"Best Opportunity Since 2020 Is Approaching"

Are you ready to capitalize on the next "opportunity market" cycle?

We've successfully identified and executed on previous opportunities, including snagging PLTR at $8, HOOD at $7, and NVDA below $20. As the market shows signs of entering another "opportunity cycle" with the election coming up, we're excited to share our latest trade ideas with you all.

In this blog, we'll dive deep into potential trades for $HOOD, $PLTR, and $NVDA. Plus, we've got a Bitcoin prediction and a FREE Trade alert waiting for you at the end of this article!!!

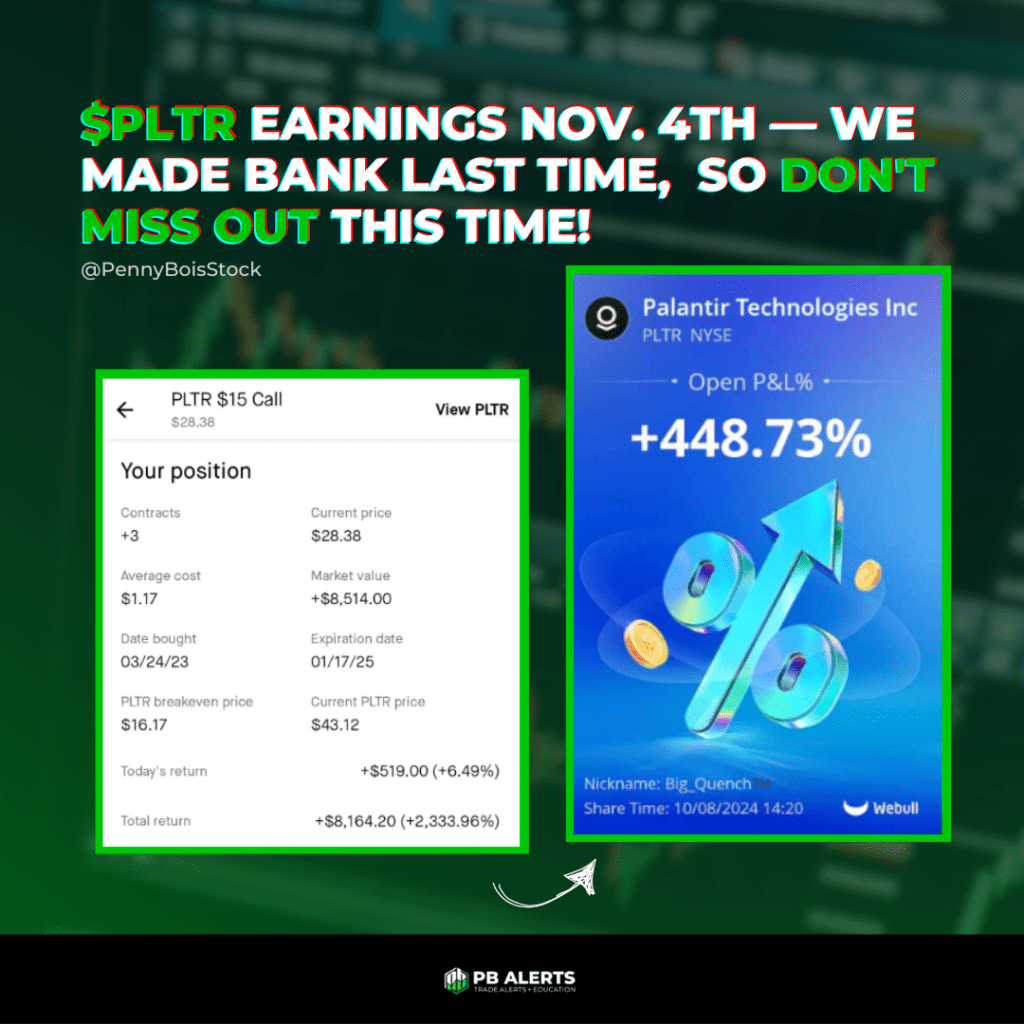

Palantir $PLTR Earnings November 4th

Palantir Technologies (NYSE: PLTR) is set to release its third-quarter 2024 earnings report on Monday, November 4th, after the U.S. markets close. Investors interested in attending the live webcast and replay can pre-register on Palantir's investor relations website (investors.palantir.com). Additionally, shareholders can submit and vote on questions beforehand using the "Say Technologies" platform.

Check out Shay and Austin every Monday 5PM EST on our Youtube, X and Discord!!

