Day 1 : Building a Watchlist and explaining the strategy Jo

Day 2 : $PLTR Trade Idea

Day 3: Buying $HOOD

Day 4: Up 5% on $HOOD

Day 5: Entered $UA Trade

Day 6: Trading In Puerto Rico

Day 7: Introducing Beacon

Day 8: S&P 500 Record Highs

Day 9: Robinhood Makes Moves Into Crypto

Day 10: Roaring Kitty Meows

Day 11: $GME Trade Idea

Day 12: $NIO Trade Entry

Day 13: Taking Profits In $HOOD

Day 14: Stopping Out Of $UA

Day 15: Stopping Out Of Everything

Day 16: No FOMO

Day 17: 6 New Trade Ideas

Day 18: Entering $ACB Trade

Day 19: DXY Tells Us To Stay Out Of The Market

Day 20: "Shoulda, Coulda Woulda"

Day 21: $CCL Hits Target 1

Day 22: Trading Psychology Book Club Week 1

Day 23: $NKE Earnings Play

Bonus: Using TraderSync To Track My Trades For This Account

Interested In Having Jay As A Trading Coach So That He Can Teach You How He Finds These Trades? Click here to get started!

$SNAP Day Trade Setups

We are watching $SNAP for a short term trade for Monday. We are only looking to enter between 10AM EST and 11AM EST, so if the setups happens outside of that hour then we aren't going to enter.

We are watching for a break below $16.31 followed by a 15 Minute candle close above for entry. Target at $16.52+ with the stop loss at the low that was made before the price broke back above $16.31.

We are also watching for a break below $16.05 followed by a 15 Minute candle close above for entry. Target at $16.31+ with the stop loss at the low that was made before the price broke back above $16.05.

We are also watching for a break below $15.79 followed by a 15 Minute candle close above for entry. Target at $16.05+ with the stop loss at the low that was made before the price broke back above $15.79.

$NKE Nike Dropping Like It's Hot

$NKE earnings came out, and investors DID NOT like the results!! Nike dropped from the $90 range to the $75 range today.

This is PERFECT for our trade idea for $NKE.

Using the 4H strategy where we wait for price to break below our area of interest and then 4H candle close back above for entry...

Entry Levels Of Interest: $88.66 $82.22 $71.37 $60

$88.66 Target $96.22, $99

$82.22 Target $88.66

$71.37 Target $82.22

$60 Target $71.37

The lower we go, building bullish divergence the whole time and leaving lots of Fair Value Gaps behind, the better chance we can see a big move up. So we actually want this to go down personally for our trade idea to have more conviction.

The price blew past our first two levels of interest, and is now heading towards our $71.37 level. We are going to see how it plays out here.

$SYM Update

$SYM is coming back to our original entry level of interest. If we close today (6/28) above $35 we will be setting a Limit Order at $35. Target at $42.45 and stop loss $31.20

