Day 1 : Building a Watchlist and explaining the strategy

Day 2 : $PLTR Trade Idea

Day 3: Buying $HOOD

Day 4: Up 5% on $HOOD

Day 5: Entered $UA Trade

Day 6: Trading In Puerto Rico

Day 7: Introducing Beacon

Day 8: S&P 500 Record Highs

Day 9: Robinhood Makes Moves Into Crypto

Day 10: Roaring Kitty Meows

Check out how I’m using TraderSync to track my trades for this account

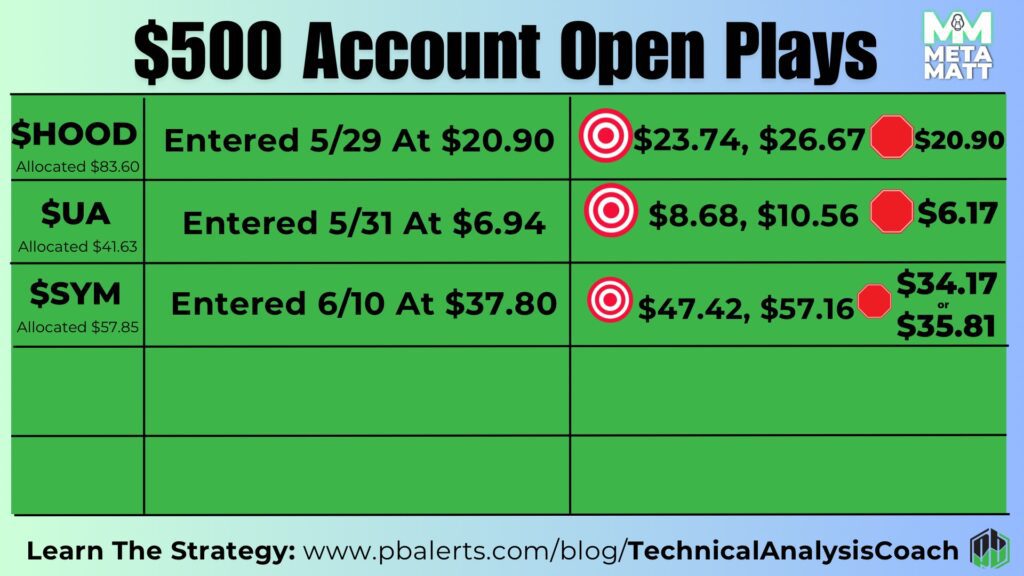

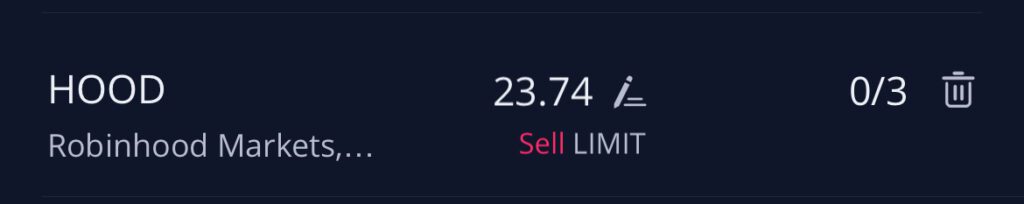

$HOOD Update

So far our $HOOD (Robinhood) trade is doing well! We are up around 11% and nearing in on target 1!! I will be selling 3 out of 4 shares at $23.74 target 1 via a Limit Order.

$UA New Stop Loss

We are moving up our stop loss here in $UA. We are keeping the $6.17 stop loss, but if we get a 4H candle close below $6.63 we will exit this trade. How you personally handle your stop loss is up to you of course, just like your sell targets for $HOOD!

We Entered $SYM Today

$SYM closed a 4H candle close above $37.22. I was able to use Webull’s fraction share market order feature to buy .5 shares, and then bought a full share as well. This was I was close to the $50 that we planned to allocate to this trade.

Target: $47.42, $57.16

Stop Loss: $34.17

$35.81 was the low that was made before moving back above our entry level of interest so could be used as stop loss for less risk

$GME Trade Idea

We are looking for the price to go below $17.70 and then enter upon a 4H candle close above $17.70. Stop loss would be below the low that is made before the 4H candle entry close. Targets $30.50 where we are selling the majority of shares, and leaving a “moonbag” for $50+ to ATH.

If we keep falling after $17.70, then we are watching $5.60 for the same entry setup with the price breaking below $5.60 followed by a 4H candle close back above $5.60 for entry. We aren’t trying to catch falling knives here with $GME. Target would be $15.94. Stop loss would work the same way as the other trade.