The AI PC Is Coming This Year

At the 2024 World Economic Forum last week, HP CEO Enrique Lores said "The AI PC is coming this year. And it's going to be probably one of the biggest changes in the PC industry since the PC was invented more than 20 years ago. It'll allow customers to run AI applications locally. So what today you need to do in the cloud with a large language model, you will be able to do that in the PC. And from a cost, security, and speed perspective, it brings a lot of advantages."

What Is An AI PC?

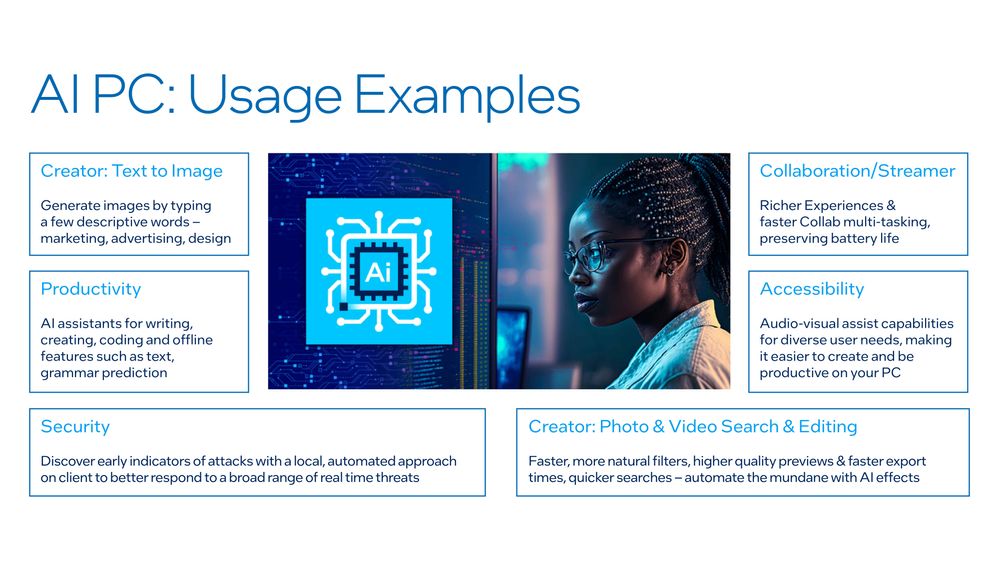

Companies are coming up with ways to integrate AI hardware and software directly into personal computers, enabling users to run AI applications without relying on the internet. This provides advantages like increased speed, security, and responsiveness. This might involve:

- Software infrastructure: Pre-installing AI frameworks and algorithms optimized for the hardware, making it easier for users to run AI applications without extensive technical knowledge.

- Processing power: Integrating specialized AI accelerators (such as GPUs or NPUs) alongside traditional CPUs to handle the intensive computations demanded by AI tasks.

- User interface: Developing intuitive interfaces that allow users to interact with AI features seamlessly through voice commands, natural language processing, and gesture recognition

How Does an AI PC Work?

There are many tech-companies creating chips and processors that integrate AI capabilities into existing personal computers. Consumers wouldn't need to buy entirely new PCs, just upgrade their existing ones with compatible graphics cards. The cost of these chips, while not insignificant, is still generally less than buying a whole new PC. By leveraging existing PC infrastructure, it could potentially reach a larger audience and drive faster adoption of AI on personal machines. Let's talk about some of the companies that are getting involved in the "AI PC" race:

Nvidia $NVDA

Leading the charge with new RTX 4080 Super, 4070 Ti Super, and 4070 Super chips specifically designed for AI capabilities on personal machines. These chips have dedicated AI processing cores and faster memory to handle demanding AI tasks. Optimized software and AI models further enhance performance and user experience.

- Focus: High-performance AI, especially for demanding creative tasks like image editing, video production, and scientific computing.

- Approach: Dedicated AI processing cores alongside powerful GPUs, offering hardware-accelerated AI computation.

