Updated 2/09/23 11 AM EST: Make sure to bookmark this page, as it will be updated regularly. It will include links to all of the stocks/crypto trade ideas that we discussed in our blog, as well as which ones have hit our price levels of interest for entry, which ones are near them, and which ones are still on watch. We also go over our winners and losers, as we want to be as transparent as possible with these trade ideas. We update in real time when levels of interest, targets, stop losses, etc are hit on our discord and twitter.

We also keep all our Blog Trades organized in a Google Sheets Doc which you can find by clicking here.

Notes:

- If you are up 5%-10%+ (depending on your risk:reward) we believe it is never a bad idea to secure profits by setting a stop loss or trailing stop loss.

- These trades are strictly based off of the charts. If you are up on a play, and there is a news catalyst coming (Fed Meeting, CPI data, earnings) and you’re unsure of the expected move due to it, it’s never a bad idea to take profits and let the catalyst shake out before re-assessing

- The "4H Entry" criteria strategy we use only counts during regular trading hours, not pre market or after hours candles.

- We teach an Options Trading Strategy as part of our 8 Week Options 101 Premium Course that goes over how to take the analysis from our blogs to find Options Trade setups. You can also check out classes 11-20 of our 50 Class Trading 101 Series for a breakdown on Options Trading.

- For "Break and Hold" one can wait for either a break and retest, a break and (3) 1H or 4H candle closes above.

- We LOVE to use StocksBuddy to help us determine potential areas to take profit before our targets are hit.

- Always do your own research before making any investment. This is only meant for educational and entertainment purposes only, not financial advice.

Stocks/Crypto That Hit Our Price Levels Of Interest

These trade ideas are meant for entertainment purposes only to show how we trade these plays based off of the strategy we teach in the discord. NFA, always DYOR!

$UBER UBER

We hit our bullish entry $64.05 on 1/18 and then again at 1/25 after a little dip. We are currently up nicely around 10% on this one.

$COST Costco

We hit our bullish entry $684.42 on 1/19 and then again at 1/26 after a little dip. We are currently up nicely around 6% on this one.

$DIS Disney

$DIS has hit a bullish $96.61 entry hit on 2/02. We are currently up nicely around 12% on this one and hit target 1.

$META Facebook Trade #2

We already took $META from $355.15 to $384.33 in the discord. On 1/23 META hit our trade #2 (option 3 above) bullish entry criteria $384.33. We are currently up 22% on this one.

$PLNT Planet Fitness

1/25 we got a bearish entry at $72.90. We are up 4% on this one, and already hit target 1 of $67.

$AAL American Airlines

Hit our $14.65 bullish entry 1/25 and hit $15.45 target 1 same day. Since then it dipped down near our entry level. We are up, but close to break-even on this one for those who didn't secure profits at Target 1 with us in the discord.

$INTC Intel

Hit our bearish entry 2/02 of $43.30. We are up on this one, but close to break-even.

$TGT Target

Target hit our bullish $142.19 entry on 2/01 and again on 2/06. We are currently up 3%.

Stocks/Crypto Near Our Price Levels Of Interest

Click Here For A List Of ALL The Blog Trade Ideas With Links On How To Find Them!

These are stocks/crypto that are nearing our price levels of interest. Be sure to read the blog posts to see the full trade idea breakdowns and news on these companies/project!

Potential Profits

$AMC AMC Theaters (Click Here For Full Trade Idea): $AMC hit our $3.85 bullish entry 2/06. On 2/09 we hit our $4.20 (noice) Target and continued pushing up without stopping until it hit $4.49 for a 16% potential profit.

$TKO Parent Company Of WWE And UFC: $TKO hit our bullish $78.87 entry level of interest on 12/19 and 12/21, but both times it went to the low $80 range before falling back below entry price. On 12/26 the price broke above entry and successfully tested that level as a new support. The price went as high as $82.82 on 12/29 before falling alongside the market to end the year and start 2024, back below our entry level of interest at $78.87, however $72 was our stop loss for this one. It bounced nicely on 1/08 back above $80. 1/23 Netflix bought the rights to Monday Night Raw (TKO is the parent company for WWE) and $TKO went past our 87.67 target, as high as $97.50 for a 11%-23% potential profit.