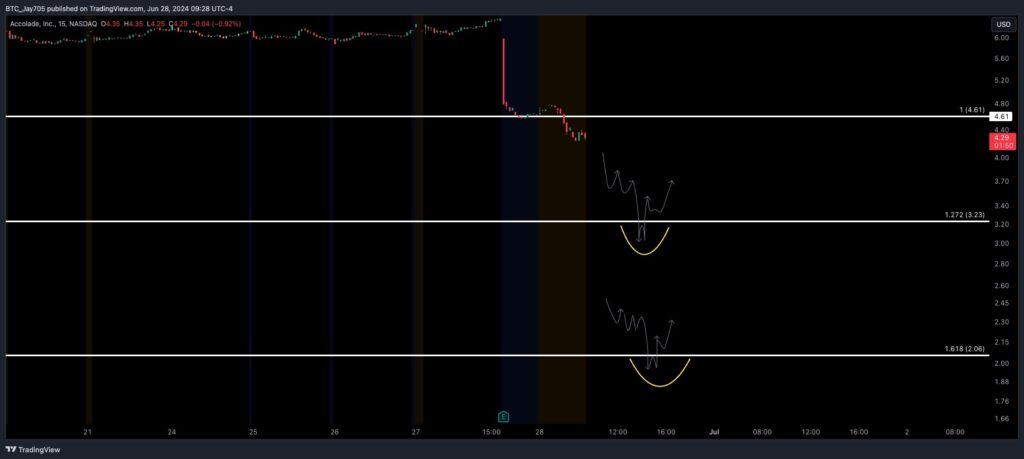

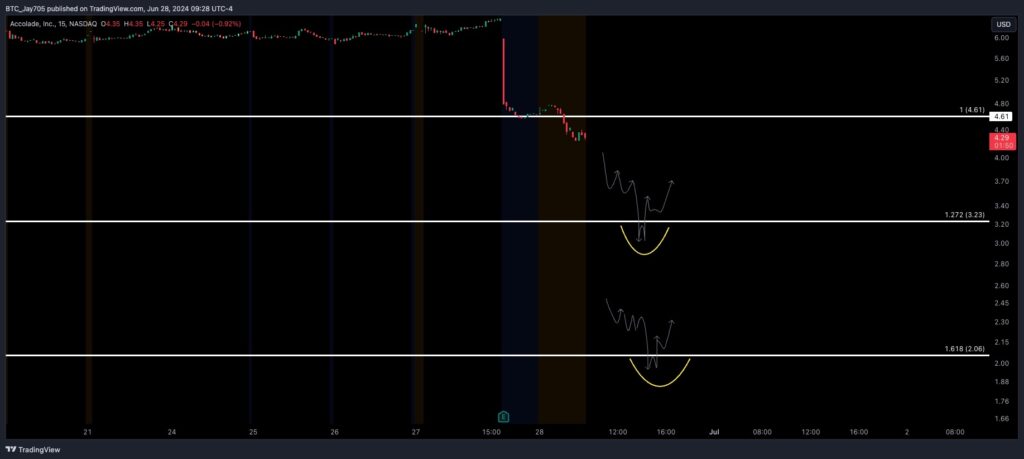

$ACCD New Trade Idea

We are looking for the price to break below $3.23 and then have a 1 Hour candle close back above $3.23 for entry. Target is $4.61+, Stop Loss at the low that was formed before the price broke below $3.23.

We are watching $2.06 with same entry and stop loss criteria, if the price keeps dropping from here. Target $3.23 for this.