- Target audience: Professionals and enthusiasts who require maximum AI performance for specific workflows.

- Integration: Upgradeable graphics cards for existing PCs.

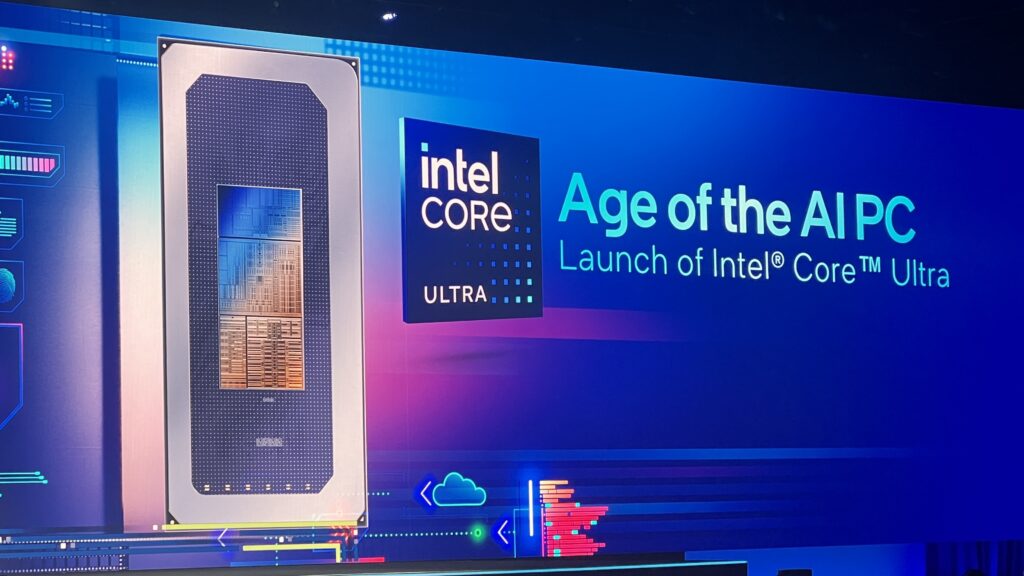

Intel $INTC

Intel is focusing on neuromorphic computing chips that mimic the human brain structure and are potentially more efficient for some AI tasks. Their Intel Core™ Ultra Processors focus on integrating AI features like built-in NPUs within traditional PC architecture, aiming for balanced performance and workload-specific acceleration. For example Samsung's Galaxy Book 2 Pro 360 integrates an Intel Evo chip with Intel Bridge technology, offering improved AI performance for tasks like image editing and voice analysis.

- Focus: Balance between traditional PC performance and AI acceleration for broader applications.

- Approach: Integrated NPUs and other AI features alongside CPUs and GPUs.

- Target audience: General PC users who want AI-enhanced productivity, creativity, and entertainment experiences.

- Integration: Upgradeable processors for both desktops and laptops.