$GOOGL Google (Trade 1): We had 5% potential profit on the table for this one, for those with low reward on their risk:reward and set stop losses or trailing stops at 5% and higher. See trade 2 below for full details.

$GOOGL Google (Trade 2): $GOOGL hit our $135 bullish entry level of interest 12/18. It hit a high of $142.68 12/26 for over 5% potential profit (see trade 1 above). Tech stocks experienced a sector sell-off to start the new year, and $GOOGL was right along with it, dropping back down to $135, bouncing RIGHT off $135 for a second entry opportunity for those that didn't enter with us the first time (see trade 1 above). The price bounced nicely off of $135 on 1/08 and hit target of $150+ on 1/25 for 11%-13% Potential Profits.

$SAVE Spirit Airlines: We hit a bullish trade from $15.46 to target 1 of $16.25 for a 5% potential profit on 1/08 for those who set trailing stops or stops at target 1. For those that didn't sell for profit, it ended up stopping out (see losses below).

$SAVE Spirit Airlines: We hit a bearish/short entry 1/11 at $15.46. On 1/16 the stock dropped down to the $7 range where we suggested to take profits or set trailing stops to secure them, hitting a low of $3.99 for 50%-74% profit potential.

$DWAC Digital Acquisition Corp (Donald Trump Related Stock): We had an entry at $17.50, and another less risky option at $18.22. On 1/18 Donald Trump won the Iowa caucus, which caused $DWAC to surge past our moderate targets in the $20 range, and past our more risky target of $55, going as high as $62 for a 25%-250%+ potential profit.

$MCD McDonald's (Trade 1): We hit target 1 on this one on 12/13, from our $287.60 entry on 12/11 to $293+ for $5 per share profit, and was suggested to take profits or set stop losses as there was a Fed meeting the next day. That only translates to around 2% profit in equity, but that is why in our premium discord we also teach a strategy on how to play options contracts based off of the blog trade analysis.

$MCD McDonalds (Trade 2): The Fed Meeting (see trade 1 above) results were indeed met with a bearish response from the market, and $MCD went back below entry 12/15. On 12/18 we got a second opportunity for an entry when it broke back above $287.60 entry level. It went as high as $297.99 on 1/03/24. Then Oppenheimer downgraded $MCD to perform from outperform, and McDonald's Chief Executive Chris Kempczinski wrote in a LinkedIn post on 1/04 that its Middle East business was hurt as a misinformation campaign spurred a consumer boycott of the fast-food chain based on its perceived support for Israel. This, mixed with the drop by the market in general caused $MCD to drop back to our entry level, bouncing right off of it for a second entry opportunity for those who missed. . On 1/19 It hit Target 2 for 4% potential profit.

$PROPC Propchain Technology: We played this one from $2.22 12/22 down to $1.95 target 12/26 for a successful short/bearish 12% profit.

$NEAR NEAR Protocol: We played this one to $3.80 1/01 and had 10% potential profit on the table before StocksBuddy gave us a bear signal 1/02 and we suggested to take profits.

$FIL Filecoin (Crypto): FileCoin hit our bullish entry at $5.80 1/11 and went as high as $6.51, we suggested setting trailing stops or stops at 5% due to the rocky crypto markets with all the BTC ETF news for 5%-12% potential profits.

$META Facebook (Trade 1): On 1/08 we hit $355.55 entry. On 1/19 it hit target of $384.33 for a 8% profit.

$META Facebook (Trade 1): On 1/23 we hit $355.55 entry. They had earnings shortly after that which were positive and shot the stock up to 25% profit potential from our entry. In the discord we suggested taking profits or setting a trailing stop loss for those who were happy with that profit percentage. We still do have longer term targets on this one.

$AAL American Airlines: Hit our $14.65 bullish entry 1/25 and hit $15.45 target 1 same day for a 5% profit potential.

$PLNT Planet Fitness: Hit our entry 1/25 of $72.90 (bearish/short) and hit target 1 of $67 2/02 for a 8% profit potential.

$DIS Disney: $DIS has hit a bullish $96.61 entry hit on 2/02.We hit target 1 of $103.50 2/07 for a 7% profit potential.

