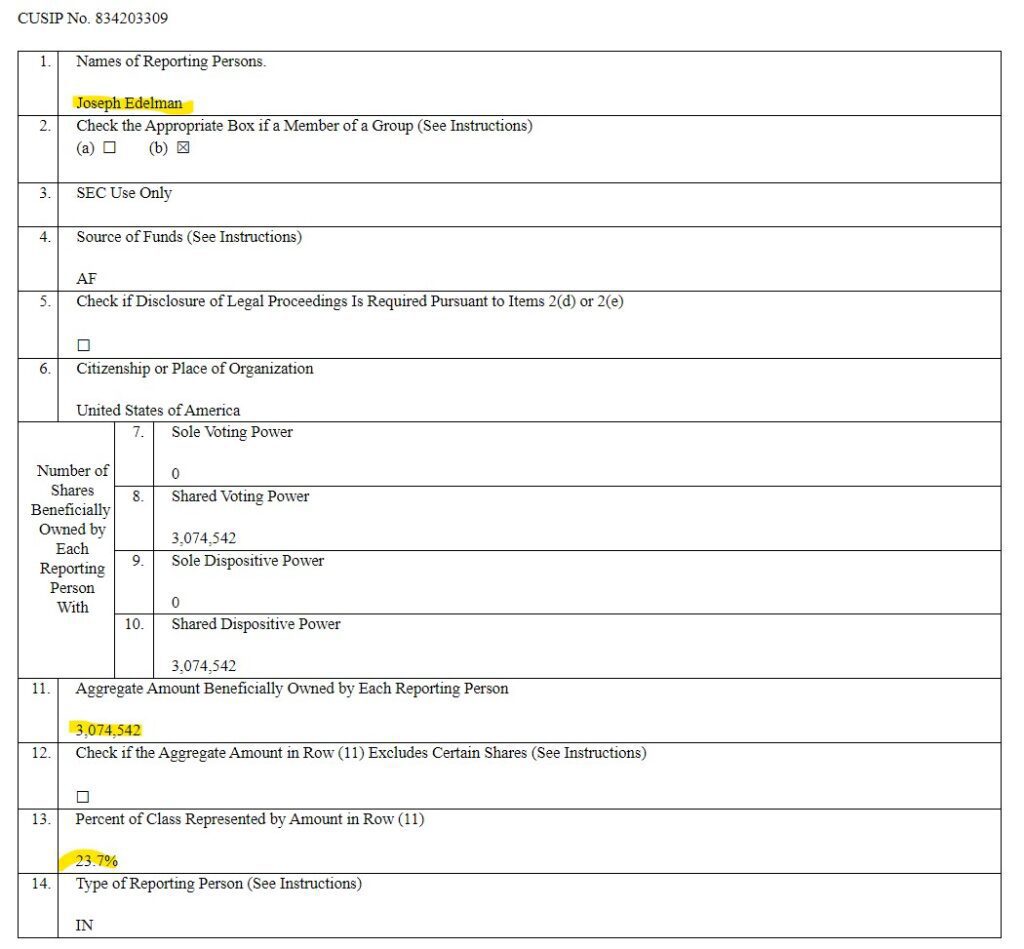

- Soleno Therapeutics (ticker: $SLNO): On September 26, 2023, a 13D filing showed Edelman’s stake of 23.7%. The stock saw a 577% increase within eight hours and a 1200% rise ever since.

- Applied Therapeutics (ticker: $APLT): Edelman filed two 13G forms on different occasions. The first returned 42% in three days and 80% within a month. The second resulted in a 117% gain over three days and 294% ever since.

Is Edelman just incredibly lucky? Or is there something else at play here?

Luck or Something More? The Million-Dollar Question

Edelman’s track record is nothing short of remarkable. He’s proven his ability to outperform the market, and his fund consistently posts some of the highest returns in the biotech sector. But the timing of his 13G filings raises questions.

Is it just luck that his filings precede significant price moves in stocks like $DRUG, $SLNO, and $APLT? Or is there something more going on behind the scenes? One thing is clear: Joseph Edelman is a man who knows how to navigate the wild world of biotech. Whether by design or chance, his involvement in certain companies often signals big moves.

What’s Next for $DRUG and Edelman?

As we continue to monitor the movements of Bright Minds Biosciences, I can’t help but wonder what the future holds. BMB-101 and BMB-201 might be promising treatments, but the real intrigue lies in the market’s reaction to Edelman’s involvement. As Edelman concluded his interview with Institutional Investor back in 2011: “If you don’t know who the sucker is, it’s probably you.”