Historically, Palantir has a knack for exceeding analyst expectations. This trend continued throughout 2024, with the company consistently surpassing market projections. However, the current analyst consensus recommendation for PLTR sits at a "Hold," suggesting a wait-and-see approach from many brokerages.

Short Interest in Palantir Raises Concerns

Despite its impressive year-to-date performance, Palantir has seen a surge in short interest, indicating that some investors are betting on a potential price decline. The company's high valuation, coupled with recent reports of Thiel's significant stock sales, has raised concerns among market observers.

While Palantir's strong financial results and strategic partnerships have fueled its growth, the elevated short interest suggests that some investors believe the stock may be overvalued. It's essential for potential investors to carefully consider these factors and conduct thorough due diligence before making any investment decisions.

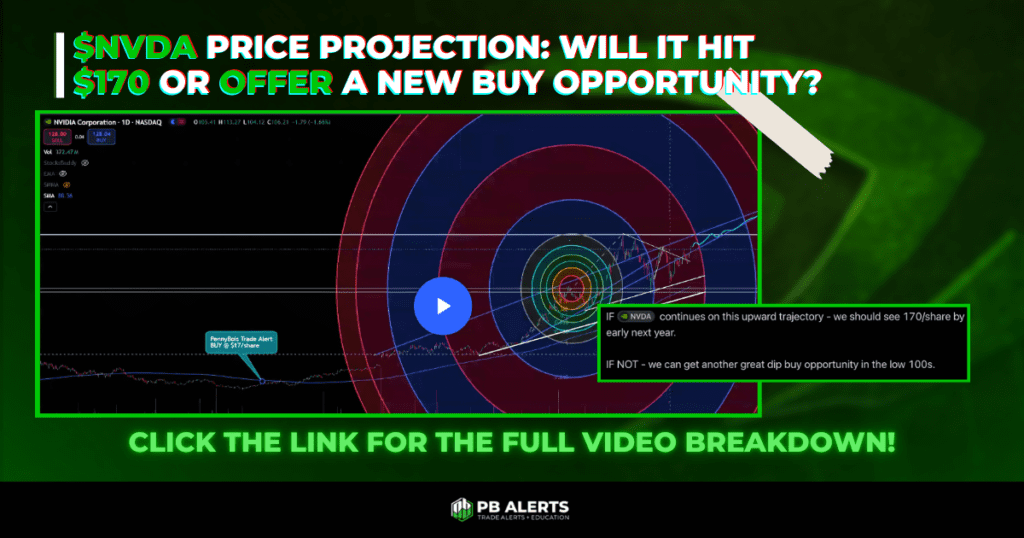

Nvidia's Stock Stumbles: A Buying Opportunity?

Nvidia (NVDA), the leading designer of graphics chips, took a hit yesterday, with its stock price dropping 6.8% in the morning session. This decline came in response to news from ASML, a major supplier of equipment used in making advanced chips.

Click Here to see Austin's full chart breakdown of $NVDA

ASML projected lower-than-expected sales for fiscal year 2025 and reported weaker-than-anticipated bookings for the quarter. This suggests a potential slowdown in the chipmaking industry. ASML's CFO lowered their expected contribution from China, a significant market, from 49% to 20%. This indicates potential weakness in the region's demand for chips. As a major customer of ASML's technology, Nvidia is susceptible to these industry trends.