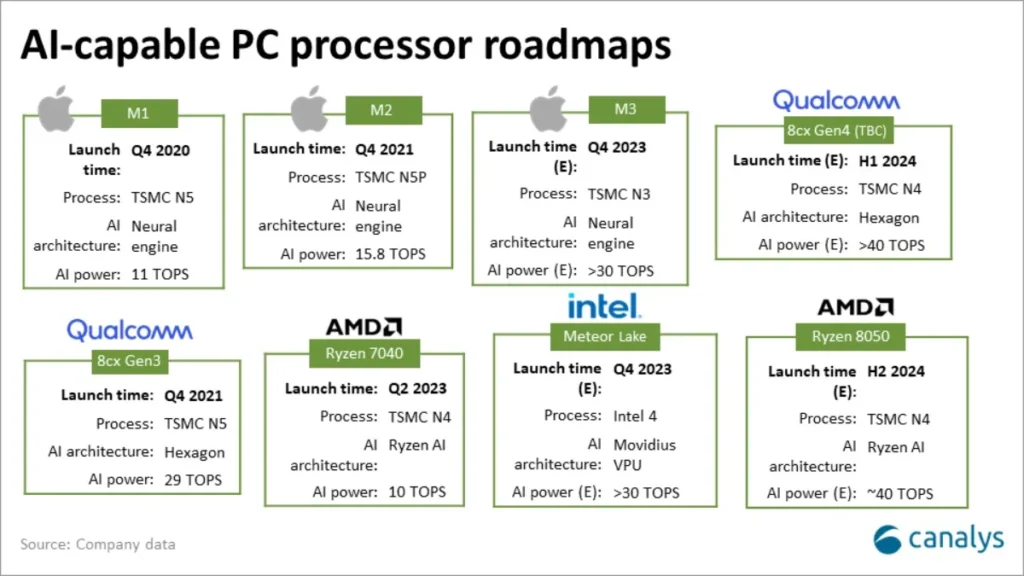

AMD $AMD

Similar to Intel, AMD is pushing their own AI-optimized processors and software frameworks. Their Ryzen 7000 Series Processors integrate AMD's Ryzen AI technology, including "AI accelerators" dedicated to handling AI workloads. This can potentially boost performance for tasks like image recognition, video editing, and machine learning compared to previous generations. Radeon GPUs are AMD's high-performance graphics cards, like the Radeon RX 6000 series, come with dedicated AI hardware called "Compute Units" which can be programmed for AI tasks. They also have software like Ryzen Master Overclocking Utility and Vitis Software Platform.

- Focus: Balanced performance between traditional PC tasks and AI acceleration for broader applications.

- Approach: Integrated AI accelerators ("AI engines") within Ryzen CPUs and dedicated AI features in Radeon GPUs, offering hardware-level acceleration for various AI tasks.

- Target audience: General PC users who want AI-enhanced productivity, creativity, and entertainment experiences.

- Integration: Upgradeable processors and graphics cards for both desktops and laptops.

Apple $AAPL

Apple's M1 chips already pack significant AI processing power, and they are rumored to be working on further integrating AI features into their Mac computers.

- Focus: Efficiency, tight hardware-software integration, and seamless user experience within the Apple ecosystem.

- Approach: Dedicated Neural Engine alongside CPU and GPU in custom M1 chips, optimized for Apple-specific AI applications like Siri and Face ID.

- Target audience: Mac users who value Apple's ecosystem, efficiency, and mobile device performance.

- Integration: Pre-installed and tightly integrated into all Apple desktops and laptops.

Microsoft $MSFT

Microsoft's Windows 11 OS now includes an "AI Toolkit" to facilitate AI development, and they are also exploring AI hardware solutions through Azure cloud services. Microsoft was, for a long time one of the biggest AI stocks of them all, as they have wasted no time integrating AI to their already iconic software franchise.

- Focus: Broad accessibility and developer tools for building AI applications on Windows PCs.

- Approach: Software-focused, providing AI frameworks and tools like the "AI Toolkit" without dedicated hardware accelerators. Users can utilize existing CPUs and GPUs for AI tasks.

- Target audience: Developers and Windows users who want to build, deploy, or access AI applications without needing specialized hardware.

- Integration: Software layer running on existing Windows PCs, compatible with various hardware configurations.

Stand-Alone AI PCs

However, not all computers will be able to accommodate the upgrades talked about above with AI chips and processors. Compatibility with the motherboard, power supply, and other components might be an issue for older or low-end machines. Additionally, while offering significant performance improvements, these new chips might not be necessary for casual users who don't require intensive AI applications. Companies like Nvidia, Intel, Apple and the others listed above are trying to bridge the gap between powerful AI technology and ordinary personal computers. They're providing the hardware upgrade path to turn regular PCs into AI-capable machines, without the need for a complete overhaul.

