Day 1 : Building a Watchlist and explaining the strategy

Day 2 : $PLTR Trade Idea

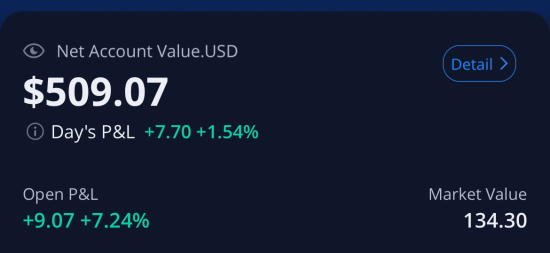

Day 3: Buying $HOOD

Day 4: Up 5% on $HOOD

Day 5: Entered $UA Trade

Day 6: Trading In Puerto Rico

Day 7: Introducing Beacon

Day 8: S&P 500 Record Highs

Robinhood Expands Crypto Horizons with Bitstamp Acquisition

In a move to solidify its presence in the global cryptocurrency market, Robinhood announced a $200 million acquisition of Bitstamp, a leading European crypto exchange. This strategic purchase marks Robinhood's significant foray outside the United States, offering its user base access to a wider range of cryptocurrencies and potentially new features available through Bitstamp's established platform. The deal, expected to close in the first half of 2025, signifies Robinhood's confidence in the future of crypto and its commitment to becoming a one-stop shop for all things digital assets.

Our Robinhood $HOOD Trade

Stop Loss Change: We have decided to move our Stop Loss up to "break even", which is $20.90. What this means is that our stop loss is now where we entered, that means that if we get stopped out, we "break even" (don't make any money, but don't lose any money). Robinhood $HOOD was trading at $23 when we mentioned this in our discord (make sure to follow our discord for real time updates on these trades). This means that our risk is now zero.

Options For Selling At Target 1: So Robinhood $HOOD closed the day (6/7) at $23.39, so we have a few options if we get to our $23.74 target...

- Option 1: Set a limit order to lock in profits at Target 1 $23.74.

- Option 2: Watch the chart and based on the price movement we can decide to instead let the price go above $23.74, and then use trailing stop losses to make sure we secure profits at/above target 1.

Option 1 is the “set it and forget it” style. This takes minimal time invest, and is susceptible to less emotions (other than FOMO) and risk. Option 2 could produce more reward, as we can sell above Target 1, but it is more time consuming as we have to watch the price movement and set trailing stops.

We also need to decide how many shares to sell at target 1. Do we sell all and move onto the next play? This limits our reward not holding out for target 2, but also limits our risk of not hitting target 2 and going back below target 1 and missing out on profits. This could bring about FOMO if we sell and then we reach target 2, but eliminates the other emotions that could come holding on for target 2.

Do we "Hodl" all our shares for target 2? This is risking securing our profits, which could cause FOMO and other emotions if it drops before target 2. If could limit FOMO if it does rip to target 2. This would be high risk, high reward.

Or do we do something in-between and sell 50%-75% of our shares at target 1? And then leave the rest for target 2? Sure we could end up getting FOMO if the stock goes up or down after target 1, but we are securing profits while still setting ourselves up for profits if we get to target 2.

I personally am going to see what my schedule is looking like tomorrow and if I have time to watch the chart. If I don’t have time I’ll just set a limit order for 50% of my position to sell at target 1, and an alarm on webull for when that price is hit (and a few for when it gets close) so that I can evaluate what to do then. What you do should be based off of your schedule and emotions. The goal is to set ourselves up for success by being aware of what emotions we struggle with as traders, and what situations those occur, so we can manage or avoid them. Regardless, I’ll be updating everything we do in the discord as it’s being done. Look for a video from Jay and I with an update and some new plays tomorrow (6/8)!

How The Rest Of Our Plays Are Looking

Right now $UA is our only other open play. There isn't really much to update on that one. $SYM is getting close to our price level of interest for entry of $37.22, and will be on watch for tomorrow.

Interested In Having Jay As A Trading Coach So That He Can Teach You This Strategy? Click Here!!