Day 1 : Building a Watchlist and explaining the strategy

Day 2 : $PLTR Trade Idea

Day 3: Buying $HOOD

Day 4: Up 5% on $HOOD

Day 5: Entered $UA Trade

Day 6: Trading In Puerto Rico

Day 7: Introducing Beacon

Day 8: S&P 500 Record Highs

Day 9: Robinhood Makes Moves Into Crypto

Day 10: Roaring Kitty Meows

Day 11: $GME Trade Idea

Day 12: $NIO Trade Entry

Day 13: Taking Profits In $HOOD

Stopping Out Of $UA Early To Limit Risk

This blog entry is for the trading day of 6/13

We had a 4H close below $6.63, so we decided to cut this one early to limit our overall risk. Our original stop loss was $6.17, but upon reassesing the market, our trades, and our portfolio we decided to move up to the stop loss (see the video above) to a 4H candle close below $6.63.

We have some other ways of playing this if we want to re-enter $UA. We don't want to force any trades or revenge trade here. Even though we stopped out, we did it via our plan and followed it perfectly.

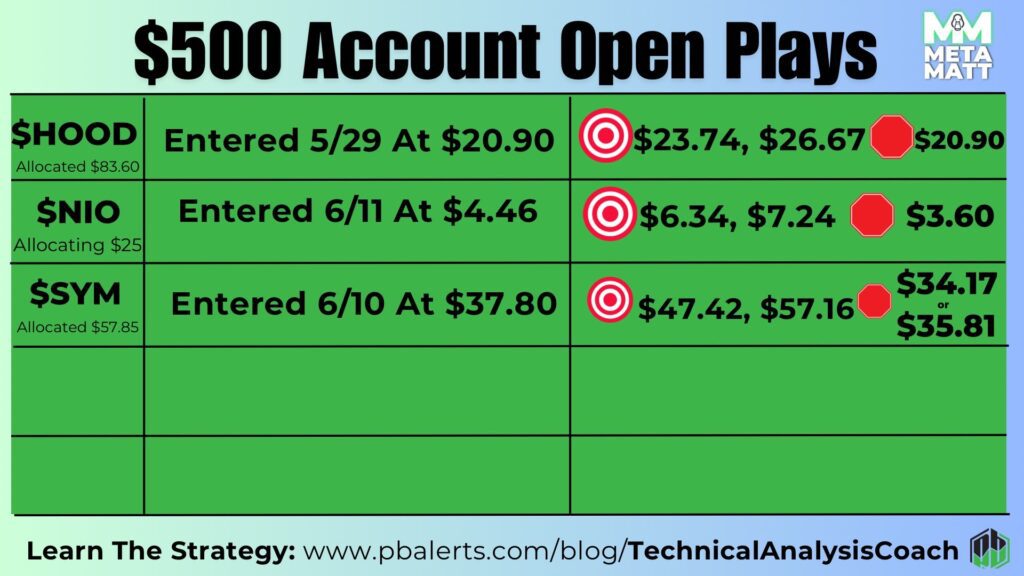

As you can see our wins our outweighing our losses. We are using risk management to make sure that our account isn't able to be "blown up" by one bad trade, as well as ensuring that our losses won't eat up our gains.

As you can see we are up on our $500 account, and all we had to do so far is make 4 buys so far and 2 sells, that's it!! The best part about this, is that because we set alarms on our brokers when our price levels or interest are hit, we don't have to stare at the phone all day to trade these plays!

TraderSync Updates

I am also using TraderSync to update my trades. You can check out my past blog going over how I am using TraderSync for these plays.

I didn't make any mistakes for $UA, so I don't have much to update on TraderSync for this trade. Looking at my running P/L for the trade, it looks like at the start of the trade I was up as high as $0.77, before the stock started dropping and I stopped out.