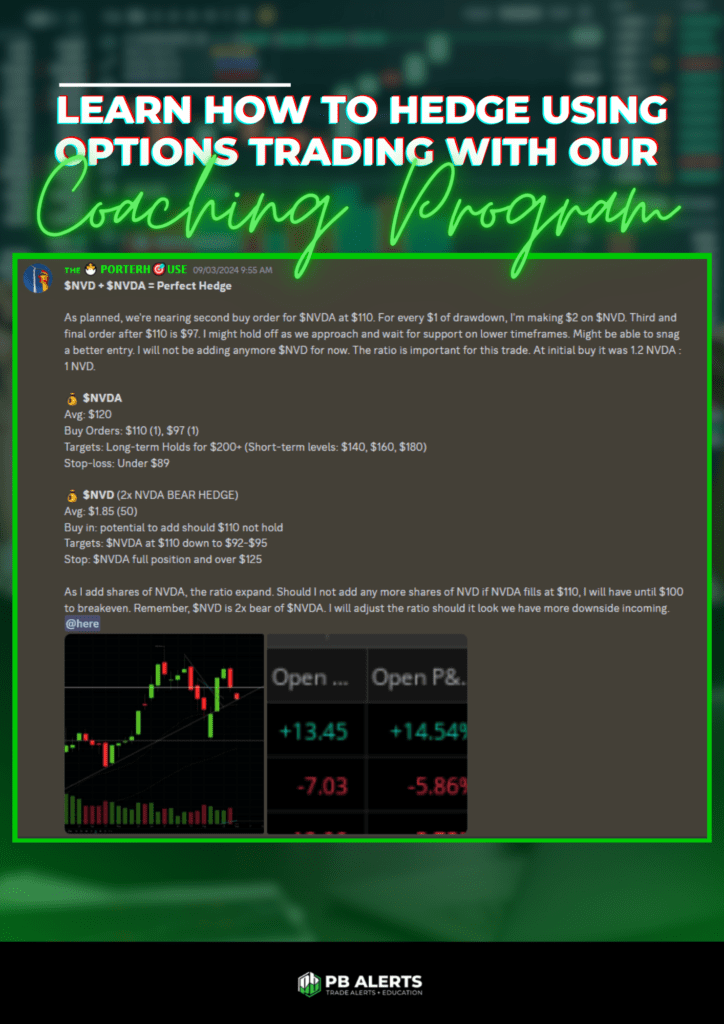

Using Options To Hedge $NVDA Trade

Hedging is a risk management strategy used to offset potential losses from an investment. In the case of options, it involves using a combination of options contracts to protect an existing position. It involves a few factors:

- Underlying Asset: The security you're trying to protect, such as Nvidia (NVDA) stock.

- Call Options: Contracts that give you the right to buy the underlying asset at a specified price (strike price) within a certain timeframe.

- Put Options: Contracts that give you the right to sell the underlying asset at a specified price (strike price) within a certain timeframe.

There are different types of ways to use this strategy with Options Contracts such as:

- Protective Put: Buying a put option on the underlying asset to protect against a decline in price.

- Covered Call: Selling a call option on the underlying asset while holding the shares. This can generate income but limits potential upside.

- Collar: Combining a protective put and a covered call to create a defined range within which the stock price can move without incurring significant losses or gains.

It's important to consider the cost, time value and volatility when using these types of strategies. Options trading can be complex and involves risks. It's essential to have a thorough understanding of options strategies before making any investment decisions.

Click here for SwingingBull's Options Trading Coaching Program where he teaches strategies like these, The Wheel, Spreads, and more!!

"The Legend Awakens" At Robinhood $HOOD

"Join us as Robinhood Chairman and CEO, Vlad Tenev introduces the world to our legendary new trading products during the Robinhood Presents: The Legend Awakens livestream. Wednesday, October 16th 3:30 PM PT / 6:30 PM ET" -Robinhood Homepage

Mad Maverick's Trade Idea For $HOOD: Our swing trading coach is looking for an entry if $HOOD can break and hold $27, with a long term target of $37. If $HOOD rejects the $27 level he is looking for a bearish entry with targets at $24, $20, and $17. Check out his coaching program to see how he finds and plays these plays!