That being said, while entirely new, dedicated AI-specific machines for the general consumer market are still somewhat uncommon, there are some exciting examples approaching the concept from different angles:

Modular Workstations: Framework Laptop: This modular laptop, while not specifically labeled as an "AI PC", boasts high upgradability and an open ecosystem, allowing users to potentially attach future modules specifically designed for AI processing or integration with external AI engines.

Cloud-Native PCs: Dell Luna: This concept device envisions a future where users access powerful AI processing and applications through connected displays, relying on cloud infrastructure for heavy computations rather than traditional desktop hardware.

Specialized Edge Computing Devices: Nvidia EGX A100: This powerful edge computing platform, while not directly targeting consumers, showcases the potential for dedicated AI hardware deployed at the network edge, potentially offloading AI tasks from individual PCs in the future.

Mobile AI Workstations: Asus ROG Zephyrus G14 (2022): This high-end gaming laptop features an AMD Ryzen 6000 series processor with integrated AI features and Radeon graphics optimized for some AI workloads, offering a portable AI-powered experience for creators and professionals.

It's important to note that these examples represent more niche approaches and might not yet be mainstream consumer products.

PC Powered By An AI Assistant

Although not as ground breaking as the AI chips and processors, there is also an interpretation of the "AI PC" that involves traditional PCs with advanced AI assistants capable of handling various tasks like personal organization, information retrieval, contextual awareness, and automation.

Many players are already strong in this space, including:

- Microsoft: Cortana is their built-in AI assistant for Windows and other platforms.

- Amazon: Alexa is a popular voice assistant available on various devices, including PCs.

- Apple: Siri is their AI assistant integrated into Mac computers and other Apple devices.

- Google: Assistant is their widely used AI assistant with various capabilities and integrations. Check out our Google Trade Idea.

Fundamental Breakdown Of These AI-Stocks | $NVDA, $AMD, $INTC, $MSFT & $AAPL

When comparing the financial performance of Apple, Intel, Microsoft, AMD, and Nvidia, several key differences emerge. Nvidia stands out with the highest market cap, revenue growth, and EPS growth among the group. Intel has a lower market cap and negative revenue and EPS growth, indicating potential weaknesses in its financial performance.

On the other hand, AMD has a higher market cap and positive revenue and EPS growth, suggesting stronger financial performance compared to Intel. Intel's weaknesses lie in its negative revenue and EPS growth, while AMD's strengths are reflected in its positive revenue and EPS growth. Microsoft is known for its strong financial position and consistent growth in various segments of its business. Check out our Apple $AAPL Trade Idea.

Technical Analysis Breakdown Of These AI-Stocks | $NVDA, $AMD, $INTC, $MSFT & $AAPL

Intel, Microsoft, AMD and Nvidia all are showing Bullish Signals on the weekly chart on StocksBuddy. Apple is the only one that is showing a bearish signal. When we go down to the 4H timeframe, all 5 of these stocks show Bull Signals.

Try StocksBuddy With This DISCOUNT Link!!

Other AI Stocks To Keep An Eye On

So we already talked about Nvidia, Microsoft, AMD, Intel, and Apple. Let's talk about a few other stocks diving into AI that might be worth keeping an eye on.

1. Marvell Technology Group ($MRVL):

- Focus: AI networking and edge computing solutions.

- Approach: Developing AI-powered chips and software for smart cities, factories, and edge devices.

- Breakdown: Marvell's Aquavera processors and PandaX AI software enable real-time data analysis and intelligent decision-making at the network edge, powering applications like traffic optimization, predictive maintenance, and autonomous vehicles.

2. Qualcomm Inc. ($QCOM):

- Focus: Mobile AI and machine learning technologies.

- Approach: Integrating AI accelerators into their mobile chipsets and developing software platforms for on-device AI applications.

- Breakdown: Qualcomm's Snapdragon processors leverage AI for facial recognition, image enhancement, and natural language processing on smartphones and other mobile devices. They also offer the Snapdragon Neural Processing Engine for developers building AI applications.