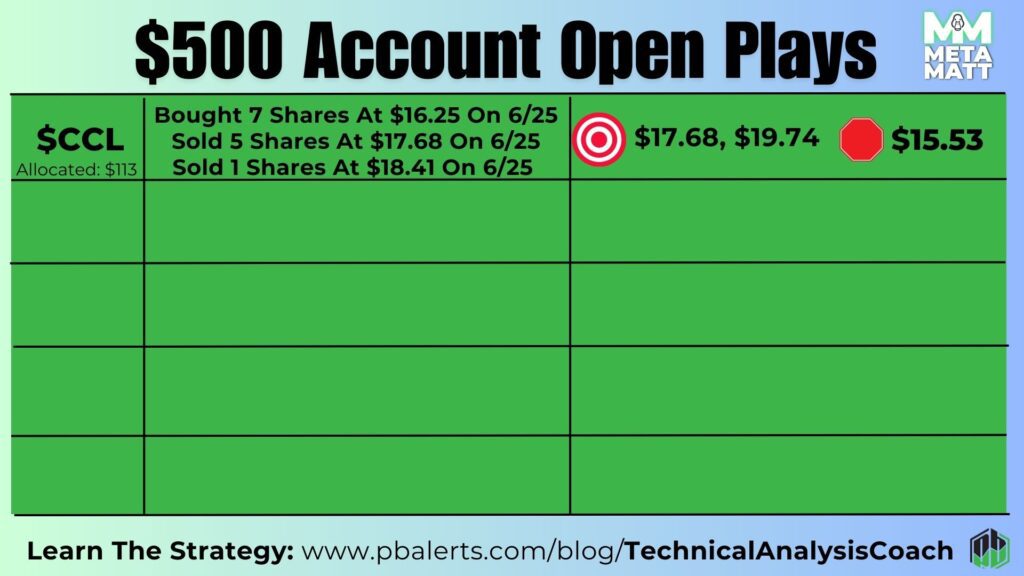

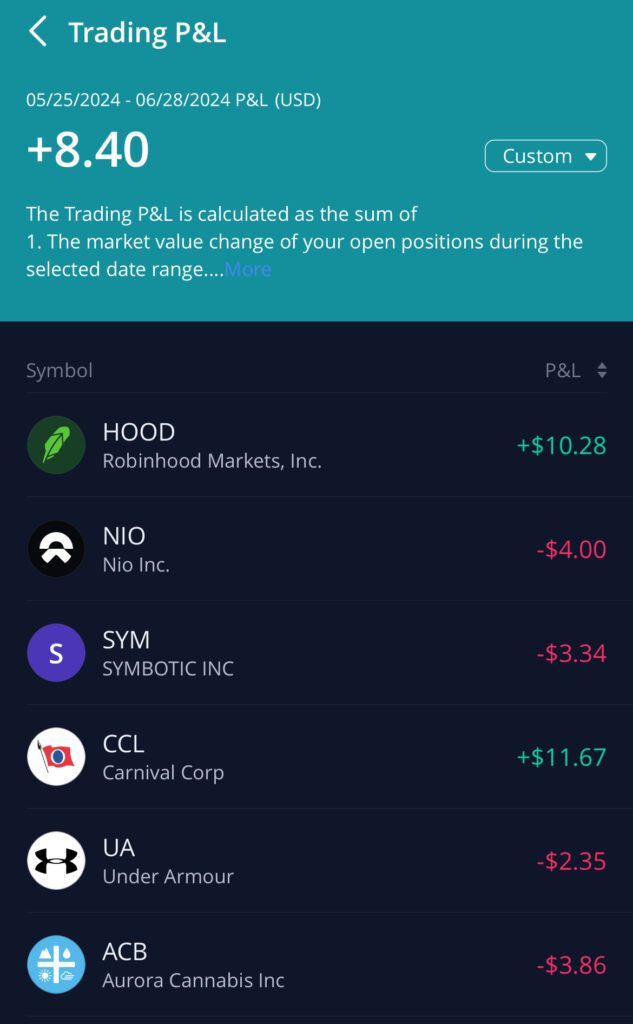

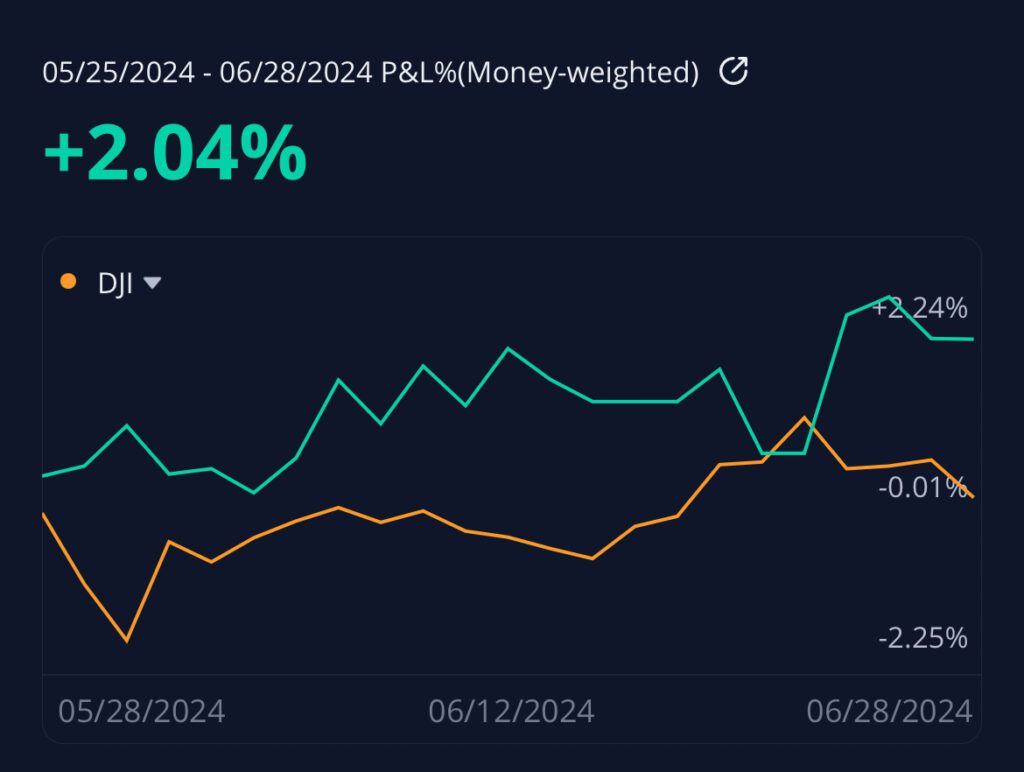

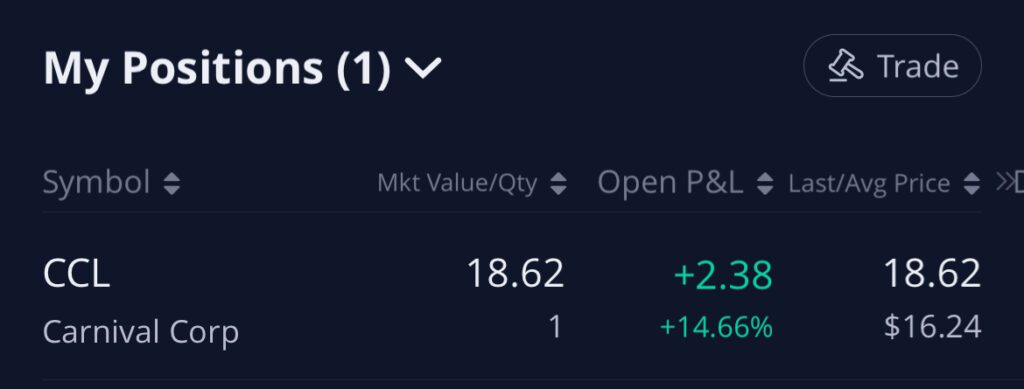

$500 Account Update

The $500 account challenge keeps rolling, and this update brings a valuable lesson: wins don't have to outnumber losses to be successful. We currently have 4 losses and 2 wins, yet our portfolio remains up 2%. How'd we pull this off? Risk management!

- Sticking to the Plan: We have a defined risk management strategy, where each trade is limited to a maximum loss of 1% of the portfolio. This ensures that even a losing trade doesn't derail our overall progress.

- Selective Exits: While we aim for long-term gains, we're not afraid to exit positions early if the market conditions change. This helps us protect profits and avoid potential losses in a volatile climate.

- Cash as a Weapon: With a rising DXY, we strategically hold some cash. This allows us to be opportunistic and capitalize on potential buying opportunities when the market dips. We also earned $1.84 in interest using Webull's Cash management program.

The key takeaway? Trading isn't about winning every trade. It's about managing risk, making calculated decisions, and capitalizing on opportunities. By focusing on these aspects, even a few well-timed wins (and strategically managed losses) can lead to overall portfolio growth!

Interested In Having Jay As A Trading Coach So That He Can Teach You How He Finds These Trades? Click here to get started!