Join Our Discord To Learn More!

Beyond The Price Tag: Unveiling the True Value of Investments with Valuation Analysis

Think you've got the market figured out? Sure, financial reports reveal a company's health, the charts show us past trends, but does that tell us the whole story? What if there was a way to peek under the hood, see beyond surface metrics, and pinpoint an investment's true potential? Enter valuation analysis, the secret weapon of veteran traders.

Fundamental analysis is like a first date. You get a general vibe, assess compatibility, and decide if someone's worth your time. But valuation analysis is like taking that person home to meet the family. You dig deeper, scrutinize finances, and determine their actual worth. It's fundamental analysis on steroids, revealing the intrinsic value hidden beneath the surface.

Imagine this: You see a shiny new stock, all hype and glamour. But with valuation analysis, you see through the glitz. You compare it to similar companies, analyze its cash flow, and uncover whether it's a diamond in the rough or a glittering fool's gold. Suddenly, investing isn't just a guessing game; it's a calculated science where informed decisions yield real results.

Why Is This Gold For Investors?

- Avoid overpriced hype: Don't be fooled by shiny promises. Valuation analysis helps you spot overvalued stocks before they crash, saving you from heartache and wasted capital.

- Discover hidden gems: Uncover undervalued stocks with explosive potential before the masses catch on. Valuation analysis helps you become a market maverick, finding value where others see only dust.

- Set realistic targets: Forget pie-in-the-sky dreams. Valuation analysis provides data-driven insights to set achievable goals and track your progress with laser focus.

- Invest with confidence: Ditch the fear and uncertainty. Valuation analysis equips you with the knowledge and tools to make informed decisions, turning you into a confident investor in control of your future.

3 Alt-Coins We Are Watching For The Bitcoin Halving 2024

Be A Step Ahead Of The Rest Of The Market

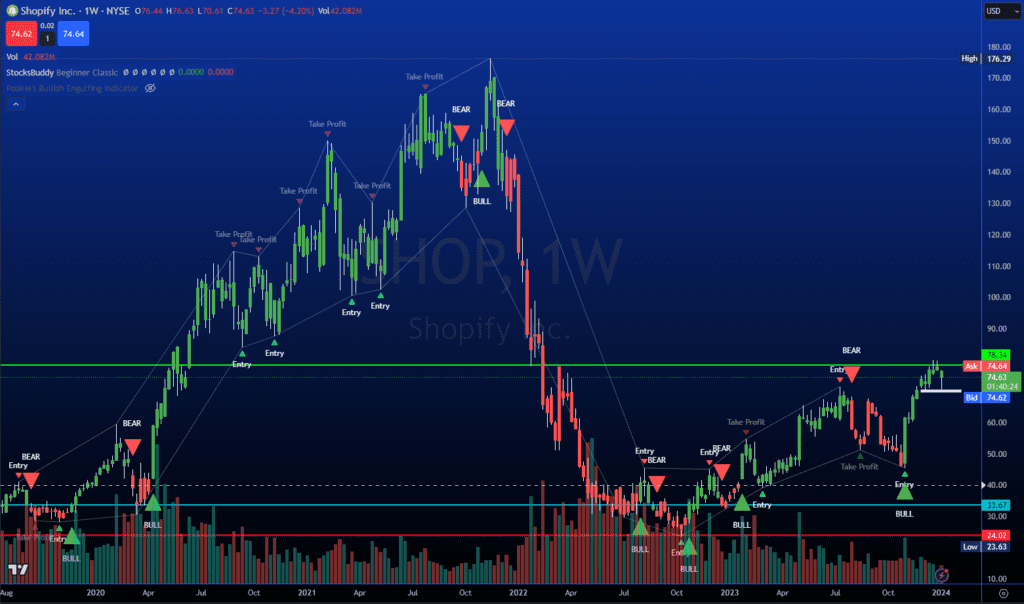

Remember Zack's recent article on $SHOP posted by Yahoo Finance? "Earnings Growth & Price Strength Make Shopify ($SHOP) A Stock To Watch." While $SHOP might seem tempting to the average investor, valuation analysis might paint a different picture. By building a precise financial model on the company, you could see a limited upside potential, saving you from a potentially risky ride.

How Our Exclusive In-House Analysts Are Trading $SHOP

"We're slapping a resistance level here and had a nice clean entry below at $33.67 on the weekly chart after the massive selloff from late 2022. This looks like a bearish flag in my opinion. If it can break over $90 and hold, it may have bullish potential, but it is at a point of value for the bears right here and may continue selling off to new lows. $SHOP has good potential as a growth candidate, but due to it's limited post-agreement valuation, the likelihood is higher that investors lose confidence and we see another deflation over time. Those investors are looking at better opportunities with higher valuation ceilings, such as $SNOW." -Steve Toggo