3. C3.ai Inc. ($AI):

- Focus: Enterprise AI software platform.

- Approach: Provides pre-built AI models and applications for various industries like oil & gas, manufacturing, and finance.

- Breakdown: C3.ai's platform helps businesses implement AI solutions without extensive coding, democratizing AI adoption for enterprise users.

4. Palantir Technologies Inc. ($PLTR):

- Focus: AI-powered data analytics for government and commercial applications.

- Approach: Offers software and services for data integration, analysis, and decision-making using AI and machine learning algorithms.

- Breakdown: Palantir's Foundry platform is used by governments and organizations for predictive analytics, fraud detection, and risk management.

5. Appen Ltd. ($APPN):

- Focus: AI training data and annotation services.

- Approach: Provides high-quality labeled data for developing and training AI models across various industries.

- Breakdown: Appen helps companies acquire and manage the vast amount of data needed to train reliable and unbiased AI models, a crucial step in AI development.

6. Unity Software Inc. ($U):

- Focus: AI-powered tools for real-time 3D content creation and gaming.

- Approach: Integrating AI and machine learning into their game engine and development tools for realistic animation, character behavior, and game environments.

- Breakdown: Unity's tools allow developers to create immersive and interactive 3D experiences using AI for automated workflows, procedural generation, and real-time rendering.

7. Datadog Inc. ($DDOG):

- Focus: AI-powered cloud monitoring and application performance management.

- Approach: Uses AI to analyze IT infrastructure data and proactively identify issues before they affect users, improving operational efficiency.

- Breakdown: Datadog's AI-powered platform helps businesses manage and optimize their cloud applications, ensuring seamless performance and user experience.

8. Baidu Inc. ($BIDU):

- Focus: Leading AI research and development in China, with applications in various sectors.

- Approach: Developing AI technologies for autonomous driving, natural language processing, and cloud computing.

- Breakdown: Baidu's Apollo platform powers autonomous vehicles, their DuerOS voice assistant competes with Alexa, and their cloud platform leverages AI for efficient resource management.

9. Tesla Inc. ($TSLA):

- Focus: AI for autonomous driving and electric vehicle technology.

- Approach: Developing custom AI chips and software for Autopilot and Full Self-Driving features in Tesla vehicles.

- Breakdown: Tesla's AI expertise is core to their self-driving ambitions, making them a key player in the future of autonomous transportation.

10. iRobot Corp. ($IRBT):

- Focus: AI-powered robotics for home cleaning and automation.

- Approach: Integrating AI and machine learning into their Roomba vacuums and Braava mops for intelligent navigation and obstacle avoidance.

- Breakdown: iRobot's AI-powered robots learn cleaning patterns, adapt to room layouts, and personalize cleaning schedules, providing users with a hands-free cleaning experience.

What Our Exclusive In-House Analysts Think Of These AI-Stocks | Nvidia, AMD, Intel, Microsoft and Apple

I asked our exclusive in-house analysts what they thought about Nvidia, AMD, Intel, Microsoft and Apple. Here's what they had to say:

Ethan

"NVDA (most bullish) they are leading the race in AI with the most advanced GPU's on the market and have made it very public that they are constantly striviing to be on the cutting edge of AI. Also partnering with major companies like Amazon, Microsoft, and Meta.

Intel (least bullish) - INTC is my least bullish name because they haven't made nearly the strides the other chip makers have when it comes to the AI world. Still a solid company, but they are slowly but surely getting out performed by the faster younger companies like AMD and NVDA.