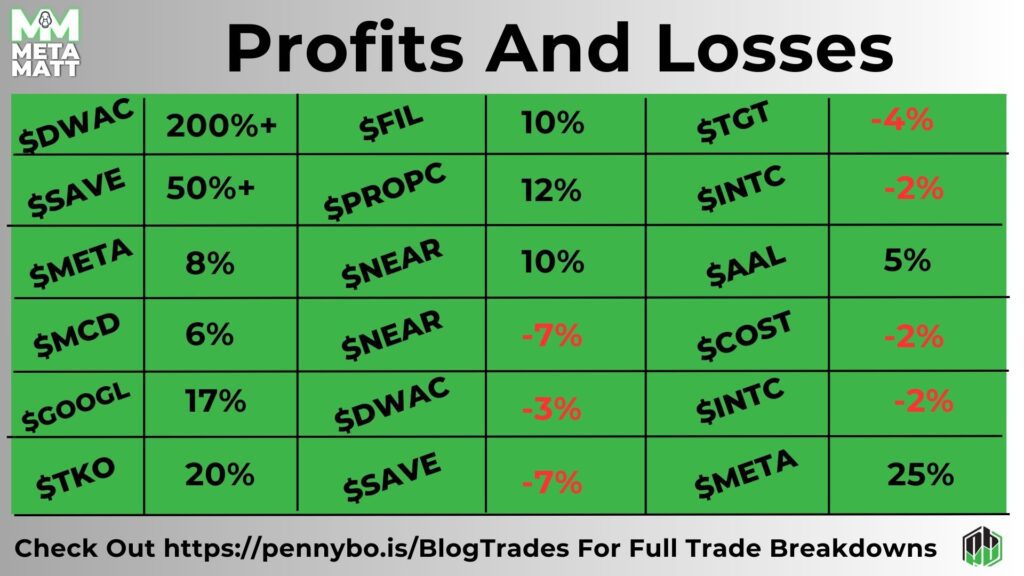

Total Profits: 2%, 4%, (5% X3), 7%, 8%, 10%, (5-12%), 12%, (11%-13%), 16%, 25%, (50%-74%), (25%-250%)

Potential Losses

$NEAR NEAR Protocol: We played this one to $3.80 and had 10%-13% potential profit on the table before StocksBuddy gave us a bear signal. However we didn't hit our target, so for those who held to stop loss of $3.50 there was a potential 7% loss.

$DWAC Digital Acquisition Corp (Donald Trump Related Stock): We did have a $17.50 entry hit stop loss at $17 for a 3% potential loss.

$SAVE Spirit Airlines: For those that didn't take profit at Target 1, we did hit stop loss for our bullish trade at $14.34 for a 7% potential loss.

$TGT Target: We hit our bullish entry in the discord but got stopped out for a 4% potential loss. Since then we re-hit entry for a succesful trade that is open currently.

$INTC Intel: We hit a bullish and bearish entry for Intel that both got stopped out on for 2% potential losses each for a total 4% potential loss. We have since re-hit entry, and that play is currently open.

$COST Costco: We hit a bearish entry in the discord but stopped out for a 2% potential loss at all-time-high levels. We then entered a bullish play that we are currently in and up nicely on.

Total Losses: (2% X3), 3%, 4%, (7% X2)

Breakdown

Here's the breakdown using the lowest numbers for potential profits. This is typically using our target prices, or prices that we suggested taking profit in our discord updates:

- Win Rate: The win rate is approximately 93.33%.

- Profit/Loss (P/L): The profit/loss ratio is calculated based on the total wins and losses relative to the initial investment. It results in a P/L ratio of approximately 220%.

- Total Return If $1,000 Invested in Each Trade: If you had invested $1,000 in each trade based on the fifth set of data, the total profits would be approximately $2,200.

Stay up to date on all our trade ideas

Here's the breakdown using the highest numbers for potential profits. This would be the potential profit for those who held past targets.

- Win Rate: The win rate is approximately 93.33%.

- Profit/Loss (P/L): The profit/loss ratio is calculated based on the total wins and losses relative to the initial investment. It results in a P/L ratio of approximately 677%.

- Total Return If $1,000 Invested in Each Trade: If you had invested $1,000 in each trade based on the fourth set of data, the total return would be approximately $6,767.