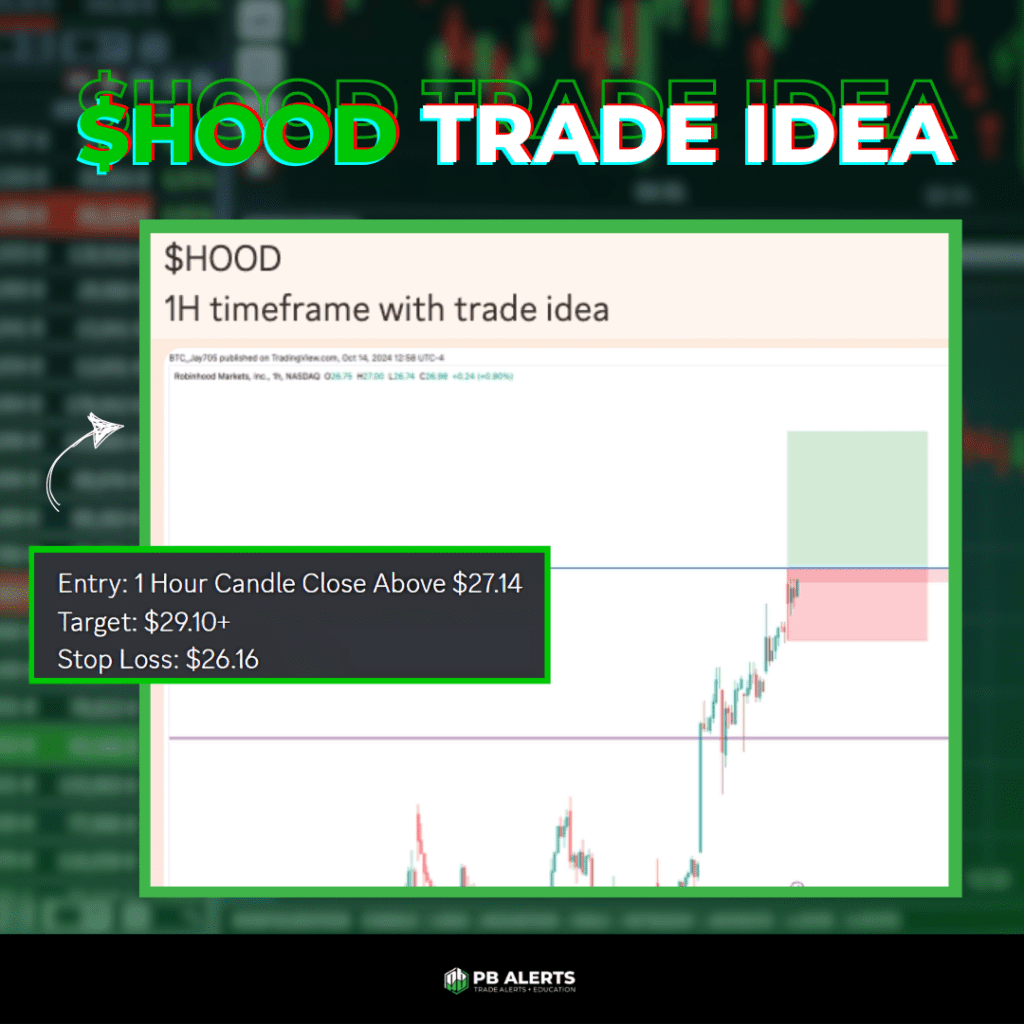

Jay's Trade Idea For $HOOD: Our technical analysis (charting) coach Jay also has a trade idea for $HOOD. He is looking for a 1 Hour Candle close above $27.17 (during regular trading hours) for his entry, with a target at $29.10+ and stop loss at $26.16. Check out Jay's coaching program to see how he finds and trades these!!

Remember these are for entertainment purposes only and NOT financial advice!!!

Middle East Tensions Fuel Defense Stock Demand

The ongoing conflicts and tensions in the Middle East, such as the recent clashes in Israel and Gaza, continue to drive significant demand for defense systems and advanced military technology. This geopolitical instability is a major factor contributing to increased government spending on defense, benefiting companies like Raytheon Technologies ($RTX) and Lockheed Martin ($LMT).

These defense contractors provide a wide range of essential military equipment, including missile defense systems, surveillance technologies, and fighter jets. As conflicts intensify, governments seek to enhance their military capabilities, leading to increased orders for these products. Additionally, countries in the region often boost their defense budgets to anticipate future threats and maintain a technological edge.

This heightened defense spending directly benefits companies like $RTX and $LMT, driving up revenues and potentially boosting their stock prices. The multi-year contracts associated with defense contracts provide long-term stability to their revenue streams, even during periods of regional uncertainty.

Investors should closely monitor developments in the Middle East as they can significantly impact the demand for defense products and the financial performance of companies like Raytheon and Lockheed Martin.

Will Bitcoin Hit $70K By Halloween?

The crypto world is buzzing with anticipation as Halloween approaches, with many investors wondering if Bitcoin (BTC) will hit the $70,000 mark by October 31st. While predicting the future of cryptocurrencies is always challenging, several factors could influence Bitcoin's price in the coming weeks.

Macroeconomic conditions, regulatory developments, institutional adoption, technical analysis, and market sentiment all play a role in shaping Bitcoin's trajectory. A favorable macroeconomic environment, positive regulatory changes, increased institutional adoption, bullish technical indicators, and positive market sentiment could fuel a rally towards $70,000.

However, it's essential to approach cryptocurrency investments with caution and be prepared for volatility. The crypto market is highly speculative, and prices can fluctuate rapidly. While the factors mentioned above suggest that a $70,000 price target is not entirely out of reach, unforeseen events could impact Bitcoin's trajectory.