AMD/NVDA are extremely over extended. However I would like to keep catching some momentum scalps to the upside. We have some key whole number levels above (200 & 600) for both of these names. I put these together because they are in the same sector. Could easily start reversing soon, but will continue to watch for more upside momentum. MSFT is also a name I will keep an eye on for the same type of plays. Blasting through all time highs with the 400 level just above." -Ethan

SwingingBull

"Overall I'm the most Bullish on NVDA because they are leading the AI charge. And most Bearish on Intel because their financials are not that good, or not nearly as good as the others" -SwingingBull

MR StockLockProfits

"To quote Austin's Smash or Pass Segment... PASS on $AMD, P/E is supporting an overvalued valuation at this level, It will be hard to compete with $NVDA in their sector! Also recently downgraded by a few big analysts.

I know this isn't one of the 5, but I am actually going to go with $MRVL as my SMASH, Revenue growth is impressive & I think we will be surprised what we see over the next few years with this one!" -Mr SLP

Check Out Our $DWAC Trade Idea

PookiesRevenge

"Very Bullish on AMD and INTC, even more bullish on NVDA as the up-and-comer, prefer MSFT for long-term stable growth as it's the current king, and AAPL's only real advantage is it's in-house control of manufacturing and inflated price point for exclusivity. These are long term outlooks, short term I am bearish on pretty much all tech/finance for a bit." -PookiesRevenge

Check Out Our Free Trading Discord

Let's Take A Look At a Few Quotes From Austin's Weekly Monday 5PM Market Watch Stream About These Stocks!

10/2/23 1:01:19-1:02:29: "For AMD $115 is make or break. Above here, we're definitely going to $142. Above there, $185. If buyers step in with considerable volume, $122 is definitely in the cards short-term"

10/16/23 24:35-31:32: "NVDA has become the champion. We haven's seen much sympathy for AMD. However, AMD is about to unveil their top gun competitor to what NVDA is producing. There is potential for upside, especially quarter over quarter. We are ranging from $75 to $100. On the monthly, we are set up for a nice run if we can break trendline resistance. This will be a 2025 leap alerted in the discord when the time is right."

11/20/23 38:38-39:11: "If we continue on this breakout, especially after earnings, I expect to see $140 to $150. I also expect this to be a sympathy play with NVDA."

11/27/23 21:20-24:13: "Stocksbuddy signaled bull at $95. $127 to $130 is significant resistance I want to see broken. This is a great hold but I will not be buying more in no man's land."

12/18/23 25:05-27:18: "We took 30% on equities already. We broke resistance and will wait for break of $150 to trade again. I don't think there is crazy upside in the short-term."

1/08/24 58:00-59:06: "INTC, just a watch for now, but interested. I am hesitant about a potential double-top. However, we can play the range and buy at $42 to $44 and sell at $52. Right now we are in no man’s land."

1/16/24 30:56-32:53: "$AAPL, we have inside candles on the daily chart after gapping down off a Double Top, which usually signals bearish short-term. I expect us to come down to our mapped-out long-term trendline support, likely around $170 to $175. Worst case scenario we will come down and trade between $130 to $150."

How Our Exclusive Analysts Are Trading $INTC

"Let's watch fora break above $49 with a 4H candle close above it for a long/bullish position to $52.90 with target 2 at $55.20, stop loss below $47. On the chart I drew out, we are looking for a move above the white line with a 4H close above for entry. Red line would be the stop loss with the blueish/greenish lines being targets." -BTC_JAY

Option 1: Bullish

Entry: Watching for a break above $49 with a 4H candle close above.

Targets: $52.90, $55.20+

Stop Loss: Below $47

We also see a Fair Value Gap between $38.99 and $43.30 on the weekly chart.

Option 2: Bullish

Entry: Watching for a break below $43.30 followed by a 4H candle close back above $43.30.

Targets: $49, $52.90, $55.20+

Stop Loss: The low that was made after the price broke below $43.30 (before that 4H candle close back above $43.30)

Option 3: Bearish

Entry: Watching for a break below $43.30 followed by a retest of $43.30 as resistance.

Targets: $39, $36.36

Stop Loss: $45.15

Check Out The Rest Of Our Trade Ideas From Our Blog Posts On $BTC, $GOOGL, $M, $COST, $DIS & MORE!!!